- Drivers can expect to pay on average $2,432 per year, $1,216 for a 6-month policy, or $203 per month for full coverage insurance on a Hyundai Sonata, depending on the trim level.

- When compared to other midsize cars, the 2024 Hyundai Sonata is one of the cheaper midsize cars to insure, costing $15 less per year on average.

- The model with the cheapest insurance rates is the Sonata Hybrid Blue trim level at $2,382 per year.

How much does Hyundai Sonata insurance cost?

The average car insurance cost for a Hyundai Sonata is $2,432 a year for full coverage, or around $203 each month. With the average midsize car costing $2,447 a year to insure, the Hyundai Sonata could save around $15 less to insure on an annual basis.

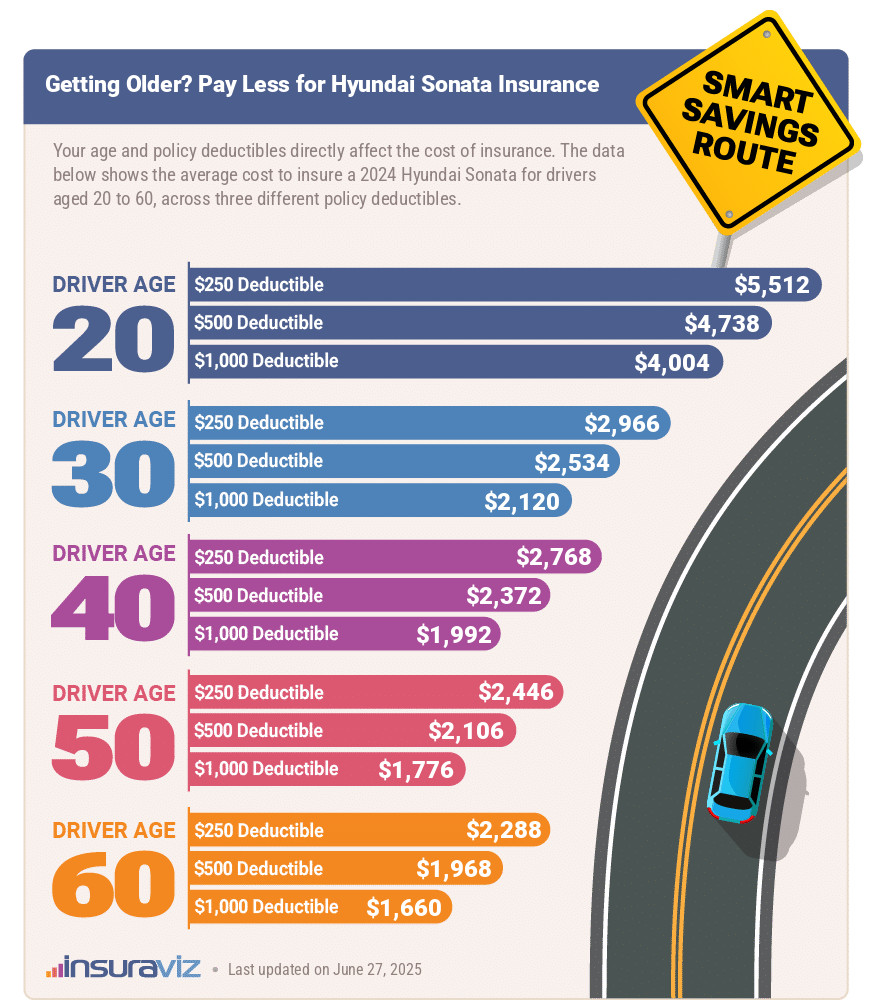

The image below demonstrates how average 2024 Hyundai Sonata car insurance rates change with differences in driver age and insurance policy deductibles.

As shown in the infographic, young drivers pay higher car insurance rates than more mature drivers. Rates trend downward as drivers age until about age 65 when they begin to increase again.

Is Hyundai Sonata car insurance expensive?

The Hyundai Sonata ranks eighth out of 11 total comparison vehicles in the 2024 midsize car segment. The Sonata costs an average of $2,432 per year to insure, while the class average rate is $2,447 annually, a difference of $15 per year.

