- The average cost of car insurance in Memphis is 16.2% more than the national average rate of $1,883.

- Memphis auto insurance costs an average of $390 per year more than the Tennessee state average rate and $331 per year more than the rate average for the entire United States.

- Monthly car insurance rates for a few popular vehicles in Memphis include the Hyundai Elantra at $201, Toyota Highlander at $168, and Nissan Altima at $200.

- For cheap car insurance in Memphis, SUV models like the Subaru Crosstrek, Chevrolet Trailblazer, and Kia Soul cost less than most other makes and models.

How much does car insurance cost in Memphis?

Average car insurance cost in Memphis is $2,214 per year, which is 16.2% more than the U.S. average rate of $1,883. Average car insurance cost per month in Memphis is $185 for a policy that provides full coverage.

The average car insurance cost in Tennessee is $1,824 per year, so Memphis drivers pay an average of $390 more per year than the overall Tennessee state-wide average rate. When compared to other cities in Tennessee, the cost to insure a car in Memphis is approximately $342 per year more than in Nashville, $396 per year more expensive than in Clarksville, and $382 per year more than in Knoxville.

The chart below shows examples of average Memphis auto insurance cost broken out for a variety of driver ages, policy deductibles, and driver risk scenarios. Rates are averaged for all 2024 model year vehicles including luxury models.

Average rates in the prior chart range from $1,840 per year for a 40-year-old driver who shops around for the cheapest Memphis car insurance rates to $5,092 per year for a 20-year-old driver who has a subpar driving record and has to buy high risk car insurance. The rate used in this article to compare different vehicles or locations is the 40-year-old safe driver rate, which has an average cost of $2,214 per year.

As a monthly expense, average car insurance cost in Memphis ranges from $153 to $424 for the same deductible limits and driver ages shown in the prior chart.

Memphis car insurance rates vary considerably and can also be significantly different between companies. The potential for large premium differences emphasizes the need for accurate auto insurance quotes when shopping for the cheapest car insurance in Memphis.

The age of the rated driver is one of the largest factors in the price of auto insurance. The list below illustrates this point by breaking down average car insurance rates in Memphis depending on driver age.

Average car insurance cost for Memphis drivers age 16 to 60

- 16-year-old rated driver – $7,886 per year or $657 per month

- 17-year-old rated driver – $7,640 per year or $637 per month

- 18-year-old rated driver – $6,846 per year or $571 per month

- 19-year-old rated driver – $6,235 per year or $520 per month

- 20-year-old rated driver – $4,454 per year or $371 per month

- 30-year-old rated driver – $2,364 per year or $197 per month

- 40-year-old rated driver – $2,214 per year or $185 per month

- 50-year-old rated driver – $1,962 per year or $164 per month

- 60-year-old rated driver – $1,836 per year or $153 per month

The rates in the list above for teen drivers were based on the driver being male. The chart below goes into more detail regarding the cost of insuring teen drivers and illustrates average teen driver rates in Memphis by gender. Females generally have cheaper auto insurance rates, especially as teenagers.

Car insurance for a 16-year-old female in Memphis costs an average of $521 less per year than the cost for a 16-year-old male, while at age 19, the cost difference is less but males still pay an average of $964 more per year.

The cost to insure popular vehicles in Memphis

The car insurance rates mentioned above are averaged for all 2024 vehicle models, which is handy when making overall comparisons such as the cost difference between two locations. Average auto insurance rates are great when presented with a question like “are Memphis car insurance rates cheaper than in Murfreesboro?” or “is car insurance cheaper in Tennessee or Illinois?”.

For more useful auto insurance rate comparisons, however, it makes sense to analyze the exact vehicle being insured. Every model has it’s own risk profile for liability and physical damage claims, and this data allows us to make cost projections and comparisons.

The next list breaks down both annual and monthly average car insurance rates in Memphis for the more popular vehicles. At the end of this article, there is a section that examines car insurance rates for some of these models even more in-depth.

Average annual and monthly car insurance cost for popular models in Memphis

- Hyundai Elantra – $2,578 per year or $215 per month

- Toyota Highlander – $2,163 per year or $180 per month

- Nissan Altima – $2,573 per year or $214 per month

- Jeep Grand Cherokee – $2,379 per year or $198 per month

- Ram Truck – $2,746 per year or $229 per month

- Toyota Corolla – $2,310 per year or $193 per month

- Honda CR-V – $2,027 per year or $169 per month

- Subaru Outback – $2,025 per year or $169 per month

- Chevrolet Equinox – $2,187 per year or $182 per month

- Honda Civic – $2,101 per year or $175 per month

What vehicles have the cheapest car insurance in Memphis?

