- For the cheapest auto insurance in Ogden, Utah, SUV models like the Subaru Crosstrek, Toyota Corolla Cross, and Kia Soul have some of the cheapest rates.

- Models with the most affordable car insurance in Ogden in their respective segments include the Mazda MX-5 Miata ($2,070 per year), Audi A5 ($2,660 per year), Mercedes-Benz CLA250 ($2,304 per year), and Toyota GR Corolla ($1,944 per year).

- Auto insurance rates for a few popular models in Ogden include the Honda Accord at $2,162 per year, Ram Truck at $2,588, and Tesla Model 3 at $2,628.

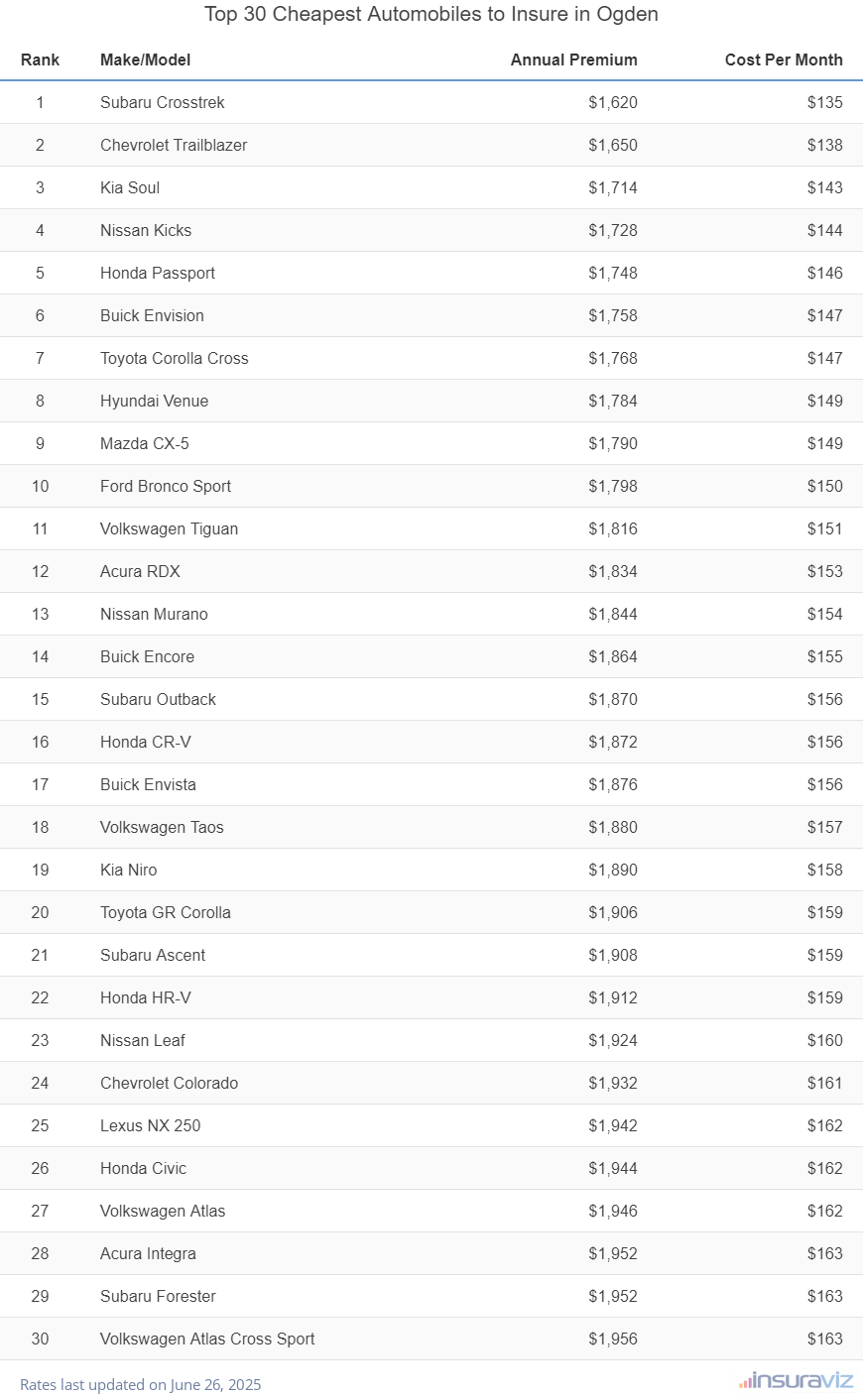

Which vehicles cost the least to insure in Ogden, UT?