When compared directly to other midsize cars, insurance for a Hyundai Sonata costs $146 less per year than the Toyota Camry, $116 more than the Honda Accord, $166 less than the Nissan Altima, and $386 less than the Tesla Model 3.

The chart below shows how car insurance rates for a 2024 Sonata compare to the rest of the top 10 best-selling midsize cars. Below that, you will see an expanded table that displays insurance affordability rankings for the entire 11 vehicle midsize car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Kia K5 | $2,312 | -$120 |

| 2 | Honda Accord | $2,316 | -$116 |

| 3 | Chevrolet Malibu | $2,326 | -$106 |

| 4 | Volkswagen Arteon | $2,358 | -$74 |

| 5 | Subaru Legacy | $2,368 | -$64 |

| 6 | Hyundai Ioniq 6 | $2,386 | -$46 |

| 7 | Toyota Crown | $2,428 | -$4 |

| 8 | Hyundai Sonata | $2,432 | -- |

| 9 | Toyota Camry | $2,578 | $146 |

| 10 | Nissan Altima | $2,598 | $166 |

| 11 | Tesla Model 3 | $2,818 | $386 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

What is the cheapest Hyundai Sonata insurance?

With Hyundai Sonata insurance rates ranging from $2,382 to $2,488 per year on average, the cheapest trim to insure is the Hybrid Blue. The second cheapest trim level to insure is the Hybrid Limited at $2,394 per year. On average, plan on paying at least $199 per month for Sonata insurance.

The highest cost trim levels of Hyundai Sonata to insure are the SE at $2,488 and the Limited at $2,466 per year. Those will cost an extra $106 and $84 per year, respectively, over the cheapest Hybrid Blue model.

The table below details the average annual, 6-month, and monthly car insurance costs for each 2024 Hyundai Sonata trim level.

| 2024 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid Blue | $2,382 | $199 |

| Hybrid Limited | $2,394 | $200 |

| Hybrid SEL | $2,404 | $200 |

| SEL Plus | $2,438 | $203 |

| SEL | $2,448 | $204 |

| N Line | $2,448 | $204 |

| Limited | $2,466 | $206 |

| SE | $2,488 | $207 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Hyundai Sonata prior model year insurance rates

The following sections detail Hyundai Sonata insurance rates for every trim level for the 2013 to 2022 model years. Insurance rates for the 2024 model are detailed previously.

2022 Hyundai Sonata

Insurance rates for a 2022 Hyundai Sonata average $2,494 per year, or around $208 per month. Rates range from $2,324 per year for the Sonata SE to $2,660 for the Sonata N Line Night.

| 2022 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $2,324 | $194 |

| SEL | $2,370 | $198 |

| Hybrid Blue | $2,394 | $200 |

| Hybrid SEL | $2,414 | $201 |

| SEL Plus | $2,508 | $209 |

| Hybrid Limited | $2,528 | $211 |

| Limited | $2,594 | $216 |

| N Line | $2,642 | $220 |

| N Line Night | $2,660 | $222 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2021 Hyundai Sonata

Average insurance rates for a 2021 Hyundai Sonata are $2,460 per year, or around $205 per month. Rates range from $2,326 per year for the Sonata SE Sedan to $2,592 for the Sonata Limited Sedan.

| 2021 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE Sedan | $2,326 | $194 |

| SEL Sedan | $2,392 | $199 |

| SEL Convenience 2 Sedan | $2,438 | $203 |

| SEL Convenience Sedan | $2,438 | $203 |

| SEL Plus Sedan | $2,438 | $203 |

| SEL Premium Plus Sedan | $2,458 | $205 |

| SEL Premium Sedan | $2,458 | $205 |

| SEL Plus Tech Sedan | $2,526 | $211 |

| SEL Premium w/Navi Sedan | $2,526 | $211 |

| Limited Sedan | $2,592 | $216 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2020 Hyundai Sonata

Average insurance rates for a 2020 Hyundai Sonata are $2,390 per year, or around $199 per month. Rates range from $2,264 per year for the Sonata SE Sedan to $2,518 for the Sonata Limited Sedan.

