- Crossover vehicles like the Chevrolet Trailblazer, Nissan Kicks, and Subaru Crosstrek have the best chance of receiving cheap car insurance in Mount Vernon.

- Models with the lowest cost auto insurance in Mount Vernon for their respective segments include the Mazda MX-5 Miata (sports car), Honda Passport (midsize SUV), Subaru Crosstrek (compact SUV), and Mercedes-Benz CLA250 (midsize luxury car).

- Monthly car insurance rates for a few popular models in Mount Vernon include the Tesla Model 3 at $331, Subaru Outback at $240, and Toyota Highlander at $256.

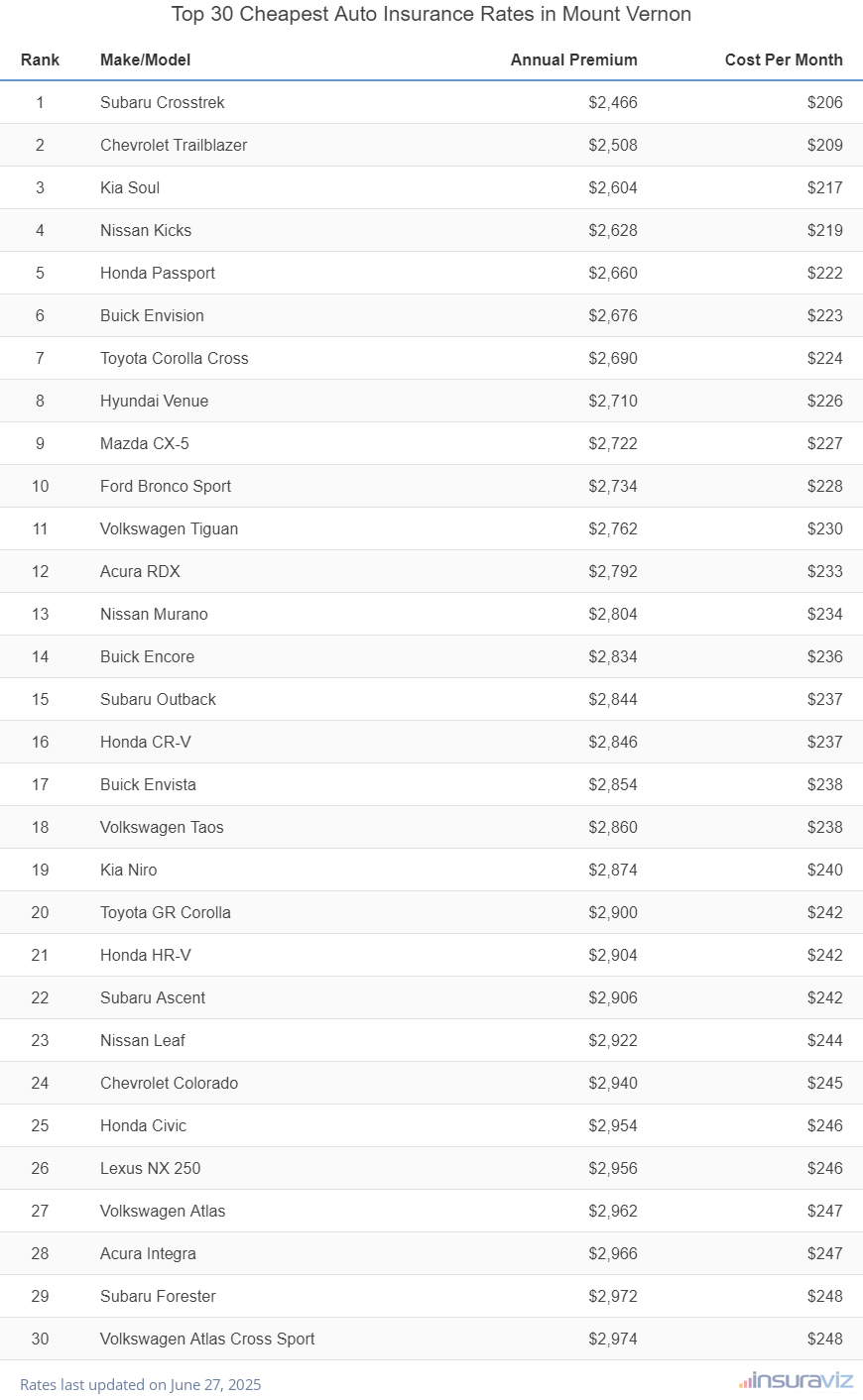

Which cars have the cheapest insurance rates?

When comparing rates for all vehicles, the models with the most affordable auto insurance quotes in Mount Vernon, NY, tend to be compact SUVs like the Subaru Crosstrek, Kia Soul, Buick Envision, and Hyundai Venue.

