- Chevy Tahoe insurance costs an estimated $2,252 per year on average, or about $188 per month for a policy with full coverage.

- The cheapest Tahoe insurance is on the LS 2WD trim level at an estimated $2,108 per year. The most expensive is the High Country 4WD at $2,380 annually.

- When compared to the entire large SUV segment, the Tahoe falls near the top at first out of nine total comparison vehicles.

- On a state level, insurance rates range from a low of $1,716 per year in Maine to $2,712 in Michigan. Rates in a few larger cities include $2,330 in Nashville, TN, $1,888 in Charlotte, NC, and $2,490 in San Diego, CA.

How much does Chevrolet Tahoe car insurance cost?

Average Chevy Tahoe insurance cost is $2,252 per year for a full coverage policy. Average insurance cost per month for the Tahoe ranges from $176 to $198 depending on the trim level.

When priced by coverage type, comprehensive (or other-than-collision) coverage will cost about $578 a year, liability and medical payments insurance is about $636, and the remaining collision insurance is an estimated $1,038.

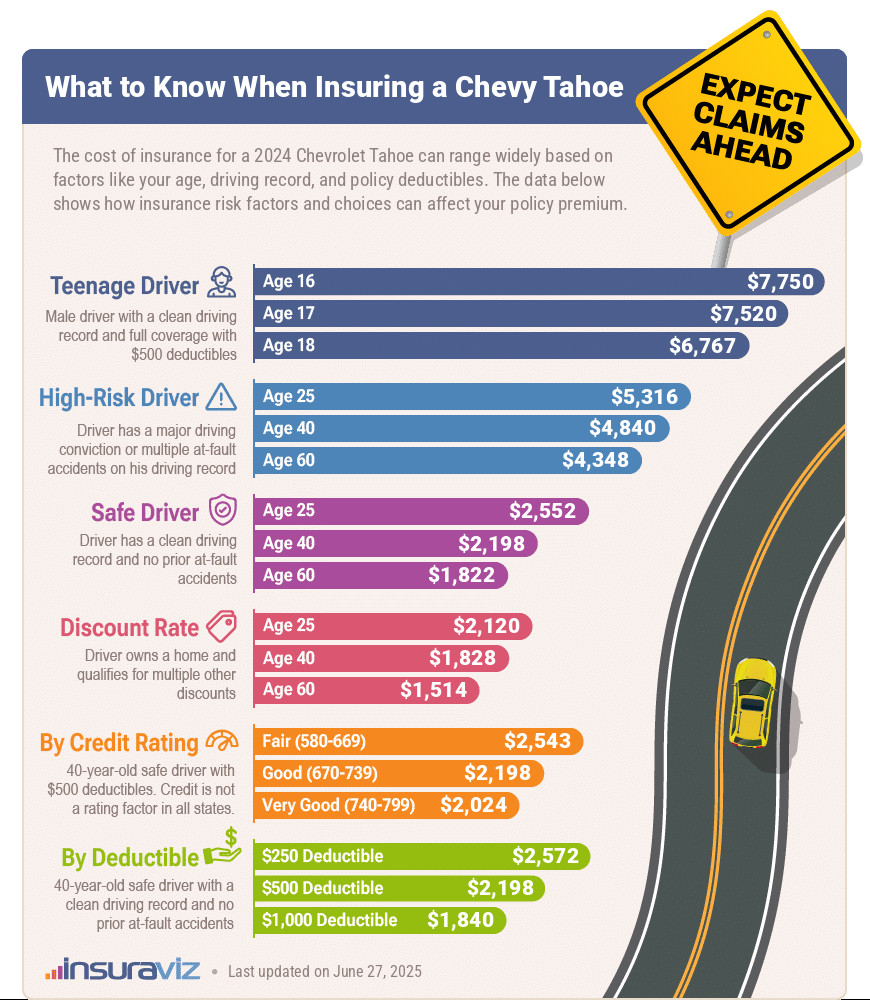

The following infographic details average 2024 Chevrolet Tahoe car insurance rates using different combinations of risk and driver age.

The image above shows average Tahoe insurance rates for a variety of different driver ages and risk scenarios for a 2024 model. But the model year of your Tahoe is also a factor in determining insurance rates.

