- Models like the Subaru Crosstrek, Chevrolet Trailblazer, and Nissan Kicks are a few picks for cheap car insurance in Fremont.

- Average Fremont car insurance cost is $1,566 per year for a full coverage policy. Average cost per month is approximately $131.

- Monthly car insurance rates for a few popular vehicles in Fremont include the Honda Civic at $116, Subaru Forester at $117, and Ram Truck at $151.

- Auto insurance quotes in Fremont can vary significantly from as low as $34 per month for minimum liability limits to over $685 per month for drivers requiring a high-risk policy.

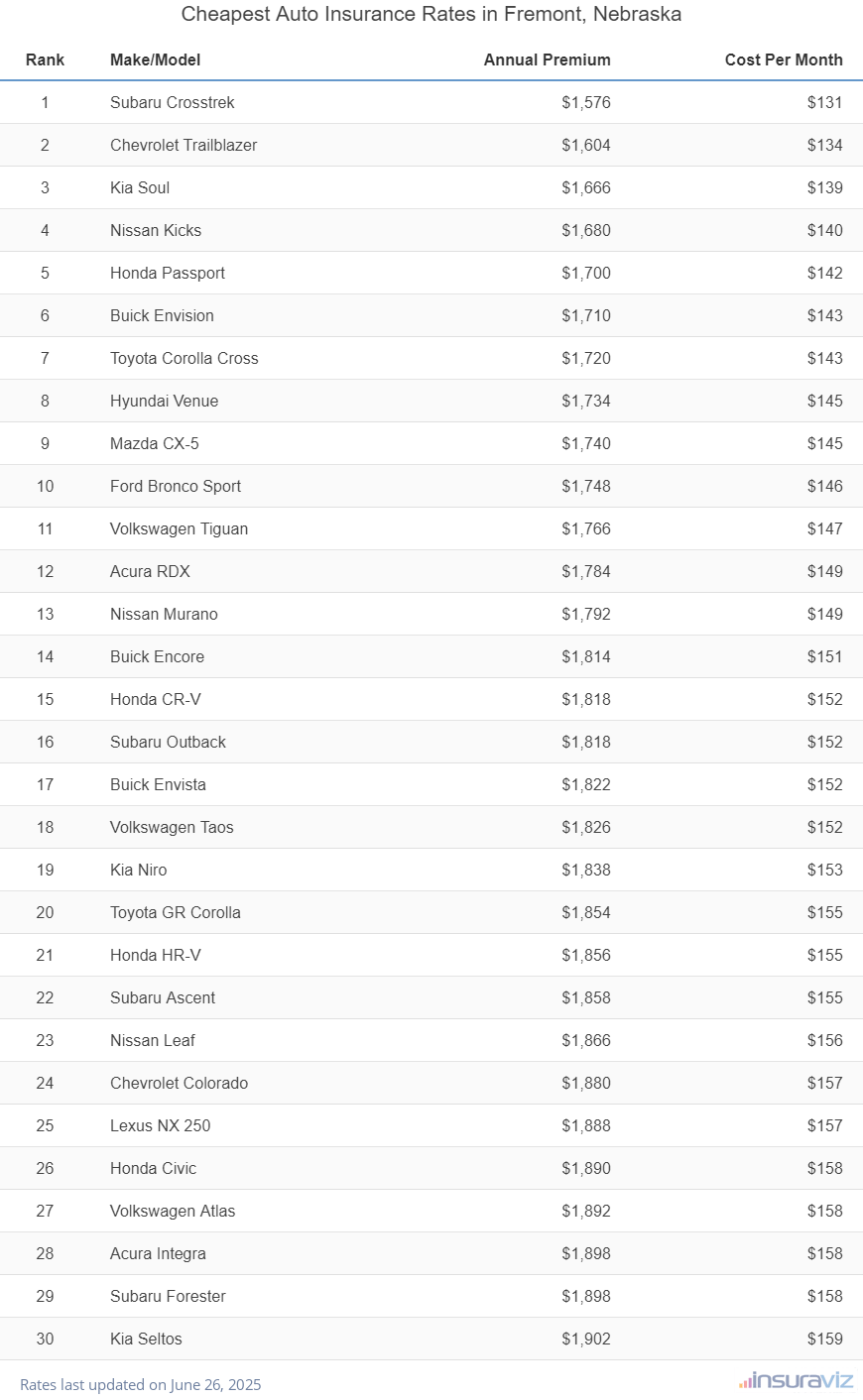

Cheapest cars to insure in Fremont

The vehicles with the most affordable car insurance rates in Fremont, NE, tend to be compact SUVs and crossovers like the Kia Soul, Subaru Crosstrek, Toyota Corolla Cross, and Nissan Kicks.