| 2020 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE Sedan | $2,264 | $189 |

| SEL Sedan | $2,328 | $194 |

| SEL Convenience 2 Sedan | $2,372 | $198 |

| SEL Convenience Sedan | $2,372 | $198 |

| SEL Plus Sedan | $2,372 | $198 |

| SEL Premium Plus Sedan | $2,390 | $199 |

| SEL Premium Sedan | $2,390 | $199 |

| SEL Plus Tech Sedan | $2,454 | $205 |

| SEL Premium w/Navi Sedan | $2,454 | $205 |

| Limited Sedan | $2,518 | $210 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2019 Hyundai Sonata

Insurance rates for a 2019 Hyundai Sonata average $2,108 per year, or about $176 per month. Rates range from $1,882 per year for the Sonata Hybrid SE Sedan to $2,274 for the Sonata Hybrid Plug-in Limited Sedan.

| 2019 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid SE Sedan | $1,882 | $157 |

| EcoSedan | $2,034 | $170 |

| SE Sedan | $2,034 | $170 |

| SEL Sedan | $2,034 | $170 |

| Hybrid Limited Sedan | $2,048 | $171 |

| Sport Sedan | $2,094 | $175 |

| Limited Sedan | $2,156 | $180 |

| Hybrid Plug-in Sedan | $2,212 | $184 |

| Limited 2.0T Sedan | $2,216 | $185 |

| Sport 2.0T Sedan | $2,216 | $185 |

| Hybrid Plug-in Limited Sedan | $2,274 | $190 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2018 Hyundai Sonata

2018 Hyundai Sonata insurance rates average $2,038 per year, or around $170 per month. Cost ranges from $1,904 per year for the Sonata Hybrid SE Sedan to $2,180 for the Sonata Hybrid Plug-in Limited Sedan.

| 2018 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid SE Sedan | $1,904 | $159 |

| EcoSedan | $1,952 | $163 |

| SE Sedan | $1,952 | $163 |

| SEL Sedan | $1,952 | $163 |

| Sport Sedan | $2,010 | $168 |

| Hybrid Limited Sedan | $2,058 | $172 |

| Limited Sedan | $2,068 | $172 |

| Sport 2.0T Sedan | $2,068 | $172 |

| Hybrid Plug-in Sedan | $2,124 | $177 |

| Limited 2.0T Sedan | $2,132 | $178 |

| Hybrid Plug-in Limited Sedan | $2,180 | $182 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2017 Hyundai Sonata

A 2017 Hyundai Sonata averages $1,966 per year for full coverage insurance, or around $164 per month. Rates range from $1,834 per year for the Sonata Hybrid Sedan to $2,104 for the Sonata Limited 2.0T Sedan.

| 2017 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid Sedan | $1,834 | $153 |

| SE Sedan | $1,834 | $153 |

| Sedan | $1,834 | $153 |

| EcoSedan | $1,888 | $157 |

| Sport Sedan | $1,888 | $157 |

| Hybrid Limited Blue Pearl Sedan | $1,982 | $165 |

| Hybrid Limited Sedan | $1,982 | $165 |

| Limited Sedan | $1,994 | $166 |

| Sport 2.0T Sedan | $1,994 | $166 |

| Hybrid Plug-in Sedan | $2,034 | $170 |

| Hybrid Plug-in Limited Blue Pearl Sedan | $2,088 | $174 |

| Hybrid Plug-in Limited Sedan | $2,088 | $174 |

| Limited 2.0T Sedan | $2,104 | $175 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2016 Hyundai Sonata

Average insurance cost for a 2016 Hyundai Sonata is $1,954 per year, or around $163 per month. Rates range from $1,744 per year for the Sonata SE Sedan to $2,164 for the Sonata Hybrid Plug-in Limited Sedan.