The table below breaks down full-coverage insurance rates back to the 2013 model year. For additional model years and comparisons between the cost of full coverage and liability-only coverage, see the liability insurance cost comparison table.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chevrolet Tahoe | $4,514 | $2,252 | $1,868 |

| 2023 Chevrolet Tahoe | $4,390 | $2,188 | $1,814 |

| 2022 Chevrolet Tahoe | $4,438 | $2,198 | $1,824 |

| 2021 Chevrolet Tahoe | $4,496 | $2,218 | $1,844 |

| 2020 Chevrolet Tahoe | $4,364 | $2,152 | $1,790 |

| 2019 Chevrolet Tahoe | $4,104 | $2,022 | $1,680 |

| 2018 Chevrolet Tahoe | $3,896 | $1,924 | $1,600 |

| 2017 Chevrolet Tahoe | $3,766 | $1,860 | $1,550 |

| 2016 Chevrolet Tahoe | $3,500 | $1,738 | $1,448 |

| 2015 Chevrolet Tahoe | $3,490 | $1,724 | $1,442 |

| 2014 Chevrolet Tahoe | $3,066 | $1,518 | $1,276 |

| 2013 Chevrolet Tahoe | $3,092 | $1,538 | $1,288 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Tahoe trim levels for each model year. Updated October 24, 2025

A few additional observations regarding the cost to insure a Chevy Tahoe include:

- Raising physical damage deductibles lowers cost. Raising your policy deductibles from $500 to $1,000 could save around $366 per year for a 40-year-old driver and $716 per year for a 20-year-old driver.

- Low deductibles make insurance more expensive. Decreasing your policy deductibles from $500 to $250 could cost an additional $384 per year for a 40-year-old driver and $754 per year for a 20-year-old driver.

- Car insurance for teenagers is expensive. Average rates for full coverage Tahoe insurance costs $7,941 per year for a 16-year-old driver, $7,708 per year for a 17-year-old driver, and $6,933 per year for an 18-year-old driver.

- No accidents mean cheaper rates. Having multiple accidents could cost you more, possibly by an extra $3,188 per year for a 20-year-old driver and as much as $532 per year for a 60-year-old driver.

- As you age, Chevrolet Tahoe car insurance rates get cheaper. The difference in insurance cost for a Chevrolet Tahoe between a 60-year-old driver ($1,868 per year) and a 30-year-old driver ($2,404 per year) is $536, or a savings of 25.1%.

- Avoid traffic tickets to pay less. If you want to receive the cheapest Chevy Tahoe insurance cost, it pays not to be aggressive behind the wheel. As a matter of fact, just one or two blemishes on your motor vehicle report have the ramification of increasing insurance rates by up to $592 per year. Serious violations like reckless driving and leaving the scene of an accident, DUI, or driving on a revoked license could raise rates by an additional $2,074 or more.

Which Tahoe trim level has the cheapest insurance?

With Chevy Tahoe insurance costs ranging from $2,108 to $2,380 annually on average, the most budget-friendly model to insure is the LS 2WD. The second cheapest model to insure is the LS 4WD at $2,158 per year. Plan on paying a minimum of $176 per month for full coverage insurance.

For more equipped Tahoe trim levels, the three highest cost Tahoe models to insure are the Chevrolet Tahoe Premier 4WD, the High Country 2WD, and the High Country 4WD trim levels at $2,322, $2,350, and $2,380 per year, respectively.

The following table shows average annual premium and cost per month for each Tahoe model and trim level.

| 2024 Chevrolet Tahoe Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LS 2WD | $2,108 | $176 |

| LS 4WD | $2,158 | $180 |

| LT 2WD | $2,194 | $183 |

| RST 2WD | $2,230 | $186 |

| LT 4WD | $2,238 | $187 |

| Z71 4WD | $2,252 | $188 |

| RST 4WD | $2,264 | $189 |

| Premier 2WD | $2,294 | $191 |

| Premier 4WD | $2,322 | $194 |

| High Country 2WD | $2,350 | $196 |

| High Country 4WD | $2,380 | $198 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does Chevy Tahoe insurance cost compare?

When compared directly to other popular large SUVs, car insurance for a Tahoe costs $334 less per year than the Ford Expedition, $330 less than the GMC Yukon, $126 less than the Chevrolet Suburban, and $236 less than the Nissan Armada.

