- For cheap car insurance, SUV models like the Nissan Kicks, Kia Soul, and Chevrolet Trailblazer have the most affordable rates.

- Models with segment-leading car insurance rates in Fairmont include the Toyota GR Corolla ($1,996 per year), Kia K5 ($2,212 per year), Subaru Crosstrek ($1,698 per year), and Honda Passport ($1,828 per year).

- Auto insurance quotes can range from as little as $26 per month for minimum liability limits to well over $704 per month for drivers requiring high-risk coverage.

- Fairmont auto insurance averages $32 per year less than the West Virginia state average rate and $20 per year more than the U.S. national average rate.

Which cars have the cheapest insurance rates?

When comparing all car, SUV, and pickup models, the models with the cheapest insurance prices in Fairmont, WV, tend to be small SUVs and crossovers like the Chevrolet Trailblazer, Subaru Crosstrek, Hyundai Venue, and Buick Envision. Average auto insurance prices for models that make the top 10 cost $157 or less per month to have full coverage.

Some other vehicles that rank well in our insurance cost comparison are the Toyota GR Corolla, Volkswagen Taos, Volkswagen Tiguan, and Kia Niro.

Average rates are slightly more for those models than the compact SUVs at the top of the rankings, but they still have average rates of $1,996 or less per year.

The following table shows the 30 models with the cheapest car insurance in Fairmont, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,698 | $142 |

| 2 | Chevrolet Trailblazer | $1,724 | $144 |

| 3 | Kia Soul | $1,792 | $149 |

| 4 | Nissan Kicks | $1,808 | $151 |

| 5 | Honda Passport | $1,828 | $152 |

| 6 | Buick Envision | $1,842 | $154 |

| 7 | Toyota Corolla Cross | $1,850 | $154 |

| 8 | Hyundai Venue | $1,864 | $155 |

| 9 | Mazda CX-5 | $1,874 | $156 |

| 10 | Ford Bronco Sport | $1,878 | $157 |

| 11 | Volkswagen Tiguan | $1,902 | $159 |

| 12 | Acura RDX | $1,920 | $160 |

| 13 | Nissan Murano | $1,928 | $161 |

| 14 | Buick Encore | $1,950 | $163 |

| 15 | Honda CR-V | $1,956 | $163 |

| 16 | Subaru Outback | $1,958 | $163 |

| 17 | Buick Envista | $1,964 | $164 |

| 18 | Volkswagen Taos | $1,968 | $164 |

| 19 | Kia Niro | $1,976 | $165 |

| 20 | Toyota GR Corolla | $1,996 | $166 |

| 21 | Subaru Ascent | $1,998 | $167 |

| 22 | Honda HR-V | $2,000 | $167 |

| 23 | Nissan Leaf | $2,012 | $168 |

| 24 | Chevrolet Colorado | $2,022 | $169 |

| 25 | Lexus NX 250 | $2,032 | $169 |

| 26 | Honda Civic | $2,034 | $170 |

| 27 | Volkswagen Atlas | $2,038 | $170 |

| 28 | Acura Integra | $2,040 | $170 |

| 29 | Subaru Forester | $2,044 | $170 |

| 30 | Volkswagen Atlas Cross Sport | $2,048 | $171 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fairmont, WV Zip Codes. Updated October 24, 2025

Additional vehicles ranking in the top 30 table above include the Subaru Ascent, Nissan Leaf, Chevrolet Colorado, and Subaru Forester. Insurance rates for those models cost between $1,996 and $2,048 per year.

In comparison to the cheapest rates, some examples of much higher insurance rates include the Jeep Grand Wagoneer costing an average of $222 per month, the Chevrolet Camaro at an average of $249, and the Mercedes-Benz S560 which averages $336.

And for extremely high-priced insurance in Fairmont, car models like the Nissan GT-R, BMW M5, and Aston Martin DBX have rates that cost at least double those of the cheapest models.

Fairmont, West Virginia car insurance cost

Average car insurance cost in Fairmont is $2,296 per year, which is about $191 per month. Fairmont car insurance costs 0.9% more than the overall U.S. national average rate of $2,276.

The average cost of car insurance in West Virginia is $2,328 per year, so Fairmont drivers pay an average of $32 less per year than the overall West Virginia rate. When prices are compared to other larger cities in West Virginia, the average cost of auto insurance in Fairmont is approximately $28 per year less than in Wheeling, $60 per year less than in Parkersburg, and $74 per year less than in Charleston.

