- Lexus GS F car insurance costs an average of $3,088 per year, or around $257 per month for full coverage.

- Out of 41 vehicles in the 2020 midsize luxury car segment, the GS F ranks 32nd for car insurance affordability.

How much does Lexus GS F insurance cost?

Lexus GS F car insurance rates average $3,088 a year, or around $257 monthly. On average, expect to pay about $318 more each year to insure a Lexus GS F when compared to the average rate for all midsize luxury cars, and $812 more per year than the all-vehicle national average of $2,276.

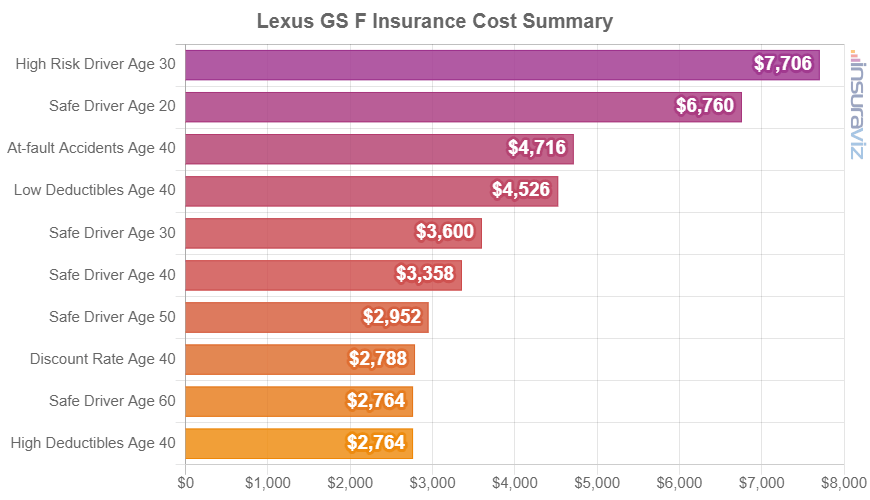

The rate chart below displays average insurance rates on a 2020 GS F rated for different driver ages and risk profiles.

The next table breaks down average Lexus GS F car insurance rates for the 2016-2020 model years and for various driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2020 Lexus GS F | $6,250 | $3,088 | $2,546 |

| 2019 Lexus GS F | $6,052 | $2,984 | $2,462 |

| 2018 Lexus GS F | $5,744 | $2,840 | $2,344 |

| 2017 Lexus GS F | $5,498 | $2,720 | $2,248 |

| 2016 Lexus GS F | $5,424 | $2,688 | $2,230 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Lexus GS F trim levels for each model year. Updated October 24, 2025

A few additional key observations regarding the cost to insure a Lexus GS F include:

- Raise your credit score for cheaper insurance rates. Drivers with high 800+ credit scores could save $485 per year versus a credit rating of 670-739. Conversely, a less-than-good credit score could cost as much as $562 more per year.

- High-risk auto insurance costs more. For a 20-year-old driver, being required to buy a high-risk insurance policy could end up with a rate increase of $4,876 or more per year.

- Research discounts to lower the cost. Discounts may be available if the insureds work in certain occupations, are accident-free, insure their home and car with the same company, are claim-free, or many other discounts which could save the average driver as much as $526 per year on the cost of insuring a GS F.

- Gender affects car insurance rates. For a 2020 Lexus GS F, a 20-year-old male driver will have an average rate of $6,250 per year, while a 20-year-old woman pays $4,460, a difference of $1,790 per year. The females get the cheaper rate by far. But by age 50, rates for male drivers are $2,716 and female driver rates are $2,656, a difference of only $60.

- Avoiding accidents saves money. Having frequent at-fault accidents will raise rates, possibly up to $1,488 per year for a 30-year-old driver and as much as $894 per year for a 50-year-old driver.

Is Lexus GS F car insurance expensive?

