- Chevy Malibu insurance rates cost an average of $2,326 per year, $1,163 for a 6-month policy, or $194 per month for a full coverage car insurance policy.

- The Malibu ranks third out of 11 vehicles in the midsize car class for car insurance affordability.

- Drivers can find the cheapest insurance on the Malibu LS Sedan trim level at $2,250 per year.

- Removing physical damage coverage on an older Chevrolet Malibu may save as much as $840 per year, depending on the level of physical damage deductibles and the age of the driver.

The Cost to Insure a Chevy Malibu

Plan on budgeting an average of $2,326 a year to insure a Chevrolet Malibu for full coverage, or around $194 a month. But keep in mind that the actual rate you pay can vary considerably based on quite a few different factors.

Things like your age, your driving record, even your credit history may have an impact on your Malibu insurance bill.

The purpose of this article is to help you understand some of these factors, and how you can make smart choices that can help bring down the price you pay.

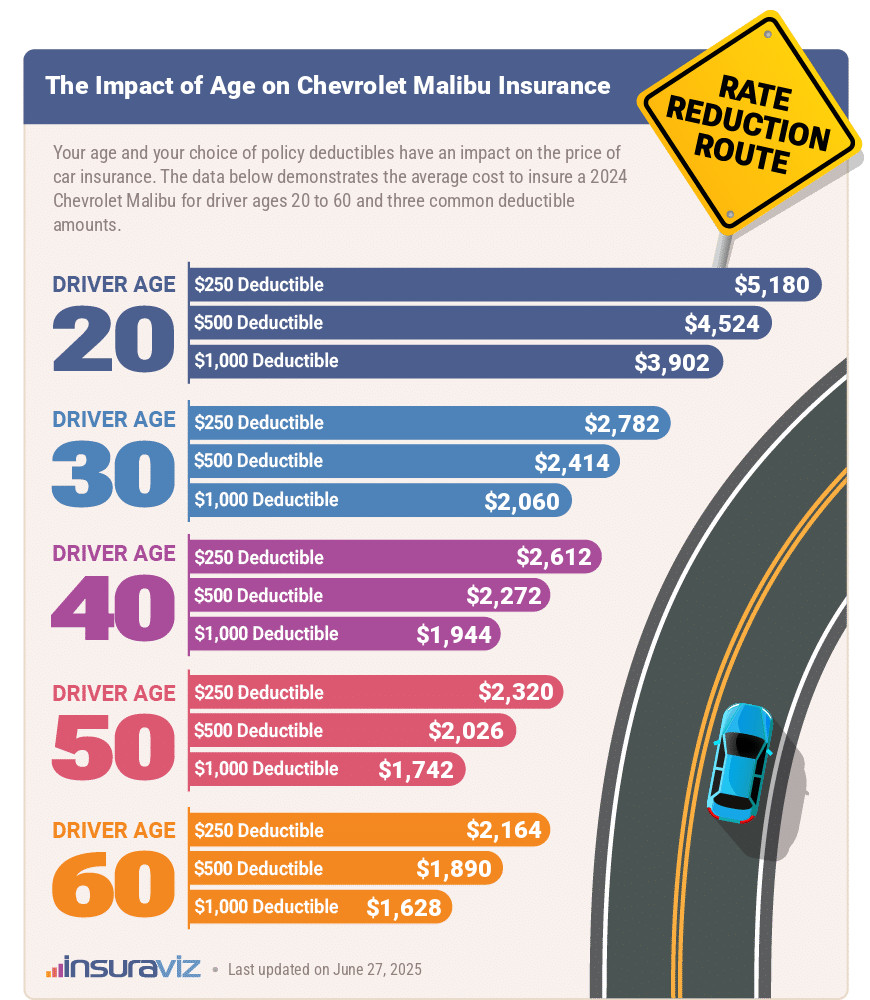

First, let’s talk about two pretty big things that affect your car insurance rates: driver age and policy deductibles. The graphic below demonstrates how average Chevy Malibu car insurance rates fluctuate based on the age of the rated driver and insurance policy deductibles.

If you happen to be closer to the 20-year-old rates than the 60-year-old rates, then you’re probably now thinking about selling your car entirely and buying a bike.

There are lots of additional factors that impact this price, so just think of these numbers as a starting point.