Average car insurance quotes for the models in the top 10 cost $1,284 or less per year ($107 per month) for a full coverage policy.

Some other models that are in the top 20 in our insurance cost comparison are the Volkswagen Tiguan, Subaru Outback, Chevrolet Colorado, and Kia Niro. Rates are a few dollars per month higher for those models than the cheapest crossovers and small SUVs at the top of the list, but they still have average rates of $1,344 or less per year.

The table below details the 30 car, truck, and SUV models with the cheapest auto insurance in Fremont, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,158 | $97 |

| 2 | Chevrolet Trailblazer | $1,178 | $98 |

| 3 | Kia Soul | $1,224 | $102 |

| 4 | Nissan Kicks | $1,234 | $103 |

| 5 | Honda Passport | $1,248 | $104 |

| 6 | Buick Envision | $1,258 | $105 |

| 7 | Toyota Corolla Cross | $1,264 | $105 |

| 8 | Hyundai Venue | $1,272 | $106 |

| 9 | Mazda CX-5 | $1,278 | $107 |

| 10 | Ford Bronco Sport | $1,284 | $107 |

| 11 | Volkswagen Tiguan | $1,296 | $108 |

| 12 | Acura RDX | $1,310 | $109 |

| 13 | Nissan Murano | $1,318 | $110 |

| 14 | Buick Encore | $1,330 | $111 |

| 15 | Buick Envista | $1,336 | $111 |

| 16 | Subaru Outback | $1,336 | $111 |

| 17 | Honda CR-V | $1,338 | $112 |

| 18 | Chevrolet Colorado | $1,340 | $112 |

| 19 | Volkswagen Taos | $1,340 | $112 |

| 20 | Kia Niro | $1,344 | $112 |

| 21 | Honda HR-V | $1,362 | $114 |

| 22 | Toyota GR Corolla | $1,362 | $114 |

| 23 | Subaru Ascent | $1,364 | $114 |

| 24 | Nissan Leaf | $1,370 | $114 |

| 25 | Honda Civic | $1,388 | $116 |

| 26 | Lexus NX 250 | $1,388 | $116 |

| 27 | Volkswagen Atlas | $1,390 | $116 |

| 28 | Acura Integra | $1,394 | $116 |

| 29 | Kia Seltos | $1,398 | $117 |

| 30 | Volkswagen Atlas Cross Sport | $1,398 | $117 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fremont, NE Zip Codes. Updated February 23, 2024

A few additional vehicles worth noting making the top 30 above include the Honda HR-V, Acura Integra, Lexus NX 250, Nissan Leaf, and Toyota GR Corolla. Average rates for those models fall between $1,344 and $1,398 per year.

In comparison to the cheapest rates, a few of the more expensive vehicles to insure include the Kia Stinger at $148 per month, the Toyota Tundra which averages $156, and the Tesla Model X at an average of $164.

For very high car insurance rates in Fremont, luxury and performance models like the BMW 750i and Mercedes-Benz G63 AMG have average rates that cost double or triple those of the cheapest models.

Average cost of car insurance in Fremont

Average car insurance rates in Fremont cost $1,566 per year, or around $131 per month. When compared to the overall national average rate, Fremont car insurance cost is 18.4% cheaper per year.

In the state of Nebraska, the average cost to insure a vehicle is $1,622 per year, so the average cost in Fremont is $56 less per year.

The average cost of car insurance in Fremont compared to other Nebraska locations is $44 per year less than in Kearney, $168 per year cheaper than in Omaha, and $26 per year more than in Lincoln.

