- Kalispell car insurance rates average $2,466 per year for full coverage, or about $206 per month.

- Kalispell auto insurance costs an average of $90 per year more than the Montana state average cost ($2,376) and $190 per year more than the average rate for all 50 states ($2,276).

- Monthly car insurance rates for a few popular vehicles include the Honda CR-V at $175, Chevrolet Equinox at $189, and Ram Truck at $238.

- For the cheapest car insurance in Kalispell, compact SUVs like the Nissan Kicks, Subaru Crosstrek, and Kia Soul cost less to insure than most other makes and models.

- A few vehicles with segment-leading car insurance rates include the Honda Passport (midsize SUV), Nissan Titan (full-size pickup), Infiniti QX80 (full-size luxury SUV), and Acura Integra (compact luxury car).

How much does car insurance cost in Kalispell, Montana?

The average cost to insure a vehicle in Kalispell is $2,466 per year, which is 8% more than the national average rate of $2,276. Average car insurance cost per month in Kalispell is $206 for full coverage.

In the state of Montana, the average price for car insurance is $2,376 per year, so the cost in Kalispell averages $90 more per year.

When compared to other larger cities in Montana, the cost of car insurance in Kalispell is around $178 per year more expensive than in Butte, $148 per year more expensive than in Bozeman, and $214 per year more expensive than in Helena.

Driver age has a significant impact the price of auto insurance. The list below details how driver age influences cost by breaking out average car insurance rates for different driver ages.

Average cost of car insurance in Kalispell, MT, by driver age

- 16 year old – $8,785 per year or $732 per month

- 17 year old – $8,510 per year or $709 per month

- 18 year old – $7,627 per year or $636 per month

- 19 year old – $6,944 per year or $579 per month

- 20 year old – $4,962 per year or $414 per month

- 30 year old – $2,632 per year or $219 per month

- 40 year old – $2,466 per year or $206 per month

- 50 year old – $2,188 per year or $182 per month

- 60 year old – $2,048 per year or $171 per month

The next chart shows different average Kalispell auto insurance rates based on a range of different driver ages, physical damage deductibles, and driver risk profiles.

Average car insurance rates in the prior chart range from $2,052 per year for a 40-year-old driver who qualifies for most policy discounts to $5,672 per year for a 30-year-old driver who is required to buy high risk car insurance.

For monthly budgeting purposes, the average cost of car insurance per month in Kalispell ranges from $171 to $473.

Kalispell car insurance rates can have significant differences in cost and depend on a lot of factors. This wide range of possible rates reinforces the need to get multiple auto insurance quotes when shopping online for the cheapest car insurance coverage.

Popular vehicles and the cost to insure them

The car insurance rates mentioned above take the cost to insure each 2024 vehicle model and average them, which is useful for making broad comparisons like the average cost difference between different locations in Montana. For more useful rate comparisons, however, we will get better data if we analyze the specific make and model of vehicle being insured.

The following chart breaks down the cost of car insurance in Kalispell for some of the most popular cars, trucks, and SUVs.

The vehicle models that are popular in Kalispell tend to be compact and midsize cars like the Volkswagen Jetta, Toyota Corolla, and Honda Accord and small or midsize SUVs like the Ford Escape, Toyota RAV4, and Ford Explorer.

Additional popular vehicles from other vehicle segments include luxury models like the Acura ILX and Infiniti QX60, pickup trucks like the Toyota Tacoma and Ram 1500, and sports cars like the Porsche 911 and Audi TT.

Let’s quickly revisit the concepts that were covered so far.

- Car insurance gets more affordable as you age – Average auto insurance rates for a 60-year-old driver in Kalispell are $2,914 per year cheaper than for a 20-year-old driver.

- Low deductibles cost more than high deductibles – A 50-year-old driver pays an average of $1,022 more per year for a policy with $250 deductibles versus $1,000 deductibles.

