- Yankton car insurance rates average $1,966 per year for full coverage, or around $164 per month.

- Yankton auto insurance costs an average of $10 per year more than the South Dakota state average cost ($1,956) and $83 per year more than the rate average for the entire United States ($1,883).

- Monthly car insurance rates for a few popular models in Yankton include the Honda Accord at $158, Honda Civic at $145, and Ram Truck at $190.

- For cheap car insurance in Yankton, small crossovers like the Subaru Crosstrek, Nissan Kicks, and Toyota Corolla Cross have the most affordable rates.

How much does car insurance cost in Yankton?

In Yankton, the average cost of car insurance is $1,966 per year, which is 4.3% more than the overall national average rate of $1,883. Per month, Yankton drivers can expect to pay an average of $164 for a full-coverage car insurance policy.

In the state of South Dakota, the average cost of car insurance is $1,956 per year, so the cost in Yankton averages $10 more per year. The cost of car insurance in Yankton compared to other South Dakota cities is about $124 per year more expensive than in Mitchell, $346 per year cheaper than in Rapid City, and $276 per year more than in Watertown.

Driver age significantly impacts the cost of auto insurance, so the list below illustrates this by breaking out average car insurance rates for drivers from 16 to 60.

Yankton, SD, car insurance cost for drivers age 16 to 60

- 16-year-old driver – $7,005 per year or $584 per month

- 17-year-old driver – $6,788 per year or $566 per month

- 18-year-old driver – $6,082 per year or $507 per month

- 19-year-old driver – $5,538 per year or $462 per month

- 20-year-old driver – $3,956 per year or $330 per month

- 30-year-old driver – $2,098 per year or $175 per month

- 40-year-old driver – $1,966 per year or $164 per month

- 50-year-old driver – $1,742 per year or $145 per month

- 60-year-old driver – $1,632 per year or $136 per month

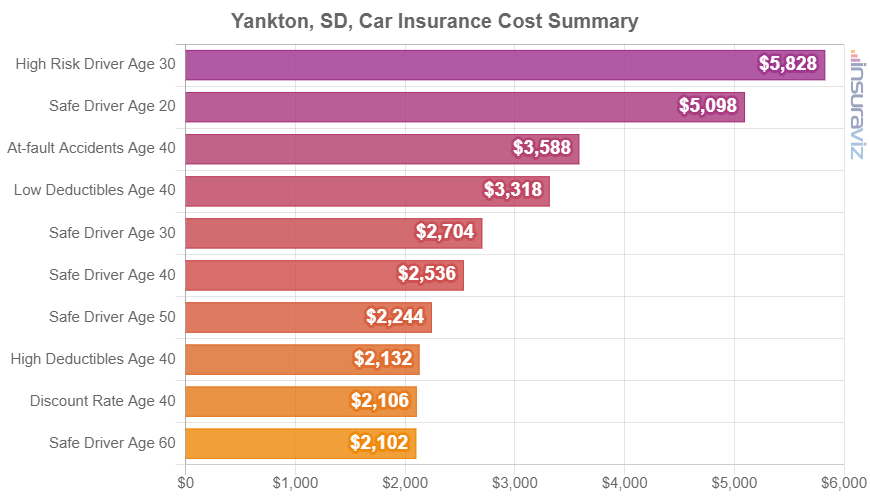

The chart below shows examples of average Yankton auto insurance cost broken out for an assortment of driver ages and possible risk profiles. Rates are averaged for all 2024 model year vehicles including luxury brands.

Average car insurance rates in the prior chart range from $1,632 per year for a 40-year-old driver that qualifies for many policy discounts to $4,524 per year for a 30-year-old driver with a poor driving record or too many at-fault accidents.

When that data is converted to a monthly rate, the average cost of car insurance per month in Yankton ranges from $136 to $377.

Car insurance rates can cost very different amounts for different drivers and minor changes in a driver’s risk profile can cause measureable changes in car insurance premiums. The likelihood of significant rate variability increases the need for accurate free auto insurance quotes when trying to find the cheapest car insurance policy.

