- Lexus GS 350 car insurance costs an estimated $2,538 per year on average, or about $212 per month for a policy with full coverage.

- The GS 350 ranks 12th out of 41 vehicles in the midsize luxury car class for insurance affordability.

How much does Lexus GS 350 car insurance cost?

Lexus GS 350 insurance costs on average $2,538 a year, or $212 each month. Expect to pay about $232 less per year to insure a Lexus GS 350 as compared to the average rate for midsize luxury cars, and $262 more per year than the all-vehicle national average of $2,276.

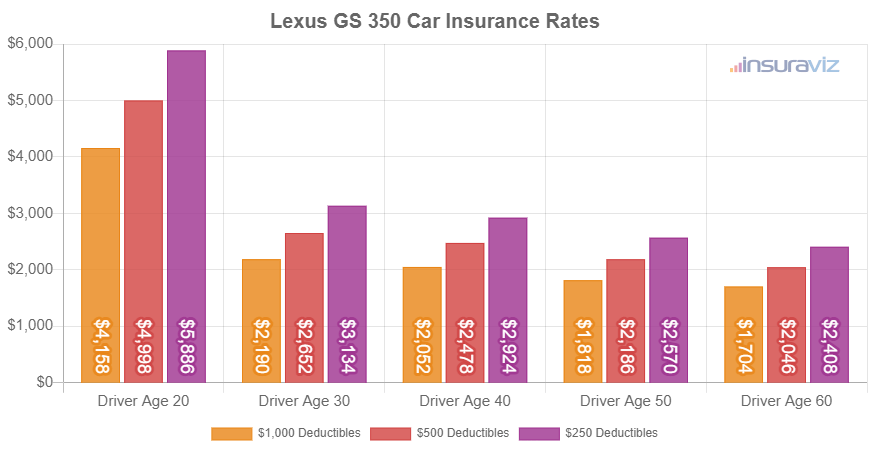

The chart below illustrates how GS 350 insurance cost varies with changes in driver age and the chosen policy deductibles.

The following table shows average GS 350 car insurance rates for the 2013 to 2020 model years. Rates range from $1,624 for a 2013 model to the most expensive cost of $2,538 for a 2020 Lexus GS 350.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2020 Lexus GS 350 | $2,538 | $212 |

| 2019 Lexus GS 350 | $2,454 | $205 |

| 2018 Lexus GS 350 | $2,336 | $195 |

| 2017 Lexus GS 350 | $2,254 | $188 |

| 2016 Lexus GS 350 | $2,084 | $174 |

| 2015 Lexus GS 350 | $2,234 | $186 |

| 2014 Lexus GS 350 | $2,004 | $167 |

| 2013 Lexus GS 350 | $1,624 | $135 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Lexus GS 350 trim levels for each model year. Updated October 24, 2025

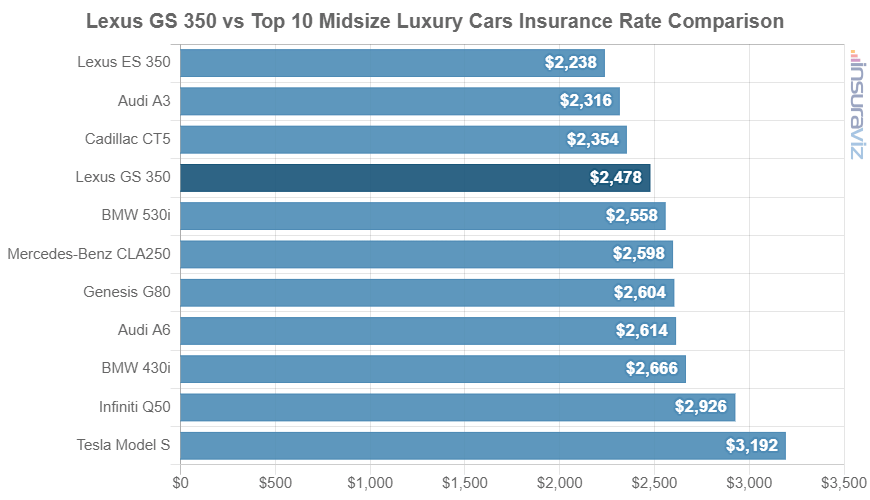

How does Lexus GS 350 insurance cost compare?

When compared to other popular midsize luxury cars, Lexus GS 350 car insurance rates cost $606 more per year than the Acura ILX, $80 less than the BMW 530i, $458 less than the Infiniti Q50, and $236 more than the Lincoln MKZ.

The Lexus GS 350 ranks 12th out of 41 total vehicles in the midsize luxury car segment. The GS 350 costs an estimated $2,538 per year to insure and the segment average car insurance rate is $2,770 annually, a difference of $232 per year.

