- For cheap auto insurance in Greenville, SC, small SUV models like the Toyota Corolla Cross, Buick Envision, and Subaru Crosstrek rank very well for overall cost.

- A few vehicles with the cheapest car insurance in Greenville in their segment include the Acura RDX ($153 per month), Honda Passport ($146 per month), Nissan Titan ($172 per month), and Jaguar E-Pace ($171 per month).

- Monthly auto insurance rates for a few popular vehicles in Greenville include the Jeep Wrangler at $209, Honda Accord at $177, and GMC Sierra at $203.

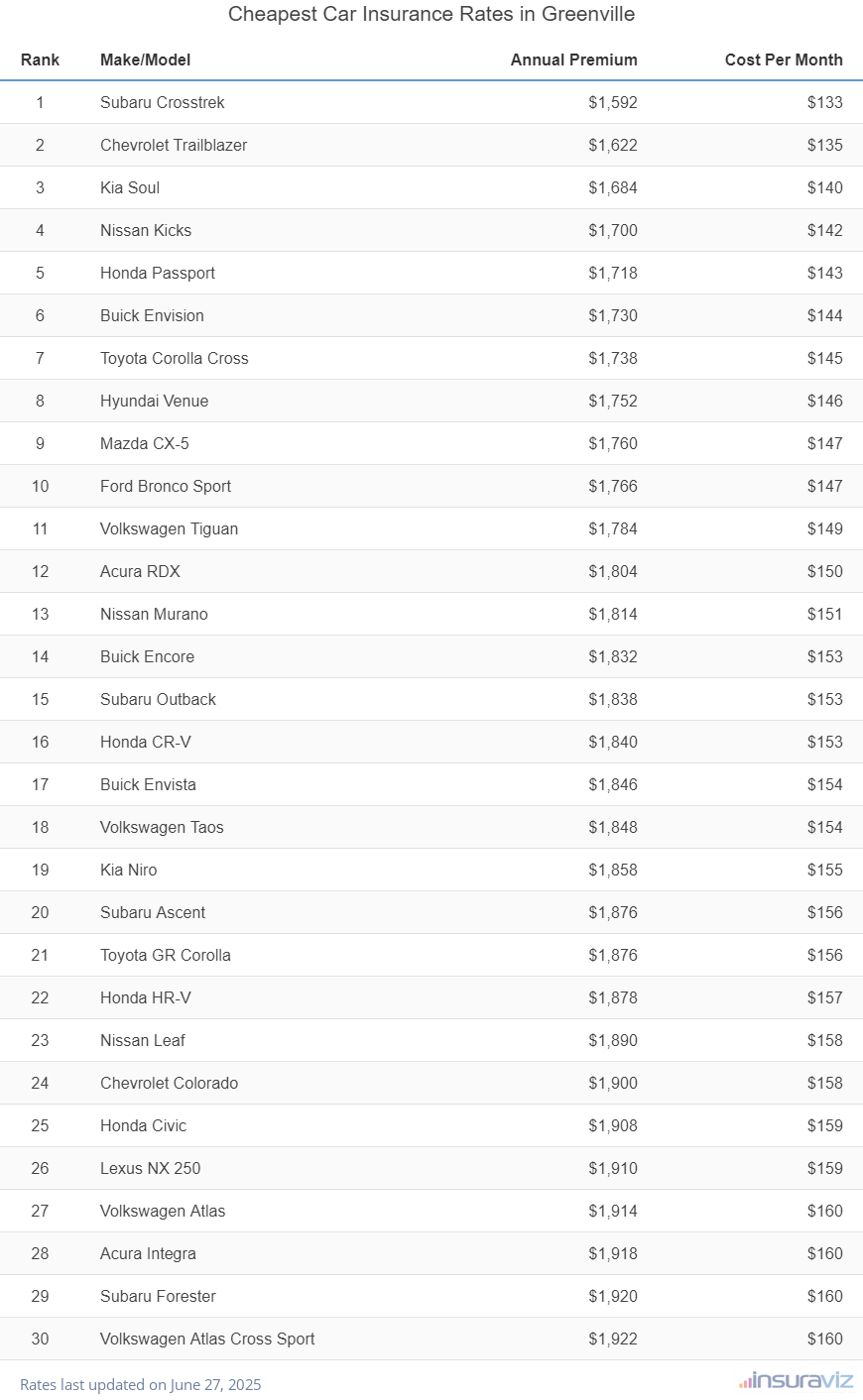

Cheapest cars to insure in Greenville, South Carolina

When all car, SUV, and pickup insurance rates are compared, the models with the best car insurance prices in Greenville, SC, tend to be small SUVs and crossovers like the Chevrolet Trailblazer, Subaru Crosstrek, and Toyota Corolla Cross.

Average insurance rates for models ranked in the top 10 cost $1,802 or less per year for a full-coverage insurance policy.

Additional vehicles that rank well in our car insurance price comparison are the Volkswagen Tiguan, Nissan Murano, Ford Bronco Sport, and Buick Encore. Average insurance cost is slightly higher for those models than the crossovers and compact SUVs at the top of the list, but they still have average rates of $159 or less per month.