Rates for top-selling vehicles

With over 500 vehicle models in production for the 2024 model year, there is a lot of car insurance data available. However, there are some vehicles that you’ll see on the road in South Dakota much more often than others.

We take these popular models and break down the average cost to insure each one. The chart below ranks popular cars, pickups, and SUVs for average annual insurance cost.

Let’s quickly review the important concepts that were presented so far.

- Yankton car insurance cost is more than the U.S. average – $1,966 (Yankton average) compared to $1,883 (U.S. average)

- Car insurance is cheaper the older you are – Auto insurance rates for a 60-year-old driver in Yankton are $2,324 per year cheaper than for a 20-year-old driver.

- Teenage female drivers pay lower rates than teenage males – Teenage female drivers pay $852 to $460 less annually than males of the same age.

- Yankton car insurance prices are more expensive than the South Dakota state average – $1,966 (Yankton average) compared to $1,956 (South Dakota average)

- Auto insurance rates drop a lot in your twenties – The average 30-year-old Yankton driver will pay $1,858 less annually than a 20-year-old driver, $2,098 compared to $3,956.

- Insurance for teens costs a lot – Cost ranges from $4,686 to $7,005 per year to insure a teen driver in Yankton, SD.

Which cars have cheap insurance in Yankton, SD?

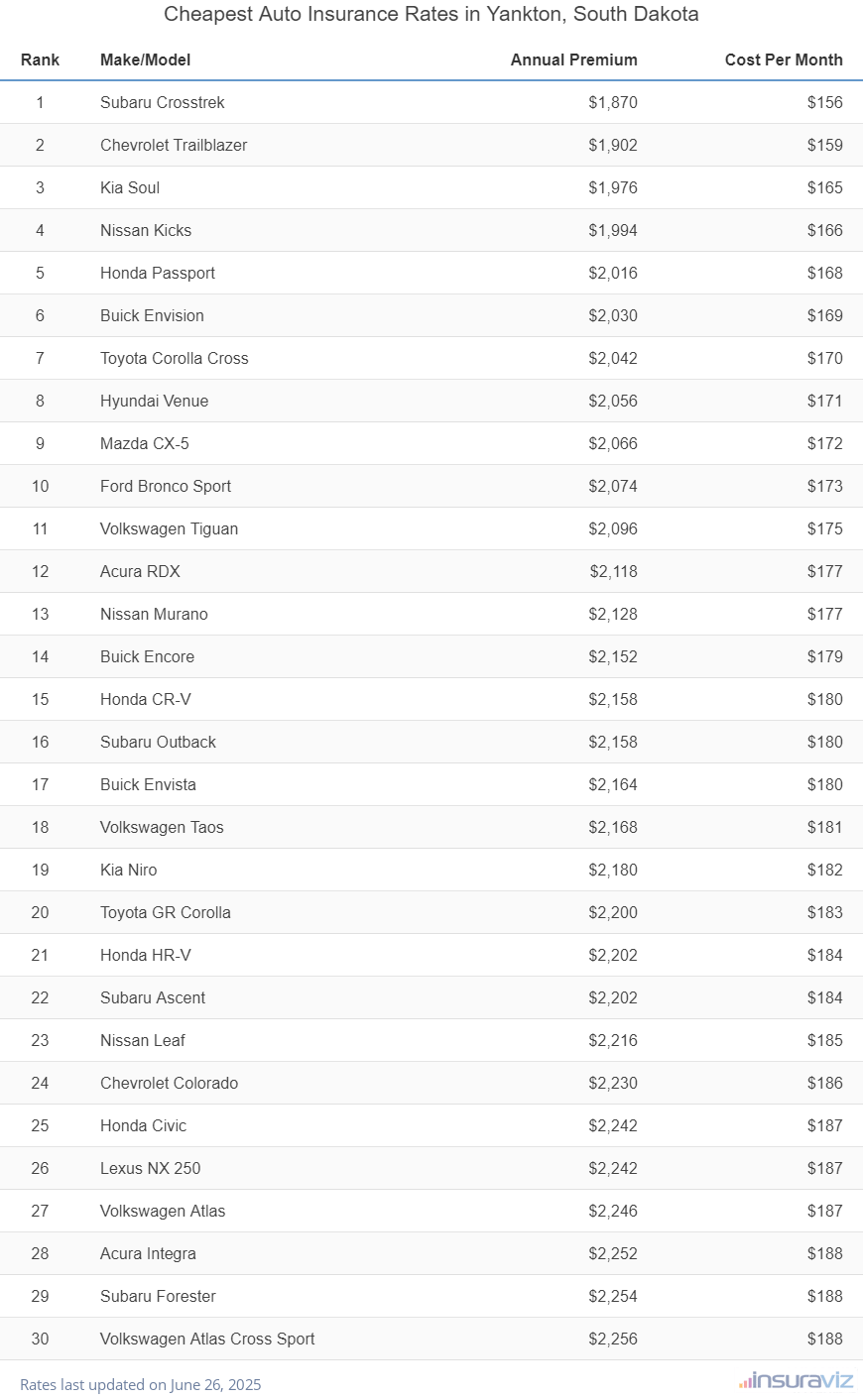

When comparing rates for all models, the vehicles with the cheapest average car insurance quotes in Yankton tend to be compact SUVs and crossovers like the Kia Soul, Chevrolet Trailblazer, Buick Envision, and Hyundai Venue.

Average auto insurance rates for vehicles in the top 10 cost $1,610 or less per year for a policy with full coverage.