- Kalispell auto insurance rates are more expensive than the Montana state average – $2,466 (Kalispell average) compared to $2,376 (Montana average)

- Insurance rates fall significantly in your twenties – The average 30-year-old Kalispell, MT, driver will pay $2,330 less each year than a 20-year-old driver, $2,632 compared to $4,962.

- Teenage females pay less than teen males – Teen females (age 16 to 19) pay $1,071 to $579 less each year than male drivers of the same age.

- Kalispell, MT, car insurance costs more than the U.S. average – $2,466 (Kalispell average) compared to $2,276 (U.S. average)

- Average cost per month ranges from $171 to $732 – That’s the average car insurance price range for drivers age 16 to 60 in Kalispell.

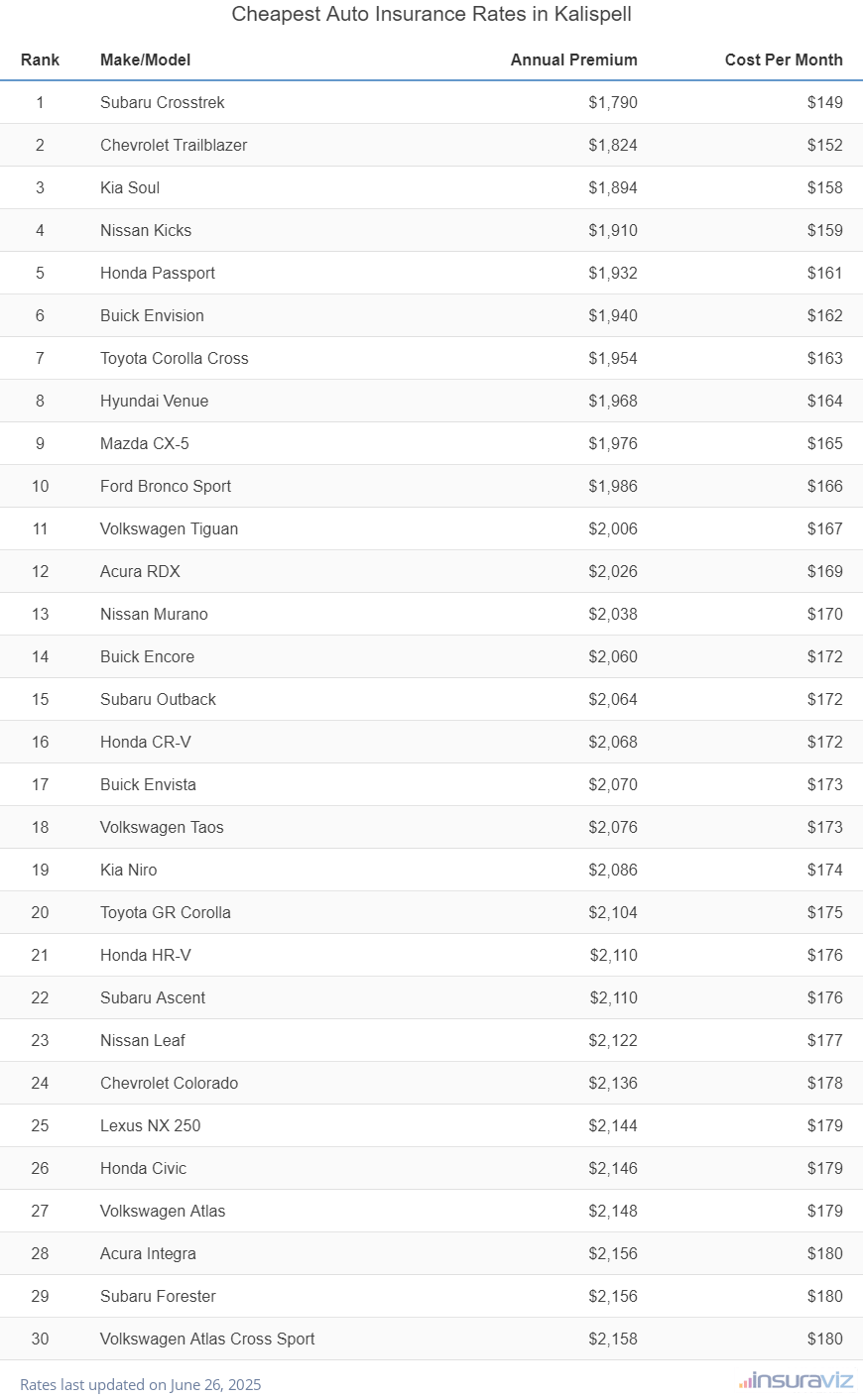

Cheapest cars to insure in Kalispell, Montana

The models with the most affordable auto insurance quotes in Kalispell tend to be small SUVs and crossovers like the Chevrolet Trailblazer, Subaru Crosstrek, Toyota Corolla Cross, and Hyundai Venue.

Average insurance prices for cars and SUVs in the top 10 cost $2,020 or less per year for a policy with full coverage.

Examples of other vehicles that have affordable car insurance prices in our car insurance cost comparison are the Volkswagen Taos, Buick Envista, Volkswagen Tiguan, and Acura RDX. The average rates are a little higher for those models than the cheapest crossover SUVs at the top of the rankings, but they still have average rates of $2,142 or less per year, or $179 per month in Kalispell.

The table below lists the top 30 cheapest vehicles to insure in Kalispell, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,820 | $152 |

| 2 | Chevrolet Trailblazer | $1,854 | $155 |

| 3 | Kia Soul | $1,926 | $161 |

| 4 | Nissan Kicks | $1,940 | $162 |

| 5 | Honda Passport | $1,964 | $164 |

| 6 | Buick Envision | $1,976 | $165 |

| 7 | Toyota Corolla Cross | $1,988 | $166 |

| 8 | Hyundai Venue | $2,004 | $167 |

