- SUV models like the Toyota Corolla Cross, Buick Envision, and Nissan Kicks are the top picks for the cheapest car insurance in Iowa City.

- A few models with segment-leading auto insurance rates include the Audi A5, Toyota GR Corolla, Infiniti QX80, and Honda Passport.

- Auto insurance rates for a few popular models in Iowa City include the Chevrolet Silverado at $173 per month, Ford Escape at $142, and Subaru Outback at $133.

- Iowa City, Iowa, car insurance averages $70 per year less than the Iowa state average rate ($1,942) and $404 per year less than the average for all 50 states ($2,276).

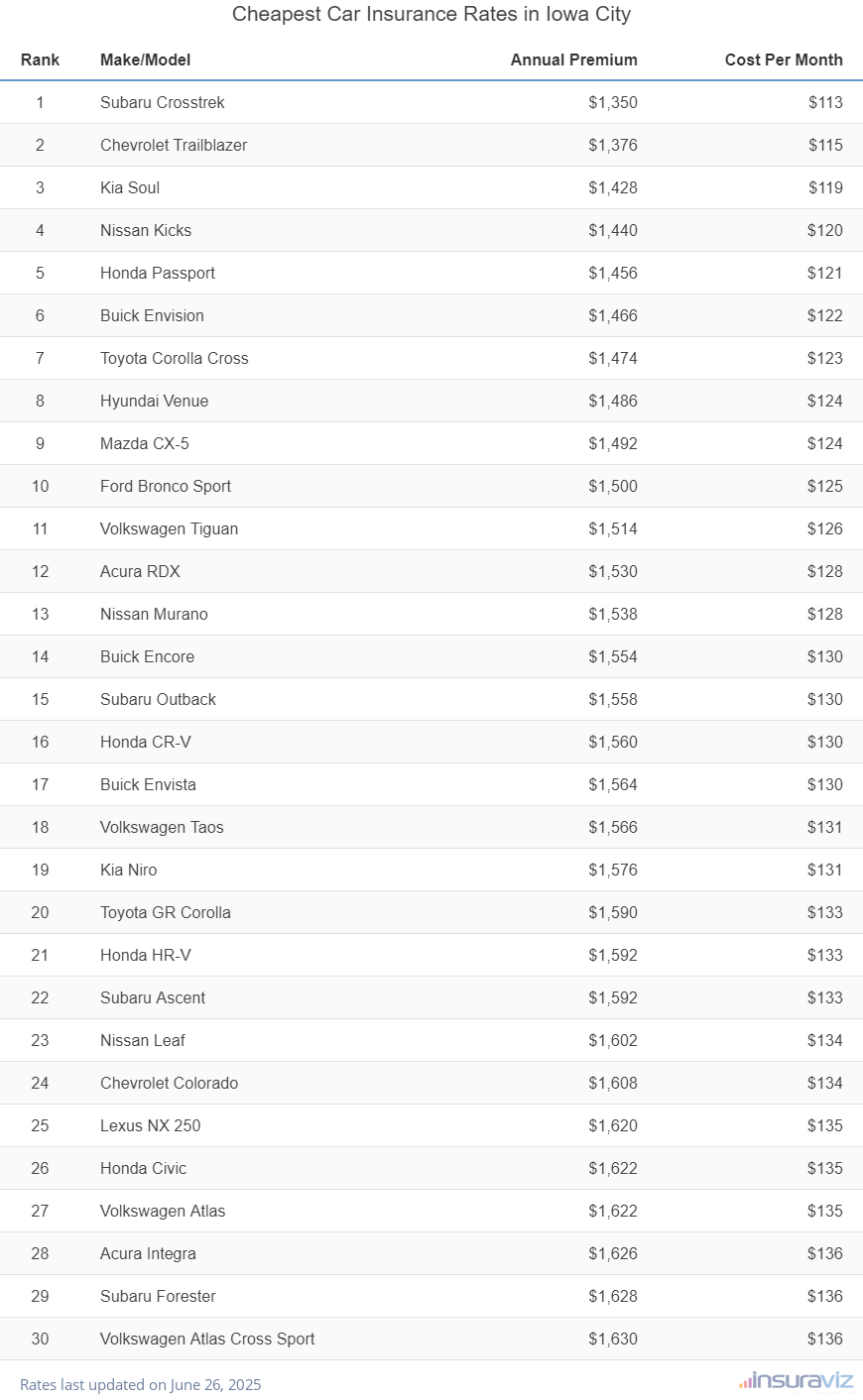

Cheapest cars to insure in Iowa City, IA

The models with the best insurance rates in Iowa City, IA, tend to be small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Hyundai Venue, and Toyota Corolla Cross. Average car insurance prices for cars and SUVs in the top 10 cost $128 or less per month to insure for full coverage in Iowa City.