The age of the driver is probably the number one factor that determines the price you pay for auto insurance, so the list below details how driver age influences cost by showing average car insurance rates in Fremont for different driver ages.

Fremont, Nebraska, car insurance cost by driver age

- 16-year-old rated driver – $5,581 per year or $465 per month

- 17-year-old rated driver – $5,408 per year or $451 per month

- 18-year-old rated driver – $4,847 per year or $404 per month

- 19-year-old rated driver – $4,414 per year or $368 per month

- 20-year-old rated driver – $3,152 per year or $263 per month

- 30-year-old rated driver – $1,672 per year or $139 per month

- 40-year-old rated driver – $1,566 per year or $131 per month

- 50-year-old rated driver – $1,390 per year or $116 per month

- 60-year-old rated driver – $1,302 per year or $109 per month

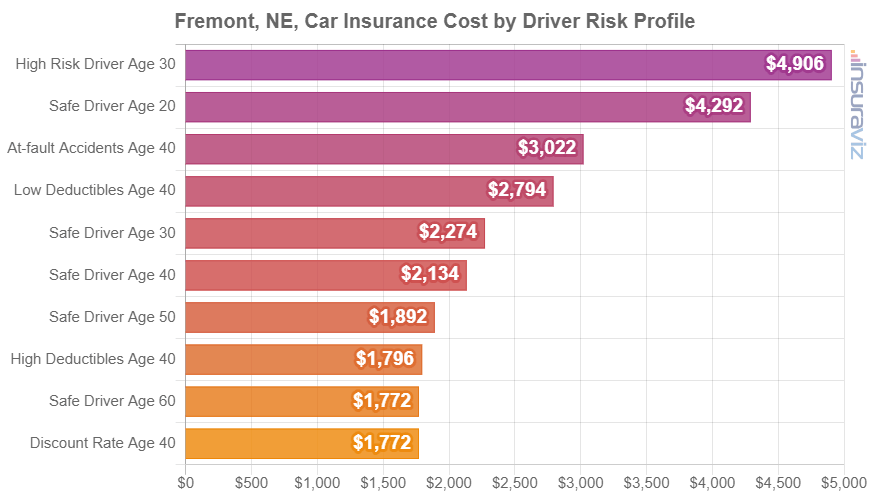

The chart below shows a summary of auto insurance rates in Fremont for 2024 model year vehicles, averaged for an assortment of driver ages and policy risk profiles.

Average car insurance rates in the prior chart range from $1,304 per year for a 40-year-old driver who qualifies for many discounts to $3,604 per year for a 30-year-old driver with too many violations and accidents.

When the average rates are converted to monthly figures, the average cost of car insurance per month in Fremont ranges from $109 to $300.