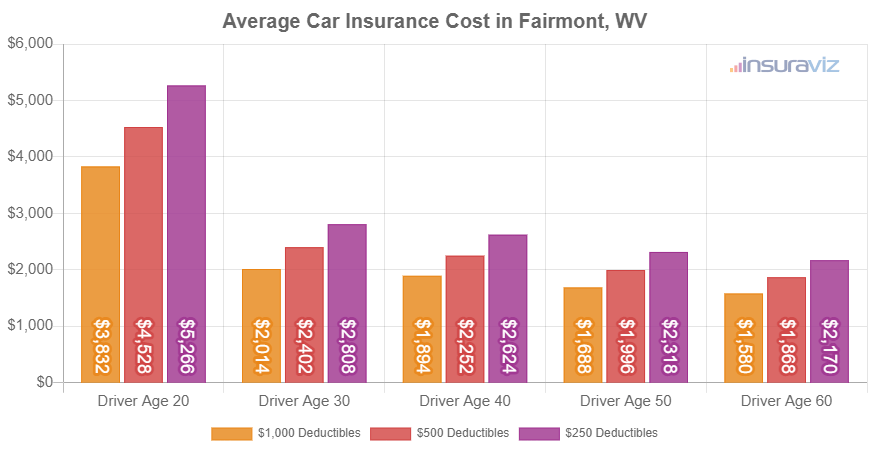

The chart below shows average auto insurance rates in Fairmont for 2024 model year vehicles by driver age and physical damage coverage deductibles.

Average rates in the chart range from $1,610 per year for a 60-year-old driver with $1,000 deductibles for comprehensive and collision coverage to $5,370 per year for a 20-year-old driver with $250 deductibles. The average rate we use for comparison of different segments, models, and locations is a 40-year-old driver with $500 comprehensive and collision coverage deductibles, which has an average cost of $2,296 per year.

As a monthly expense, the average cost of auto insurance in Fairmont ranges from $134 to $448 for the same deductible limits and driver ages shown in the prior chart.

Car insurance rates can cost very different amounts for different drivers and small changes in driver risk profiles can have enormous effects on car insurance cost. The potential for large differences in cost reinforces the need to get multiple auto insurance quotes when looking for the cheapest rate.

The age of the rated driver influences the price of auto insurance, so the list below details how age impacts cost by breaking down average car insurance rates in Fairmont for driver ages 16 through 60.