Average car insurance prices for vehicles ranking in the top 10 cost $2,766 or less per year to get full coverage.

Some other vehicles that have low-cost auto insurance rates in our car insurance price comparison are the Volkswagen Tiguan, Kia Niro, Honda CR-V, and Buick Envista. Average car insurance rates are a little higher for those models than the cheapest small SUVs that rank at the top, but they still have average rates of $2,936 or less per year in Mount Vernon.

The table below ranks the top 30 cheapest vehicles to insure in Mount Vernon, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,496 | $208 |

| 2 | Chevrolet Trailblazer | $2,540 | $212 |

| 3 | Kia Soul | $2,638 | $220 |

| 4 | Nissan Kicks | $2,662 | $222 |

| 5 | Honda Passport | $2,694 | $225 |

| 6 | Buick Envision | $2,708 | $226 |

| 7 | Toyota Corolla Cross | $2,726 | $227 |

| 8 | Hyundai Venue | $2,746 | $229 |

| 9 | Mazda CX-5 | $2,758 | $230 |

| 10 | Ford Bronco Sport | $2,766 | $231 |

| 11 | Volkswagen Tiguan | $2,798 | $233 |

| 12 | Acura RDX | $2,826 | $236 |

| 13 | Nissan Murano | $2,840 | $237 |

| 14 | Buick Encore | $2,870 | $239 |

| 15 | Honda CR-V | $2,880 | $240 |

| 16 | Subaru Outback | $2,880 | $240 |

| 17 | Buick Envista | $2,892 | $241 |

| 18 | Volkswagen Taos | $2,896 | $241 |

| 19 | Kia Niro | $2,908 | $242 |

| 20 | Toyota GR Corolla | $2,936 | $245 |

| 21 | Honda HR-V | $2,944 | $245 |

| 22 | Subaru Ascent | $2,944 | $245 |

| 23 | Nissan Leaf | $2,962 | $247 |

| 24 | Chevrolet Colorado | $2,976 | $248 |

| 25 | Honda Civic | $2,992 | $249 |

| 26 | Lexus NX 250 | $2,992 | $249 |

| 27 | Volkswagen Atlas | $2,998 | $250 |

| 28 | Acura Integra | $3,006 | $251 |

| 29 | Subaru Forester | $3,008 | $251 |

| 30 | Volkswagen Atlas Cross Sport | $3,012 | $251 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mount Vernon, NY Zip Codes. Updated October 24, 2025

Some additional models worth noting that rank in the top 30 table above include the Subaru Ascent, the Nissan Leaf, the Chevrolet Colorado, and the Subaru Forester. Car insurance rates for those models cost between $2,936 and $3,012 per year.

To help put these rates in perspective, some of the more expensive vehicles to insure include the Hyundai Nexo that averages $3,728 per year, the BMW M240i which averages $4,120, and the Mercedes-Benz S560 that costs $5,946.

What is average car insurance cost in Mount Vernon?

The average cost to insure a vehicle in Mount Vernon is $3,384 per year, which is 39.2% more than the U.S. average rate of $2,276. The average monthly cost of car insurance in Mount Vernon is $282 for full coverage auto insurance.

In New York, the average cost of car insurance is $2,796 per year, so the average cost to insure a vehicle in Mount Vernon is $588 more per year. The average cost to insure a car in Mount Vernon compared to other New York locations is around $1,162 per year more than in Albany, $1,192 per year more expensive than in Rochester, and $464 per year less than in New York.

The next chart summarizes average auto insurance cost in Mount Vernon, New York, broken out for a variety of driver ages, physical damage coverage deductibles, and driver risk profiles. Rates are averaged for all 2024 vehicle models including luxury models.

Average car insurance rates in the prior chart range from $2,810 per year for a 40-year-old driver who receives an exceptional discount rate to $7,780 per year for a 30-year-old driver with a history of violations and/or at-fault accidents.

When converted to a monthly cost, the average cost of car insurance per month in Mount Vernon ranges from $234 to $648.

Mount Vernon car insurance rates vary considerably and can also be significantly different between companies. Since there can be such a large difference in rates, it stresses the need for accurate free auto insurance quotes when shopping for the cheapest rate.

The age of the rated driver has the biggest impact on the price of auto insurance. The list below illustrates these differences by showing the difference in average car insurance rates for driver ages 16 through 60.

Average car insurance rates in Mount Vernon for drivers age 16 to 60

- 16 year old – $12,045 per year or $1,004 per month

- 17 year old – $11,669 per year or $972 per month

- 18 year old – $10,455 per year or $871 per month

- 19 year old – $9,524 per year or $794 per month

- 20 year old – $6,802 per year or $567 per month

- 30 year old – $3,608 per year or $301 per month

- 40 year old – $3,384 per year or $282 per month

- 50 year old – $2,996 per year or $250 per month

- 60 year old – $2,804 per year or $234 per month

Popular models and the cost of insurance

The previous car insurance rates in this article are averaged for every 2024 model year vehicle, which is practical when making big picture comparisons like the difference in average auto insurance cost by location or driver age.