| 9 | Mazda CX-5 | $2,010 | $168 |

| 10 | Ford Bronco Sport | $2,020 | $168 |

| 11 | Volkswagen Tiguan | $2,040 | $170 |

| 12 | Acura RDX | $2,060 | $172 |

| 13 | Nissan Murano | $2,072 | $173 |

| 14 | Buick Encore | $2,094 | $175 |

| 15 | Subaru Outback | $2,098 | $175 |

| 16 | Honda CR-V | $2,102 | $175 |

| 17 | Buick Envista | $2,108 | $176 |

| 18 | Volkswagen Taos | $2,112 | $176 |

| 19 | Kia Niro | $2,124 | $177 |

| 20 | Toyota GR Corolla | $2,142 | $179 |

| 21 | Honda HR-V | $2,146 | $179 |

| 22 | Subaru Ascent | $2,146 | $179 |

| 23 | Nissan Leaf | $2,160 | $180 |

| 24 | Chevrolet Colorado | $2,174 | $181 |

| 25 | Lexus NX 250 | $2,182 | $182 |

| 26 | Honda Civic | $2,184 | $182 |

| 27 | Volkswagen Atlas | $2,184 | $182 |

| 28 | Subaru Forester | $2,192 | $183 |

| 29 | Acura Integra | $2,194 | $183 |

| 30 | Volkswagen Atlas Cross Sport | $2,196 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Kalispell, MT Zip Codes. Updated October 24, 2025

Other models ranking in the top 30 above include the Acura Integra, Lexus NX 250, Honda Civic, Chevrolet Colorado, and Honda HR-V. Car insurance rates for those vehicles fall between $2,142 and $2,196 per year in Kalispell.

To help put these rates in perspective, a few examples of more expensive insurance rates include the Tesla Model 3 which costs $241 per month, the Chevrolet Camaro at $267, and the BMW X3 at an average of $242.

This next article section showcases the cost of car insurance based on automotive segment. These rates should provide a decent idea of the automotive segments that have the best rates.

Best types of vehicles to buy for cheap auto insurance rates

If you’re considering buying a different vehicle, it’s useful to know which categories of vehicles have better car insurance rates in Kalispell. To illustrate this, maybe you want to know if compact SUVs have cheaper auto insurance than midsize SUVs or which size car has cheaper insurance.

