- GMC Sierra insurance costs an average of $2,650 per year, or around $221 per month for full coverage.

- Out of seven vehicles in the 2024 full-size pickup truck segment, the Sierra ranks second for insurance affordability.

- The Sierra Pro Regular Cab 2WD trim level is the cheapest to insure at around $2,296 per year, or around $191 per month, while the most expensive model to insure is the EV Denali Edition 1 at $3,032 per year, or around $221 per month.

- Dropping full coverage on an older model Sierra could save $650 or more each year.

How much does GMC Sierra insurance cost?

GMC Sierra insurance costs an average of $2,650 a year. Depending on your truck’s trim level, monthly car insurance cost for a 2024 GMC Sierra ranges from $191 to $253 and averages $221 a month.

On average, expect to pay about $10 less annually for GMC Sierra insurance compared to the average rate for all full-size half-ton pickups, and $374 more per year than the all-vehicle national average of $2,276.

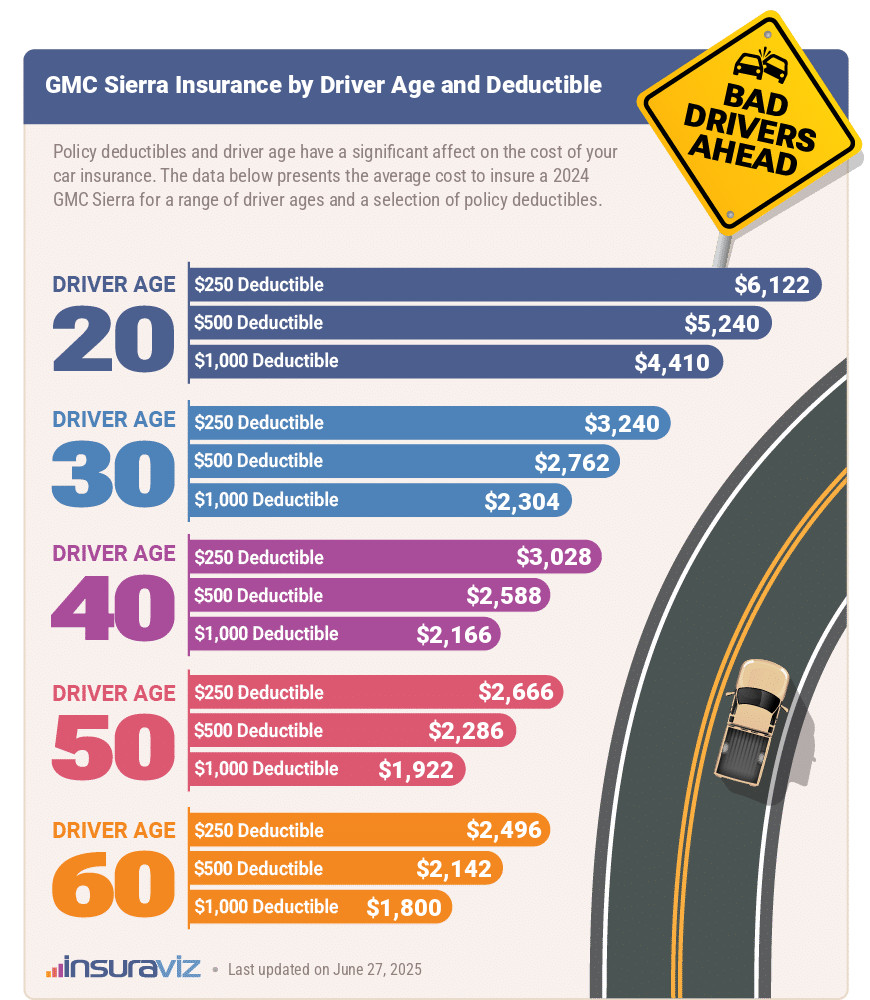

The infographic below details how average insurance rates on a 2024 GMC Sierra change based on driver age and comprehensive and collision deductibles. The cost estimates range from a low of $1,844 per year for a 60-year-old driver with high policy deductibles to the most expensive rate of $6,276 annually for a driver age 20 with a $250 policy deductible.