When comparing rates for all vehicle models, the models with the cheapest average insurance rates in Memphis, TN, tend to be compact SUVs and crossovers like the Chevrolet Trailblazer, Kia Soul, and Nissan Kicks.

Average auto insurance quotes for those small SUVs cost $1,927 or less per year ($161 per month) for a full coverage policy.

A few other vehicles that have low-cost auto insurance rates in the comparison table below are the Honda CR-V, Volkswagen Tiguan, Volkswagen Taos, and Buick Encore.

Average auto insurance rates are a little bit more for those models than the cheapest compact SUVs that rank near the top, but they still have an average cost of $2,038 or less per year, or $170 per month.

The following table shows the 30 models with the cheapest car insurance in Memphis, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,634 | $136 |

| 2 | Chevrolet Trailblazer | $1,664 | $139 |

| 3 | Kia Soul | $1,730 | $144 |

| 4 | Nissan Kicks | $1,744 | $145 |

| 5 | Honda Passport | $1,764 | $147 |

| 6 | Buick Envision | $1,774 | $148 |

| 7 | Toyota Corolla Cross | $1,784 | $149 |

| 8 | Hyundai Venue | $1,800 | $150 |

| 9 | Mazda CX-5 | $1,806 | $151 |

| 10 | Ford Bronco Sport | $1,814 | $151 |

| 11 | Volkswagen Tiguan | $1,832 | $153 |

| 12 | Acura RDX | $1,850 | $154 |

| 13 | Nissan Murano | $1,862 | $155 |

| 14 | Buick Encore | $1,880 | $157 |

| 15 | Subaru Outback | $1,886 | $157 |

| 16 | Honda CR-V | $1,890 | $158 |

| 17 | Buick Envista | $1,894 | $158 |

| 18 | Chevrolet Colorado | $1,896 | $158 |

| 19 | Volkswagen Taos | $1,896 | $158 |

| 20 | Kia Niro | $1,900 | $158 |

| 21 | Toyota GR Corolla | $1,924 | $160 |

| 22 | Subaru Ascent | $1,926 | $161 |

| 23 | Honda HR-V | $1,928 | $161 |

| 24 | Nissan Leaf | $1,940 | $162 |

| 25 | Honda Civic | $1,958 | $163 |

| 26 | Lexus NX 250 | $1,960 | $163 |

| 27 | Volkswagen Atlas | $1,962 | $164 |

| 28 | Acura Integra | $1,970 | $164 |

| 29 | Volkswagen Atlas Cross Sport | $1,972 | $164 |

| 30 | Subaru Forester | $1,974 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

A table of 30 vehicle models with cheap Memphis car insurance really is not a great way to present an overall summary of the cost of auto insurance. A more thorough way to look at rates for more vehicles is by breaking them out by automotive segment.

This next section further discusses the cost of car insurance based on automotive segment. This will give you a good idea of the types of vehicles that have the overall cheapest Memphis auto insurance rates. Then the sections after the chart break out and rank the specific models that have the cheapest insurance rates for each automotive segment.

Memphis auto insurance rates by vehicle segment

When shopping for a new or used vehicle, it’s very useful to know which types of vehicles have cheaper car insurance rates. To illustrate this, maybe you’re curious if compact SUVs are cheaper to insure than minivans or if regular SUVs are more affordable to insure than luxury SUVs.

The next chart displays the average car insurance cost in Memphis for each automotive segment. Typically, compact SUVs and midsize pickup trucks have the most affordable average auto insurance rates, while exotic high-performance models have the most expensive overall rates.

Rates by different vehicle segments are precise enough for getting an initial comparison, but cost ranges substantially within each automotive segment listed in the above chart.

For example, in the small luxury car segment, rates range from the Acura Integra costing $1,970 per year for a full coverage policy to the BMW M340i costing $2,704 per year, a difference of $734 within that segment.

Also, in the midsize truck segment, average rates range from the Chevrolet Colorado at $1,896 per year to the Rivian R1T costing $2,762 per year.

In the following sections, we will eliminate a lot of this variability by looking at the cost of car insurance in Memphis for specific vehicles.

