- Average car insurance cost in Portsmouth is $1,948 per year, or around $162 per month, for a full-coverage policy.

- Auto insurance rates for a few popular models include the Nissan Altima at $2,110 per year, GMC Sierra at $2,150, and Ford F150 at $2,178.

- For cheap auto insurance, compact SUVs like the Chevrolet Trailblazer, Kia Soul, and Toyota Corolla Cross have the most affordable rates.

- A few models with segment-leading auto insurance rates include the Infiniti QX80 ($182 per month), Subaru Crosstrek ($120 per month), Chevrolet Colorado ($143 per month), and Kia K5 ($157 per month).

How much does Portsmouth car insurance cost?

The average price for car insurance in Portsmouth, New Hampshire, is $1,948 per year, which is 15.5% less than the national average rate of $2,276. The average cost of car insurance per month is $162 for a policy that provides full coverage.

The average car insurance cost in New Hampshire is $1,944 per year, so Portsmouth drivers pay an average of $4 more per year than the overall New Hampshire average rate.

The cost to insure a vehicle in Portsmouth compared to other New Hampshire cities is around $144 per year cheaper than in Manchester, $76 per year more than in Concord, and $48 per year more than in Rochester.

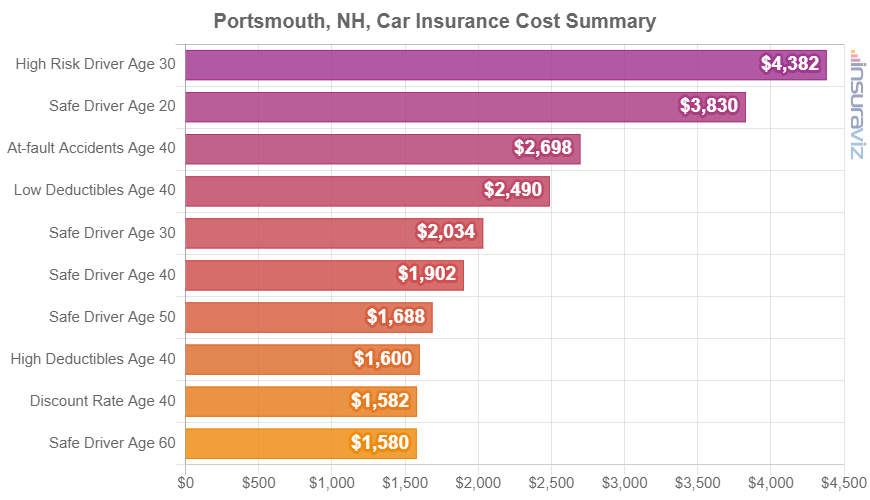

The next chart shows examples of average Portsmouth auto insurance cost. Rates are averaged for all Portsmouth Zip Codes and shown for different driver ages, deductibles, and risk profiles.

In the chart above, the cost of auto insurance in Portsmouth ranges from $1,620 per year for a 40-year-old driver who qualifies for a great discount rate to $4,478 per year for a 30-year-old driver who has to buy high risk car insurance. From a monthly point of view, the average cost in the previous chart ranges from $135 to $373 per month.

Auto insurance rates can have a wide range and subtle changes in driver risk profiles can have significant effects on car insurance cost. This wide range of possible rates emphasizes the need for multiple car insurance quotes when shopping online for more affordable car insurance.

The age of the driver is the largest factor that influences the cost of car insurance. The list below details how age impacts cost by showing the difference in average car insurance rates in Portsmouth based on the age of the driver.

