- Dearborn car insurance rates average $3,852 per year for full coverage, or about $321 on a monthly basis.

- Dearborn auto insurance costs an average of $966 per year more than the Michigan state average ($2,886) and $1,576 per year more than the average rate for all 50 U.S. states ($2,276).

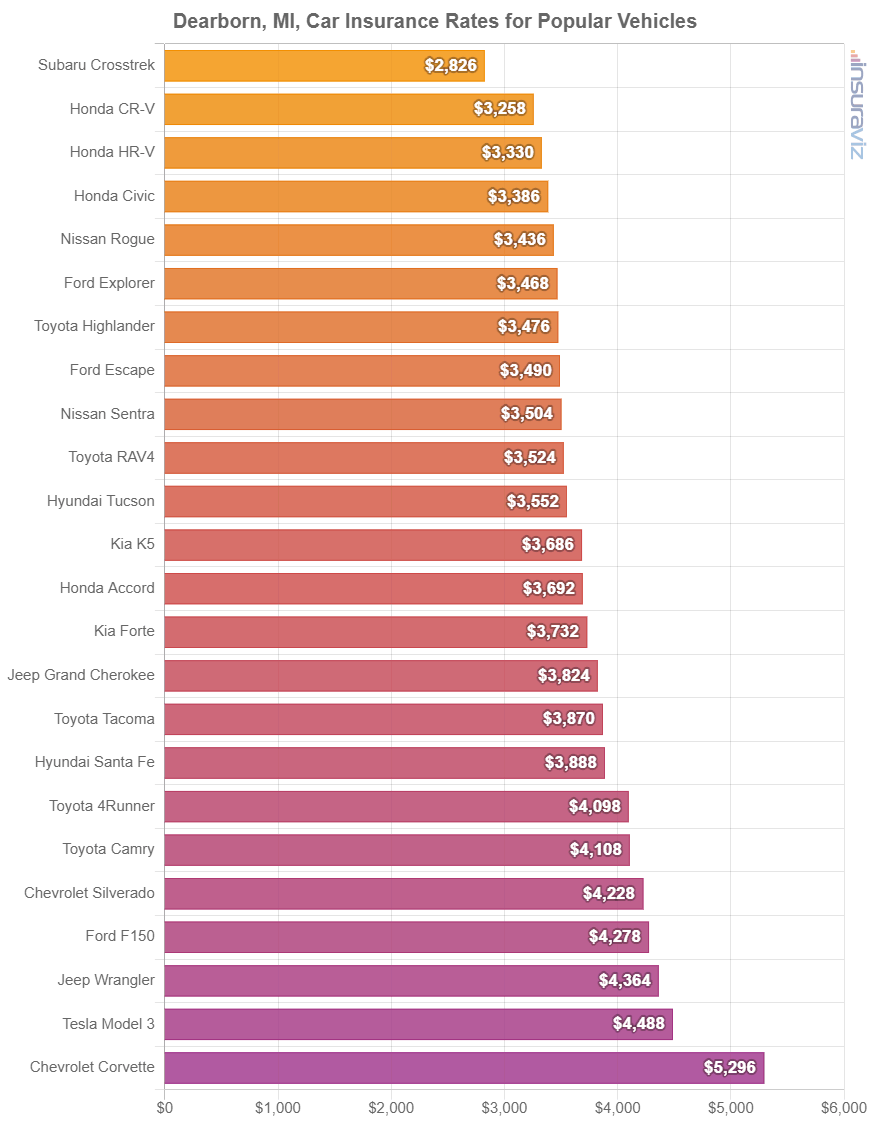

- Car insurance rates for a few popular vehicles in Dearborn include the Nissan Sentra at $294 per month, Toyota RAV4 at $296, and Toyota Highlander at $292.

- For the cheapest car insurance, compact SUV models like the Buick Envision, Nissan Kicks, and Toyota Corolla Cross have the best rates.

How much is car insurance in Dearborn, Michigan?

In Dearborn, average auto insurance cost is $3,852 per year, which is 51.4% more than the national average rate of $2,276. Per month, Dearborn car insurance costs about $321 per month for full coverage auto insurance.