The next chart displays average car insurance rates by segment in Kalispell. From a segment comparison perspective, compact SUVs, midsize trucks, and minivans have the most affordable rates, with luxury, performance, and sports cars having the most expensive insurance rates.

Rates by automotive segment are suitable to make a general comparison, but insurance cost varies quite significantly within each of the segments shown in the previous chart.

For example, in the small luxury car segment, average Kalispell auto insurance rates range from the Acura Integra at $2,194 per year to the BMW M340i at $3,010 per year. As another example, in the small car segment, rates vary from the Toyota GR Corolla at $2,142 per year up to the Toyota Mirai at $3,068 per year, a difference of $926 within that segment.

Detailed insurance rate breakdown

To reinforce the concept of how much the cost of the same car insurance policy can range between drivers (and also stress the importance of getting rate quotes from multiple companies), the sections below show detailed rates for five popular vehicles in Kalispell: the Nissan Sentra, Honda CR-V, Honda Pilot, Kia K5, and Ford Mustang.

The example for each vehicle displays average rates for different driver profiles to illustrate the possible price variation with only minor changes to the factors that affect policy cost.

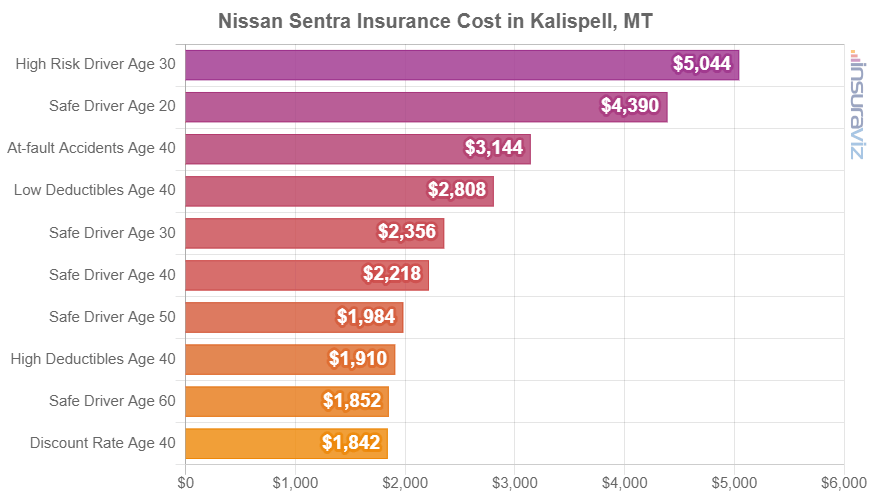

Nissan Sentra insurance rates

The cheapest 2024 Nissan Sentra trim version to insure in Kalispell is the S model, costing an average of $2,212 per year, or about $184 per month. This model sells for $20,630.

The most expensive 2022 Nissan Sentra trim level to insure in Kalispell is the SR, costing an average of $2,324 per year, or about $194 per month. The MSRP for this trim is $23,720, not including documentation and destination fees.

When Kalispell car insurance quotes on a Nissan Sentra are compared with the overall national average cost for the same vehicle, the cost is $62 to $64 more expensive per year in Kalispell, depending on which trim level is insured.

From a monthly standpoint, full-coverage auto insurance on a Nissan Sentra for a good driver can range from $184 to $194 per month, depending on exactly where you live in Kalispell.

The chart below may help explain how auto insurance quotes for a Nissan Sentra can range significantly based on changes in the age of the driver and risk profiles.

The Nissan Sentra is classified as a compact car, and additional similar models include the Volkswagen Jetta, Hyundai Elantra, and Kia Forte.