Cheapest cars to insure in Memphis

Ranking at the top for the most affordable Memphis auto insurance rates in the non-luxury sedan or hatchback segment are the Toyota GR Corolla, Nissan Leaf, Honda Civic, Nissan Sentra, and Subaru Impreza. Auto insurance prices for these 2024 models average $170 or less per month.

Not the cheapest in the list, but still ranking well, are models like the Hyundai Ioniq 6, Honda Accord, Kia K5, and Chevrolet Malibu, with average annual insurance rates of $2,150 per year or less.

Auto insurance in this segment starts at an average of $160 per month, depending on the company.

The rate comparison table below ranks the cars with the cheapest car insurance rates in Memphis, starting with the Toyota GR Corolla at $1,924 per year ($160 per month) and ending with the Mazda 3 at $2,290 per year ($191 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,924 | $160 |

| Nissan Leaf | Compact | $1,940 | $162 |

| Honda Civic | Compact | $1,958 | $163 |

| Nissan Sentra | Compact | $2,030 | $169 |

| Hyundai Ioniq 6 | Midsize | $2,036 | $170 |

| Subaru Impreza | Compact | $2,036 | $170 |

| Toyota Prius | Compact | $2,070 | $173 |

| Kia K5 | Midsize | $2,134 | $178 |

| Honda Accord | Midsize | $2,140 | $178 |

| Chevrolet Malibu | Midsize | $2,150 | $179 |

| Toyota Corolla | Compact | $2,156 | $180 |

| Kia Forte | Compact | $2,164 | $180 |

| Volkswagen Arteon | Midsize | $2,174 | $181 |

| Nissan Versa | Compact | $2,180 | $182 |

| Subaru Legacy | Midsize | $2,186 | $182 |

| Mitsubishi Mirage G4 | Compact | $2,232 | $186 |

| Toyota Crown | Midsize | $2,242 | $187 |

| Volkswagen Jetta | Compact | $2,242 | $187 |

| Hyundai Sonata | Midsize | $2,244 | $187 |

| Mazda 3 | Compact | $2,290 | $191 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to compare rates for all makes and models.

Don’t see insurance rates for your vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Memphis car insurance quotes from top companies in Tennessee.

Cheapest SUV insurance rates in Memphis

The four highest ranking SUVs with the most affordable auto insurance rates in Memphis are the Subaru Crosstrek at $1,634 per year, Chevrolet Trailblazer at $1,664 per year, Kia Soul at $1,730 per year, and Nissan Kicks at $1,744 per year.

Not the cheapest in the list, but still ranking well, are SUVs like the Ford Bronco Sport, Toyota Corolla Cross, Mazda CX-5, and Hyundai Venue, with average annual insurance rates of $1,814 per year or less.

As a cost per month, full-coverage auto insurance on this segment in Memphis starts at around $136 per month, depending on your company and location.

The lowest-cost non-luxury compact SUV to insure in Memphis is the Subaru Crosstrek at $1,634 per year. For midsize SUVs, the Honda Passport is cheapest to insure at $1,764 per year. And for full-size non-luxury SUVs, the Chevrolet Tahoe is most affordable to insure at $2,080 per year.

The rate comparison table below ranks the twenty SUVs with the most affordable average car insurance rates in Memphis, starting with the Subaru Crosstrek at $1,634 per year ($136 per month) and ending with the Honda HR-V at $1,928 per year ($161 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,634 | $136 |

| Chevrolet Trailblazer | Compact | $1,664 | $139 |

| Kia Soul | Compact | $1,730 | $144 |

| Nissan Kicks | Compact | $1,744 | $145 |

| Honda Passport | Midsize | $1,764 | $147 |

| Buick Envision | Compact | $1,774 | $148 |

| Toyota Corolla Cross | Compact | $1,784 | $149 |

| Hyundai Venue | Compact | $1,800 | $150 |

| Mazda CX-5 | Compact | $1,806 | $151 |

| Ford Bronco Sport | Compact | $1,814 | $151 |

| Volkswagen Tiguan | Compact | $1,832 | $153 |

| Nissan Murano | Midsize | $1,862 | $155 |

| Buick Encore | Compact | $1,880 | $157 |

| Subaru Outback | Midsize | $1,886 | $157 |

| Honda CR-V | Compact | $1,890 | $158 |

| Buick Envista | Midsize | $1,894 | $158 |

| Volkswagen Taos | Compact | $1,896 | $158 |

| Kia Niro | Compact | $1,900 | $158 |

| Subaru Ascent | Midsize | $1,926 | $161 |

| Honda HR-V | Compact | $1,928 | $161 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

See our comprehensive guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view data for vehicles not featured in the table.

