- Compact crossovers like the Buick Envision, Chevrolet Trailblazer, and Kia Soul are the top choices for cheap car insurance in Hagerstown.

- Vehicles with segment-leading auto insurance rates include the Honda Passport (midsize SUV), Mazda MX-5 Miata (sports car), Infiniti QX80 (full-size luxury SUV), and Audi A5 (full-size luxury car).

Cheapest cars to insure in Hagerstown, Maryland

When comparing makes and models from all segments, the models with the lowest cost average auto insurance prices in Hagerstown tend to be crossovers and compact SUVs like the Subaru Crosstrek, Kia Soul, and Nissan Kicks.

Average insurance quotes for the vehicles ranked in the top 10 cost $1,700 or less per year, or $142 per month, for a full-coverage insurance policy.

Some other vehicles that have low-cost auto insurance quotes in our overall cost comparison are the Buick Encore, Buick Envista, Kia Niro, and Ford Bronco Sport.

Average auto insurance rates are somewhat higher for those models than the cheapest small SUVs that rank near the top, but they still have average rates of $1,802 or less per year ($150 per month).

The following table details the top 30 cheapest vehicles to insure in Hagerstown, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,534 | $128 |

| 2 | Chevrolet Trailblazer | $1,560 | $130 |

| 3 | Kia Soul | $1,620 | $135 |

| 4 | Nissan Kicks | $1,634 | $136 |

| 5 | Honda Passport | $1,652 | $138 |

| 6 | Buick Envision | $1,662 | $139 |

| 7 | Toyota Corolla Cross | $1,670 | $139 |

| 8 | Hyundai Venue | $1,684 | $140 |

| 9 | Mazda CX-5 | $1,694 | $141 |

| 10 | Ford Bronco Sport | $1,700 | $142 |

| 11 | Volkswagen Tiguan | $1,716 | $143 |

| 12 | Acura RDX | $1,734 | $145 |

| 13 | Nissan Murano | $1,742 | $145 |

| 14 | Buick Encore | $1,760 | $147 |

| 15 | Honda CR-V | $1,768 | $147 |

| 16 | Subaru Outback | $1,768 | $147 |

| 17 | Buick Envista | $1,770 | $148 |

| 18 | Volkswagen Taos | $1,776 | $148 |

| 19 | Kia Niro | $1,784 | $149 |

| 20 | Toyota GR Corolla | $1,802 | $150 |

| 21 | Honda HR-V | $1,804 | $150 |

| 22 | Subaru Ascent | $1,806 | $151 |

| 23 | Nissan Leaf | $1,814 | $151 |

| 24 | Chevrolet Colorado | $1,826 | $152 |

| 25 | Honda Civic | $1,834 | $153 |

| 26 | Lexus NX 250 | $1,836 | $153 |

| 27 | Volkswagen Atlas | $1,840 | $153 |

| 28 | Acura Integra | $1,844 | $154 |

| 29 | Subaru Forester | $1,846 | $154 |

| 30 | Volkswagen Atlas Cross Sport | $1,848 | $154 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hagerstown, MD Zip Codes. Updated October 24, 2025

Some additional models worth noting ranking in the top 30 table above include the Subaru Forester, Chevrolet Colorado, Subaru Ascent, and Acura Integra. Car insurance rates for those vehicles fall between $1,802 and $1,848 per year.

In contrast to the cheapest vehicles to insure, some examples that have more expensive auto insurance include the Hyundai Sonata costing an average of $2,100 per year, the Audi A4 at an average of $2,384, and the Lexus LX 570 at $2,932.

Average cost of car insurance in Hagerstown

In Hagerstown, average car insurance cost is $2,076 per year, which is 9.2% less than the national average rate of $2,276. Per month, Hagerstown drivers can expect to pay an average of $173 for full coverage auto insurance.

In the state of Maryland, the average price for car insurance is $2,394 per year, so the average cost in Hagerstown is $318 less per year. When compared to other locations in Maryland, the cost of auto insurance in Hagerstown is around $278 per year less than in Rockville, $396 per year less than in Bowie, and $40 per year less than in Frederick.