Average auto insurance cost in Michigan is $2,886 per year, so Dearborn drivers pay an average of $966 more per year than the Michigan average rate.

The cost to insure a car in Dearborn compared to other Michigan cities is about $1,552 per year more expensive than in Grand Rapids, $656 per year more expensive than in Sterling Heights, and $1,418 per year more than in Lansing.

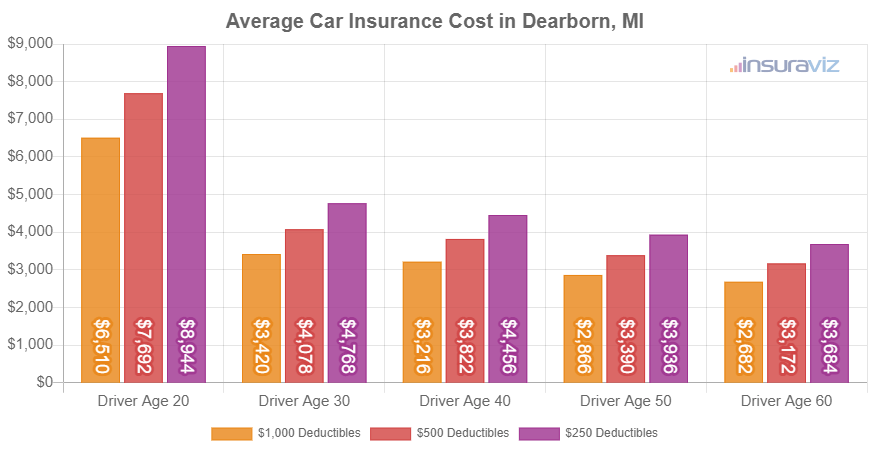

The chart below shows average Dearborn, Michigan, auto insurance cost broken out for both different driver ages and policy deductibles. Rates are averaged for all 2024 vehicle models including luxury models.

Average car insurance rates in the previous chart range from $2,702 per year for a high deductible policy for a 60-year-old driver to $9,008 per year for a 20-year-old driver with a policy with low comprehensive and collision deductibles.

When these rates are converted to a cost per month, the average cost of car insurance per month in Dearborn ranges from $225 to $751.

The age of the driver is probably the number one factor that determines the cost of auto insurance, so the list below illustrates this by breaking down average car insurance rates for different driver ages.

Car insurance cost in Dearborn for drivers age 16 to 60

- 16-year-old rated driver – $13,713 per year or $1,143 per month

- 17-year-old rated driver – $13,286 per year or $1,107 per month

- 18-year-old rated driver – $11,907 per year or $992 per month

- 19-year-old rated driver – $10,842 per year or $904 per month

- 20-year-old rated driver – $7,746 per year or $646 per month

- 30-year-old rated driver – $4,110 per year or $343 per month

- 40-year-old rated driver – $3,852 per year or $321 per month

- 50-year-old rated driver – $3,414 per year or $285 per month

- 60-year-old rated driver – $3,196 per year or $266 per month

Average car insurance rates for popular vehicles

So far, we’ve compared average rates across the entire automotive industry. This section focuses on rates for specific vehicles models.

The next chart displays insurance rates for some of the most popular cars, trucks, and SUVs that you will find driving around Dearborn.

