- Car insurance rates for a Mercedes-Benz E450 average $2,954 per year or around $246 per month, but vary considerably based on driver age and policy deductibles.

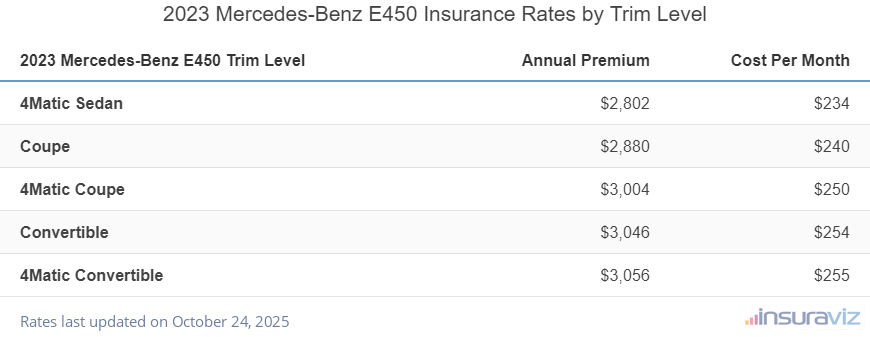

- The E450 4Matic Sedan trim level is the cheapest to insure at $2,802 per year. The most expensive trim is the 4Matic Convertible at an average of $3,056 per year.

- The Mercedes-Benz E450 is one of the cheaper midsize luxury cars to insure, costing $15 less per year on average as compared to the rest of the vehicles in the segment.

How much does Mercedes-Benz E450 insurance cost?

Drivers should budget around about $2,954 a year to insure a Mercedes-Benz E450, which is about $246 each month. When a policy is broken down into individual coverages, comprehensive (or other-than-collision) coverage will cost approximately $772 a year, liability and medical (or PIP) coverage is about $692, and the remaining collision coverage costs approximately $1,490.

The chart below illustrates how Mercedes E450 car insurance rates change based on the age of the driver and the amount of physical damage deductibles.

The next table details the estimated yearly and 6-month policy costs, including a monthly insurance rate, for each Mercedes-Benz E450 package and trim.

| 2023 Mercedes-Benz E450 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4Matic Sedan | $2,802 | $234 |

| Coupe | $2,880 | $240 |

| 4Matic Coupe | $3,004 | $250 |

| Convertible | $3,046 | $254 |

| 4Matic Convertible | $3,056 | $255 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

The table below illustrates average full coverage insurance rates for a Mercedes-Benz E450 for the 2019 to 2023 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2023 Mercedes-Benz E450 | $2,954 | $246 |

| 2022 Mercedes-Benz E450 | $2,798 | $233 |

| 2021 Mercedes-Benz E450 | $2,800 | $233 |

| 2020 Mercedes-Benz E450 | $2,710 | $226 |

| 2019 Mercedes-Benz E450 | $2,536 | $211 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz E450 trim levels for each model year. Updated October 24, 2025

How do E450 car insurance rates rank?

The Mercedes E450 ranks 21st out of 38 total vehicles in the midsize luxury car category for most affordable insurance cost. The E450 costs an average of $2,954 per year to insure and the segment average car insurance cost is $2,969 annually, a difference of $15 per year.

When rates are compared to other vehicles in the midsize luxury car class, insurance rates for a Mercedes-Benz E450 cost $434 more per year than the Lexus ES 350, $146 more than the BMW 530i, and $302 less than the Infiniti Q50.

The table below shows how well E450 insurance rates compare to all other midsize luxury cars in the U.S. like the Mercedes-Benz CLA250, Audi A6, and the Tesla Model S.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Cadillac CT5 | $2,510 | -$444 |