When all car, SUV, and pickup insurance rates are compared, the models with the cheapest insurance rates in Ogden, UT, tend to be small SUVs like the Kia Soul, Chevrolet Trailblazer, Buick Envision, and Toyota Corolla Cross. Average auto insurance quotes for cars and SUVs in the top 10 cost $1,832 or less per year ($153 per month) for full coverage.

Some additional vehicles that are ranked high in the cost comparison table below are the Acura RDX, Ford Bronco Sport, Buick Envista, and Volkswagen Taos.

Insurance rates are slightly more for those models than the cheapest crossovers and compact SUVs that rank near the top, but they still have average rates of $1,944 or less per year, or $162 per month.

The following table ranks the 30 car, truck, and SUV models with the cheapest auto insurance in Ogden, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,652 | $138 |

| 2 | Chevrolet Trailblazer | $1,680 | $140 |

| 3 | Kia Soul | $1,746 | $146 |

| 4 | Nissan Kicks | $1,760 | $147 |

| 5 | Honda Passport | $1,784 | $149 |

| 6 | Buick Envision | $1,792 | $149 |

| 7 | Toyota Corolla Cross | $1,804 | $150 |

| 8 | Hyundai Venue | $1,818 | $152 |

| 9 | Mazda CX-5 | $1,824 | $152 |

| 10 | Ford Bronco Sport | $1,832 | $153 |

| 11 | Volkswagen Tiguan | $1,852 | $154 |

| 12 | Acura RDX | $1,870 | $156 |

| 13 | Nissan Murano | $1,880 | $157 |

| 14 | Buick Encore | $1,900 | $158 |

| 15 | Honda CR-V | $1,906 | $159 |

| 16 | Subaru Outback | $1,906 | $159 |

| 17 | Buick Envista | $1,912 | $159 |

| 18 | Volkswagen Taos | $1,918 | $160 |

| 19 | Kia Niro | $1,926 | $161 |

| 20 | Toyota GR Corolla | $1,944 | $162 |

| 21 | Honda HR-V | $1,948 | $162 |

| 22 | Subaru Ascent | $1,948 | $162 |

| 23 | Nissan Leaf | $1,960 | $163 |

| 24 | Chevrolet Colorado | $1,972 | $164 |

| 25 | Honda Civic | $1,980 | $165 |

| 26 | Lexus NX 250 | $1,980 | $165 |

| 27 | Volkswagen Atlas | $1,984 | $165 |

| 28 | Acura Integra | $1,988 | $166 |

| 29 | Subaru Forester | $1,992 | $166 |

| 30 | Volkswagen Atlas Cross Sport | $1,992 | $166 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Ogden, UT Zip Codes. Updated October 24, 2025

Other models ranking in the top 30 table above include the Volkswagen Atlas, Subaru Forester, Acura Integra, and Chevrolet Colorado. Average car insurance rates for those vehicles fall between $1,944 and $1,992 per year.

In comparison to the cheapest rates, some of the more expensive vehicles to insure include the Tesla Model 3 costing an average of $2,628 per year, the Audi A4 that averages $2,576, and the Audi e-tron that averages $2,790.

How much does car insurance cost in Ogden, UT?

Average auto insurance cost in Ogden is $2,240 per year, which is 1.6% less than the U.S. average rate of $2,276 per year. The average cost of car insurance per month in Ogden is $187 for a policy with full coverage.

In the state of Utah, average car insurance cost is $2,302 per year, so the cost in Ogden averages $62 less per year. When prices are compared to other larger cities in Utah, the average cost to insure a car in Ogden is around $50 per year cheaper than in Sandy, $222 per year cheaper than in West Valley City, and $86 per year less than in Orem.