The age of the driver is the factor that has the most impact on the price you pay for car insurance, so the list below illustrates this by breaking down average car insurance rates in Hagerstown for drivers from 16 to 60.

Average cost of car insurance in Hagerstown for drivers age 16 to 60

- 16-year-old rated driver – $7,384 per year or $615 per month

- 17-year-old rated driver – $7,154 per year or $596 per month

- 18-year-old rated driver – $6,413 per year or $534 per month

- 19-year-old rated driver – $5,840 per year or $487 per month

- 20-year-old rated driver – $4,174 per year or $348 per month

- 30-year-old rated driver – $2,214 per year or $185 per month

- 40-year-old rated driver – $2,076 per year or $173 per month

- 50-year-old rated driver – $1,838 per year or $153 per month

- 60-year-old rated driver – $1,722 per year or $144 per month

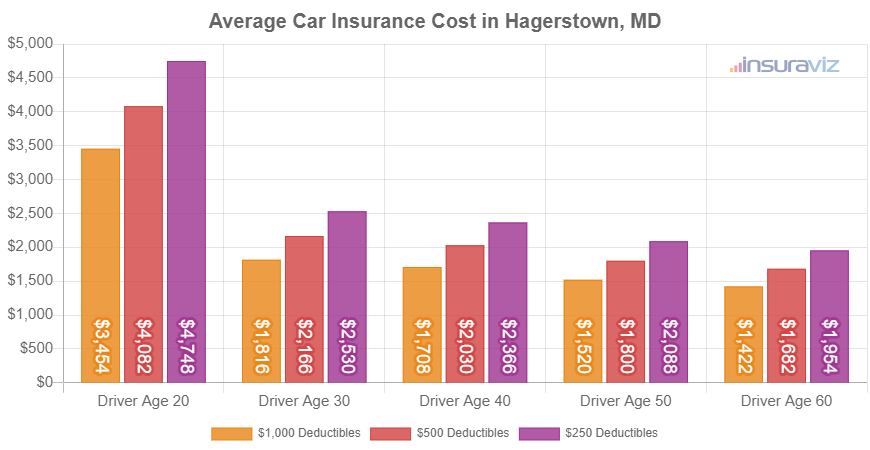

The chart below shows average car insurance rates in Hagerstown for 2024 model year vehicles not only by driver age, but also by physical damage deductibles.

The average cost of auto insurance per month in Hagerstown is $173, with policy premium ranging from $121 to $405 for the driver ages and deductible levels shown in the chart above.

Auto insurance rates are not static and subtle changes in a driver’s risk profile can have considerable effects on car insurance cost. Due to the fact that rates are so variable, this stresses the need for multiple car insurance quotes when searching online for more affordable car insurance.

Tips for cheaper Hagerstown car insurance rates

Drivers are always looking to reduce their monthly auto insurance expenses. So glance through the tips in this next list to see if you can save a little cash on your next policy.

- Shop around often. Setting aside the time to get some free car insurance quotes could significantly reduce the cost of insurance. Companies change rates often and switching companies is very easy to do.

- Compare rates before buying a car. Different cars, trucks, and SUVs can have significantly different car insurance premiums, and auto insurance companies can price policies with a wide range of costs. Get quotes to compare the cost of insurance before you buy a different vehicle in order to avoid insurance sticker shock when insuring your new car.

- If your vehicle is older, reduce coverage. Deleting comprehensive and collision coverage from older vehicles whose value has decreased can reduce the cost of car insurance significantly.

- Lower policy cost by raising deductibles. Raising your policy deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Credit score can influence insurance rates. Having a high credit score of 800+ could save $326 per year when compared to a rating of 670-739. Conversely, a weaker credit score below 579 could cost around $378 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Research discounts to lower the cost. Discounted rates may be available if the insured drivers sign their policy early, take a defensive driving course, are homeowners, drive a vehicle with safety or anti-theft features, are military or federal employees, or many other discounts which could save the average Hagerstown driver as much as $352 per year on auto insurance.

- Choose a vehicle that is cheaper to insure. Vehicle performance is one of the primary factors in the price you pay for auto insurance. As an example, a Honda CR-V costs $2,268 less per year to insure in Hagerstown than a Nissan GT-R. Lower performance vehicles save money.