The following table lists the top 30 cheapest vehicles to insure in Greenville, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,624 | $135 |

| 2 | Chevrolet Trailblazer | $1,652 | $138 |

| 3 | Kia Soul | $1,716 | $143 |

| 4 | Nissan Kicks | $1,732 | $144 |

| 5 | Honda Passport | $1,750 | $146 |

| 6 | Buick Envision | $1,762 | $147 |

| 7 | Toyota Corolla Cross | $1,774 | $148 |

| 8 | Hyundai Venue | $1,786 | $149 |

| 9 | Mazda CX-5 | $1,794 | $150 |

| 10 | Ford Bronco Sport | $1,802 | $150 |

| 11 | Volkswagen Tiguan | $1,820 | $152 |

| 12 | Acura RDX | $1,838 | $153 |

| 13 | Nissan Murano | $1,848 | $154 |

| 14 | Buick Encore | $1,868 | $156 |

| 15 | Honda CR-V | $1,874 | $156 |

| 16 | Subaru Outback | $1,874 | $156 |

| 17 | Buick Envista | $1,880 | $157 |

| 18 | Volkswagen Taos | $1,884 | $157 |

| 19 | Kia Niro | $1,894 | $158 |

| 20 | Toyota GR Corolla | $1,910 | $159 |

| 21 | Subaru Ascent | $1,914 | $160 |

| 22 | Honda HR-V | $1,916 | $160 |

| 23 | Nissan Leaf | $1,926 | $161 |

| 24 | Chevrolet Colorado | $1,938 | $162 |

| 25 | Lexus NX 250 | $1,946 | $162 |

| 26 | Honda Civic | $1,950 | $163 |

| 27 | Volkswagen Atlas | $1,950 | $163 |

| 28 | Acura Integra | $1,956 | $163 |

| 29 | Subaru Forester | $1,958 | $163 |

| 30 | Volkswagen Atlas Cross Sport | $1,958 | $163 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greenville, SC Zip Codes. Updated October 24, 2025

Additional models making the list of the top 30 above include the Lexus NX 250, the Honda Civic, the Chevrolet Colorado, and the Volkswagen Atlas. Auto insurance rates for those models cost between $1,910 and $1,958 per year.

To help put these rates in perspective, some vehicles that cost more to insure include the Jeep Wrangler that averages $2,512 per year, the Audi S3 that averages $2,468, and the Infiniti Q50 at an average of $2,490.

For expensive insurance rates in Greenville, luxury and high-performance models like the BMW M5, Nissan GT-R, Aston Martin DBX, and BMW Alpina B8 have average rates that frequently cost twice as much or more as the cheapest vehicles.

The next section of this article showcases the average cost of auto insurance by vehicle segment. The average rates shown in the chart should give a good understanding of which types of cars, trucks, and SUVs that have the overall cheapest car insurance rates in Greenville.

Cheapest insurance rates by vehicle segment

If you’re considering buying a different vehicle, it’s in your best interest to know which categories of vehicles have less expensive auto insurance rates. For example, if you’re car shopping for a family of four or five, it’s good to know if car insurance is more affordable on a midsize SUV or full-size SUV.

The next chart shows average auto insurance rates in Greenville for different vehicle segments. From a segment perspective, small SUVs and midsize pickups tend to have the most affordable average rates, while exotic high-performance models have the most expensive average cost to insure.

Just keep in mind when comparing average rates by segment that rates WITHIN each segment can vary dramatically.

For example, in the midsize car segment, car insurance rates range from the Kia K5 at $2,118 per year for a full coverage policy up to the Tesla Model 3 costing $2,582 per year, a difference of $464 within that segment.

And in the large SUV segment, rates range from the Chevrolet Tahoe at $2,064 per year up to the Toyota Sequoia costing $2,754 per year, a difference of $690 within that segment.

If you know the specific vehicles that interest you, it’s always best to compare not only average rates for each specific vehicle, but also rates for each trim level.

As an example, for our Toyota Sequoia example above, rates in Greenville can range from $2,588 per year on the SR5 2WD trim level up to $2,862 per year on the Capstone 4WD model.

How much does car insurance cost in Greenville?

In Greenville, the average car insurance expense is $2,198 per year, which is 3.5% less than the U.S. average rate of $2,276. Per month, Greenville car insurance costs around $183 for a full-coverage policy.

In the state of South Carolina, average car insurance cost is $2,238 per year, so the cost in Greenville averages $40 less per year.

When prices are compared to other cities in South Carolina, the average cost to insure a vehicle in Greenville is approximately $128 per year cheaper than in Rock Hill, $200 per year less than in North Charleston, and $42 per year cheaper than in Mount Pleasant.

The age of the rated driver has the single biggest impact on the cost of car insurance. The list below details how age impacts cost by showing the difference in average car insurance rates for driver ages 16 through 60.