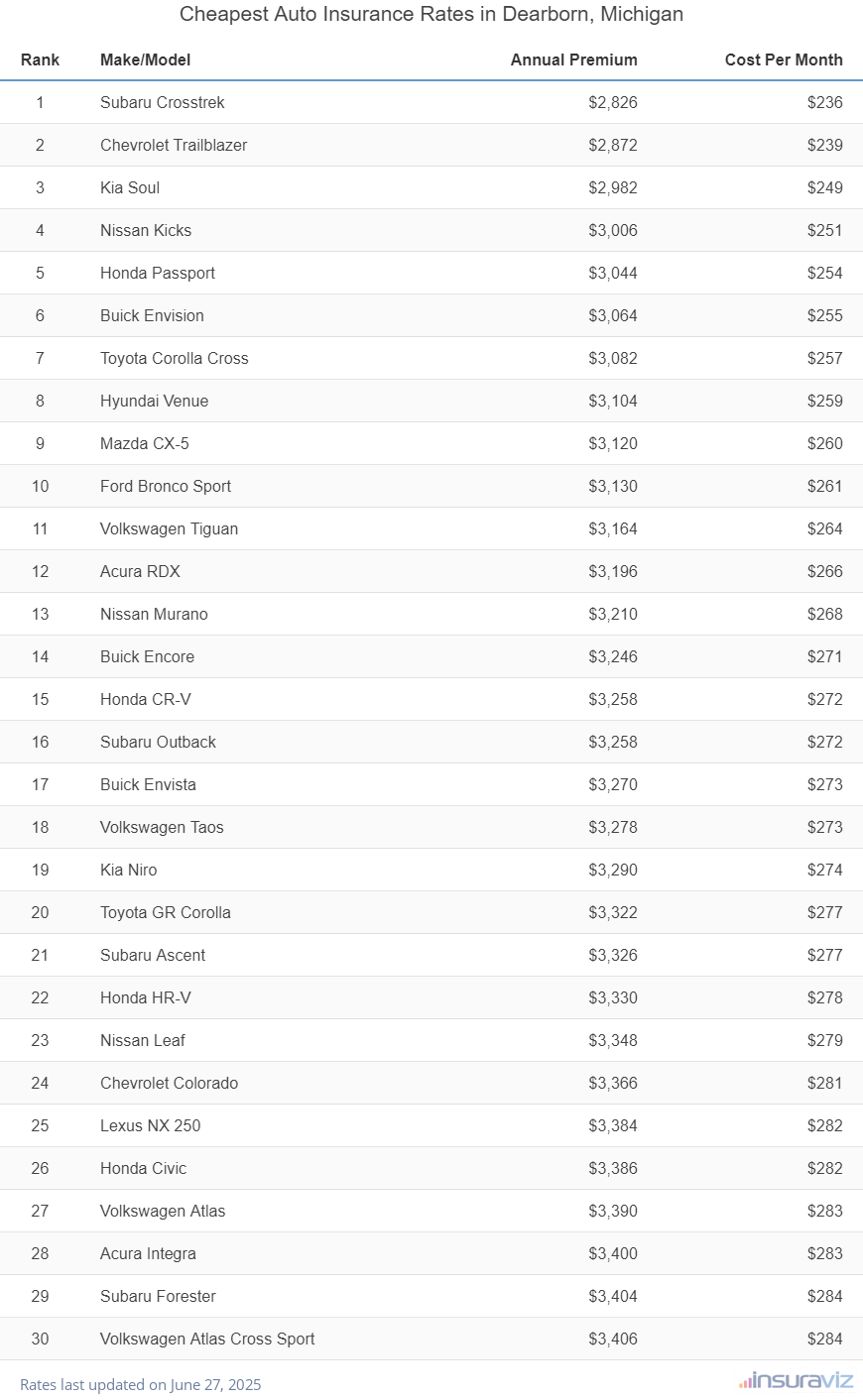

What is the cheapest car insurance in Dearborn?

The vehicles with the best insurance quotes in Dearborn tend to be crossover SUVs like the Kia Soul, Chevrolet Trailblazer, and Buick Envision. Average auto insurance prices for the vehicles ranked in the top 10 cost $263 or less per month to have full coverage.

Other models that are in the top 20 in our auto insurance cost comparison are the Kia Niro, Volkswagen Taos, Subaru Outback, and Acura RDX.

The average insurance cost is a little bit more for those models than the compact SUVs and crossovers that rank near the top, but they still have average rates of $279 or less per month in Dearborn.

