- Range Rover insurance costs an average of $4,342 per year, or around $362 per month, depending on the trim level.

- The cheapest Range Rover insurance is on the base P400 SE model costing an average of $3,764 per year, or about $314 per month.

- When compared to other large luxury SUVs, the Land Rover Range Rover is one of the more expensive large luxury SUVs to insure, costing $626 more per year on average.

- Range Rover insurance quotes in a few larger cities include $5,408 in Sacramento, CA, $5,186 in Kansas City, MO, and $4,324 in San Antonio, TX.

How much does Range Rover insurance cost?

Range Rover insurance rates average $4,342 a year for full coverage, or $362 each month. With the average large luxury SUV costing $3,716 a year to insure, the Land Rover Range Rover costs around $626 more on an annual basis.

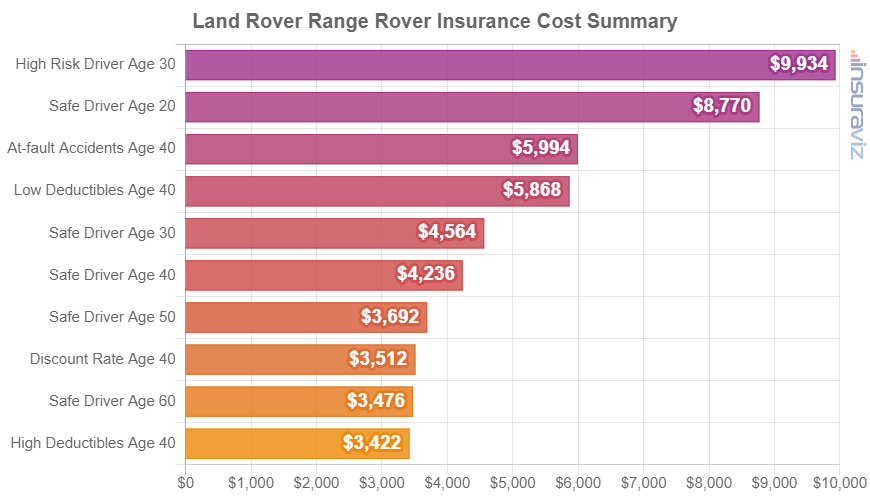

The chart below illustrates average car insurance rates for a 2024 Range Rover using variations of risk profiles and driver ages.

What is the cheapest Range Rover to insure?

The cheapest trim level of Land Rover Range Rover to insure is the base P400 SE model at $3,764 per year, or about $314 per month. The second cheapest model is the P400 SE LWB Seven Seats, also at $3,876 per year. The third cheapest model to insure is the P530 SE at $4,128 per year.

The highest cost models of Land Rover Range Rover to insure are the P615 SV LWB at $4,884 and the P615 SV at $4,768 per year. Those trims will cost an extra $1,120 and $1,004 per year, respectively, over the lowest cost P400 SE model.

The rate table below displays average car insurance rates for a 2024 Range Rover, including a monthly amount for budgeting, for each trim level.

| 2024 Land Rover Range Rover Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| P400 SE | $3,764 | $314 |

| P400 SE LWB Seven Seats | $3,876 | $323 |

| P530 SE | $4,128 | $344 |

| P530 SE LWB Seven Seats | $4,204 | $350 |

| P550e SE | $4,258 | $355 |

| Autobiography | $4,496 | $375 |

| Autobiography LWB Seven Seats | $4,510 | $376 |

| Autobiography LWB | $4,530 | $378 |

| P615 SV | $4,768 | $397 |

| P615 SV LWB | $4,884 | $407 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