A few other models that rank towards the top in our auto insurance price comparison are the Buick Encore, Kia Niro, Acura RDX, and Subaru Outback. Rates are slightly higher for those models than the cheapest small SUVs at the top of the rankings, but they still have an average insurance cost of $141 or less per month in Yankton.

The next table lists the 30 models with the cheapest car insurance in Yankton, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,454 | $121 |

| 2 | Chevrolet Trailblazer | $1,476 | $123 |

| 3 | Kia Soul | $1,534 | $128 |

| 4 | Nissan Kicks | $1,548 | $129 |

| 5 | Honda Passport | $1,564 | $130 |

| 6 | Buick Envision | $1,578 | $132 |

| 7 | Toyota Corolla Cross | $1,584 | $132 |

| 8 | Hyundai Venue | $1,598 | $133 |

| 9 | Mazda CX-5 | $1,604 | $134 |

| 10 | Ford Bronco Sport | $1,610 | $134 |

| 11 | Volkswagen Tiguan | $1,628 | $136 |

| 12 | Acura RDX | $1,646 | $137 |

| 13 | Nissan Murano | $1,650 | $138 |

| 14 | Buick Encore | $1,670 | $139 |

| 15 | Honda CR-V | $1,676 | $140 |

| 16 | Subaru Outback | $1,676 | $140 |

| 17 | Buick Envista | $1,682 | $140 |

| 18 | Chevrolet Colorado | $1,682 | $140 |

| 19 | Kia Niro | $1,686 | $141 |

| 20 | Volkswagen Taos | $1,686 | $141 |

| 21 | Subaru Ascent | $1,708 | $142 |

| 22 | Honda HR-V | $1,710 | $143 |

| 23 | Toyota GR Corolla | $1,710 | $143 |

| 24 | Nissan Leaf | $1,722 | $144 |

| 25 | Honda Civic | $1,738 | $145 |

| 26 | Lexus NX 250 | $1,740 | $145 |

| 27 | Volkswagen Atlas | $1,746 | $146 |

| 28 | Acura Integra | $1,748 | $146 |

| 29 | Volkswagen Atlas Cross Sport | $1,752 | $146 |

| 30 | Subaru Forester | $1,756 | $146 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Yankton, SD Zip Codes. Updated February 23, 2024

A few other popular vehicles making the top 30 table above include the Honda HR-V, Acura Integra, Honda Civic, and Volkswagen Atlas. Car insurance rates for those models fall between $1,686 and $1,752 per year.