Portsmouth, New Hampshire, car insurance cost by driver age

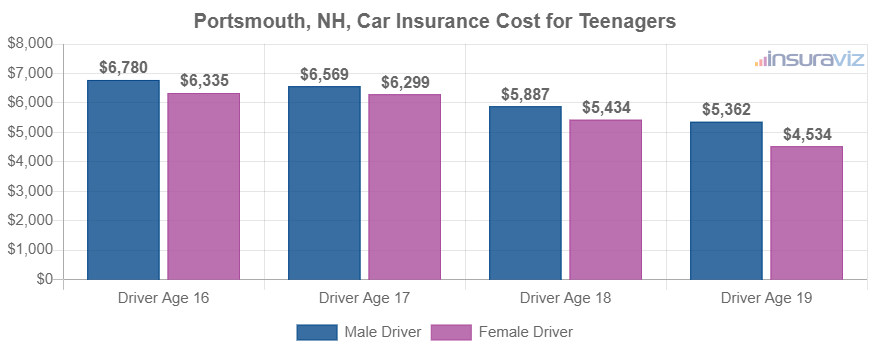

- 16-year-old rated driver – $6,937 per year or $578 per month

- 17-year-old rated driver – $6,719 per year or $560 per month

- 18-year-old rated driver – $6,024 per year or $502 per month

- 19-year-old rated driver – $5,486 per year or $457 per month

- 20-year-old rated driver – $3,920 per year or $327 per month

- 30-year-old rated driver – $2,078 per year or $173 per month

- 40-year-old rated driver – $1,948 per year or $162 per month

- 50-year-old rated driver – $1,724 per year or $144 per month

- 60-year-old rated driver – $1,616 per year or $135 per month

The rates in the list above that detailed the cost to insure teen drivers assumed the driver was male. The next chart separates average car insurance rates for teen drivers by gender. Teenage females are expensive to insure, but do tend to have cheaper car insurance rates than males of the same age.

Auto insurance for a 16-year-old female in Portsmouth costs an average of $453 less per year than the cost for a male driver, while at age 19, the cost is still $846 less per year.