Looking for rates for a different SUV? No sweat! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free Memphis car insurance quotes from the best companies in Tennessee.

Cheapest luxury cars to insure in Memphis

Ranking #1 in Memphis for cheapest auto insurance in the luxury car segment is the Acura Integra, at an average of $1,970 per year. Second place is the BMW 330i at $2,254 per year, coming in third is the Mercedes-Benz CLA250, costing an average of $2,280 per year, and the fourth cheapest is the Lexus IS 300, costing an average of $2,280 per year.

Also ranking well in our comparison are luxury cars like the Genesis G70, Cadillac CT4, Lexus RC 300, and Lexus ES 350, with an average car insurance cost of $2,328 per year or less.

Additional 2024 models worth mentioning include the BMW 330e, Audi S3, BMW 230i, Lexus IS 350, and Lexus ES 250, which cost between $2,328 and $2,482 per year to insure in Memphis.

As a cost per month, car insurance rates on this segment in Memphis can cost as low as $164 per month, depending on where you live and the company you use.

The comparison table below ranks the cars with the most affordable average car insurance rates in Memphis, starting with the Acura Integra at $1,970 per year ($164 per month) and ending with the Audi S3 at $2,482 per year ($207 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,970 | $164 |

| BMW 330i | Compact | $2,254 | $188 |

| Lexus IS 300 | Midsize | $2,280 | $190 |

| Mercedes-Benz CLA250 | Midsize | $2,280 | $190 |

| Acura TLX | Compact | $2,292 | $191 |

| Cadillac CT4 | Compact | $2,314 | $193 |

| Lexus ES 350 | Midsize | $2,314 | $193 |

| Genesis G70 | Compact | $2,318 | $193 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,322 | $194 |

| Lexus RC 300 | Midsize | $2,328 | $194 |

| Lexus IS 350 | Compact | $2,332 | $194 |

| Jaguar XF | Midsize | $2,342 | $195 |

| Cadillac CT5 | Midsize | $2,388 | $199 |

| Lexus ES 250 | Midsize | $2,396 | $200 |

| BMW 330e | Compact | $2,404 | $200 |

| Lexus RC 350 | Compact | $2,404 | $200 |

| BMW 228i | Compact | $2,408 | $201 |

| BMW 230i | Compact | $2,428 | $202 |

| Lexus ES 300h | Midsize | $2,432 | $203 |

| Audi S3 | Compact | $2,482 | $207 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

See our comprehensive guide for luxury car insurance to view data for vehicles not featured in the table.

Don’t see your luxury car in the list? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Memphis car insurance quotes from the best auto insurance companies in Tennessee.

Cheapest luxury SUV insurance rates in Memphis

Ranking highest for the most affordable Memphis car insurance rates in the luxury SUV segment are the Acura RDX, Cadillac XT4, Lexus NX 250, Cadillac XT5, and Jaguar E-Pace. Rates for these vehicles average $2,090 or less per year.

Additional models that rank well in our comparison include the Lexus NX 350h, Mercedes-Benz GLB 250, Lexus NX 450h, and Lexus UX 250h, with average annual insurance rates of $2,134 per year or less.

As a cost per month, auto insurance rates in Memphis on this segment for a middle-age safe driver starts at around $154 per month, depending on the company.

If vehicle size is considered, the most affordable compact luxury SUV to insure in Memphis is the Acura RDX at $1,850 per year, or $154 per month. For midsize 2024 models, the Jaguar E-Pace has the cheapest rates at $2,070 per year, or $173 per month. And for full-size luxury SUV models, the Infiniti QX80 has the cheapest car insurance rates at $2,482 per year, or $207 per month.