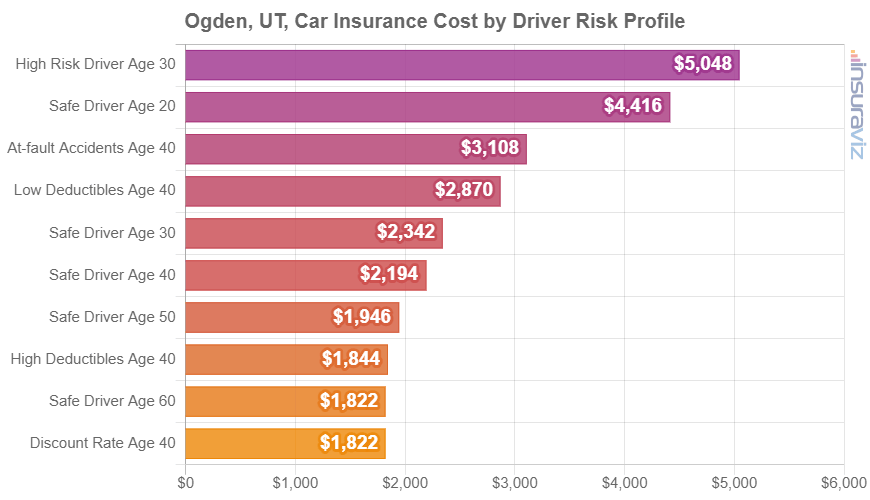

Driver age is one of the biggest determining factors on the cost of car insurance, so the list below illustrates these differences by breaking out average car insurance rates in Ogden for young, middle-age, and senior drivers.

Average cost of car insurance in Ogden for drivers age 16 to 60

- 16-year-old rated driver – $7,973 per year or $664 per month

- 17-year-old rated driver – $7,722 per year or $644 per month

- 18-year-old rated driver – $6,921 per year or $577 per month

- 19-year-old rated driver – $6,303 per year or $525 per month

- 20-year-old rated driver – $4,502 per year or $375 per month

- 30-year-old rated driver – $2,388 per year or $199 per month

- 40-year-old rated driver – $2,240 per year or $187 per month

- 50-year-old rated driver – $1,984 per year or $165 per month

- 60-year-old rated driver – $1,858 per year or $155 per month

The chart below summarizes average car insurance cost in Ogden, Utah, broken out based on a range of different driver ages, physical damage coverage deductibles, and driver risk profiles. Rates are averaged for all 2024 vehicle models including luxury models.

The average cost of auto insurance per month in Ogden is $187, with policy prices ranging from $155 to $429 for drivers age 20 to 60 and the risk profiles included in the previous chart.

Auto insurance rates have different premiums for every driver and are impacted by many factors. This variability increases the need to get accurate car insurance quotes when shopping for a cheaper car insurance policy.

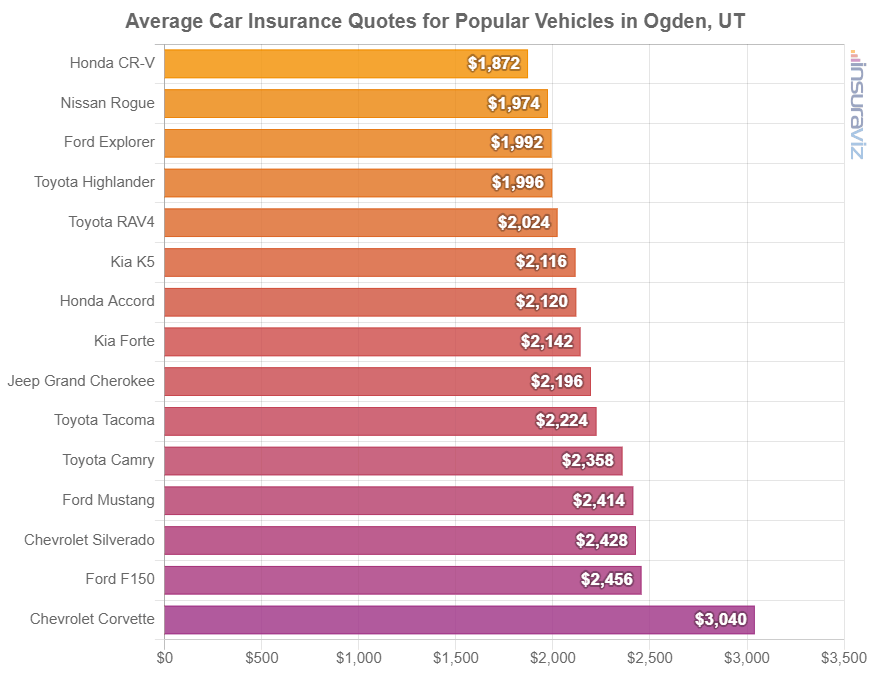

Popular vehicles in Ogden and the cost to insure them

The auto insurance rates discussed up to this point take the cost to insure each 2024 vehicle model and average them, which is suitable when making big picture comparisons like the average cost difference between multiple locations.