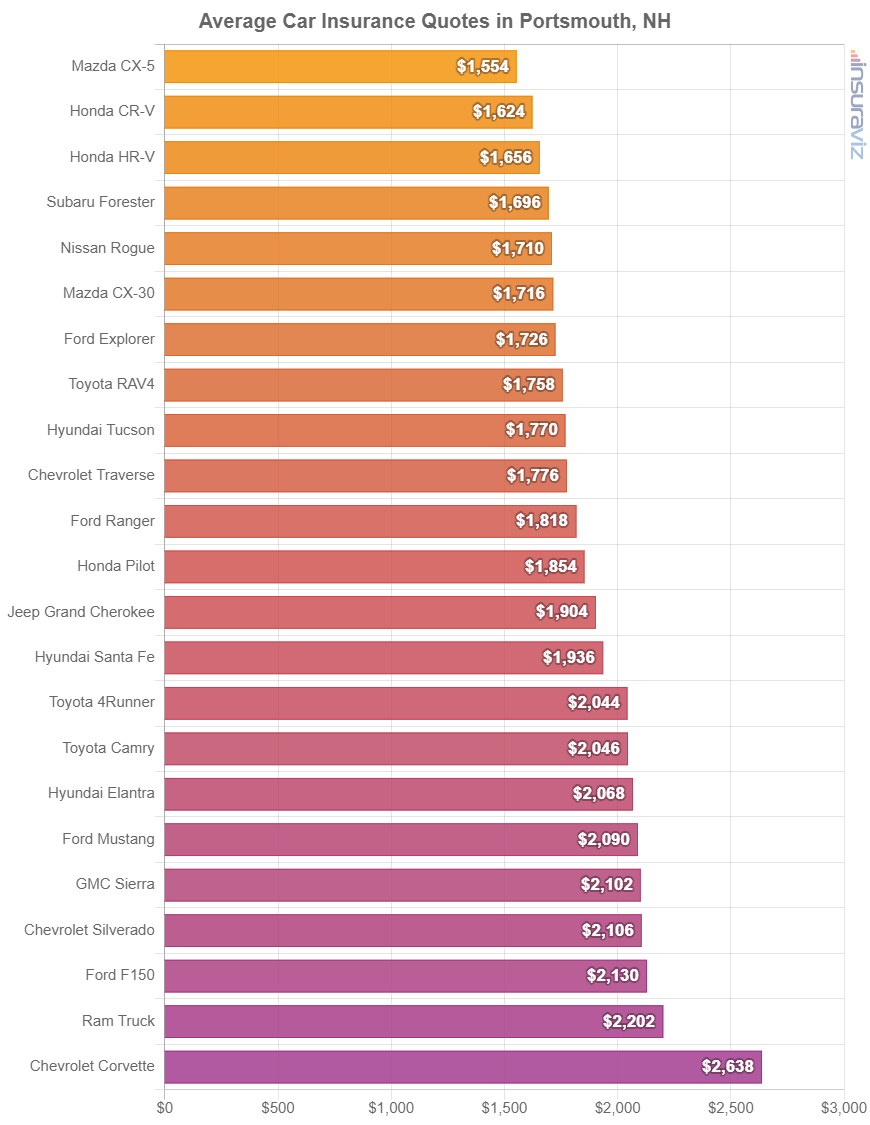

Average rates for popular cars, pickups, and SUVs

There are some vehicles that you’ll see on the road more than others, and this section focuses on average insurance rates for those models.

The next chart displays average auto insurance rates for popular cars, trucks, and SUVs in Portsmouth and surrounding areas.

The models that sell well in Portsmouth tend to be small or midsize cars like the Honda Civic, Nissan Sentra, and Toyota Camry and compact or midsize SUVs like the Honda CR-V, Ford Escape, and Jeep Grand Cherokee.

Additional popular vehicles from other vehicle segments include luxury models like the Tesla Model S, Lexus RX 350, and Infiniti QX60 and sports cars like the Ford Mustang, Audi TT, and Nissan GT-R.

Let’s look at the main concepts covered so far in the data above.

- Cost per month ranges from $135 to $578 – That’s the average auto insurance price range for insured drivers age 16 to 60 in Portsmouth.

- Portsmouth car insurance costs less than the U.S. average – $1,948 (Portsmouth average) versus $2,276 (U.S. average)

- Insurance for teen drivers can cost a lot – Average cost ranges from $4,640 to $6,937 per year to insure a teen driver in Portsmouth, NH.

- Teenage girls have cheaper rates than teenage males – Teen females (age 16 to 19) pay $846 to $453 less per year than male drivers of the same age.

- Portsmouth auto insurance rates are more expensive than the New Hampshire state average – $1,948 (Portsmouth average) compared to $1,944 (New Hampshire average)

- Lower deductible insurance is more expensive than high deductible – A 40-year-old driver pays an average of $634 more per year for a policy with $250 deductibles versus $1,000 deductibles.