Some factors cause rates to increase (like getting a speeding ticket) and some cause rates to decrease (like staying claim-free).

The key here is knowing that as you get older, you can expect rates to drop.

One key way to save money when insuring your Malibu is to raise your physical damage deductible. This reduces the burden on your insurance company if you have a claim, so they reward you with lower rates.

Just keep in mind that if you do raise your deductible, you’ll need additional savings to pony up if you do have a covered claim.

Here are some additional details regarding factors that influence the cost of car insurance:

- It’s expensive to buy high-risk insurance. For a 30-year-old driver, having too many driving record violations or accidents can cause a rate increase of $2,852 or more per year.

- Increasing deductibles lowers insurance cost. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $334 per year for a 40-year-old driver and $636 per year for a 20-year-old driver.

- The lower deductible you choose, the higher the policy cost. Dropping your physical damage deductibles from $500 to $250 could cost an additional $348 per year for a 40-year-old driver and $672 per year for a 20-year-old driver.

- Malibu insurance rates for teens are expensive. Average rates for full coverage Malibu insurance costs $8,339 per year for a 16-year-old driver, $8,022 per year for a 17-year-old driver, and $7,087 per year for an 18-year-old driver.

- Obey the law to get lower rates. To pay the cheapest possible Malibu insurance rates, it pays to drive safely. Just a couple of traffic tickets have the consequences of increasing policy cost as much as $618 per year. Serious convictions such as hit-and-run, DUI, or reckless driving could raise rates by an additional $2,144 or more.

- Earn a discount from your profession. Many auto insurance companies offer discounts for specific occupations like architects, high school and elementary teachers, members of the military, accountants, lawyers, and other occupations. Having this discount applied to your policy may save between $70 and $233 on your yearly Malibu insurance premium.

- Driver gender influences rates. For a 2024 Chevrolet Malibu, a 20-year-old male will pay an average rate of $4,638 per year, while a 20-year-old female pays an average of $3,358, a difference of $1,280 per year. The females get much better rates. But by age 50, the male rate is $2,078 and the rate for females is $2,016, a difference of only $62.

Your Malibu Compared to Other Midsize Cars

The Chevrolet Malibu ranks third out of 11 total vehicles in the 2024 midsize car segment. The Malibu costs an average of $2,326 per year for full coverage insurance, while the class average rate is $2,447 annually, a difference of $121 per year.

When compared to other midsize models, insurance for a Malibu costs $252 less per year than the Toyota Camry, $10 more than the Honda Accord, $272 less than the Nissan Altima, and $492 less than the Tesla Model 3.

The chart below shows how average Malibu car insurance rates compare to nine other midsize cars that together make up the top 10 selling models in America.

Rates by Trim: What is the Cheapest Malibu to Insure?

The cheapest Chevy Malibu insurance can be found on the base LS Sedan trim (MSRP of $25,100) costing $2,250 per year and the RS Sedan trim (MSRP of $26,000) costing an average of $2,280.

Anticipate a monthly payment of around $188 to insure a Malibu for full coverage. This payment can vary significantly, however, based on the age of the driver, location, policy limits, and driving record.

The $31,500 2LT Sedan trim is the most expensive to insure, costing an average of $182 more per year than the cheapest LS Sedan model.

The rate table below shows the average insurance cost for a 2024 Malibu for different trim levels policy terms.

| 2024 Chevrolet Malibu Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LS Sedan | $2,250 | $188 |

| RS Sedan | $2,280 | $190 |

| LT Sedan | $2,346 | $196 |

| 2LT Sedan | $2,432 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

New vs. Used: How Much Cheaper is an Older Model?

It’s a fact that as your Malibu gets older, insurance gets cheaper. The reason for this is due to the lower value of your vehicle due to additional mileage and depreciation.

It’s just like shopping for a used car. The older a vehicle is and the more miles it has on it, the cheaper the price. It’s no different with car insurance, but the buyer of the car is your insurance company.

If your Malibu gets damaged to the point where repairs would exceed the value of the vehicle, then it’s considered “totaled”. If that damage was caused by a covered peril on your car insurance policy, and you have full coverage, then your insurance company would pay you the “actual cash value” of your vehicle.

As this actual cash value amount drops over the years, your insurance company is on the hook for less money in the case of a total loss. So insurance rates drop accordingly.