Additional vehicles that are highly ranked in our car insurance cost comparison are the Toyota GR Corolla, Ford Bronco Sport, Volkswagen Taos, and Nissan Murano.

Average cost is slightly more for those models than the crossovers and compact SUVs at the top of the list, but they still have an average insurance cost of $1,626 or less per year.

The next table ranks the top 30 cheapest vehicles to insure in Iowa City, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,382 | $115 |

| 2 | Chevrolet Trailblazer | $1,406 | $117 |

| 3 | Kia Soul | $1,462 | $122 |

| 4 | Nissan Kicks | $1,476 | $123 |

| 5 | Honda Passport | $1,492 | $124 |

| 6 | Buick Envision | $1,498 | $125 |

| 7 | Toyota Corolla Cross | $1,508 | $126 |

| 8 | Hyundai Venue | $1,522 | $127 |

| 9 | Mazda CX-5 | $1,526 | $127 |

| 10 | Ford Bronco Sport | $1,532 | $128 |

| 11 | Volkswagen Tiguan | $1,548 | $129 |

| 12 | Acura RDX | $1,564 | $130 |

| 13 | Nissan Murano | $1,574 | $131 |

| 14 | Buick Encore | $1,590 | $133 |

| 15 | Subaru Outback | $1,594 | $133 |

| 16 | Honda CR-V | $1,596 | $133 |

| 17 | Buick Envista | $1,602 | $134 |

| 18 | Volkswagen Taos | $1,606 | $134 |

| 19 | Kia Niro | $1,612 | $134 |

| 20 | Toyota GR Corolla | $1,626 | $136 |

| 21 | Honda HR-V | $1,630 | $136 |

| 22 | Subaru Ascent | $1,630 | $136 |

| 23 | Nissan Leaf | $1,642 | $137 |

| 24 | Chevrolet Colorado | $1,650 | $138 |

| 25 | Lexus NX 250 | $1,656 | $138 |

| 26 | Honda Civic | $1,658 | $138 |

| 27 | Volkswagen Atlas | $1,660 | $138 |

| 28 | Acura Integra | $1,666 | $139 |

| 29 | Subaru Forester | $1,666 | $139 |

| 30 | Volkswagen Atlas Cross Sport | $1,668 | $139 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Iowa City, IA Zip Codes. Updated October 24, 2025

A few additional models making the top 30 above include the Lexus NX 250, the Subaru Forester, the Subaru Ascent, and the Volkswagen Atlas. Insurance rates for those vehicles cost between $1,626 and $1,668 per year.

In comparison to the cheapest rates, a few vehicles that cost more to insure include the Dodge Durango which costs $191 per month, the Dodge Challenger that costs $235, and the Infiniti Q50 which averages $177.

For extremely high auto insurance rates, car models like the Aston Martin DBX and BMW Alpina B8 have rates that can easily be double the cheapest models.

How much does car insurance cost in Iowa City?

Average auto insurance cost in Iowa City is $1,872 per year, which is 19.5% less than the overall U.S. national average rate of $2,276. The average cost of car insurance per month in Iowa City is $156 for full coverage auto insurance.

In the state of Iowa, the average car insurance cost is $1,942 per year, so the cost in Iowa City averages $70 less per year. When rates are compared to other locations in Iowa, the cost to insure a car in Iowa City is around $166 per year cheaper than in Waterloo, $156 per year cheaper than in Sioux City, and $132 per year less than in Davenport.

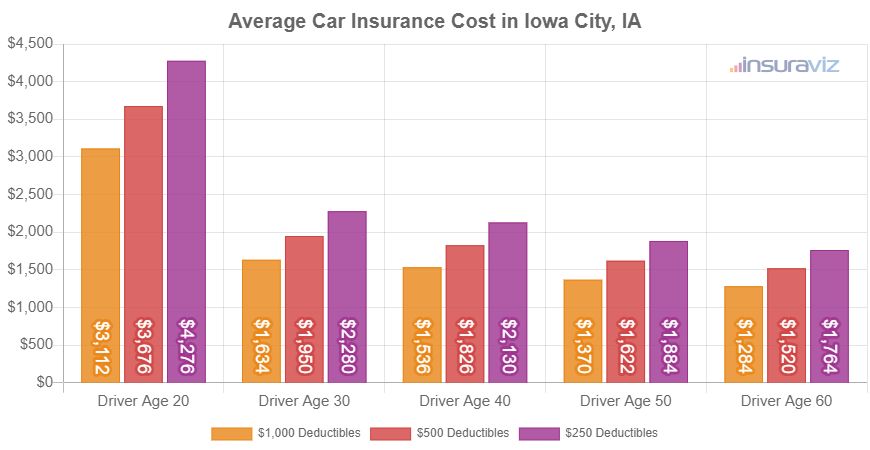

The next chart goes into more detail for drivers age 20 to 60 by including rates for three different physical damage deductibles. Displaying these different rates can help visualize how the cost of car insurance increases with lower deductibles, and decreases with higher deductibles.