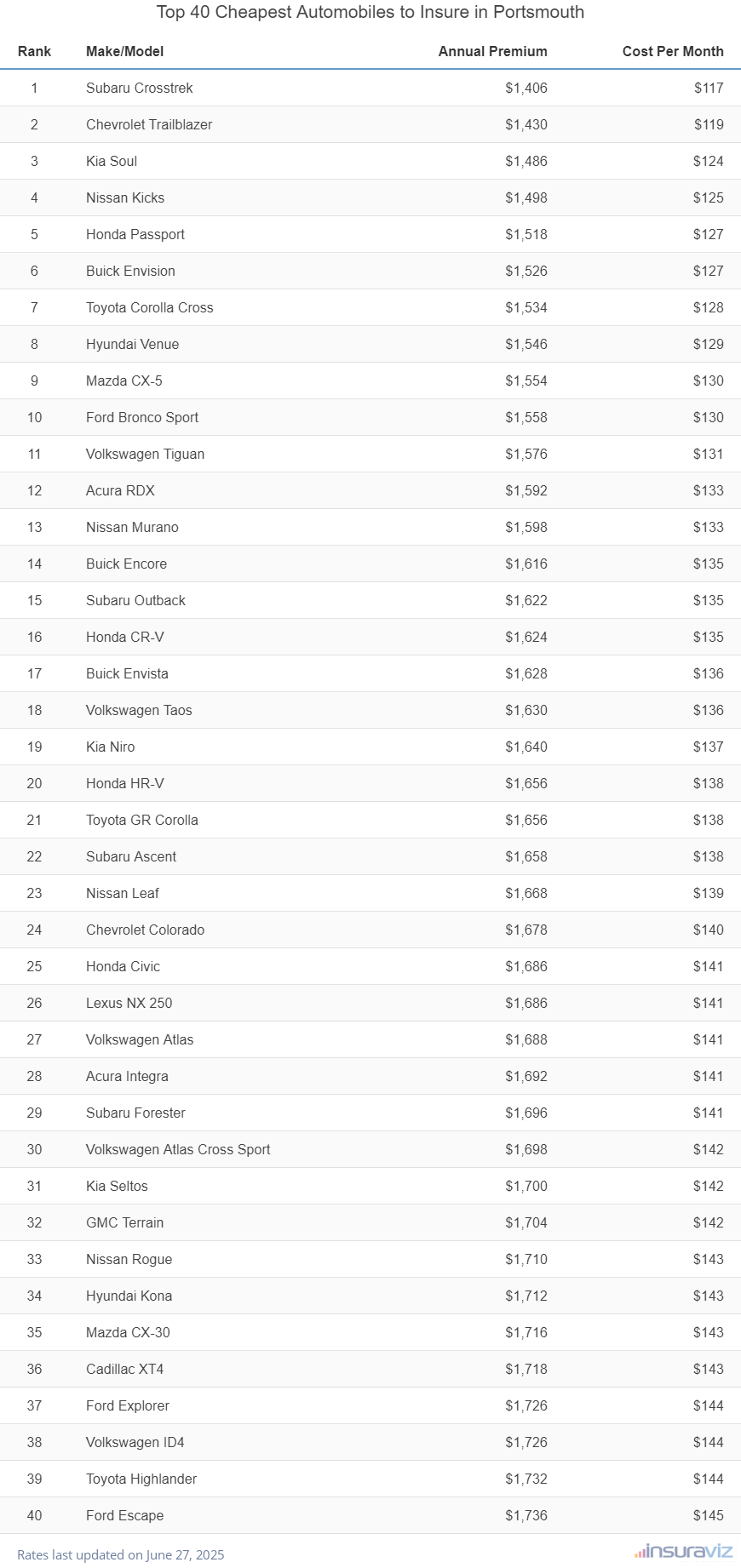

Which cars are cheapest to insure?

From an overall standpoint, the vehicles with the lowest cost average auto insurance prices in Portsmouth tend to be crossover SUVs like the Kia Soul, Chevrolet Trailblazer, Buick Envision, and Hyundai Venue. Average auto insurance rates for cars and SUVs that rank in the top 10 cost $1,596 or less per year for full coverage.

Some other models that rank very well in the comparison table below are the Honda CR-V, Toyota GR Corolla, Volkswagen Taos, and Buick Envista. Rates are a little bit more for those models than the small SUVs that rank near the top, but they still have average rates of $1,690 or less per year.