For more complete auto insurance rate comparisons, however, we will get better data if we perform a rate analysis for the specific model of vehicle being insured. A few of the most popular models will be used to see how car insurance rates size up in Mount Vernon.

The chart below details average insurance cost in Mount Vernon for a handful of the more popular vehicles.

If we look to see how many popular models are in the previous table of the top 30 vehicles with the cheapest car insurance rates, most on the popular list did not make the cut.

Higher auto insurance premiums can be triggered by buying an expensive vehicle, like a Tesla Model X that has an average MSRP of $68,590 or a BMW M5 that costs an average of $109,900, or possibly the potential for higher liability insurance claims like a Toyota Corolla, Mazda 3, or Mitsubishi Outlander.

Let’s look at the concepts and comparisons that we covered in the prior data.

- Lower deductible car insurance is more expensive than high deductible – A 40-year-old driver pays an average of $1,098 more per year for a $250 deductible policy versus a $1,000 deductible policy.

- Mount Vernon auto insurance prices are more expensive than the New York state average – $3,384 (Mount Vernon average) compared to $2,796 (New York average)

- Mount Vernon, New York, car insurance costs more than the U.S. average – $3,384 (Mount Vernon average) versus $2,276 (U.S. average)

- Insuring teenagers can be very expensive – Cost ranges from $8,052 to $12,045 per year to insure a teen driver in Mount Vernon.

- Auto insurance rates fall considerably from age 20 to 30 – The average 30-year-old Mount Vernon, New York, driver will pay $3,194 less annually than a 20-year-old driver, $3,608 compared to $6,802.

- Car insurance is cheaper as you get older – Average rates for a 50-year-old driver in Mount Vernon are $3,806 per year cheaper than for a 20-year-old driver.

- Cost per month ranges from $234 to $1,004 – That is the average car insurance cost range for drivers age 16 to 60 in Mount Vernon, New York.

To reinforce the concept of the amount that car insurance prices can fluctuate from one person to the next, the sections below have many different rates for three popular models in Mount Vernon: the Ford F150, Nissan Sentra, and Honda Pilot.

Each example shows average rates for a range of driver profiles to demonstrate the difference in price based on driver risk and policy deductibles.

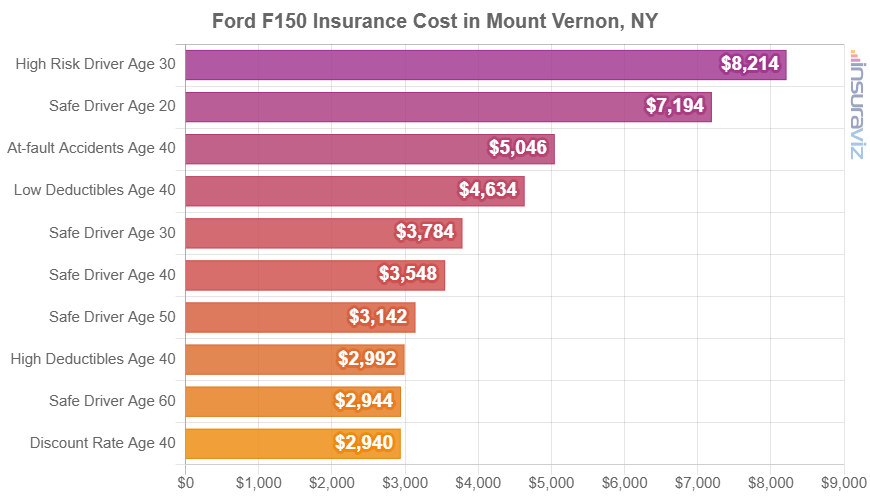

Ford F150 insurance rates

The average rate paid for Ford F150 insurance in Mount Vernon is $3,784 per year. With sticker prices ranging from $46,195 to $100,090, average insurance quotes on a 2024 Ford F150 range from $3,176 per year on the Ford F150 XL Super Cab 4WD model up to $4,394 per year on the Ford F150 Lightning Platinum Black Special Edition trim level.

On a monthly basis, full-coverage car insurance for a Ford F150 can cost from $265 to $366 per month, depending on exactly where you live in Mount Vernon.

The next chart may aid in understanding how the prices of car insurance on a Ford F150 can change based on a variety of different driver ages, physical damage coverage deductibles, and driver risk profiles.

The Ford F150 belongs to the full-size truck segment, and other models in that segment include the Toyota Tundra, GMC Sierra, and Ram Truck.