Average car insurance rates in the prior chart range from $1,314 per year for a policy with high physical damage deductibles for a 60-year-old driver to $4,380 per year for a 20-year-old driver with a low deductible policy.

When the rates in the chart are converted for monthly budgeting, the average cost of car insurance per month in Iowa City ranges from $110 to $365.

Iowa City auto insurance rates can cost significantly different amounts and minor changes in a driver’s risk profile can cause considerable changes in car insurance premiums. The possibility of a wide range of rates increases the need for accurate free car insurance quotes when shopping online for cheaper auto insurance.

Driver age influences the cost of car insurance. The list below illustrates this by breaking down average car insurance rates in Iowa City for drivers from age 16 to 60.

Iowa City, Iowa, car insurance cost by driver age

- 16 year old – $6,669 per year or $556 per month

- 17 year old – $6,460 per year or $538 per month

- 18 year old – $5,789 per year or $482 per month

- 19 year old – $5,274 per year or $440 per month

- 20 year old – $3,768 per year or $314 per month

- 30 year old – $1,996 per year or $166 per month

- 40 year old – $1,872 per year or $156 per month

- 50 year old – $1,662 per year or $139 per month

- 60 year old – $1,554 per year or $130 per month

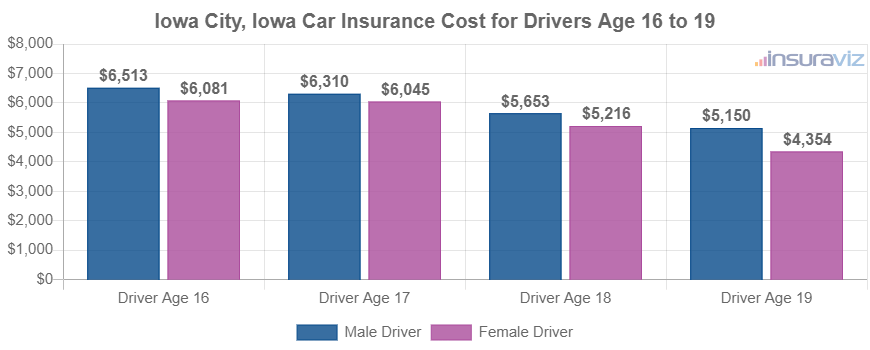

The rates shown above for teen drivers were based on a male driver. The next chart shows average car insurance rates for teen drivers by gender. In general, females have cheaper car insurance rates, in particular for ages 20 and below.

Auto insurance for a 16-year-old female driver in Iowa City costs an average of $439 less per year than the cost for a male driver, while at age 19, the cost difference is less but females still cost $815 less per year.