The next table ranks the SUVs with the lowest-cost car insurance rates in Memphis, starting with the Acura RDX at $1,850 per year ($154 per month) and ending with the Lexus NX 350 at $2,222 per year ($185 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,850 | $154 |

| Lexus NX 250 | Compact | $1,960 | $163 |

| Cadillac XT4 | Compact | $2,000 | $167 |

| Jaguar E-Pace | Midsize | $2,070 | $173 |

| Cadillac XT5 | Midsize | $2,090 | $174 |

| Lexus NX 350h | Compact | $2,090 | $174 |

| Lincoln Corsair | Compact | $2,116 | $176 |

| Mercedes-Benz GLB 250 | Compact | $2,120 | $177 |

| Lexus UX 250h | Compact | $2,124 | $177 |

| Lexus NX 450h | Compact | $2,134 | $178 |

| Infiniti QX50 | Midsize | $2,152 | $179 |

| Mercedes-Benz GLA250 | Compact | $2,154 | $180 |

| Cadillac XT6 | Midsize | $2,166 | $181 |

| Mercedes-Benz GLA35 AMG | Compact | $2,166 | $181 |

| Infiniti QX60 | Midsize | $2,176 | $181 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,182 | $182 |

| Land Rover Evoque | Compact | $2,210 | $184 |

| Acura MDX | Midsize | $2,212 | $184 |

| Lexus RX 350 | Midsize | $2,214 | $185 |

| Lexus NX 350 | Compact | $2,222 | $185 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

For all luxury SUV comparisons, see our complete guide for luxury SUV insurance.

Looking for rates for a different luxury SUV? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in Tennessee.

Cheapest sports car insurance rates in Memphis

Taking the top spot in Memphis for the lowest-cost insurance in the sports car segment is the Mazda MX-5 Miata, at an average of $2,050 per year. Second place is the Toyota GR86 at $2,334 per year, third place goes to the Ford Mustang, costing an average of $2,432 per year, and ranking fourth is the BMW Z4, costing an average of $2,448 per year.

Also ranking in the top 10 are models like the Toyota GR Supra, BMW M2, Lexus RC F, and Subaru BRZ, with an average cost to insure of $2,646 per year or less.

Full-coverage auto insurance for this segment in Memphis starts at around $171 per month, depending on the company.

The rate comparison table below ranks the twenty sports cars with the cheapest insurance rates in Memphis, starting with the Mazda MX-5 Miata at $2,050 per year ($171 per month) and ending with the Porsche Taycan at $3,752 per year ($313 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,050 | $171 |

| Toyota GR86 | Sports Car | $2,334 | $195 |

| Ford Mustang | Sports Car | $2,432 | $203 |

| BMW Z4 | Sports Car | $2,448 | $204 |

| Subaru WRX | Sports Car | $2,484 | $207 |

| Toyota GR Supra | Sports Car | $2,488 | $207 |

| BMW M2 | Sports Car | $2,560 | $213 |

| Nissan Z | Sports Car | $2,566 | $214 |

| Lexus RC F | Sports Car | $2,618 | $218 |

| Subaru BRZ | Sports Car | $2,646 | $221 |

| BMW M3 | Sports Car | $2,796 | $233 |

| Porsche 718 | Sports Car | $2,852 | $238 |

| Chevrolet Camaro | Sports Car | $2,876 | $240 |

| Chevrolet Corvette | Sports Car | $3,064 | $255 |

| Porsche 911 | Sports Car | $3,172 | $264 |

| BMW M4 | Sports Car | $3,302 | $275 |

| Lexus LC 500 | Sports Car | $3,320 | $277 |

| Jaguar F-Type | Sports Car | $3,492 | $291 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,666 | $306 |

| Porsche Taycan | Sports Car | $3,752 | $313 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

Looking for a different vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in Memphis.

Cheapest pickup truck insurance rates in Memphis

The top five most affordable pickup trucks to insure in Memphis are the Chevrolet Colorado, Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. Average insurance rates for for these five models range from $1,896 to $2,146 per year.

Not the cheapest, but still very affordable, are models like the Toyota Tacoma, GMC Sierra 2500 HD, Honda Ridgeline, and GMC Canyon, with average annual insurance rates of $2,278 per year or less.