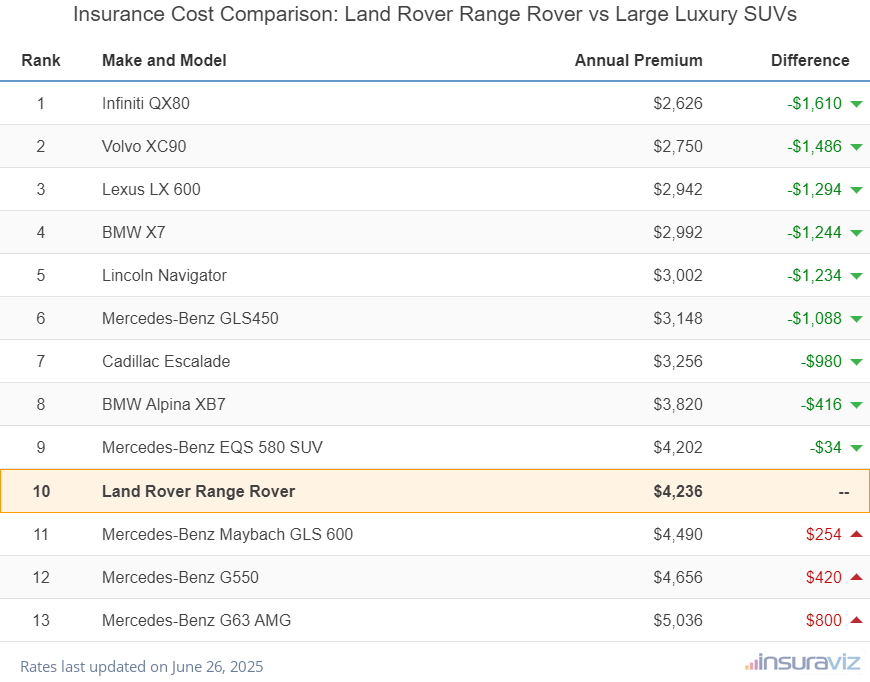

How does Range Rover insurance cost rank?

The Land Rover Range Rover ranks 10th out of 13 total vehicles in the large luxury SUV segment. The Range Rover costs an average of $4,342 per year to insure for full coverage and the segment average cost is $3,716 per year, a difference of $626 per year.

When rates are compared directly to the best-selling models in the large luxury SUV category, insurance for a Range Rover costs $1,118 more per year than the Mercedes-Benz GLS450, $1,528 more than the Volvo XC90, $1,008 more than the Cadillac Escalade, and $1,276 more than the BMW X7.

The table below shows how well average Range Rover insurance rates compare to the rest of the 2024 model year full-size luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Infiniti QX80 | $2,690 | -$1,652 |

| 2 | Volvo XC90 | $2,814 | -$1,528 |

| 3 | Lexus LX 600 | $3,012 | -$1,330 |

| 4 | BMW X7 | $3,066 | -$1,276 |

| 5 | Lincoln Navigator | $3,076 | -$1,266 |

| 6 | Mercedes-Benz GLS450 | $3,224 | -$1,118 |

| 7 | Cadillac Escalade | $3,334 | -$1,008 |

| 8 | BMW Alpina XB7 | $3,914 | -$428 |

| 9 | Mercedes-Benz EQS 580 SUV | $4,302 | -$40 |

| 10 | Land Rover Range Rover | $4,342 | -- |

| 11 | Mercedes-Benz Maybach GLS 600 | $4,602 | $260 |

| 12 | Mercedes-Benz G550 | $4,770 | $428 |

| 13 | Mercedes-Benz G63 AMG | $5,158 | $816 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Average insurance rates by location

The cost of auto insurance for a Range Rover ranges from cheaper rates like $3,380 a year in Raleigh, NC, or $3,518 in Virginia Beach, VA, to higher rates like $6,324 a year in Las Vegas, NV, and $8,260 in Detroit, MI.

Some additional examples include Phoenix, AZ, at an estimated $4,864 per year, San Jose, CA, costing $4,958, Milwaukee, WI, at $4,476, and Albuquerque, NM, at $4,420.

The chart data below ranks typical insurance policy premiums for a Range Rover in the thirty largest metro areas in the U.S.

Some additional rates and policy savings insights include:

- Be a responsible driver and save. Having at-fault accidents will cost you more, possibly by an extra $2,134 per year for a 30-year-old driver and even as much as $1,014 per year for a 60-year-old driver.

- Rated driver gender affects the rate you pay. For a 2024 Range Rover, a 20-year-old male will pay an estimated rate of $8,982 per year, while a 20-year-old woman pays an average of $6,306, a difference of $2,676 per year. The females get much better rates. But by age 50, the male rate is $3,784 and female rates are $3,712, a difference of only $72.

- Save money due to your occupation. The large majority of auto insurance providers offer policy discounts for being employed in professions like firefighters, members of the military, college professors, lawyers, accountants, emergency medical technicians, and other occupations. Qualifying for an occupational discount could save between $130 and $233 on your yearly insurance bill, depending on the policy coverages.

- Range Rover insurance rates for teens are expensive. Average rates for full coverage Range Rover insurance costs $15,401 per year for a 16-year-old driver, $15,169 per year for a 17-year-old driver, and $14,035 per year for an 18-year-old driver.

- Tickets and violations can cost a lot. To get the cheapest Range Rover insurance rates, it pays to drive safe. As a matter of fact, just one or two speeding tickets can raise Range Rover insurance cost as much as $1,170 per year.

- Polish up your credit rating for lower rates. Having a high credit rating over 800 could save as much as $682 per year when compared to a decent credit rating of 670-739. Conversely, a weaker credit score could cost around $790 more per year.