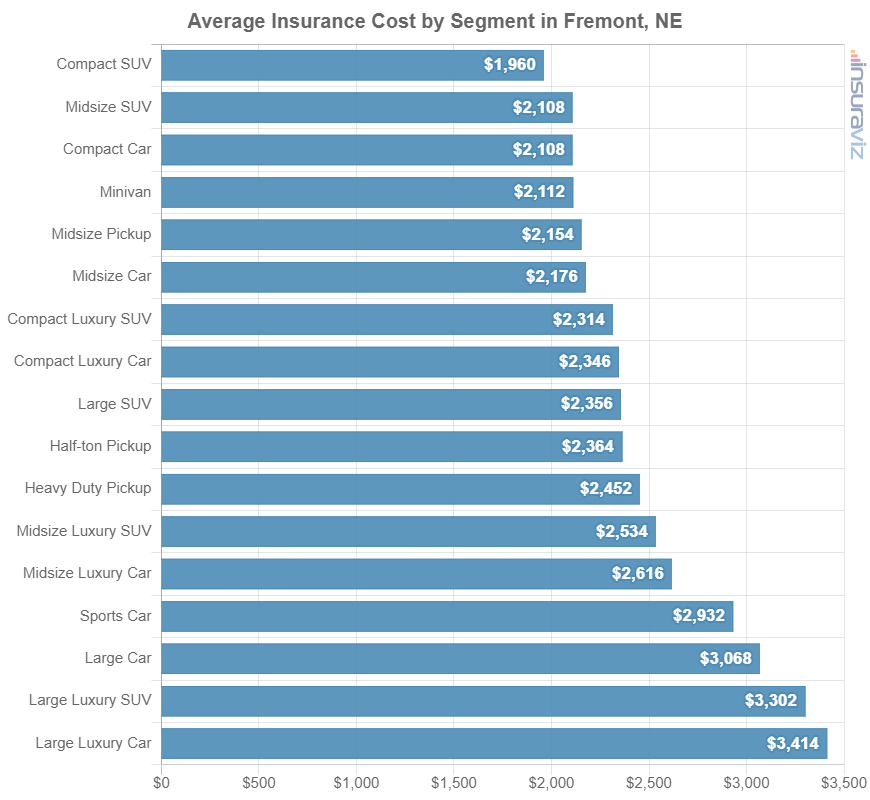

This next section showcases the average cost of car insurance by vehicle segment. The average rates shown in the chart will provide a good understanding of which types of vehicles have the most affordable auto insurance rates in Fremont. The sections following the chart break out and rank the vehicles with the cheapest insurance rates for the most popular automotive segments.

Best vehicles for the cheapest insurance rates

When shopping for a different vehicle, it’s in your best interest to know which types of vehicles have better car insurance rates in Fremont. For example, maybe you want to know if midsize SUVs cost less to insure than small SUVs or if sports cars have more affordable insurance than luxury cars.

The chart below displays the average cost of car insurance rates in Fremont for different vehicle segments. From an overal segment perspective, small SUVs, vans, and midsize pickups tend to have the least expensive rates, with luxury and performance models having the highest average cost to insure.

Rates by different vehicle segments are practical for getting a ballpark comparison, but rates vary substantially within each automotive segment shown in the previous chart.

For example, in the midsize car segment, average Fremont auto insurance rates range from the Hyundai Ioniq 6 at $1,440 per year for full coverage insurance up to the Tesla Model 3 costing $1,842 per year, a difference of $402 just within that segment. In the midsize SUV segment, the cost of insurance varies from the Honda Passport costing $1,248 per year up to the Dodge Durango costing $1,924 per year, a difference of $676 just for that segment.

Popular vehicles are not always the cheapest to insure

The car insurance costs referenced previously are an average for all 2024 vehicle models, which is helpful when making overall comparisons like the cost difference between driver ages or locations. For more useful cost comparisons, however, it makes better sense to compare rates for the exact make and model of vehicle being insured.

Now let’s look at the most popular vehicles to see how car insurance prices stack up in Fremont.

The chart below details average insurance cost for some of the more popular vehicles you’ll see on the streets of Fremont. Later in this article, we’ll explore the ins-and-outs of insuring some of these models even more in-depth.

To help clarify the amount that auto insurance prices can deviate from one person to the next, the examples below have a wide range of rates for three popular models in Fremont: the Chevrolet Silverado, Nissan Sentra, and Nissan Rogue.

Each example uses a variety of risk profiles to demonstrate the price fluctuation with only small changes in driver profile or coverage limits.

Chevrolet Silverado insurance rates

The cheapest 2024 Chevrolet Silverado trim to insure in Fremont is the EV WT model, costing an average of $1,468 per year, or about $122 per month. This trim stickers at $39,900.

The most expensive 2022 Chevrolet Silverado trim to insure in Fremont is the EV RST First Edition, costing an average of $2,056 per year, or about $171 per month. The MSRP for this model is $105,000, before documentation and delivery charges.

When Fremont car insurance rates on the Chevrolet Silverado are compared with the national average cost on the same vehicle, rates are $310 to $430 less per year in Fremont, depending on the model being insured.

The rate chart below shows how insurance rates for a Chevrolet Silverado can be very different based on different driver ages and common policy situations.

The Chevrolet Silverado is considered a full-size truck, and other models in that segment include the GMC Sierra, Ford F150, and Nissan Titan.

Nissan Sentra insurance rates

The average rate paid for Nissan Sentra insurance in Fremont is $1,436 per year. With sticker prices ranging from $20,630 to $23,720, average insurance rates for a Nissan Sentra cost from $1,404 per year for the Nissan Sentra S model up to $1,476 per year for the Nissan Sentra SR model.