For more complete car insurance cost comparisons, however, it makes more sense to do a rate analysis for the specific make and model of vehicle being insured. Let’s take a high-level look at the most common vehicles to see how auto insurance rates stack up in Ogden.

The next chart details average auto insurance rates in Ogden for popular vehicles.

If we see how many popular models are included in the earlier table showing the 30 vehicles with the cheapest insurance, most of the top-selling models rank out of the top 30. Expensive insurance rates could be due to a higher MSRP, like a Lexus LX 570 with an average MSRP of $89,160 or a Nissan GT-R that costs an average of $120,990, or maybe the cause is the potential for higher medical or liability claims like a Dodge Charger or a Chevrolet Suburban.

In an effort to help you understand the amount that the cost of auto insurance can vary for different drivers, the examples below have a wide range of rates for four popular models in Ogden: the Ford F150, Honda Civic, Nissan Rogue, and Kia Sorento.

Each example uses a variety of different driver profiles to demonstrate the price fluctuation for the different scenarios.

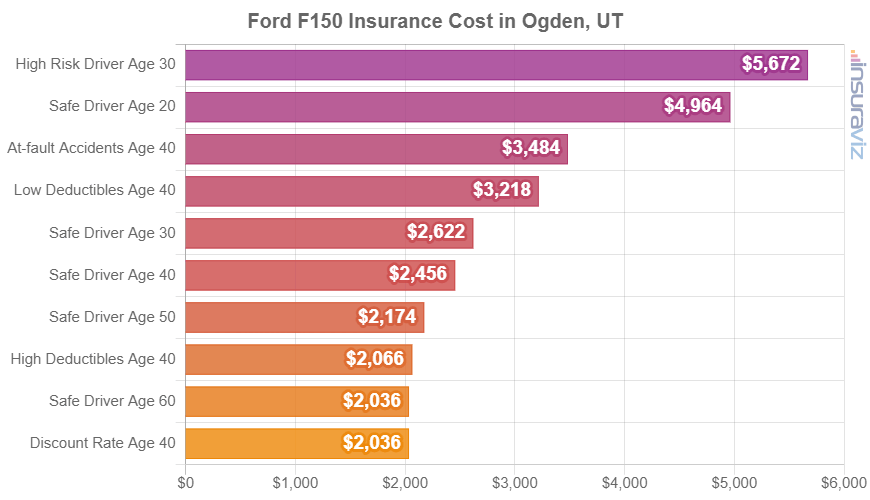

Ford F150 insurance rates

The lowest-cost 2024 Ford F150 trim level to insure in Ogden is the XL Super Cab 4WD model, costing an average of $2,102 per year, or about $175 per month. This trim level stickers at $46,195.

The most expensive 2022 Ford F150 trim level to insure in Ogden is the Lightning Platinum Black Special Edition, costing an average of $2,912 per year, or about $243 per month. The sticker price for this trim level is $100,090, before destination charges and documentation fees.

When Ogden insurance rates for a Ford F150 are compared to the average cost for the entire U.S. on the same model, the cost is $152 to $208 more per year in Ogden, depending on the exact model being insured.

As a cost per month, full-coverage car insurance on a 2024 Ford F150 can cost from $175 to $243 per month, depending on the car insurance company you choose in Ogden.

The next rate chart should help you understand how the price of car insurance on a Ford F150 can be significantly different based on a variety of driver ages, policy physical damage deductibles, and risk scenarios. For our example drivers, cost varies from $2,074 to $5,784 per year, which is a price difference of $3,710 for insurance on the same vehicle.

The Ford F150 is considered a full-size truck, and other similar models that are popular in Ogden, Utah, include the GMC Sierra, Chevrolet Silverado, and Toyota Tundra.