The table below demonstrates how the cost to insure a Chevy Malibu decreases over time. In this example, insurance costs range from the cheapest rate of $1,274 for a 60-year-old driver rated on a 2013 Chevrolet Malibu to the most expensive yearly cost for a 20-year-old driver rated on a new 2024 Malibu.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chevrolet Malibu | $4,638 | $2,326 | $1,938 |

| 2023 Chevrolet Malibu | $4,524 | $2,266 | $1,888 |

| 2022 Chevrolet Malibu | $4,596 | $2,290 | $1,908 |

| 2021 Chevrolet Malibu | $4,098 | $2,044 | $1,700 |

| 2020 Chevrolet Malibu | $3,984 | $1,986 | $1,652 |

| 2019 Chevrolet Malibu | $4,076 | $2,028 | $1,696 |

| 2018 Chevrolet Malibu | $3,844 | $1,920 | $1,602 |

| 2017 Chevrolet Malibu | $3,698 | $1,846 | $1,542 |

| 2016 Chevrolet Malibu | $3,392 | $1,696 | $1,420 |

| 2015 Chevrolet Malibu | $3,242 | $1,608 | $1,350 |

| 2014 Chevrolet Malibu | $3,126 | $1,554 | $1,302 |

| 2013 Chevrolet Malibu | $3,050 | $1,520 | $1,274 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Malibu trim levels for each model year. Updated October 24, 2025

Sooner or later, you will need to decide when to delete physical damage coverage from the policy. As a vehicle loses value over time, the costs required to keep physical damage protection surpass the benefits provided by having it.

Deleting full coverage on an older Chevrolet Malibu may save the average driver $844 per year, depending on the level of physical damage deductibles and the driver age.

Average Chevy Malibu Insurance Rates by U.S. State

Your Zip Code is more than just a way to get your mail. It also significantly impacts the price of car insurance.

States like Maine ($1,768) and Iowa ($1,884) have cheaper Malibu insurance rates, while states like New York ($2,710), Louisiana ($2,614), and Michigan ($2,798) tend to be on the expensive side.

The table below shows average insurance rates for a 2024 Malibu in all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,274 | $190 |

| Alaska | $2,032 | $169 |

| Arizona | $2,302 | $192 |

| Arkansas | $2,520 | $210 |

| California | $2,798 | $233 |

| Colorado | $2,566 | $214 |

| Connecticut | $2,636 | $220 |

| Delaware | $2,676 | $223 |

| Florida | $2,708 | $226 |

| Georgia | $2,478 | $207 |

| Hawaii | $1,904 | $159 |

| Idaho | $1,960 | $163 |

| Illinois | $2,236 | $186 |

| Indiana | $2,014 | $168 |

| Iowa | $1,884 | $157 |

| Kansas | $2,416 | $201 |

| Kentucky | $2,564 | $214 |

| Louisiana | $2,614 | $218 |

| Maine | $1,768 | $147 |

| Maryland | $2,324 | $194 |

| Massachusetts | $2,594 | $216 |

| Michigan | $2,798 | $233 |

| Minnesota | $2,204 | $184 |

| Mississippi | $2,400 | $200 |

| Missouri | $2,660 | $222 |

| Montana | $2,304 | $192 |

| Nebraska | $2,164 | $180 |

| Nevada | $2,776 | $231 |

| New Hampshire | $1,884 | $157 |

| New Jersey | $2,800 | $233 |

| New Mexico | $2,140 | $178 |

| New York | $2,710 | $226 |

| North Carolina | $1,808 | $151 |

| North Dakota | $2,154 | $180 |

| Ohio | $1,934 | $161 |

| Oklahoma | $2,618 | $218 |

| Oregon | $2,332 | $194 |

| Pennsylvania | $2,374 | $198 |

| Rhode Island | $2,848 | $237 |

| South Carolina | $2,170 | $181 |

| South Dakota | $2,488 | $207 |

| Tennessee | $2,360 | $197 |

| Texas | $2,320 | $193 |

| Utah | $2,232 | $186 |

| Vermont | $1,982 | $165 |

| Virginia | $1,876 | $156 |

| Washington | $2,280 | $190 |

| West Virginia | $2,258 | $188 |

| Wisconsin | $1,960 | $163 |

| Wyoming | $2,254 | $188 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025