| 2016 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE Sedan | $1,744 | $145 |

| EcoSedan | $1,794 | $150 |

| Sport Sedan | $1,794 | $150 |

| Limited Sedan | $1,894 | $158 |

| Sport 2.0T Sedan | $1,894 | $158 |

| Hybrid Sedan | $1,932 | $161 |

| Limited 2.0T Sedan | $1,994 | $166 |

| Hybrid Limited Sedan | $2,066 | $172 |

| Hybrid Limited Blue Pearl Sedan | $2,114 | $176 |

| Hybrid Plug-in Sedan | $2,114 | $176 |

| Hybrid Plug-in Limited Sedan | $2,164 | $180 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2015 Hyundai Sonata

Insurance rates average $1,640 per year for a 2015 Hyundai Sonata, or around $137 per month. Rates range from $1,548 per year for the Sonata SE Sedan to $1,718 for the Sonata Hybrid Limited Sedan.

| 2015 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE Sedan | $1,548 | $129 |

| EcoSedan | $1,588 | $132 |

| Sport Sedan | $1,594 | $133 |

| Hybrid Sedan | $1,670 | $139 |

| Limited Sedan | $1,676 | $140 |

| Sport 2.0T Sedan | $1,686 | $141 |

| Hybrid Limited Sedan | $1,718 | $143 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2014 Hyundai Sonata

Average insurance cost for a 2014 Hyundai Sonata is $1,662 per year, or around $139 per month. Rates range from $1,544 per year for the Sonata GLS Sedan to $1,774 for the Sonata Hybrid Limited Sedan.

| 2014 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| GLS Sedan | $1,544 | $129 |

| SE Sedan | $1,630 | $136 |

| Limited Sedan | $1,674 | $140 |

| Hybrid Sedan | $1,688 | $141 |

| Hybrid Limited Sedan | $1,774 | $148 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

2013 Hyundai Sonata

Insurance rates for a 2013 Hyundai Sonata average $1,546 per year, or about $129 per month. Rates range from $1,486 per year for the Sonata GLS Sedan to $1,614 for the Sonata Hybrid Limited Sedan.

| 2013 Hyundai Sonata Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| GLS Sedan | $1,486 | $124 |

| SE Sedan | $1,528 | $127 |

| Hybrid Sedan | $1,532 | $128 |

| Limited Sedan | $1,568 | $131 |

| Hybrid Limited Sedan | $1,614 | $135 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Insurance rates by location

The insurance cost for a Hyundai Sonata varies significantly from cheaper amounts like $1,204 a year in Raleigh, NC, or $1,254 in Virginia Beach, VA, to more expensive rates like $2,018 a year in Miami, FL, and $2,942 in Detroit, MI.

The cost of insurance for a Hyundai Sonata in some other areas include Colorado Springs, CO, averaging $1,794 per year, Indianapolis, IN, costing $1,404, Oakland, CA, at $2,006, and Milwaukee, WI, at $1,594.

The following chart visualizes estimated Hyundai Sonata insurance policy premiums for the larger urban areas in the United States.

Other important data observations concerning Sonata insurance costs include:

- As you age, insurance rates get cheaper. The difference in Sonata insurance cost between a 50-year-old driver ($1,396 per year) and a 30-year-old driver ($1,632 per year) is $236, or a savings of 15.6%.

- Your profession could save you a few bucks. The large majority of auto insurance companies offer policy discounts for earning a living in occupations like the military, emergency medical technicians, scientists, farmers, accountants, engineers, and others. By earning this discount on your policy you could save between $46 and $147 on your annual insurance bill, depending on your policy.

- Good credit can save money. In states that do not prevent an insured’s credit rating to be used for policy pricing purposes, having excellent credit of 800+ could save $243 per year when compared to a credit score ranging from 670-739. Conversely, a weak credit score could cost as much as $281 more per year.

- Driver gender influences rates. For a 2013 Hyundai Sonata, a 20-year-old man will pay an estimated rate of $3,096 per year, while a 20-year-old woman will pay $2,246, a difference of $850 per year. Women get significantly cheaper rates. But by age 50, the rate for men is $1,396 and the rate for women is $1,348, a difference of only $48.

- A good driving record means cheaper insurance costs. To get the cheapest Sonata insurance rates, it pays to be a conservative driver. Just one or two minor lapses of judgment on your driving record could result in increasing policy rates by as much as $418 per year. Major infractions such as a DUI could raise rates by an additional $1,434 or more.