Sandwiched between General Motors’ mainstream brands and the Cadillac luxury brand, Buick sales have fallen off in the U.S. in recent years.

Lack of offering and the inability to shed the perception that a Buick is an “old person’s car”, the majority of Buick vehicles are actually now sold in China under the Velite, GL6, GL8, and Excelle names.

But here in the U.S., only the Enclave, Encore, and Envision remain as current production models.

How much does it cost to insure a Buick? Let’s find out as we look at average rates plus compare Buick insurance cost to other popular brands.

How much does Buick insurance cost?

Average car insurance cost for 2024 Buick models ranges from $1,922 per year for the Buick Envision to $2,320 per year for the Buick Enclave. As a monthly cost, this is the equivalent of $160 to $193.

The average cost per year when averaged for all Buick models is $2,083. When this value is compared to the average car insurance rate for all vehicles in the U.S. of $2,276, Buick vehicles cost $193 less per year on average to insure.

The table below shows the average Buick insurance rates for models produced after the 2013 model year. Models no longer in production have their last production year noted next to the model name.

| Model | Annual Premium | Cost Per Month |

|---|---|---|

| Buick Cascada 2019 and prior model years | $1,778 | $148 |

| Buick Enclave | $2,320 | $193 |

| Buick Encore | $2,038 | $170 |

| Buick Envision | $1,922 | $160 |

| Buick Envista | $2,050 | $171 |

| Buick LaCrosse 2019 and prior model years | $2,026 | $169 |

| Buick Regal 2020 and prior model years | $1,920 | $160 |

| Buick Verano 2017 and prior model years | $1,740 | $145 |

How do average Buick insurance rates compare?

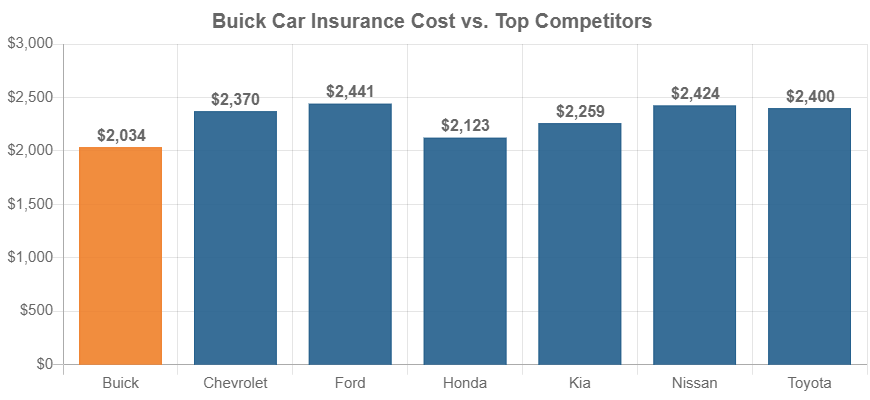

When compared to other popular car manufacturers, Buick car insurance costs $344 less per year on average than Chevrolet, $417 less than Ford, $91 less than Honda, and $375 less than Toyota.

The chart below compares average Buick car insurance (first column) to six of it’s main competitors.

The next table expands on the chart above, by comparing the average cost to insure a Buick to many additional automotive brands, including luxury nameplates like BMW, Lexus, and Volvo.

The table shows the average Buick cost in the first row. The rest of the table shows average rates for other brands, plus a difference column which shown if the average insurance cost for that brand is cheaper or more expensive than Buick.

If the value in the difference column is green, this means that brand is cheaper to insure than Buick. If the value is red, that means the brand is more expensive to insure than Buick.

| Automotive Brand | Insurance Cost | Difference |

|---|---|---|

| Buick | $2,083 | -- |

| Acura | $2,255 | $172 |

| Audi | $3,098 | $1,015 |

| Cadillac | $2,579 | $496 |

| Chevrolet | $2,427 | $344 |

| Dodge | $2,982 | $899 |

| Ford | $2,500 | $417 |

| Genesis | $2,866 | $783 |

| GMC | $2,495 | $412 |

| Honda | $2,174 | $91 |

| Hyundai | $2,370 | $287 |

| Infiniti | $2,515 | $432 |

| Jaguar | $2,954 | $871 |

| Jeep | $2,620 | $537 |

| Kia | $2,314 | $231 |

| Land Rover | $3,141 | $1,058 |

| Lexus | $2,664 | $581 |

| Lincoln | $2,650 | $567 |

| Mazda | $2,294 | $211 |

| Mercedes-Benz | $3,469 | $1,386 |

| Mitsubishi | $2,329 | $246 |

| Nissan | $2,483 | $400 |

| Subaru | $2,282 | $199 |

| Tesla | $2,909 | $826 |

| Toyota | $2,458 | $375 |

| Volkswagen | $2,239 | $156 |

| Volvo | $2,684 | $601 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Insurance cost is averaged for all models for the 2024 model year for each automobile manufacturer. Updated October 24, 2025

As shown in the table, Buick insurance tends to compare very favorably to other brands (lots of red values means Buick insurance is cheaper).

Buick does not offer high-performance models which helps keep the average insurance cost down. Most other brands offer performance models that tend to cost more to insure, which in turn pushes the average cost upwards.

It should not be difficult to find cheap Buick car insurance rates as long as your driving history is decent and your financial responsibility is good. Younger drivers will pay more than more mature drivers (up to about age 65), but Buick models should be a solid choice for affordable auto insurance cost.