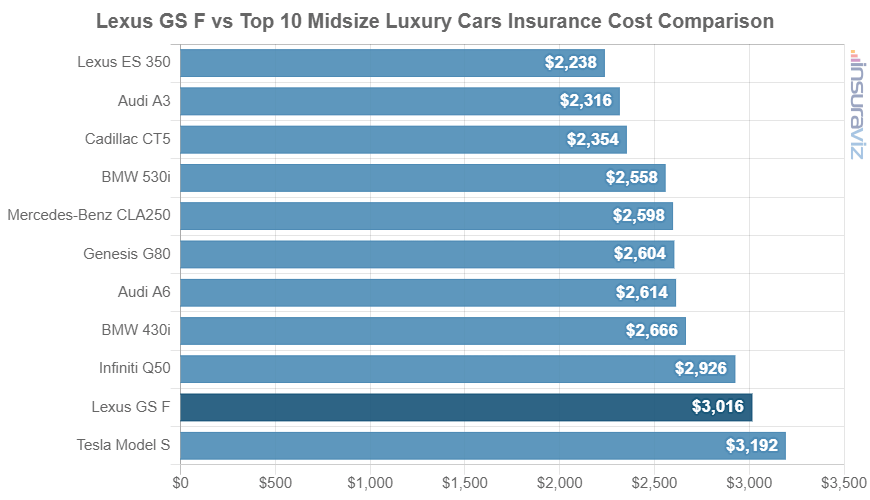

When compared to other models in the midsize luxury car segment, auto insurance rates for a Lexus GS F cost $794 more per year than the Lexus ES 350, $470 more than the BMW 530i, and $92 more than the Infiniti Q50.

The Lexus GS F ranks 32nd out of 41 total comparison vehicles in the 2020 midsize luxury car class for car insurance affordability. The GS F costs an estimated $3,088 per year for a car insurance policy with full coverage and the category average insurance cost is $2,770 annually, a difference of $318 per year.

The next chart shows how average Lexus GS F car insurance rates compare to the top-selling midsize luxury cars in America like the Lincoln MKZ, Mercedes-Benz CLA250, and the Audi A6. In addition to the chart, a larger table is included that displays car insurance affordability rankings for all 41 models in the 2020 midsize luxury car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura ILX | $1,932 | -$1,156 |

| 2 | Lexus RC 300 | $2,220 | -$868 |

| 3 | Mercedes-Benz SLC300 | $2,284 | -$804 |

| 4 | Lexus ES 350 | $2,294 | -$794 |

| 5 | Lincoln MKZ | $2,302 | -$786 |

| 6 | Mercedes-Benz AMG CLA45 | $2,322 | -$766 |

| 7 | Jaguar XE | $2,328 | -$760 |

| 8 | Lexus IS 300 | $2,330 | -$758 |

| 9 | Audi A3 | $2,372 | -$716 |

| 10 | Cadillac CT5 | $2,410 | -$678 |

| 11 | Audi S5 | $2,474 | -$614 |

| 12 | Lexus GS 350 | $2,538 | -$550 |

| 13 | Mercedes-Benz E350 | $2,550 | -$538 |

| 14 | Lexus ES 300H | $2,586 | -$502 |

| 15 | Audi S4 | $2,612 | -$476 |

| 16 | BMW 530i | $2,618 | -$470 |

| 17 | BMW 540i | $2,646 | -$442 |

| 18 | Mercedes-Benz CLA250 | $2,664 | -$424 |

| 19 | Genesis G80 | $2,668 | -$420 |

| 20 | Audi A6 | $2,676 | -$412 |

| 21 | Mercedes-Benz E450 | $2,710 | -$378 |

| 22 | BMW 430i | $2,730 | -$358 |

| 23 | Mercedes-Benz CLS450 | $2,766 | -$322 |

| 24 | Jaguar XF | $2,768 | -$320 |

| 25 | BMW 440i | $2,870 | -$218 |

| 26 | Mercedes-Benz AMG C43 | $2,872 | -$216 |

| 27 | Mercedes-Benz SL450 | $2,892 | -$196 |

| 28 | Audi RS 5 | $2,906 | -$182 |

| 29 | Audi S6 | $2,966 | -$122 |

| 30 | Infiniti Q50 | $2,996 | -$92 |

| 31 | BMW 530e | $3,012 | -$76 |

| 32 | Lexus GS F | $3,088 | -- |

| 33 | Mercedes-Benz AMG C63 | $3,130 | $42 |

| 34 | BMW M550i | $3,186 | $98 |

| 35 | Mercedes-Benz SL550 | $3,214 | $126 |

| 36 | Tesla Model S | $3,272 | $184 |

| 37 | Audi A7 | $3,316 | $228 |

| 38 | Lexus LC 500H | $3,402 | $314 |

| 39 | Audi S7 | $3,528 | $440 |

| 40 | BMW M8 | $3,532 | $444 |

| 41 | BMW M5 | $3,580 | $492 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated October 24, 2025