Fairmont, WV, car insurance cost for drivers age 16 to 60

- 16 year old – $8,175 per year or $681 per month

- 17 year old – $7,919 per year or $660 per month

- 18 year old – $7,099 per year or $592 per month

- 19 year old – $6,462 per year or $539 per month

- 20 year old – $4,616 per year or $385 per month

- 30 year old – $2,450 per year or $204 per month

- 40 year old – $2,296 per year or $191 per month

- 50 year old – $2,036 per year or $170 per month

- 60 year old – $1,904 per year or $159 per month

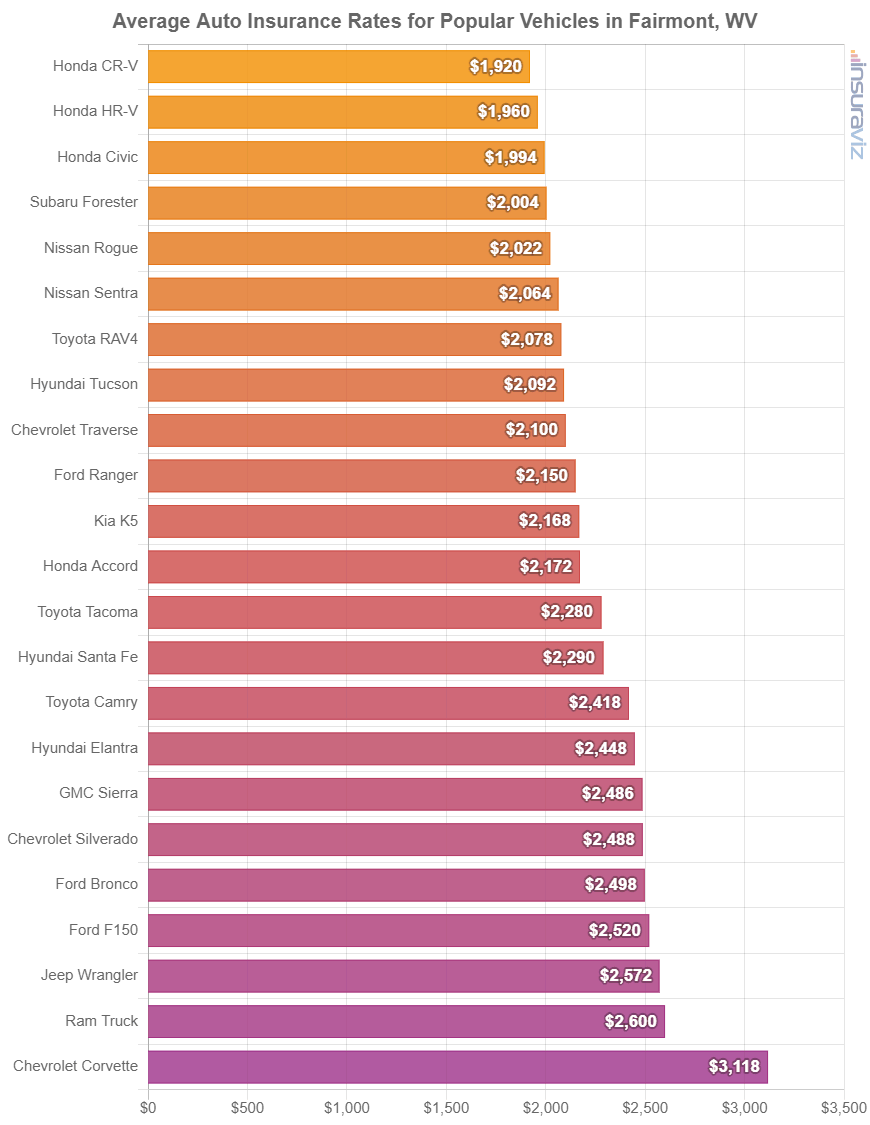

Average rates for popular vehicles

The previously referenced car insurance rates take the cost to insure each 2024 vehicle model and average them, which is suitable when making big picture comparisons like the average cost difference for different locations or driver risk profiles. Average auto insurance rates are perfect when answering questions like “are car insurance rates in Fairmont cheaper than in Huntington?” or “are West Virginia car insurance rates cheaper than in Arizona?”.

But for more comprehensive price comparisons, it makes more sense to perform a rate analysis for the specific make and model of vehicle being insured. Each individual model has a unique profile for car insurance rating and this data makes it possible to perform insurance cost comparisons.

The following chart shows average insurance cost in Fairmont for the more popular models.

Popular models in Fairmont tend to be compact or midsize cars like the Hyundai Elantra, Volkswagen Jetta, and Honda Accord and compact or midsize SUVs like the Nissan Rogue, Ford Escape, and Ford Explorer.

Additional popular models from different automotive segments include luxury SUVs like the Cadillac XT5 and BMW X5, luxury cars like the Lexus ES 350 and Infiniti Q50, and pickup trucks like the Ford Ranger and Ram 1500.

If we compare the popular vehicles to the prior table showing the top 30 vehicles with the cheapest car insurance rates, most of the top-selling models are not included. Expensive insurance could be due to things like a higher-priced vehicle, like a Nissan GT-R with an average MSRP of $120,990 or a Lexus RC F with an average MSRP of $68,295. Another possible cause could be a potentially higher chance of medical or liability claims like a GMC Sierra 2500 pickup, Mitsubishi Outlander, or Dodge Challenger.

Let’s take a condensed look at the important concepts covered so far and then keep reading to learn some of the best ways to save on car insurance.

- Fairmont car insurance prices are cheaper than the West Virginia state average – $2,296 (Fairmont average) compared to $2,328 (West Virginia average)

- Insuring teen drivers can be expensive – Rates range from $5,465 to $8,175 per year for insurance on a teen driver in Fairmont.

- Fairmont car insurance costs more than the U.S. average – $2,296 (Fairmont average) compared to $2,276 (U.S. average)

- A low deductible policy costs more – A 50-year-old driver pays an average of $954 more per year for $250 deductibles versus $1,000 deductibles.

- Insurance rates drop considerably between ages 20 and 30 – The average 30-year-old Fairmont driver will pay $2,166 less each year than a 20-year-old driver, $2,450 compared to $4,616.

- Cost per month ranges from $159 to $681 – That is the average car insurance price range for drivers aged 16 to 60 in Fairmont, West Virginia.

Six ways to find cheaper car insurance quotes

Fairmont drivers are always looking to reduce their monthly insurance expenses, so look through the money-saving ideas below and maybe you’ll find a way to save a few dollars on your next renewal or new policy.

- Improve your credit to save money. Insureds with excellent credit scores of 800+ may save $360 per year when compared to a credit rating of 670-739. Conversely, a less-than-perfect credit score could cost as much as $418 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Shop around anytime. Taking 5-10 minutes before every policy renewal to get some free car insurance quotes is the best way to save money. Rates change frequently and you can switch anytime.

- Tickets and violations can cost a lot. If you want affordable car insurance in Fairmont, it pays to avoid traffic tickets. In fact, just a couple minor traffic citations could raise rates as much as $608 per year.

- Fewer accidents saves money. Having frequent at-fault accidents will raise rates, potentially as much as $3,278 per year for a 20-year-old driver and even as much as $560 per year for a 60-year-old driver. So be a cautious driver and save.

- Car insurance is cheaper with higher deductibles. Raising your policy deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Remove optional coverage on older vehicles. Dropping physical damage coverage (comprehensive and collision) from vehicles whose low value makes coverage cost prohibitive can reduce the cost of auto insurance considerably.