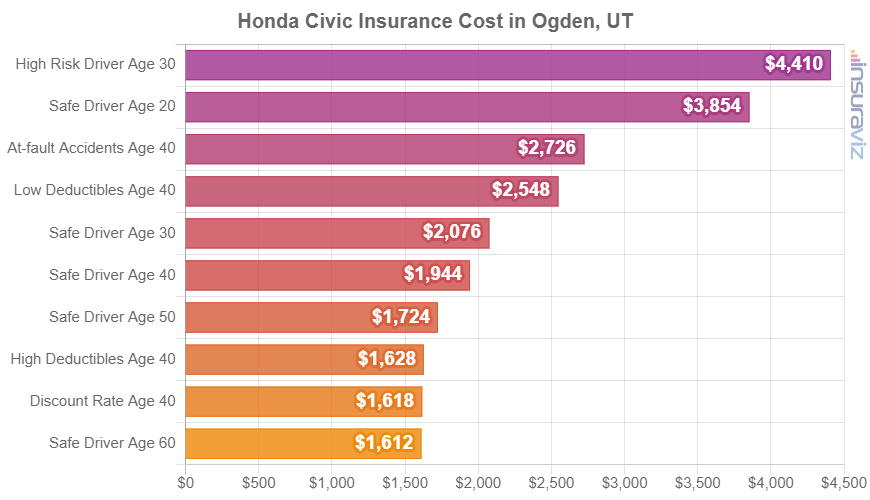

Honda Civic insurance rates

Honda Civic insurance in Ogden averages $1,980 per year, with rates ranging from a low of $1,772 per year on the Honda Civic LX trim (MSRP of $23,950) up to $2,348 per year on the Honda Civic Type R model (MSRP of $43,795).

When Ogden insurance rates for a Honda Civic are compared to the cost averaged for the entire U.S. for the same vehicle, rates are $128 to $168 more expensive per year in Ogden, depending on which model is insured.

The next rate chart illustrates how the price of car insurance for a Honda Civic can be quite different for different driver ages, risk profiles, and policy deductibles.

The Honda Civic belongs to the compact car segment, and other popular same-segment models include the Toyota Corolla, Hyundai Elantra, Chevrolet Cruze, and Kia Forte.

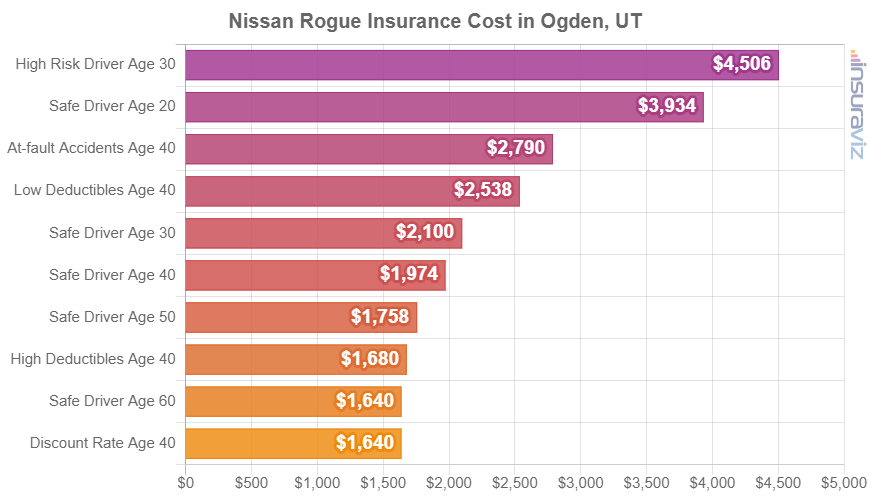

Nissan Rogue insurance rates

The lowest-cost 2024 Nissan Rogue model to insure in Ogden is the S 2WD model, costing an average of $1,904 per year, or about $159 per month. This model costs $29,360.

The most expensive 2022 Nissan Rogue trim to insure in Ogden is the Platinum AWD, costing an average of $2,108 per year, or about $176 per month. The retail cost for this trim is $39,230, not including documentation and destination fees.

When Ogden car insurance quotes for the Nissan Rogue are compared with the national average cost on the same model, rates are anywhere from $140 to $150 more per year in Ogden, depending on trim level.

From a monthly standpoint, full-coverage insurance on the Nissan Rogue for a good driver can range from $159 to $176 per month, depending on the company you’re using in Ogden.