| 2 | Lexus ES 350 | $2,520 | -$434 |

| 3 | Lexus ES 250 | $2,530 | -$424 |

| 4 | Lexus RC 300 | $2,542 | -$412 |

| 5 | Mercedes-Benz AMG CLA35 | $2,548 | -$406 |

| 6 | Audi A3 | $2,552 | -$402 |

| 7 | Mercedes-Benz AMG CLA45 | $2,606 | -$348 |

| 8 | Mercedes-Benz CLA250 | $2,616 | -$338 |

| 9 | Lexus IS 300 | $2,628 | -$326 |

| 10 | Jaguar XF | $2,642 | -$312 |

| 11 | Audi S4 | $2,690 | -$264 |

| 12 | BMW i4 | $2,698 | -$256 |

| 13 | Mercedes-Benz E350 | $2,718 | -$236 |

| 14 | Lexus ES 300h | $2,756 | -$198 |

| 15 | BMW 530i | $2,808 | -$146 |

| 16 | Audi A6 | $2,864 | -$90 |

| 17 | Audi S5 | $2,868 | -$86 |

| 18 | BMW 540i | $2,876 | -$78 |

| 19 | BMW 430i | $2,926 | -$28 |

| 20 | Lexus IS 500 | $2,928 | -$26 |

| 21 | Mercedes-Benz E450 | $2,954 | -- |

| 22 | Genesis G80 | $2,962 | $8 |

| 23 | Mercedes-Benz CLS450 | $3,040 | $86 |

| 24 | Mercedes-Benz EQE 350 | $3,060 | $106 |

| 25 | Audi RS 5 | $3,068 | $114 |

| 26 | BMW 530e | $3,086 | $132 |

| 27 | Audi S6 | $3,116 | $162 |

| 28 | Mercedes-Benz AMG C43 | $3,122 | $168 |

| 29 | BMW M440i | $3,130 | $176 |

| 30 | Mercedes-Benz EQE 500 | $3,132 | $178 |

| 31 | Audi A7 | $3,252 | $298 |

| 32 | Infiniti Q50 | $3,256 | $302 |

| 33 | Lexus LC 500h | $3,496 | $542 |

| 34 | BMW M550i | $3,504 | $550 |

| 35 | Tesla Model S | $3,584 | $630 |

| 36 | Audi S7 | $3,608 | $654 |

| 37 | BMW M5 | $3,712 | $758 |

| 38 | BMW M8 | $3,916 | $962 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2023 model year. Updated October 24, 2025

Supplementary E450 insurance rates and insights

Some additional relevant data observations about E450 insurance rates include:

- Qualify for policy discounts to save money. Discounts may be available if the insureds are homeowners, choose electronic billing, insure their home and car with the same company, insure multiple vehicles on the same policy, or many other policy discounts which could save the average driver as much as $498 per year on the cost of insuring a Mercedes-Benz E450.

- No accidents means better rates. Too many at-fault accidents can cost more, potentially up to $1,414 per year for a 30-year-old driver and as much as $686 per year for a 60-year-old driver.

- Bring up your credit score to save money. Maintaining a high credit score could save $464 per year when compared to a slightly lower credit score between 670-739. Conversely, a credit score below 579 could cost around $538 more per year.

- Young male drivers pay the highest rates. For a 2023 Mercedes E450, a 20-year-old male pays an estimated $5,948 per year, while a 20-year-old woman pays $4,258, a difference of $1,690 per year. The females get much better rates. But by age 50, male driver rates are $2,604 and the cost for female drivers is $2,544, a difference of only $60.

- Get a discount from your profession. Many car insurance providers offer policy discounts for working in professions like high school and elementary teachers, engineers, police officers and law enforcement, scientists, nurses, college professors, and others. By qualifying for this profession discount, you could potentially save between $89 and $239 on your yearly E450 insurance premium, depending on the level of coverage purchased.

- Make your policy cheaper by raising deductibles. Raising deductibles from $500 to $1,000 could save around $512 per year for a 40-year-old driver and $1,004 per year for a 20-year-old driver.

- Low deductibles will increase rates. Lowering your policy deductibles from $500 to $250 could cost an additional $534 per year for a 40-year-old driver and $1,068 per year for a 20-year-old driver.

- Driving violations increase insurance rates. To pay the cheapest possible E450 insurance rates, it pays to be a good, safe driver. A couple of minor incidents on your driving report have the ramification of raising the cost of a policy by as much as $780 per year. Serious violations such as DUI and hit-and-run could raise rates by an additional $2,732 or more.