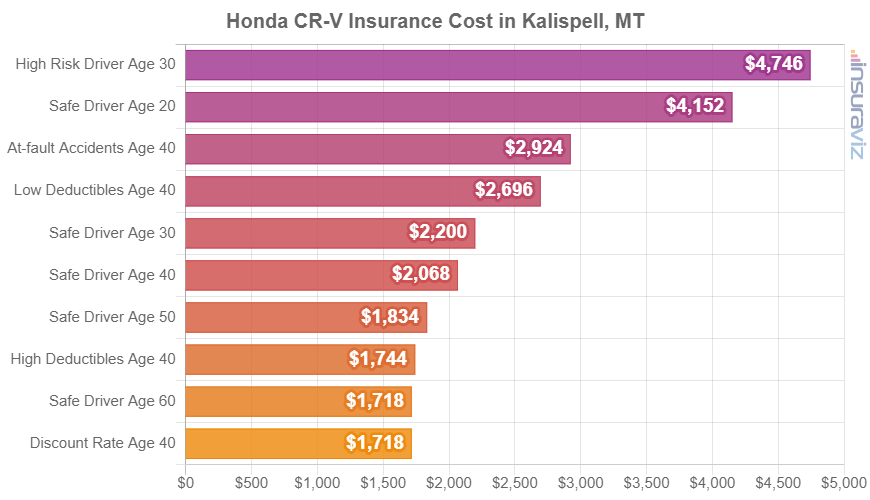

Honda CR-V insurance rates

The average rate paid for Honda CR-V insurance in Kalispell is $2,102 per year. With a purchase price ranging from $29,500 to $39,850, average car insurance quotes on a 2024 Honda CR-V cost from $1,994 per year on the Honda CR-V LX model up to $2,220 per year for the Honda CR-V Sport Touring Hybrid AWD trim level.

When Kalispell car insurance rates for the Honda CR-V are compared with national average insurance rates on the same model, the cost is $52 to $60 more per year in Kalispell, depending on the exact trim being insured.

From a cost per month standpoint, auto insurance on a Honda CR-V can range from $166 to $185 per month, depending on exactly where you live in Kalispell.

The chart displayed below may help illustrate how the cost to insure a Honda CR-V can be very different based on different driver ages, policy deductibles, and risk profiles.

For this example, rates range from $1,750 to $4,830 per year, which is a difference of $3,080 per year simply by increasing driver risk.

The Honda CR-V is a compact SUV, and other models in the same segment include the Subaru Forester, Mazda CX-5, Ford Escape, and Toyota RAV4.

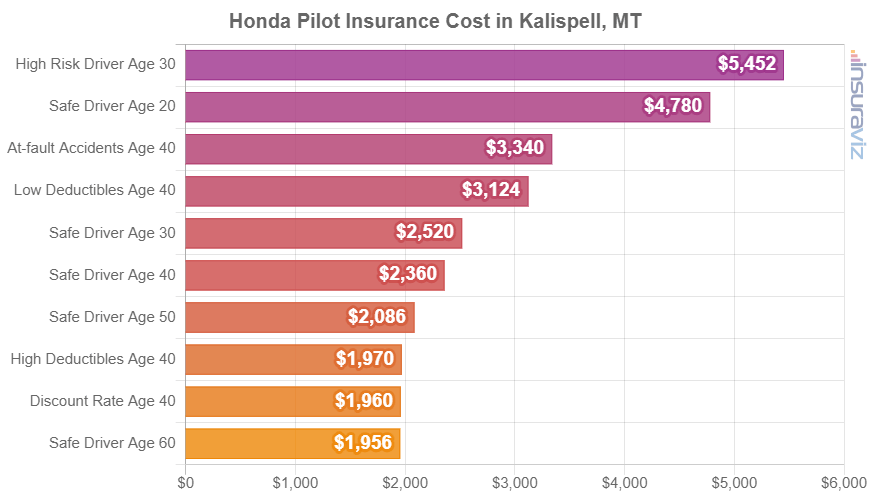

Honda Pilot insurance rates

The average cost for Honda Pilot insurance in Kalispell is $2,400 per year. With prices ranging from $37,090 to $52,480, average car insurance rates for a 2024 Honda Pilot cost from $2,246 per year for the Honda Pilot LX model up to $2,550 per year on the Honda Pilot Elite AWD trim.