The table below breaks down the 30 car, truck, and SUV models with the cheapest auto insurance in Dearborn, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,844 | $237 |

| 2 | Chevrolet Trailblazer | $2,894 | $241 |

| 3 | Kia Soul | $3,006 | $251 |

| 4 | Nissan Kicks | $3,028 | $252 |

| 5 | Honda Passport | $3,068 | $256 |

| 6 | Buick Envision | $3,084 | $257 |

| 7 | Toyota Corolla Cross | $3,104 | $259 |

| 8 | Hyundai Venue | $3,126 | $261 |

| 9 | Mazda CX-5 | $3,140 | $262 |

| 10 | Ford Bronco Sport | $3,152 | $263 |

| 11 | Volkswagen Tiguan | $3,186 | $266 |

| 12 | Acura RDX | $3,218 | $268 |

| 13 | Nissan Murano | $3,236 | $270 |

| 14 | Buick Encore | $3,270 | $273 |

| 15 | Subaru Outback | $3,280 | $273 |

| 16 | Honda CR-V | $3,282 | $274 |

| 17 | Buick Envista | $3,294 | $275 |

| 18 | Volkswagen Taos | $3,298 | $275 |

| 19 | Kia Niro | $3,316 | $276 |

| 20 | Toyota GR Corolla | $3,346 | $279 |

| 21 | Honda HR-V | $3,352 | $279 |

| 22 | Subaru Ascent | $3,352 | $279 |

| 23 | Nissan Leaf | $3,374 | $281 |

| 24 | Chevrolet Colorado | $3,390 | $283 |

| 25 | Honda Civic | $3,408 | $284 |

| 26 | Lexus NX 250 | $3,408 | $284 |

| 27 | Volkswagen Atlas | $3,414 | $285 |

| 28 | Acura Integra | $3,424 | $285 |

| 29 | Subaru Forester | $3,426 | $286 |

| 30 | Volkswagen Atlas Cross Sport | $3,430 | $286 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Dearborn, MI Zip Codes. Updated October 24, 2025

Some additional models worth noting ranked in the top 30 above include the Honda HR-V, the Honda Civic, the Lexus NX 250, and the Subaru Forester. Average auto insurance rates for those vehicles cost between $3,346 and $3,430 per year.

To help put these rates in perspective, a few models that cost much more to insure include the Jeep Grand Wagoneer that averages $373 per month, the Toyota Tundra that costs $382, and the Tesla Model X at an average of $403.

Is car insurance in Dearborn expensive?

Car insurance pretty much anywhere in Michigan, especially Dearborn, averages more than most other states. Rates dropped an average of 18% from 2019 to 2020 due to insurance reform legislation, but Michigan drivers still pay high car insurance rates.

There are some ways you can help ensure your rates stay as low as possible, however.

- Don’t be a negligent driver. Having frequent accidents may increase rates, possibly as much as $5,496 per year for a 20-year-old driver and even $940 per year for a 60-year-old driver. So drive safe and save!

- Compare insurance cost before buying a car. Different models, and even different trim levels of the same model, can have significantly different car insurance rates, and insurers can price policies with very different rates. Get plenty of quotes to compare the cost of insurance before you upgrade you car in order to avoid insurance sticker shock when you receive your bill.

- Shop around often. Setting aside 5-10 minutes to get free car insurance quotes is a fantastic way to save money. Rates change frequently and switching to a different company is very easy to do.

- A good driving record means cheaper rates. If you want affordable auto insurance in Dearborn, it pays off to be a safe driver. In fact, just one or two speeding tickets can increase insurance policy rates by up to $1,022 per year. Major violations such as driving while intoxicated could raise rates by an additional $3,576 or more.

- Stay claim free and save. Most insurers offer a discount if you have no claims. Insurance should be used in the case of significant claims, not minor claims that should be paid out-of-pocket.

- Buy vehicles with cheaper insurance rates. The type of vehicle you drive has a significant impact on the cost of car insurance. For example, a Kia Telluride costs $1,778 less per year to insure in Dearborn than a Dodge Challenger. Drive cheaper models and save money.

- Polish up your credit rating for lower rates. Having excellent credit of 800+ could save $605 per year when compared to a lower credit score of 670-739. Conversely, a less-than-perfect credit score could cost around $701 more per year. Not all states use credit score as a rating factor, so check with your agent or company.