- For the cheapest car insurance in Montpelier, small SUVs like the Kia Soul, Chevrolet Trailblazer, and Nissan Kicks have some of the best rates.

- Models with the lowest cost auto insurance in Montpelier for their segment include the Acura RDX (compact luxury SUV), Nissan Titan (full-size pickup), Kia K5 (midsize car), and Toyota GR Corolla (compact car).

Cheapest car insurance in Montpelier, Vermont

The models with the most affordable insurance quotes in Montpelier tend to be crossovers and small SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, Buick Envision, and Toyota Corolla Cross.

Average insurance prices for the models ranking in the top 10 cost $140 or less per month to get full coverage.

Examples of other vehicles that have low-cost car insurance quotes in our auto insurance price comparison are the Toyota GR Corolla, Subaru Outback, Kia Niro, and Volkswagen Tiguan.

The average cost is a little bit more for those models than the crossovers and compact SUVs at the top of the rankings, but they still have an average cost of $1,782 or less per year, or $149 per month.

The next table ranks the top 30 cheapest vehicles to insure in Montpelier, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,516 | $126 |

| 2 | Chevrolet Trailblazer | $1,542 | $129 |

| 3 | Kia Soul | $1,604 | $134 |

| 4 | Nissan Kicks | $1,616 | $135 |

| 5 | Honda Passport | $1,634 | $136 |

| 6 | Buick Envision | $1,644 | $137 |

| 7 | Toyota Corolla Cross | $1,654 | $138 |

| 8 | Hyundai Venue | $1,666 | $139 |

| 9 | Mazda CX-5 | $1,674 | $140 |

| 10 | Ford Bronco Sport | $1,682 | $140 |

| 11 | Volkswagen Tiguan | $1,700 | $142 |

| 12 | Acura RDX | $1,716 | $143 |

| 13 | Nissan Murano | $1,724 | $144 |

| 14 | Buick Encore | $1,744 | $145 |

| 15 | Subaru Outback | $1,748 | $146 |

| 16 | Honda CR-V | $1,750 | $146 |

| 17 | Buick Envista | $1,754 | $146 |

| 18 | Volkswagen Taos | $1,758 | $147 |

| 19 | Kia Niro | $1,768 | $147 |

| 20 | Toyota GR Corolla | $1,782 | $149 |

| 21 | Honda HR-V | $1,784 | $149 |

| 22 | Subaru Ascent | $1,784 | $149 |

| 23 | Nissan Leaf | $1,798 | $150 |

| 24 | Chevrolet Colorado | $1,806 | $151 |

| 25 | Honda Civic | $1,818 | $152 |

| 26 | Lexus NX 250 | $1,818 | $152 |

| 27 | Volkswagen Atlas | $1,820 | $152 |

| 28 | Acura Integra | $1,824 | $152 |

| 29 | Subaru Forester | $1,826 | $152 |

| 30 | Volkswagen Atlas Cross Sport | $1,828 | $152 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Montpelier, VT Zip Codes. Updated October 24, 2025

Other models ranked in the top 30 table above include the Chevrolet Colorado, the Lexus NX 250, the Nissan Leaf, the Volkswagen Atlas, and the Honda Civic. Auto insurance rates for those models cost between $1,782 and $1,828 per year.

As a comparison, a few models that have much higher car insurance rates include the Jeep Grand Wagoneer at $199 per month, the Audi S3 at an average of $192, and the Infiniti Q50 at $194.

Average cost of car insurance in Montpelier

In Montpelier, average auto insurance cost is $2,052 per year, which is 10.4% less than the U.S. overall average rate of $2,276. Per month, Montpelier drivers can expect to pay an average of $171 for full coverage.

The average car insurance cost in Vermont is $2,042 per year, so drivers in Montpelier pay an average of $10 more per year than the Vermont state-wide rate.

When compared to other cities in Vermont, the cost of auto insurance in Montpelier is $30 per year more expensive than in Rutland and $16 per year more expensive than in Burlington.