On a monthly basis, full-coverage car insurance on this segment in Memphis will start around $158 per month, depending on your location. The comparison table below ranks the pickups with the cheapest car insurance rates in Memphis, starting with the Chevrolet Colorado at $158 per month and ending with the Ram Truck at $213 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,896 | $158 |

| Nissan Titan | Full-size | $2,068 | $172 |

| Nissan Frontier | Midsize | $2,092 | $174 |

| Ford Ranger | Midsize | $2,116 | $176 |

| Ford Maverick | Midsize | $2,146 | $179 |

| Honda Ridgeline | Midsize | $2,198 | $183 |

| Hyundai Santa Cruz | Midsize | $2,234 | $186 |

| Toyota Tacoma | Midsize | $2,244 | $187 |

| GMC Sierra 2500 HD | Heavy Duty | $2,252 | $188 |

| GMC Canyon | Midsize | $2,278 | $190 |

| Jeep Gladiator | Midsize | $2,334 | $195 |

| GMC Sierra 3500 | Heavy Duty | $2,346 | $196 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,366 | $197 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,430 | $203 |

| GMC Sierra | Full-size | $2,446 | $204 |

| Chevrolet Silverado | Full-size | $2,448 | $204 |

| Nissan Titan XD | Heavy Duty | $2,448 | $204 |

| Ford F150 | Full-size | $2,478 | $207 |

| GMC Hummer EV Pickup | Full-size | $2,538 | $212 |

| Ram Truck | Full-size | $2,560 | $213 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Memphis, TN Zip Codes. Updated February 23, 2024

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Don’t see insurance cost for your pickup? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Tennessee.

Memphis car insurance rate variability

To help clarify the extent to which the cost of auto insurance can vary from one person to the next (and also emphasize the importance of accurate rate quotes), the sections below present a wide range of rates for five popular models in Memphis: the Ford F150, Nissan Sentra, Honda CR-V, Honda Pilot, and Toyota Supra.

Each illustration displays average rates for different driver profiles to demonstrate the difference in cost when changes are made to the rated driver.

Ford F150 insurance rates

With sticker prices ranging from $46,195 to $100,090, average Memphis insurance rates for a Ford F150 cost from $2,080 per year on the F150 XL Super Cab 4WD model up to $2,878 per year for the F150 Lightning Platinum Black Special Edition trim level.

From a cost per month standpoint, full-coverage auto insurance on the Ford F150 for a good driver can cost from $173 to $240 per month, depending on the company and where you live in Memphis.

The next chart demonstrates how the cost of car insurance on a Ford F150 can change based on driver age, policy physical damage deductibles, and risk scenarios.

The Ford F150 is a full-size truck, and other similar models include the Toyota Tundra, Chevrolet Silverado, GMC Sierra, and Nissan Titan.

Nissan Sentra insurance rates

In Memphis, the cheapest car insurance rates for a 2024 Nissan Sentra are on the S trim model, costing an average of $1,984 per year, or around $165 per month. This model sells for $20,630.

The most expensive 2022 Nissan Sentra to insure in Memphis is the SR model, costing an average of $2,086 per year, or around $174 per month. The sticker price for this trim level is $23,720, before destination and documentation fees.

When Memphis car insurance rates on a Nissan Sentra are compared to the national average cost for the same vehicle, the cost is $284 to $300 less per year in Memphis, depending on the trim level being insured.

The next chart might be helpful in explaining how the cost of car insurance for a Nissan Sentra can range significantly based on a number of different driver ages and risk profiles.

The Nissan Sentra is part of the compact car segment, and other similar models that are popular in Memphis include the Volkswagen Jetta, Chevrolet Cruze, and Hyundai Elantra.

Honda CR-V insurance rates

In Memphis, the least-expensive insurance rates for a 2024 Honda CR-V are on the LX trim, costing an average of $1,790 per year, or around $149 per month. This model has a retail price of $29,500.

The most expensive 2022 Honda CR-V model to insure in Memphis is the Sport Touring Hybrid AWD model, costing an average of $1,994 per year, or around $166 per month. The MSRP for this model is $39,850, before destination charges and documentation fees.

When Memphis auto insurance rates on a Honda CR-V are compared to the overall national average cost for the same model, the cost is anywhere from $256 to $288 less per year in Memphis, depending on the exact trim being insured.

As a cost per month, auto insurance on a Honda CR-V for a middle-age safe driver can cost from $149 to $166 per month, but your actual rate can vary based on your address in Memphis.

The next rate chart shows how the cost of car insurance on a Honda CR-V can be very different based on a number of different driver ages, policy deductibles, and potential risk scenarios. For our example, prices range from $1,568 to $4,340 per year, which is a cost difference of $2,772 for insurance on the same vehicle with different rated drivers.

The Honda CR-V is classified as a compact SUV, and additional models from the same segment that are popular in Memphis include the Mazda CX-5, Chevrolet Equinox, Nissan Rogue, and Subaru Forester.