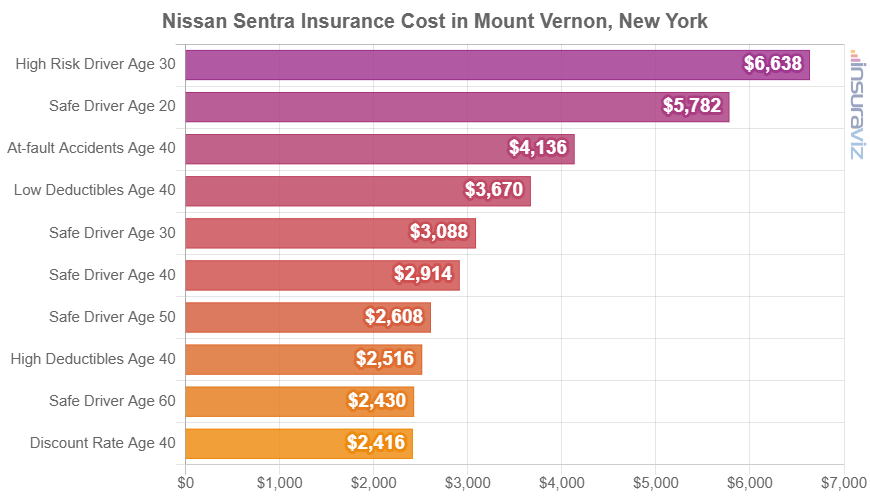

Nissan Sentra insurance rates

Average Nissan Sentra insurance cost in Mount Vernon ranges from $3,030 to $3,184 per year. The most affordable insurance will be on the $20,630 Nissan Sentra S trim level, while the trim with the most expensive average rate is the $23,720 Nissan Sentra SR trim.

On a monthly basis, car insurance on a Nissan Sentra for a middle-age safe driver can cost from $253 to $265 per month, depending on policy limits and your exact location in Mount Vernon.

The chart displayed below may aid in understanding how the price of car insurance on a Nissan Sentra can range considerably based on driver age, physical damage coverage deductibles, and driver risk profiles. For this example, rates vary from $2,572 to $7,040 per year, which is a cost difference of $4,468.

The Nissan Sentra is considered a compact car, and other popular models include the Chevrolet Cruze, Hyundai Elantra, Honda Civic, and Volkswagen Jetta.

Honda Pilot insurance rates

Average Honda Pilot insurance cost in Mount Vernon ranges from $3,076 to $3,494 per year. The lowest-cost model to insure is the $37,090 Honda Pilot LX trim level, while the most expensive model to insure is the $52,480 Honda Pilot Elite AWD.

When Mount Vernon car insurance rates on the Honda Pilot are compared to the cost averaged for the entire U.S. on the same vehicle, the cost is anywhere from $890 to $1,012 more expensive per year in Mount Vernon, depending on trim level.

The next chart illustrates how the cost of car insurance on a Honda Pilot can be quite different based on changes in driver age and common risk profiles.

In this example, cost varies from $2,736 to $7,610 per year, which is a price difference of $4,874.

The Honda Pilot is part of the midsize SUV segment, and other similar models from the same segment include the Jeep Grand Cherokee, Kia Telluride, Ford Explorer, and Ford Edge.

Tips for finding cheaper auto insurance quotes

Take a minute to read through the money-saving ideas in this next list and see if you can save a little cash on your next renewal.

- Compare car insurance rates before buying a car. Different vehicles, and even different trims of the same vehicle, can have significantly different car insurance rates, and companies charge a wide range of costs. Check rates before you buy a different vehicle in order to prevent any surprises when you get the bill.

- Policy discounts mean cheaper car insurance. Discounts may be available if the insured drivers are good students, take a defensive driving course, drive low annual mileage, work in certain occupations, are military or federal employees, or many other policy discounts which could save the average Mount Vernon driver as much as $574 per year.

- Don’t file small claims. Most insurance companies offer a discount if you have no claims on your account. Insurance is intended to be used to protect you from significant claims, not for insignificant claims.

- Be a safe driver and save on car insurance. Causing too many accidents will raise rates, possibly by an extra $4,826 per year for a 20-year-old driver and even $1,018 per year for a 50-year-old driver. So be a cautious driver and save.

- Consider raising your deductibles. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- If your vehicle is older, remove optional coverages. Removing physical damage coverage from vehicles that are older will cut the cost of car insurance substantially.

- Earn a discount from your occupation. The large majority of auto insurance providers offer policy discounts for earning a living in occupations like college professors, engineers, emergency medical technicians, firefighters, police officers and law enforcement, high school and elementary teachers, and others. By working in a job that qualifies, you may save between $102 and $329 on your car insurance cost, depending on the age of the rated driver.