- Crossover vehicles like the Toyota Corolla Cross, Nissan Kicks, Kia Soul, and Subaru Crosstrek receive top rankings for the cheapest car insurance in Brooklyn Park.

- Average car insurance cost in Brooklyn Park is $2,386 per year, or approximately $199 per month.

- Brooklyn Park, MN, car insurance averages $114 per year more than the Minnesota state average cost ($2,272) and $110 per year more than the average rate for all 50 U.S. states ($2,276).

Top 40 cheapest cars to insure in Brooklyn Park

The vehicles with the best insurance quotes in Brooklyn Park, MN, tend to be small SUVs and crossovers like the Chevrolet Trailblazer, Kia Soul, and Nissan Kicks.

Average auto insurance quotes for models that make the top ten cost $1,956 or less per year to insure for full coverage in Brooklyn Park.

A few other models that are highly ranked in the cost comparison table are the Toyota GR Corolla, Volkswagen Tiguan, Nissan Murano, and Acura RDX. The average cost is somewhat higher for those models than the crossovers and compact SUVs at the top of the list, but they still have an average cost of $173 or less per month in Brooklyn Park.

The following table details the 40 cars, trucks, and SUVs with the cheapest insurance rates in Brooklyn Park, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,762 | $147 |

| 2 | Chevrolet Trailblazer | $1,794 | $150 |

| 3 | Kia Soul | $1,862 | $155 |

| 4 | Nissan Kicks | $1,878 | $157 |

| 5 | Honda Passport | $1,900 | $158 |

| 6 | Buick Envision | $1,912 | $159 |

| 7 | Toyota Corolla Cross | $1,924 | $160 |

| 8 | Hyundai Venue | $1,938 | $162 |

| 9 | Mazda CX-5 | $1,948 | $162 |

| 10 | Ford Bronco Sport | $1,956 | $163 |

| 11 | Volkswagen Tiguan | $1,976 | $165 |

| 12 | Acura RDX | $1,996 | $166 |

| 13 | Nissan Murano | $2,006 | $167 |

| 14 | Buick Encore | $2,028 | $169 |

| 15 | Subaru Outback | $2,034 | $170 |

| 16 | Honda CR-V | $2,036 | $170 |

| 17 | Buick Envista | $2,040 | $170 |

| 18 | Volkswagen Taos | $2,046 | $171 |

| 19 | Kia Niro | $2,054 | $171 |

| 20 | Toyota GR Corolla | $2,074 | $173 |

| 21 | Honda HR-V | $2,076 | $173 |

| 22 | Subaru Ascent | $2,076 | $173 |

| 23 | Nissan Leaf | $2,090 | $174 |

| 24 | Chevrolet Colorado | $2,102 | $175 |

| 25 | Lexus NX 250 | $2,112 | $176 |

| 26 | Honda Civic | $2,114 | $176 |

| 27 | Volkswagen Atlas | $2,116 | $176 |

| 28 | Acura Integra | $2,122 | $177 |

| 29 | Subaru Forester | $2,124 | $177 |

| 30 | Volkswagen Atlas Cross Sport | $2,128 | $177 |

| 31 | Kia Seltos | $2,130 | $178 |

| 32 | GMC Terrain | $2,136 | $178 |

| 33 | Nissan Rogue | $2,144 | $179 |

| 34 | Hyundai Kona | $2,148 | $179 |

| 35 | Mazda CX-30 | $2,152 | $179 |

| 36 | Cadillac XT4 | $2,156 | $180 |

| 37 | Volkswagen ID4 | $2,164 | $180 |

| 38 | Ford Explorer | $2,166 | $181 |

| 39 | Toyota Highlander | $2,170 | $181 |

| 40 | Ford Escape | $2,178 | $182 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Brooklyn Park, MN Zip Codes. Updated October 24, 2025

Other models ranking in the top 40 table above include the Lexus NX 250, the Chevrolet Colorado, the Volkswagen Atlas Cross Sport, and the Nissan Rogue. Rates for those vehicles fall between $2,074 and $2,178 per year.

In contrast with the cheapest car insurance rates, a few vehicles that cost considerably more to insure include the Tesla Model 3 which averages $2,804 per year, the Ram Truck at $2,760, and the Tesla Model X at $2,998.

For extremely high-priced insurance, car models like the BMW M8, BMW 750i, Aston Martin DBX, and Nissan GT-R have rates that can easily exceed three times the cost of the cheapest models.

How much does car insurance cost in Brooklyn Park?

The average price for car insurance in Brooklyn Park is $2,386 per year, which is 4.7% more than the U.S. average rate of $2,276. Car insurance in Brooklyn Park per month costs approximately $199 per month for a full-coverage car insurance policy.

In the state of Minnesota, the average car insurance cost is $2,272 per year, so the cost in Brooklyn Park averages $114 more per year.

The cost of car insurance in Brooklyn Park compared to other Minnesota locations is approximately $176 per year more than in Duluth, $152 per year cheaper than in Minneapolis, and $250 per year more than in Rochester.