The chart below shows how GS 350 insurance rates compare to the top 10 most popular midsize luxury cars in the United States. In addition, a table after the chart breaks down average auto insurance rates for all 41 models in the midsize luxury car category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura ILX | $1,932 | -$606 |

| 2 | Lexus RC 300 | $2,220 | -$318 |

| 3 | Mercedes-Benz SLC300 | $2,284 | -$254 |

| 4 | Lexus ES 350 | $2,294 | -$244 |

| 5 | Lincoln MKZ | $2,302 | -$236 |

| 6 | Mercedes-Benz AMG CLA45 | $2,322 | -$216 |

| 7 | Jaguar XE | $2,328 | -$210 |

| 8 | Lexus IS 300 | $2,330 | -$208 |

| 9 | Audi A3 | $2,372 | -$166 |

| 10 | Cadillac CT5 | $2,410 | -$128 |

| 11 | Audi S5 | $2,474 | -$64 |

| 12 | Lexus GS 350 | $2,538 | -- |

| 13 | Mercedes-Benz E350 | $2,550 | $12 |

| 14 | Lexus ES 300H | $2,586 | $48 |

| 15 | Audi S4 | $2,612 | $74 |

| 16 | BMW 530i | $2,618 | $80 |

| 17 | BMW 540i | $2,646 | $108 |

| 18 | Mercedes-Benz CLA250 | $2,664 | $126 |

| 19 | Genesis G80 | $2,668 | $130 |

| 20 | Audi A6 | $2,676 | $138 |

| 21 | Mercedes-Benz E450 | $2,710 | $172 |

| 22 | BMW 430i | $2,730 | $192 |

| 23 | Mercedes-Benz CLS450 | $2,766 | $228 |

| 24 | Jaguar XF | $2,768 | $230 |

| 25 | BMW 440i | $2,870 | $332 |

| 26 | Mercedes-Benz AMG C43 | $2,872 | $334 |

| 27 | Mercedes-Benz SL450 | $2,892 | $354 |

| 28 | Audi RS 5 | $2,906 | $368 |

| 29 | Audi S6 | $2,966 | $428 |

| 30 | Infiniti Q50 | $2,996 | $458 |

| 31 | BMW 530e | $3,012 | $474 |

| 32 | Lexus GS F | $3,088 | $550 |

| 33 | Mercedes-Benz AMG C63 | $3,130 | $592 |

| 34 | BMW M550i | $3,186 | $648 |

| 35 | Mercedes-Benz SL550 | $3,214 | $676 |

| 36 | Tesla Model S | $3,272 | $734 |

| 37 | Audi A7 | $3,316 | $778 |

| 38 | Lexus LC 500H | $3,402 | $864 |

| 39 | Audi S7 | $3,528 | $990 |

| 40 | BMW M8 | $3,532 | $994 |

| 41 | BMW M5 | $3,580 | $1,042 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated October 24, 2025

Some other interesting observations concerning GS 350 insurance cost include:

- The higher the deductibles, the lower the cost. Increasing your deductibles from $500 to $1,000 could save around $436 per year for a 40-year-old driver and $860 per year for a 20-year-old driver.

- Decreasing deductibles increases car insurance rates. Decreasing deductibles from $500 to $250 could cost an additional $456 per year for a 40-year-old driver and $912 per year for a 20-year-old driver.

- Credit ratings can impact car insurance rates. If you have a high credit score of 800+, you could save as much as $398 per year when compared to a good credit rating of 670-739. Conversely, a poor credit score could cost around $462 more per year. Not all states or insurance companies use credit scores as a rating factor, however.

- Driver gender affects car insurance rates. For a 2020 Lexus GS 350, a 20-year-old male driver pays an estimated $5,120 per year for full coverage car insurance, while a 20-year-old female pays an estimated $3,658, a difference of $1,462 per year. The females get much better rates. But by age 50, rates for male drivers are $2,238 and the rate for females is $2,190, a difference of only $48.

- Save money by qualifying for discounts. Discounts may be available if you sign the policy early, are a good student, are a loyal customer, own your home, take a defensive driving course, or other discounts which could save as much as $428 per year on the cost of insuring a Lexus GS 350.

- Save money due to your profession. Most car insurance companies offer discounts for working in professions like scientists, high school and elementary teachers, engineers, doctors, police officers and law enforcement, and others. By qualifying for this discount, you could save between $76 and $216 on your yearly GS 350 insurance cost, depending on the age of the rated driver.

- Plan on paying a lot to insure a teen driver. Average rates for full coverage GS 350 insurance costs $8,928 per year for a 16-year-old driver, $8,702 per year for a 17-year-old driver, and $7,894 per year for an 18-year-old driver.