The next table details the vehicles with the cheapest overall insurance rates in Portsmouth, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,438 | $120 |

| 2 | Chevrolet Trailblazer | $1,464 | $122 |

| 3 | Kia Soul | $1,520 | $127 |

| 4 | Nissan Kicks | $1,532 | $128 |

| 5 | Honda Passport | $1,550 | $129 |

| 6 | Buick Envision | $1,558 | $130 |

| 7 | Toyota Corolla Cross | $1,570 | $131 |

| 8 | Hyundai Venue | $1,580 | $132 |

| 9 | Mazda CX-5 | $1,586 | $132 |

| 10 | Ford Bronco Sport | $1,596 | $133 |

| 11 | Volkswagen Tiguan | $1,612 | $134 |

| 12 | Acura RDX | $1,628 | $136 |

| 13 | Nissan Murano | $1,636 | $136 |

| 14 | Buick Encore | $1,654 | $138 |

| 15 | Subaru Outback | $1,658 | $138 |

| 16 | Honda CR-V | $1,660 | $138 |

| 17 | Buick Envista | $1,664 | $139 |

| 18 | Volkswagen Taos | $1,670 | $139 |

| 19 | Kia Niro | $1,676 | $140 |

| 20 | Toyota GR Corolla | $1,690 | $141 |

| 21 | Honda HR-V | $1,694 | $141 |

| 22 | Subaru Ascent | $1,694 | $141 |

| 23 | Nissan Leaf | $1,704 | $142 |

| 24 | Chevrolet Colorado | $1,716 | $143 |

| 25 | Lexus NX 250 | $1,722 | $144 |

| 26 | Honda Civic | $1,724 | $144 |

| 27 | Volkswagen Atlas | $1,726 | $144 |

| 28 | Acura Integra | $1,732 | $144 |

| 29 | Subaru Forester | $1,732 | $144 |

| 30 | Volkswagen Atlas Cross Sport | $1,734 | $145 |

| 31 | Kia Seltos | $1,740 | $145 |

| 32 | GMC Terrain | $1,742 | $145 |

| 33 | Nissan Rogue | $1,750 | $146 |

| 34 | Hyundai Kona | $1,752 | $146 |

| 35 | Mazda CX-30 | $1,756 | $146 |

| 36 | Cadillac XT4 | $1,758 | $147 |

| 37 | Volkswagen ID4 | $1,766 | $147 |

| 38 | Ford Explorer | $1,768 | $147 |

| 39 | Toyota Highlander | $1,772 | $148 |

| 40 | Ford Escape | $1,776 | $148 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Portsmouth, NH Zip Codes. Updated October 24, 2025

Other models making the list of the top 40 table above include the Mazda CX-30, Kia Seltos, Nissan Rogue, and Acura Integra. Rates for those vehicles fall between $1,690 and $1,776 per year in Portsmouth, NH.

To see how cheap these rates are, some models that have much higher car insurance rates include the Tesla Model Y costing an average of $180 per month, the BMW M240i at $198, and the BMW X3 at an average of $191.

And for really high-priced insurance in Portsmouth, high-performance and luxury models like the BMW Alpina B8 and BMW M8 have rates that frequently cost two to three times more than the cheapest vehicles.