When Fremont insurance rates for the Nissan Sentra are compared with the cost averaged for the entire U.S. for the same model, rates are anywhere from $296 to $310 less per year in Fremont, depending on the exact trim being insured.

From a cost per month standpoint, auto insurance on a Nissan Sentra can cost from $117 to $123 per month, depending on policy coverages and your address in Fremont.

The next chart may help you understand how the cost of insurance for a Nissan Sentra can be quite different based on changes in the age of the driver and common policy situations.

The Nissan Sentra is part of the compact car segment, and other popular same-segment models include the Honda Civic, Kia Forte, and Hyundai Elantra.

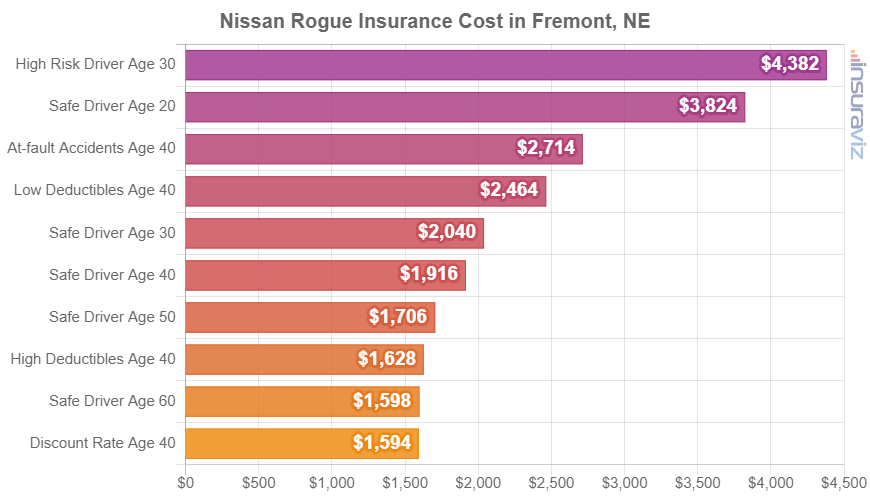

Nissan Rogue insurance rates

With prices ranging from $29,360 to $39,230, average Fremont insurance rates on a 2024 Nissan Rogue cost from $1,332 per year for the Nissan Rogue S 2WD model up to $1,472 per year for the Nissan Rogue Platinum AWD trim.

The next rate chart illustrates how the prices of car insurance on a Nissan Rogue can range considerably for different driver ages, policy deductibles, and driver risk scenarios.

For this example, rates range from $1,172 to $3,218 per year, which is a cost difference of $2,046.

The Nissan Rogue is a compact SUV, and other popular models in the same segment include the Honda CR-V, Subaru Forester, Ford Escape, and Toyota RAV4.

Best practices for saving money on auto insurance

Financially savvy drivers are often looking to cut the monthly cost of car insurance, so glance through the money-saving ideas below and maybe you’ll find a way to save a few bucks when buying auto insurance.

- Consider raising your deductibles. Boosting your deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Stay claim free and save. Most insurers offer a discount for not filing any claims. Insurance should be used to protect you from significant claims, not for minor claims that can easily be paid out-of-pocket.

- Be a careful driver and pay less for insurance. Having a few at-fault accidents can really raise rates, to the tune of $2,236 per year for a 20-year-old driver and even $384 per year for a 60-year-old driver. So drive safe and save!

- Compare rates before you buy the car. Different vehicles, and even different trims of the same vehicle, can have very different insurance premiums, and insurers charge a wide range of prices. Get plenty of quotes to compare the cost of insurance before you buy a different car in order to prevent insurance sticker shock when you get the bill.

- If your car is older, remove unneeded coverages. Removing physical damage coverage from vehicles that are older can reduce the cost of car insurance substantially.

- Policy discounts mean cheaper auto insurance. Discounts may be available if the insured drivers are military or federal employees, drive a vehicle with safety or anti-theft features, are accident-free, are homeowners, insure multiple vehicles on the same policy, or many other policy discounts which could save the average Fremont driver as much as $262 per year.