Let’s talk about the data shown in the chart above as there are two key points presented.

First, younger drivers pay more for car insurance on any vehicle, not just a GMC Sierra. This is due to their lack of experience and tendency to be involved in more at-fault accidents.

As you age, you gain not only driving experience, but also more responsibility. Trends show that older drivers are less likely to not only get into accidents, but also tend to file fewer claims. This directly results in lower car insurance rates.

Second, the deductible you choose on your policy makes a big difference in the price you pay. If you select a lower deductible like $250, you are placing more burden on your insurance company, which results in higher premiums.

A higher deductible (like $1,000) means you are willing to pay more out-of-pocket if you do have a claim, so you are rewarded with a cheaper rate.

The data in the infographic uses rates based on a 2024 Sierra, but the model year of your vehicle does indeed affect the rate you pay.

The following table shows average GMC Sierra car insurance rates for the 2013 to 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 GMC Sierra | $2,650 | $221 |

| 2023 GMC Sierra | $2,546 | $212 |

| 2022 GMC Sierra | $2,232 | $186 |

| 2021 GMC Sierra | $2,254 | $188 |

| 2020 GMC Sierra | $2,184 | $182 |

| 2019 GMC Sierra | $2,130 | $178 |

| 2018 GMC Sierra | $2,010 | $168 |

| 2017 GMC Sierra | $1,934 | $161 |

| 2016 GMC Sierra | $1,954 | $163 |

| 2015 GMC Sierra | $1,682 | $140 |

| 2014 GMC Sierra | $1,694 | $141 |

| 2013 GMC Sierra | $1,618 | $135 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all GMC Sierra trim levels for each model year. Updated October 24, 2025

How does GMC Sierra car insurance cost rank?

The GMC Sierra 1500 pickup ranks second out of seven comparison vehicles in the 2024 large truck class. The Sierra costs an average of $2,650 per year for full coverage insurance, while the category average is $2,660 annually, a difference of $10 per year.

When compared to other half-ton pickups, insurance for a GMC Sierra costs $34 less per year than the Ford F150, $126 less than the Ram Truck, $4 less than the Chevrolet Silverado, and $206 less than the Toyota Tundra.

The chart below shows how average Sierra insurance rates compare to the rest of the full-size half-ton truck segment for insurance affordability.

What is the cheapest GMC Sierra insurance?

The cheapest GMC Sierra model to insure is the Pro Regular Cab 2WD costing an average of $2,296 per year. The second cheapest model to insure is the Pro Double Cab 2WD at $2,386 per year.

The three most expensive trim levels to insure are the Sierra Denali Ultimate Crew Cab 4WD, the Denali Ultimate 4WD, and the EV Denali Edition 1 trim levels at an estimated $2,904, $2,906, and $3,032 per year, respectively.

The table below shows average car insurance cost for all 2024 GMC Sierra trim levels and powertrain options. Rates are broken out for annual and 6-month policy terms, as well as the monthly cost for each trim level.

| 2024 GMC Sierra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Pro Regular Cab 2WD | $2,296 | $191 |

| Pro Double Cab 2WD | $2,386 | $199 |

| Pro Regular Cab 4WD | $2,420 | $202 |

| Pro Crew Cab 2WD | $2,426 | $202 |

| Pro Double Cab 4WD | $2,464 | $205 |

| Pro Crew Cab 4WD | $2,512 | $209 |

| SLE Double Cab 2WD | $2,554 | $213 |

| Elevation Double Cab 2WD | $2,584 | $215 |

| SLE Double Cab 4WD | $2,610 | $218 |

| SLE Crew Cab 2WD | $2,612 | $218 |

| Elevation Crew Cab 2WD | $2,638 | $220 |

| Elevation Double Cab 4WD | $2,638 | $220 |

| SLE Crew Cab 4WD | $2,648 | $221 |

| SLT Crew Cab 2WD | $2,662 | $222 |

| Elevation Crew Cab 4WD | $2,674 | $223 |

| SLT Crew Cab 4WD | $2,690 | $224 |

| Denali Crew Cab 2WD | $2,778 | $232 |

| AT4 Crew Cab 4WD | $2,788 | $232 |

| Denali Crew Cab 4WD | $2,820 | $235 |

| AT4X Crew Cab 4WD | $2,892 | $241 |

| Denali Ultimate Crew Cab 4WD | $2,904 | $242 |

| Denali Ultimate 4WD | $2,906 | $242 |

| EV Denali Edition 1 | $3,032 | $253 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

The rates in the above table are for a new 2024 GMC Sierra, but many older models are roadworthy but may not justify carrying (and paying for) full coverage. The next section details the savings available when insuring your Sierra for liability only.