When Kalispell insurance rates on the Honda Pilot are compared to national average insurance rates for the same model, the cost is anywhere from $60 to $68 more expensive per year in Kalispell, depending on the specific model being insured.

The next rate chart shows how the price of car insurance for a Honda Pilot can range considerably for different driver ages, policy deductibles, and risk profiles. For our example risk profiles, the cost ranges from $1,996 to $5,548 per year, which is a price difference of $3,552 for the same vehicle.

The Honda Pilot is classified as a midsize SUV, and other similar models that are popular in Kalispell include the Toyota Highlander, Ford Explorer, and Kia Sorento.

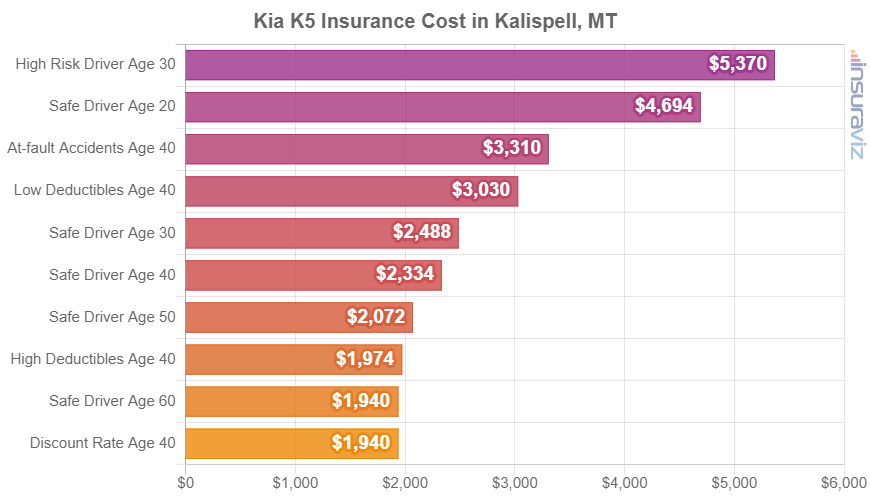

Kia K5 insurance rates

In Kalispell, the most affordable insurance quotes on a 2024 Kia K5 are on the LXS trim, costing an average of $2,276 per year, or about $190 per month. This model stickers at $25,090.

The most expensive 2022 Kia K5 trim to insure in Kalispell is the GT model, costing an average of $2,476 per year, or about $206 per month. The retail price for this trim is $31,490, before destination charges and documentation fees.

When Kalispell insurance rates on the Kia K5 are compared to the national average cost on the same model, the cost is $60 to $66 more expensive per year in Kalispell, depending on the specific trim level being insured.

The chart below shows how the cost of car insurance for a Kia K5 can change based on driver age, policy deductibles, and driver risk scenarios.

The Kia K5 is considered a midsize car, and other models from that segment that are popular in Kalispell, MT, include the Toyota Camry, Hyundai Sonata, and Nissan Altima.

Ford Mustang insurance rates

Ford Mustang insurance in Kalispell costs an average of $2,712 per year, with a range of $2,322 per year for the Ford Mustang Ecoboost Fastback trim (MSRP of $30,920) up to $2,958 per year on the Ford Mustang Dark Horse Premium model (MSRP of $63,265).

On a monthly basis, car insurance quotes for the Ford Mustang can range from $194 to $247 per month, depending on the insurance company and where you live in Kalispell.

The chart below should aid in understanding how the cost to insure a Ford Mustang can be quite different based on a number of different driver ages, policy physical damage deductibles, and risk scenarios. For this example, cost varies from $2,248 to $6,206 per year, which is a difference of $3,958 per year for insurance on the same vehicle.

The Ford Mustang is a sports car, and other models from that segment that are popular in Kalispell include the Nissan 370Z, Chevrolet Corvette, Toyota GR Supra, and Subaru BRZ.