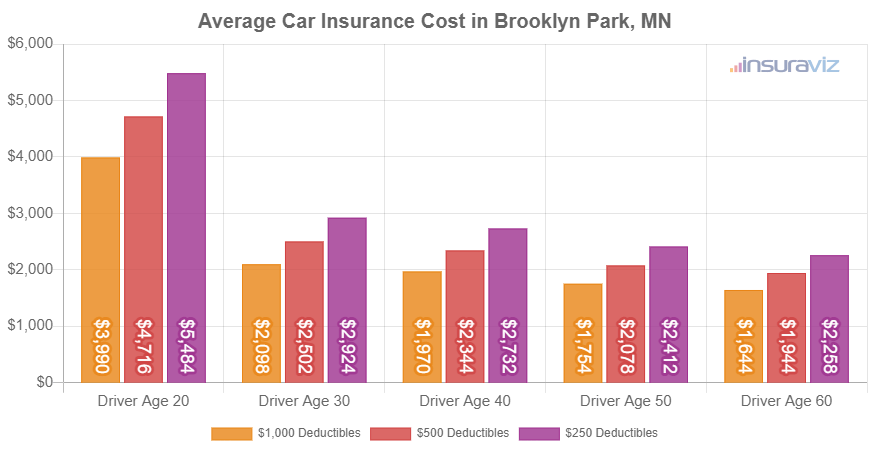

The next chart shows average auto insurance cost in Brooklyn Park, Minnesota, for all 2024 models. Rates are averaged for all Brooklyn Park Zip Codes and shown by driver age and policy deductible amounts.

In the chart above, the cost of auto insurance in Brooklyn Park ranges from $1,674 per year for a 60-year-old driver with a policy with high physical damage deductibles to $5,584 per year for a 20-year-old driver with a low deductible. From a monthly budget point of view, the average cost in the chart above ranges from $140 to $465 per month.

Auto insurance rates can have a very wide price range and are impacted by many different factors. The potential for significant variability stresses the need to get multiple car insurance quotes when shopping around for the cheapest rate.

The age of the driver is probably the number one factor that determines the cost of car insurance. The list below illustrates this point by showing average car insurance rates in Brooklyn Park for driver ages from 16 to 60.

Average cost of car insurance in Brooklyn Park, Minnesota, for drivers age 16 to 60

- 16-year-old rated driver – $8,502 per year or $709 per month

- 17-year-old rated driver – $8,236 per year or $686 per month

- 18-year-old rated driver – $7,384 per year or $615 per month

- 19-year-old rated driver – $6,724 per year or $560 per month

- 20-year-old rated driver – $4,802 per year or $400 per month

- 30-year-old rated driver – $2,546 per year or $212 per month

- 40-year-old rated driver – $2,386 per year or $199 per month

- 50-year-old rated driver – $2,116 per year or $176 per month

- 60-year-old rated driver – $1,980 per year or $165 per month

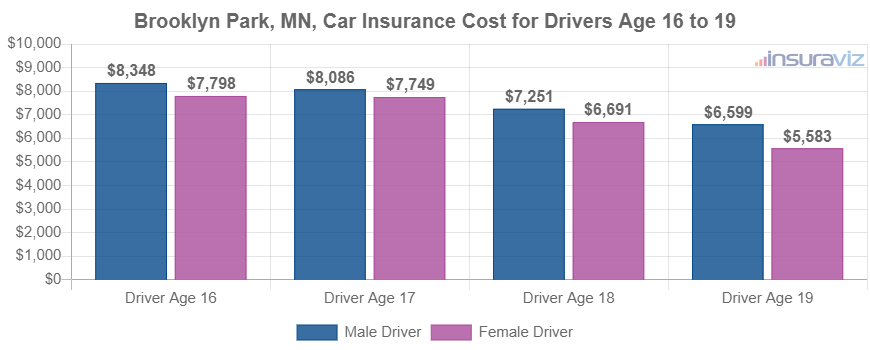

The rates in the list above for insuring teenage drivers were based on a male driver. The next chart gets more specific and shows average car insurance rates for teenagers by gender. Females are generally slightly cheaper to insure than males, notably at younger ages.

Auto insurance for a 16-year-old female driver in Brooklyn Park costs an average of $559 less than male drivers each year, while at age 19, the cost difference is less but females still cost $1,037 less per year.

Saving money on auto insurance

Brooklyn Park drivers should always be thinking of ways to reduce their monthly insurance expenses, so glance at the savings concepts in this next list and it’s very possible you can save a few bucks on your next policy purchase.

- Your choice of occupation could lower your rates. The vast majority of car insurance providers offer discounts for specific professions like dentists, high school and elementary teachers, doctors, emergency medical technicians, firefighters, and others. If your profession qualifies you for this discount, you could potentially save between $72 and $232 on your yearly car insurance bill, depending on your age.

- Break the law and you’ll pay more. In order to have the cheapest auto insurance in Brooklyn Park, it pays to drive safe. In fact, just a few minor traffic citations could result in spiking policy cost as much as $638 per year. Serious infractions like hit-and-run could raise rates by an additional $2,220 or more.

- Compare car insurance quote before buying a car. Different cars can have significantly different car insurance rates, and insurers charge a wide range of costs. Get multiple insurance quotes before you buy a different vehicle to prevent insurance sticker shock when you receive your bill.

- Raise your credit score for cheaper insurance rates. Drivers with high 800+ credit scores could save around $375 per year versus a credit score between 670-739. Conversely, a poor credit rating could cost around $434 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Buy vehicles with low cost auto insurance rates. The performance of the vehicle you drive has a significant impact on the cost of auto insurance. For example, a Kia Soul costs $866 less per year to insure in Brooklyn Park than a Nissan 370Z. Lower performance vehicles save money.

- Research discounts to lower the cost. Discounted rates may be available if the insured drivers are homeowners, choose electronic billing, are accident-free, are good students, or many other discounts which could save the average Brooklyn Park driver as much as $404 per year.