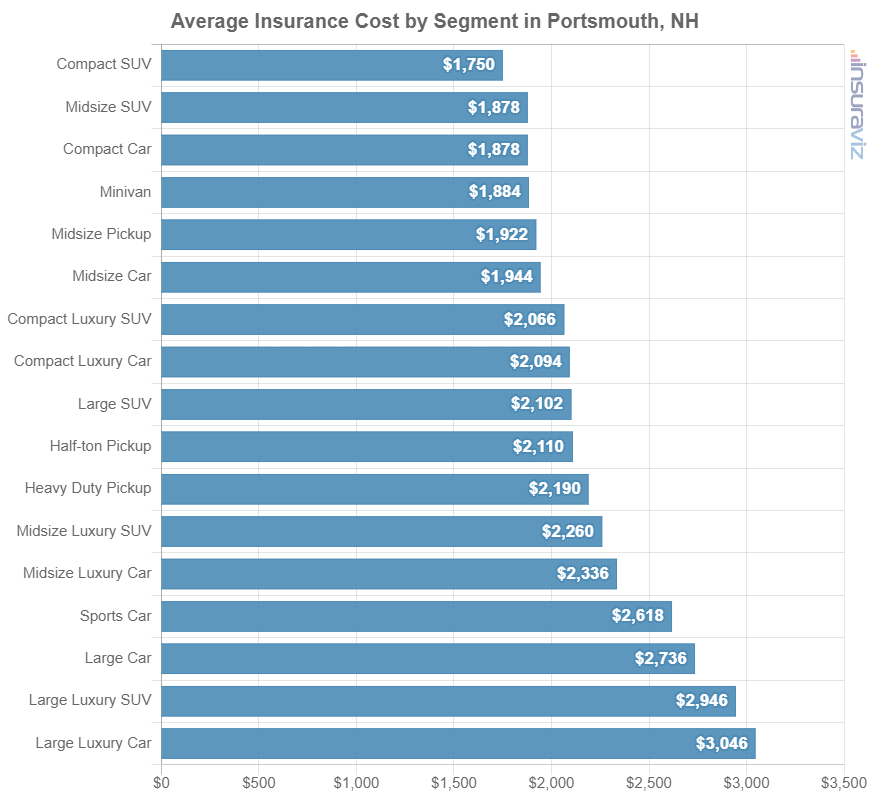

This next section illustrates the different automotive segments and the average cost of auto insurance in Portsmouth. The rates shown will provide a better idea of which types of cars, trucks, and SUVs that have the cheapest Portsmouth car insurance rates.

Insurance cost averages by automotive segment

When shopping around for a new or used vehicle, it’s good to know which kinds of vehicles have less expensive insurance rates.

As an example, many people wonder if compact cars have more affordable insurance than midsize cars or if full-size pickups have more expensive car insurance than midsize pickups.

The next chart shows average auto insurance rates by segment in Portsmouth. From an overall average perspective, small and midsize SUVs, vans and minivans, and midsize pickup trucks have the best rates, with luxury, performance, and sports cars having the most expensive overall rates.

From a data standpoint, it’s okay to view average insurance cost by segment more as a generality, because more accurate comparison data is available if you use rates for individual models to find the cheapest to insure for each segment.

For example, in the small luxury car segment, Portsmouth insurance rates range from the Acura Integra at $1,732 per year to the BMW M340i costing $2,380 per year. In the large luxury SUV segment, average rates can range from the Infiniti QX80 at $2,184 per year to the Mercedes-Benz G63 AMG costing $4,188 per year, a difference of $2,004 just within that segment.

Six tips to find cheaper car insurance

It doesn’t matter where you live, car insurance is going to cost more than you would like. Even the states with the best rates would not really be considered “affordable”. But there are some ways you can make sure you’re not overpaying for car insurance no matter where you live.

- Buy vehicles that are cheaper to insure. The vehicle you drive has a huge impact on the cost of car insurance in Portsmouth. For example, a Volkswagen Atlas costs $604 less per year to insure in Portsmouth than a Subaru BRZ. Insure cheaper models and save money.

- Obey the law to get lower insurance cost. If you want cheap auto insurance in Portsmouth, it’s necessary to be an excellent driver. As a matter of fact, just a couple blemishes on your motor vehicle report could end up increasing insurance rates by up to $520 per year. Major misdemeanors like driving under the influence could raise rates by an additional $1,808 or more.

- Avoid filing small claims. Auto insurance companies give a discount if you do not file any claims. Auto insurance should be used to protect you from significant financial loss, not for small claims.

- Remove unneeded coverage on older vehicles. Deleting comprehensive and collision coverage from vehicles whose value does not support the cost of the coverage can cheapen the cost substantially.

- Shop around anytime. Taking a few minutes to get some free car insurance quotes is a smart way to save money. Rates change often and you can switch anytime.

- Save money due to your occupation. Most auto insurance companies offer discounts for specific professions like architects, nurses, members of the military, police officers and law enforcement, doctors, college professors, and others. If you can qualify for this discount, you could save between $58 and $189 on your yearly insurance cost, depending on the age of the driver.