To help gauge how cheap these rates are, some models with much more expensive insurance include the Kia Stinger at $2,230 per year, the Audi A4 at an average of $2,262, and the BMW X3 which costs $2,320.

Additional rates for popular vehicles

To emphasize the importance of the amount car insurance premiums can change for different drivers, the examples below present comprehensive rates for five popular models in Yankton: the Ford F150, Toyota Corolla, Honda CR-V, Honda Accord, and Ford Mustang.

Each vehicle example shows average rates for different driver profiles to demonstrate the possible cost variation with only minor changes to the policy rating factors.

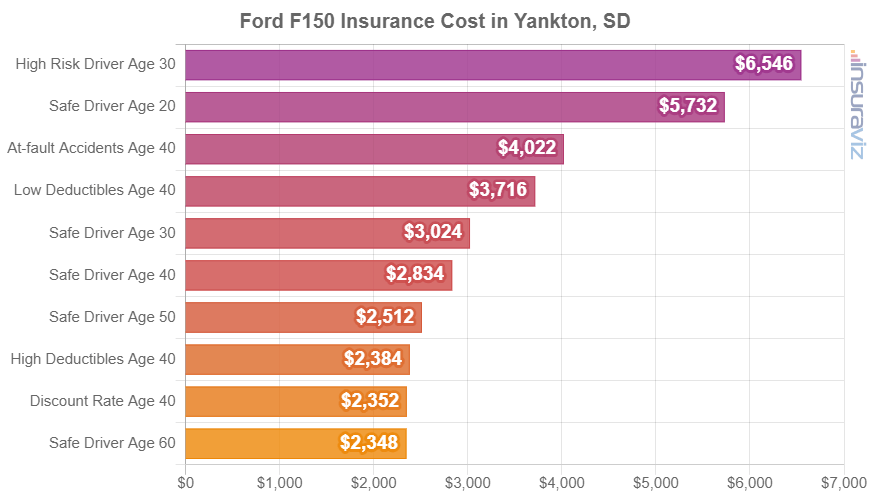

Ford F150 insurance rates

Average Ford F150 insurance cost in Yankton ranges from $1,848 up to $2,558 per year. The most affordable insurance rates are on the $46,195 Ford F150 XL Super Cab 4WD trim level, while the most expensive is the $100,090 Ford F150 Lightning Platinum Black Special Edition.

When Yankton insurance rates for the Ford F150 are compared with the overall national average cost on the same model, rates are $64 to $88 more per year in Yankton, depending on the specific trim level being insured.

The rate chart below visualizes how the price of car insurance on a Ford F150 can be significantly different for different driver ages and risk profiles. In this example, cost varies from $1,824 to $5,084 per year, which is a price difference of $3,260 per year for insurance on the same vehicle.

The Ford F150 is classified as a full-size truck, and other popular models include the Chevrolet Silverado, Nissan Titan, Ram Truck, and GMC Sierra.

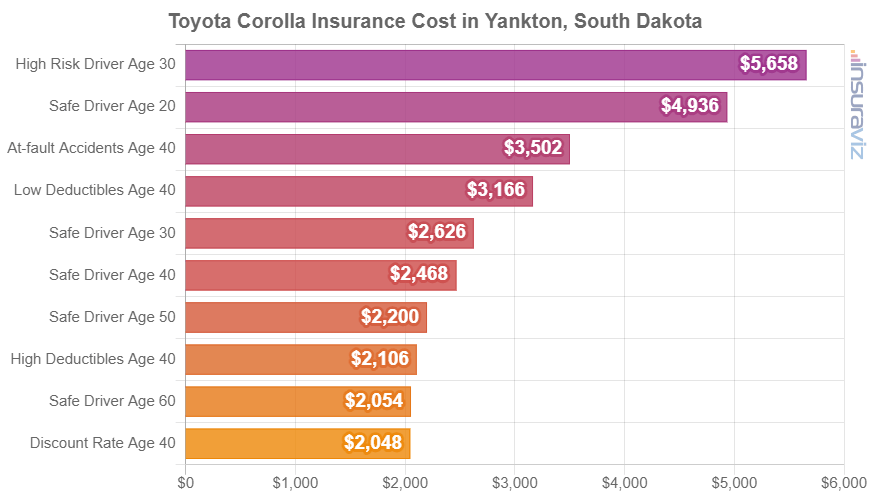

Toyota Corolla insurance rates

The lowest-cost 2024 Toyota Corolla trim to insure in Yankton is the LE model, costing an average of $1,744 per year, or about $145 per month. This trim costs $21,900.