The Chevy Tahoe ranks first out of nine total vehicles in the large SUV segment. The Tahoe costs an average of $2,252 per year to insure for full coverage, and the class average is $2,650 annually, the Tahoe being $398 cheaper per year.

The table below shows how all the rates for the large SUV class and how the Tahoe compares.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Chevrolet Tahoe | $2,252 | -- |

| 2 | Chevrolet Suburban | $2,378 | $126 |

| 3 | Nissan Armada | $2,488 | $236 |

| 4 | GMC Yukon | $2,582 | $330 |

| 5 | Ford Expedition | $2,586 | $334 |

| 6 | Jeep Grand Wagoneer | $2,784 | $532 |

| 7 | GMC Hummer EV | $2,796 | $544 |

| 8 | Jeep Wagoneer | $2,986 | $734 |

| 9 | Toyota Sequoia | $3,002 | $750 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

When we factor in sticker price, we can see how the cost of insurance compares between the Tahoe and models with similar MSRP. For the 2024 model year, the average MSRP for a Tahoe is $66,777 and ranges from the cheapest LS 2WD model at $56,095 to the most expensive High Country 4WD costing $78,295 (before delivery and doc fees).

The models in the full-size SUV segment closest in cost to the Chevrolet Tahoe are the Chevrolet Suburban, Toyota Sequoia, Ford Expedition, and GMC Yukon. Here’s how they compare to the Tahoe by MSRP and average insurance rates.

- Compared to the Chevrolet Suburban – The MSRP for the 2024 Chevrolet Suburban averages $2,991 more than the average cost for the Chevrolet Tahoe ($69,768 compared to $66,777). The average insurance cost for the Tahoe compared to the Chevrolet Suburban is $126 less annually.

- Compared to the Toyota Sequoia – The 2024 Chevrolet Tahoe has an average MSRP that is $5,409 cheaper than the Toyota Sequoia ($66,777 versus $72,186). Drivers can expect to pay approximately $750 more per year to insure the Toyota Sequoia compared to a Tahoe.

- Compared to the Ford Expedition – With an average sticker price of $72,840 and ranging from $55,525 to $89,235, the 2024 Ford Expedition costs $6,063 more than the average MSRP for the Chevrolet Tahoe. The cost to insure a Chevrolet Tahoe compared to the Ford Expedition is $334 less every 12 months on average.

- Compared to the GMC Yukon – The average MSRP for a 2024 Chevrolet Tahoe is $7,102 cheaper than the GMC Yukon, at $66,777 compared to $73,879. Insuring a Chevrolet Tahoe compared to the GMC Yukon costs an average of $330 less every 12 months.

How much is liability insurance for a Chevy Tahoe?

The table below compares the difference in Chevy Tahoe insurance cost between full-coverage and liability-only Tahoe insurance rates for the 2001 through 2012 model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Chevrolet Tahoe | $1,468 | $670 |

| 2011 Chevrolet Tahoe | $1,408 | $664 |

| 2010 Chevrolet Tahoe | $1,344 | $658 |

| 2009 Chevrolet Tahoe | $1,286 | $652 |

| 2008 Chevrolet Tahoe | $1,234 | $646 |

| 2007 Chevrolet Tahoe | $1,216 | $640 |

| 2006 Chevrolet Tahoe | $1,190 | $634 |

| 2005 Chevrolet Tahoe | $1,148 | $628 |

| 2004 Chevrolet Tahoe | $1,118 | $622 |

| 2003 Chevrolet Tahoe | $1,096 | $610 |

| 2002 Chevrolet Tahoe | $1,074 | $597 |

| 2001 Chevrolet Tahoe | $1,052 | $585 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Tahoe insurance rates by U.S. city

The cost of insurance for a Chevrolet Tahoe varies widely, from cheaper rates like $1,888 a year in Charlotte, NC, or $1,942 in Columbus, OH, to higher rates such as $3,612 a year in New York City, NY and $3,274 in Los Angeles, CA.

Other larger metro area rates include Dallas, TX, costing $2,408 per year, Memphis, TN, at an estimated $2,650, Tucson, AZ, at $2,262, and Atlanta, GA, averaging $2,626.

The following bar chart shows average Chevrolet Tahoe insurance rates in thirty large metro areas in the U.S.