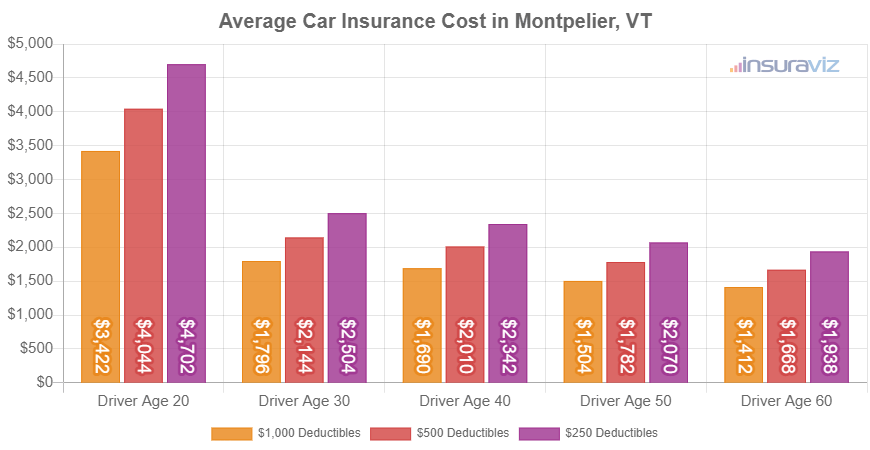

The chart below shows additional data for the 20 to 60-year-old age groups by including rates for three different comprehensive and collision deductibles. This helps visualize how auto insurance cost increases with lower deductibles, and decreases with higher deductibles.

The average cost of car insurance per month in Montpelier is $171, with policy prices ranging from $120 to $400 for the data shown in the chart above.

Car insurance rates can have a very wide price range and can also be significantly different between companies. This amount of variability increases the need for accurate auto insurance quotes when shopping around for the cheapest auto insurance policy.

Driver age has a big impact on the cost of auto insurance, so the list below illustrates these differences by breaking out average car insurance rates for driver ages from 16 to 60.

Average cost of car insurance in Montpelier, VT, for drivers age 16 to 60

- 16-year-old driver – $7,312 per year or $609 per month

- 17-year-old driver – $7,084 per year or $590 per month

- 18-year-old driver – $6,348 per year or $529 per month

- 19-year-old driver – $5,782 per year or $482 per month

- 20-year-old driver – $4,130 per year or $344 per month

- 30-year-old driver – $2,192 per year or $183 per month

- 40-year-old driver – $2,052 per year or $171 per month

- 50-year-old driver – $1,820 per year or $152 per month

- 60-year-old driver – $1,704 per year or $142 per month

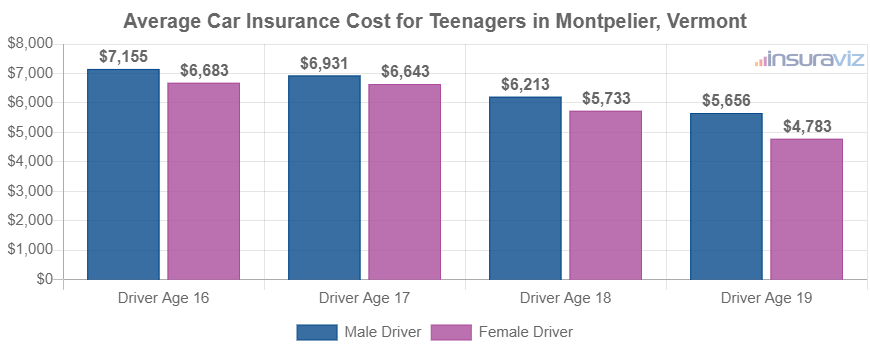

The previous rates shown for insuring teen drivers age 16 to 19 were based on a male driver. The chart below breaks out car insurance cost for teens by gender. Teenage females tend to have cheaper auto insurance rates than their male counterparts.

Car insurance for a female 16-year-old driver in Montpelier costs an average of $482 less per year than male drivers, while at age 19, the cost difference is less but males still pay an average of $896 more per year.

How to get the best price on car insurance

There are a lot of ways to save on car insurance, but you may not know that some of the items listed below can impact the rate you pay.

- Being a safe driver saves money. Causing too many accidents will raise rates, potentially by an additional $2,932 per year for a 20-year-old driver and as much as $504 per year for a 60-year-old driver. So be safe and save.

- Get cheaper rates by avoiding traffic tickets. In order to have affordable car insurance in Montpelier, it pays to avoid traffic tickets. A few minor incidents on your driving report can potentially raise policy cost by at least $546 per year. Serious citations such as failing to stop at the scene of an accident could raise rates by an additional $1,908 or more.

- More discounts equals more savings. Discounted rates may be available if the insureds are senior citizens, choose electronic billing, are loyal customers, drive a vehicle with safety or anti-theft features, are claim-free, or many other policy discounts which could save the average Montpelier driver as much as $346 per year on their insurance cost.

- Buy vehicles that are cheaper to insure. The vehicle you drive has a huge impact on the price you pay for car insurance. For example, a Subaru Crosstrek costs $2,426 less per year to insure in Montpelier than a BMW i8. Lower performance vehicles cost less to insure.

- Increase deductibles to save money. Boosting your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.