How much is liability insurance for a GMC Sierra?

Insuring an older model Sierra for only liability insurance could save upwards of $650 a year when compared to the full coverage rate. The table below compares liability-only car insurance rates to full coverage rates for the 2000 to 2012 model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 GMC Sierra | $1,546 | $766 |

| 2011 GMC Sierra | $1,492 | $760 |

| 2010 GMC Sierra | $1,426 | $752 |

| 2009 GMC Sierra | $1,368 | $746 |

| 2008 GMC Sierra | $1,318 | $738 |

| 2007 GMC Sierra | $1,298 | $732 |

| 2006 GMC Sierra | $1,272 | $724 |

| 2005 GMC Sierra | $1,230 | $718 |

| 2004 GMC Sierra | $1,200 | $710 |

| 2003 GMC Sierra | $1,176 | $696 |

| 2002 GMC Sierra | $1,152 | $682 |

| 2001 GMC Sierra | $1,129 | $668 |

| 2000 GMC Sierra | $1,107 | $655 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Insurance cost by U.S. city

Depending upon where you live, the cost of insurance for a GMC Sierra can vary from cheaper premiums like $2,224 a year in Charlotte, NC, or $2,064 in Raleigh, NC, to higher rates like $4,248 a year in New York, NY and $4,024 in New Orleans, LA.

Insurance rates in some additional cities include Dallas, TX, at $2,832 per year, Louisville, KY, at an estimated $3,734, El Paso, TX, costing $2,576, and Colorado Springs, CO, at $3,070.

The chart below illustrates average GMC Sierra insurance rates for the thirty largest urban areas in the United States. Additionally, the chart is followed by a table showing both annual and monthly rates by city for a 2024 GMC Sierra.

Additional facts and figures

If you’ve digested all the rate information so far, here are some additional factors that can have an impact on how much you’ll pay to insure your Sierra pickup.

- Your employment could lower your rates. Many car insurance companies offer policy discounts for working in professions like college professors, lawyers, engineers, emergency medical technicians, architects, and others. If you qualify, you may save between $80 and $233 on your annual car insurance bill, subject to the policy coverages selected.

- Older drivers tend to pay less than younger drivers. The difference in insurance cost on a Sierra truck between a 50-year-old driver ($2,340 per year) and a 20-year-old driver ($5,372 per year) is $3,032, a decrease of 78.6%.

- Raising deductibles results in a cheaper policy. Increasing deductibles from $500 to $1,000 could save around $432 per year for a 40-year-old driver and $852 per year for a 20-year-old driver.

- Decreasing deductibles will cost more. Decreasing your policy deductibles from $500 to $250 could cost an additional $450 per year for a 40-year-old driver and $904 per year for a 20-year-old driver.

- Insurance for teenage drivers is expensive. Average rates for full coverage Sierra car insurance costs $9,480 per year for a 16-year-old driver, $9,206 per year for a 17-year-old driver, and $8,283 per year for an 18-year-old driver.

- Age and gender affect car insurance rates. For a 2024 GMC Sierra, a 20-year-old male pays an average rate of $5,372 per year, while a 20-year-old female pays an estimated $3,838, a difference of $1,534 per year in the women’s favor by a large margin. But by age 50, the cost for male drivers is $2,340 and female driver rates are $2,284, a difference of only $56.

- It’s expensive to buy high-risk insurance. For a 30-year-old driver, having to buy a high-risk insurance policy can cause a rate increase of $3,298 or more per year. High-risk insurance policies are generally only required if you cannot get coverage in the standard market due to excessive violations or at-fault accidents.

During his career as an independent insurance agent,

During his career as an independent insurance agent,