The most expensive 2022 Toyota Corolla to insure in Yankton is the XSE Hatchback, costing an average of $2,166 per year, or around $181 per month. The retail price for this model is $26,655, not including charges and fees.

When Yankton car insurance quotes on the Toyota Corolla are compared with the cost averaged for the entire U.S. for the same vehicle, the cost is $62 to $72 more per year in Yankton, depending on the trim being insured.

On a monthly basis, car insurance quotes on a Toyota Corolla can range from $145 to $181 per month, depending on your Zip Code in Yankton.

The chart below might help to visualize how insurance quotes for a Toyota Corolla can range considerably based on changes in driver age and possible risk profiles.

The Toyota Corolla is classified as a compact car, and other models popular in Yankton include the Volkswagen Jetta, Chevrolet Cruze, and Honda Civic.

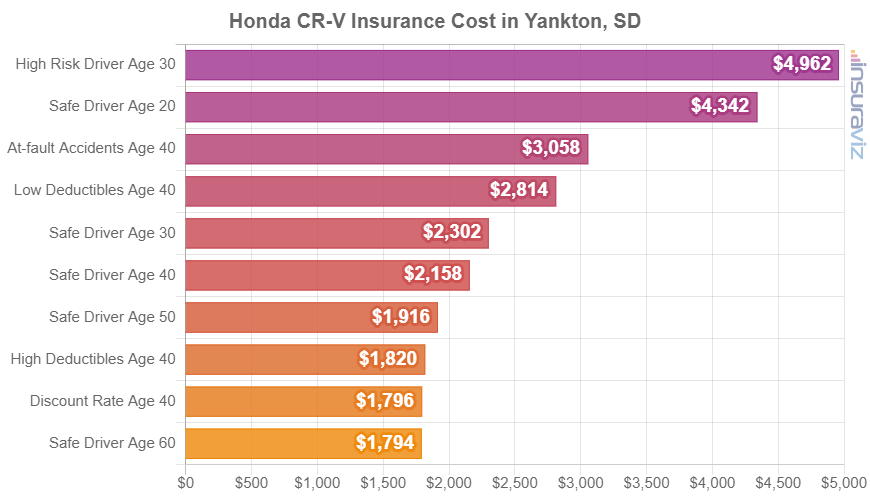

Honda CR-V insurance rates

Honda CR-V insurance in Yankton averages $1,676 per year, ranging from a low of $1,588 per year for the Honda CR-V LX trim level up to $1,770 per year for the Honda CR-V Sport Touring Hybrid AWD trim level.

The next rate chart can help visualize how the prices of car insurance on a Honda CR-V can be quite different based on a variety of different driver ages, policy deductibles, and policy risk factors.

For our example drivers, rates range from $1,392 to $3,854 per year, which is a difference in cost of $2,462 per year just depending on the driver.

The Honda CR-V is considered a compact SUV, and other models popular in Yankton include the Ford Escape, Chevrolet Equinox, Toyota RAV4, and Mazda CX-5.