Average cost of car insurance in Greenville for drivers age 16 to 60

- 16-year-old driver – $7,841 per year or $653 per month

- 17-year-old driver – $7,593 per year or $633 per month

- 18-year-old driver – $6,805 per year or $567 per month

- 19-year-old driver – $6,196 per year or $516 per month

- 20-year-old driver – $4,428 per year or $369 per month

- 30-year-old driver – $2,348 per year or $196 per month

- 40-year-old driver – $2,198 per year or $183 per month

- 50-year-old driver – $1,950 per year or $163 per month

- 60-year-old driver – $1,826 per year or $152 per month

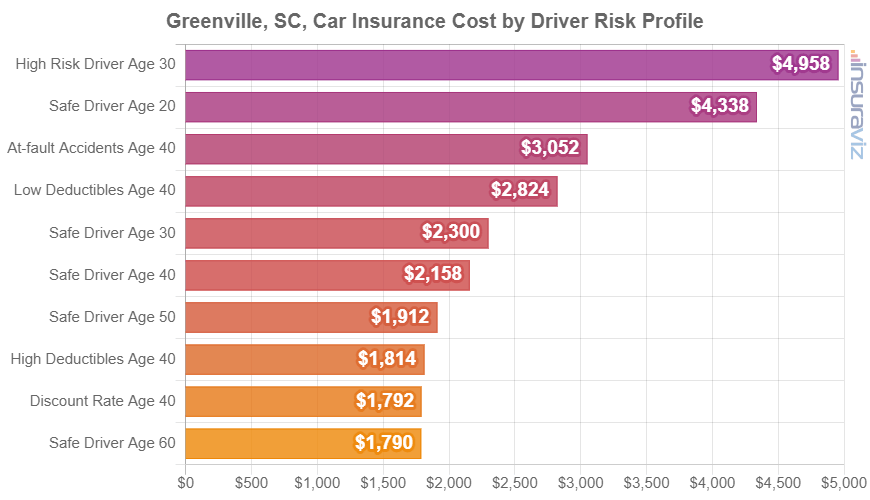

The next chart shows a summary of car insurance rates in Greenville for 2024 model year vehicles, averaged based on a range of driver ages, policy deductibles, and policy risk factors.

Average rates in the previous chart range from $1,830 per year for a 40-year-old driver who meets the requirements for many policy discounts to $5,062 per year for a 20-year-old driver who has a subpar driving record and has to buy high risk car insurance. The rate used in this article for comparison of different models and locations is the 40-year-old safe driver rate, which is an average cost of $2,198 per year.

As a monthly price, car insurance cost in Greenville ranges from $153 to $422 for the same driver ages shown in the chart.

Auto insurance rates can cost significantly different amounts and seemingly inconsequential changes in a driver’s risk profile can cause meaningful changes in car insurance premiums. This large rate variability emphasizes the need to get accurate car insurance quotes when shopping around for cheaper auto insurance.

Car insurance cost for the most popular vehicles

The rates referenced earlier in this article are the average cost across all 2024 model year vehicles, which is practical when making broad comparisons such as the average cost difference between multiple locations.

For more in-depth rate comparisons, however, we need to instead use rates for the specific model of vehicle being insured. And as mentioned earlier, it’s even better if you compare rates on the specific trim or package of vehicle you own are are considering purchasing.

The next chart shows average rates in Greenville for some of the most popular vehicles sold in the state of South Carolina.

If you compare the models listed above to the prior list of the top 30 models with the cheapest car insurance rates, most of the popular models cost more to insure than the cheapest vehicles.

Expensive car insurance premiums can be caused by a higher replacement cost, like a Tesla Model Y which has an average cost of $31,890 or a Tesla Model X that has an average MSRP of $68,590, or perhaps a greater likelihood of liability or medical claims like a Ford F-250 Super Duty pickup, GMC Sierra 2500 pickup, or Chevrolet Suburban.

Every vehicle has a unique profile that takes things into consideration like the cost to repair, the availability of repair parts, safety features, crash test ratings, and many others. These all contribute in a positive or negative way when pricing car insurance.

We covered a lot of data in the charts and tables above, so here’s a quick summary of some of the concepts along with some additional points that could help you save money on your next policy.

- Auto insurance for teenagers is expensive in Greenville – Average cost can range from $5,240 to $7,841 per year for teen driver car insurance in Greenville.

- Greenville car insurance prices are cheaper than the South Carolina state average – $2,198 (Greenville average) versus $2,238 (South Carolina average)

- Average cost per month ranges from $152 to $653 – That is the average auto insurance cost range for drivers age 16 to 60 in Greenville.

- Auto insurance costs less as you age – Auto insurance rates for a 60-year-old driver in Greenville are $2,602 per year cheaper than for a 20-year-old driver.

- Low deductibles cost more than high deductibles – A 40-year-old driver pays an average of $714 more per year for a policy with $250 deductibles versus $1,000 deductibles.

- Car insurance rates decrease substantially in your twenties – The average 30-year-old Greenville, South Carolina, driver will pay $2,080 less annually than a 20-year-old driver, $2,348 compared to $4,428.