The chart below illustrates how car insurance rates for a Nissan Rogue can range considerably based on driver age, physical damage deductibles, and driver risk profiles. In this example, prices range from $1,672 to $4,598 per year, which is a difference in cost of $2,926 just for changes in rated drivers.

The Nissan Rogue is considered a compact SUV, and other popular models include the Subaru Forester, Honda CR-V, and Toyota RAV4.

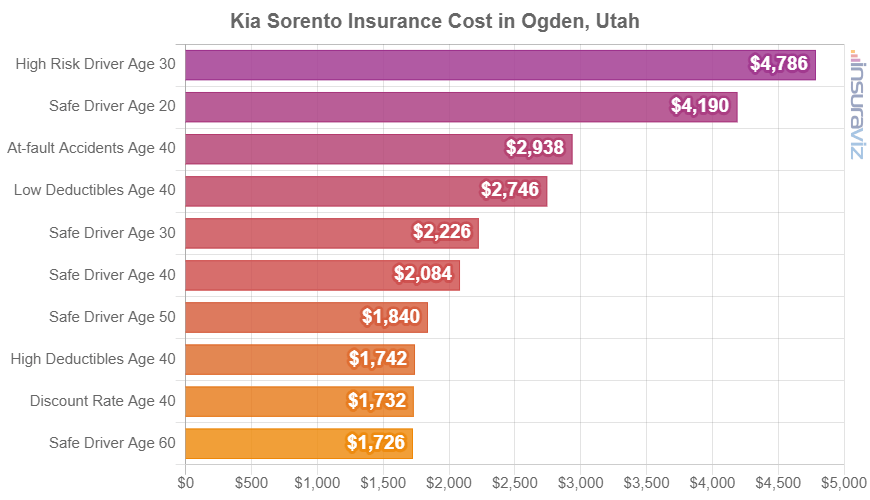

Kia Sorento insurance rates

The most affordable 2024 Kia Sorento trim version to insure in Ogden is the LX model, costing an average of $1,946 per year, or around $162 per month. This model stickers at $32,000.

The most expensive 2022 Kia Sorento trim to insure in Ogden is the SX Prestige Plug-in Hybrid, costing an average of $2,284 per year, or around $190 per month. The sticker price for this trim is $52,000, before destination charges and documentation fees.

When Ogden auto insurance rates for a Kia Sorento are compared with the national average cost on the same vehicle, the cost is anywhere from $142 to $166 more expensive per year in Ogden, depending on the model being insured.

The bar chart below illustrates how car insurance quotes on a Kia Sorento can range considerably for a number of different driver ages, policy deductibles, and driver risk scenarios. For this example, rates vary from $1,764 to $4,878 per year, which is a cost difference of $3,114 caused by changing the rated driver.

The Kia Sorento is considered a midsize SUV, and other popular models in the same segment include the Honda Pilot, Kia Telluride, Toyota Highlander, and Ford Edge.

Best practices for saving money on car insurance

Ogden drivers should always be looking to pay less for insurance, so run through the savings concepts in the list below and it’s very possible you can save some money insuring your vehicle.

- Buy vehicles that are cheaper to insure. The make and model of vehicle you drive is one of the biggest factors in the cost of car insurance. As an example, a Volkswagen Atlas costs $2,198 less per year to insure in Ogden than a Acura NSX. Lower performance vehicles save money.

- Remove unneeded coverage on older vehicles. Dropping physical damage coverage (comprehensive and collision) from older vehicles that are not worth a lot can cut the cost of car insurance substantially.

- Increasing deductibles makes car insurance cheaper. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Your employer could save you a few bucks. Many auto insurance companies offer policy discounts for being employed in occupations like firefighters, members of the military, lawyers, emergency medical technicians, doctors, and others. Earning this discount could save between $67 and $218 on your annual premium, depending on the policy coverages.

- The real world isn’t Grand Theft Auto. If you want to get cheap auto insurance in Ogden, it pays to be a conservative driver. As a matter of fact, just one or two minor incidents on your driving report can potentially raise auto insurance cost as much as $592 per year.

- Shop around for better prices. Setting aside a few minutes to get a few free car insurance quotes is our top recommendation for saving money on car insurance. Rates change often and switching to a different company is very easy to do.

- Stay claim free and save. Most auto insurance companies offer discounts for not filing any claims. Insurance should only be used to protect you from significant claims, not for insignificant claims.