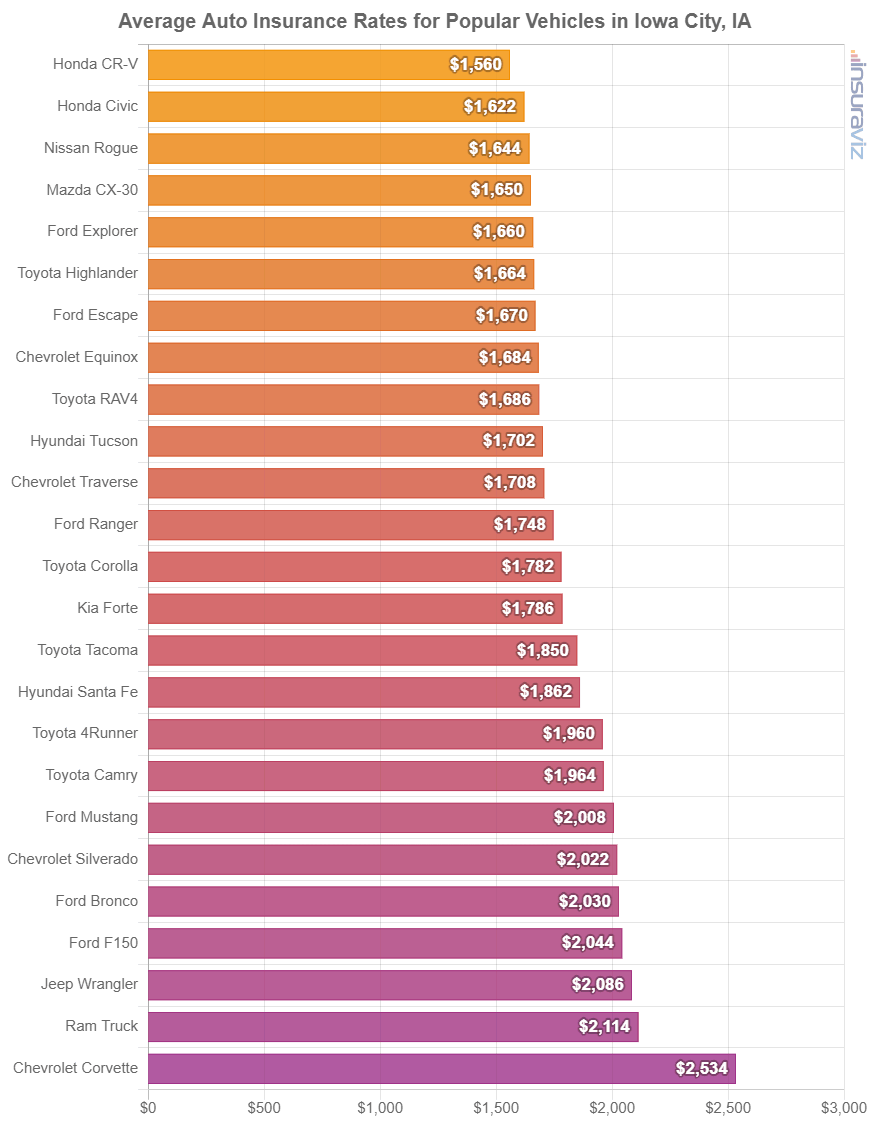

Iowa City’s favorite vehicles and the cost to insure them

The prior rates consist of an average based on every 2024 vehicle model, which is handy for making broad comparisons like the difference in average car insurance cost between two Iowa cities.

Average car insurance rates work very well for getting the answer to questions like “is auto insurance in Iowa City cheaper than Cedar Rapids?” or “are Iowa auto insurance rates cheaper than in New York?”.

For deeper rate comparisons, however, we should instead use rates for the specific vehicle being insured. Each make and model has it’s own profile for calculating the cost of car insurance and this data provides the means to perform more detailed cost comparisons.

The next chart shows the cost of auto insurance for some of the more popular vehicles that you will find cruising the streets of Iowa City.

If the models above are checked against the previous table of the top 30 cheapest vehicles to insure, most popular vehicles cost more to insure than the cheapest vehicles. This could be due to the MSRP of the vehicle, like a Jeep Grand Wagoneer that has an average price of $91,190 or a Chevy Corvette with an average purchase price of $69,995, or perhaps an increased likelihood of medical or liability insurance claims like a Jeep Cherokee or a Ford F-250 Super Duty pickup.

Tips for saving money on Iowa City car insurance

Resourceful drivers should always be thinking of ways to reduce their monthly auto insurance expenses. So take a minute or two to look through the savings tips below and it’s very likely you can save some money insuring your vehicle.

- Compare rates before buying a car. Different vehicle models can have significantly different car insurance premiums, and car insurance companies can price policies with widely varying rates. Check prices before you buy a different car in order to avoid price shock when you see your first insurance bill.

- Qualify for discounts to save money. Savings may be available if the insureds are military or federal employees, work in certain occupations, take a defensive driving course, insure their home and car with the same company, are senior citizens, or many other discounts which could save the average Iowa City driver as much as $316 per year on the cost of auto insurance

- Remove unneeded coverage on older cars. Dropping full coverage from vehicles whose low value makes coverage cost prohibitive can cheapen the cost significantly.

- Shop around for a better deal. Taking the time to get a few free car insurance quotes can save more money than you might think. Rates are always changing and you can switch companies very easily.

- Avoid filing small claims. Most auto insurance companies give a discount if you do not file any claims. Auto insurance should only be used for significant financial loss, not for minor claims that can easily be paid out-of-pocket.

- Careless drivers pay higher auto insurance rates in Iowa City. Having a few at-fault accidents can really raise rates, possibly by an additional $2,674 per year for a 20-year-old driver and even $778 per year for a 40-year-old driver. So drive safe and save money!

- Obey driving laws to save money. To get the cheapest auto insurance in Iowa City, it pays to follow the law. As a matter of fact, just one or two blemishes on your motor vehicle report could end up increasing auto insurance cost as much as $498 per year. Major misdemeanor violations such as DUI/DWI and felony use of a motor vehicle could raise rates by an additional $1,740 or more.