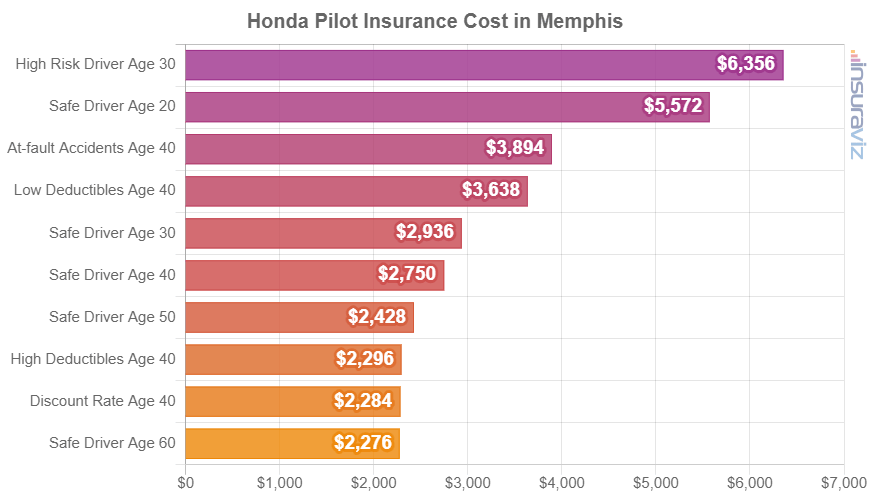

Honda Pilot insurance rates

The average cost for Honda Pilot insurance in Memphis is $2,156 per year. With sticker prices ranging from $37,090 to $52,480, average car insurance quotes for a Honda Pilot range from $2,016 per year for the Pilot LX model up to $2,290 per year for the Pilot Elite AWD trim level.

When Memphis auto insurance rates for a Honda Pilot are compared with the national average cost for the same model, the cost is anywhere from $290 to $328 less per year in Memphis, depending on the exact model being insured.

The rate chart below demonstrates how the cost of car insurance for a Honda Pilot can vary for different drivers and possible risk profiles.

The Honda Pilot belongs to the midsize SUV segment, and additional similar models include the Jeep Grand Cherokee, Kia Telluride, Ford Explorer, and Kia Sorento.

Toyota GR Supra insurance rates

Toyota GR Supra insurance in Memphis averages $2,488 per year, ranging from a low of $2,350 per year on the GR Supra 2.0 Coupe model (MSRP of $45,540) up to $2,674 per year on the GR Supra 45th Anniversary Edition model (MSRP of $64,375).

When Memphis auto insurance rates on the Toyota GR Supra are compared to the average cost for the entire U.S. for the same model, rates are anywhere from $334 to $386 cheaper per year in Memphis, depending on the exact model being insured.

The chart displayed below can help visualize how insurance rates for a Toyota GR Supra can be quite different based on different driver ages and possible risk profiles.

The Toyota Supra is considered a sports car, and additional models from the same segment that are popular in Memphis include the Nissan 370Z, Subaru BRZ, and Chevrolet Camaro.

Money-saving tips for finding cheaper Memphis auto insurance

Smart drivers are often looking to save money on car insurance So study the tips below and it’s very possible you can save a few bucks when buying auto insurance.

- If your car is older, remove unneeded coverages. Deleting physical damage coverage from vehicles that are older will cut the cost of auto insurance substantially.

- Avoid tickets to save money. If you want to get affordable car insurance in Memphis, it pays to be a conservative driver. In fact, just a few moving violations could result in increasing car insurance rates as much as $588 per year. Being convicted of a crime like DUI and hit-and-run could raise rates by an additional $2,056 or more.

- Careless drivers pay more for car insurance. Having a few at-fault accidents can really raise rates, possibly by an additional $3,160 per year for a 20-year-old driver and even as much as $922 per year for a 40-year-old driver. So drive safe and save!

- Research policy discounts to save money. Savings may be available if the insured drivers sign their policy early, are military or federal employees, take a defensive driving course, are claim-free, are loyal customers, or many other policy discounts which could save the average Memphis driver as much as $374 per year on the cost of car insurance

- Compare car insurance quote before buying a car. Different cars can have significantly different car insurance premiums, and car insurance companies can sell coverages with a wide range of costs. Check rates before you buy a new car in order to prevent price shock when you get your first insurance bill.