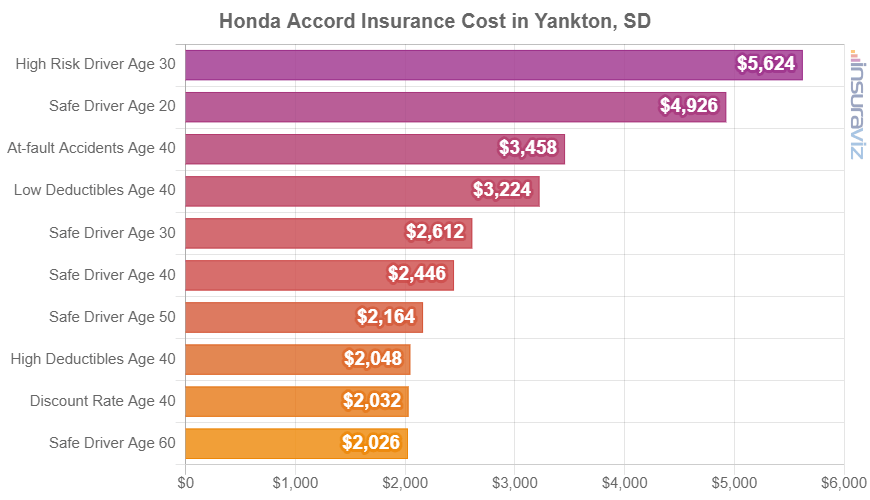

Honda Accord insurance rates

Honda Accord insurance in Yankton costs an average of $1,898 per year, ranging from a low of $1,832 per year on the Honda Accord EX-L Hybrid model (MSRP of $34,190) up to $1,950 per year on the Honda Accord LX (MSRP of $27,895).

When Yankton insurance rates for a Honda Accord are compared to national average insurance rates for the same vehicle, the cost is anywhere from $64 to $72 more expensive per year in Yankton, depending on the specific model being insured.

The chart displayed below illustrates how the price of car insurance for a Honda Accord can be very different for different driver ages, policy physical damage deductibles, and risk scenarios.

The Honda Accord is considered a midsize car, and additional models from the same segment that are popular in Yankton, SD, include the Chevrolet Malibu, Kia K5, Nissan Altima, and Toyota Camry.

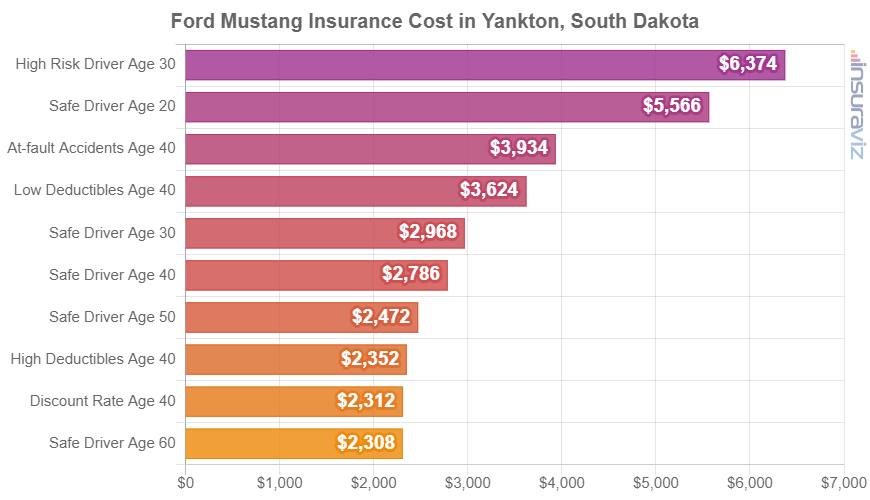

Ford Mustang insurance rates

In Yankton, the most affordable car insurance rates for a 2024 Ford Mustang are on the Ecoboost Fastback model, costing an average of $1,852 per year, or around $154 per month. This model has a retail price of $30,920.

The most expensive 2022 Ford Mustang model to insure in Yankton is the Dark Horse Premium model, costing an average of $2,358 per year, or about $197 per month. The MSRP for this trim is $63,265, not including documentation and destination fees.

When Yankton car insurance quotes on a Ford Mustang are compared to the national average cost on the same model, rates are $64 to $84 more per year in Yankton, depending on the trim level being insured.

As a cost per month, full-coverage car insurance on the Ford Mustang for an average middle-age driver can range from $154 to $197 per month, depending on the car insurance company you’re using in Yankton.

The chart below illustrates how insurance rates for a Ford Mustang can be significantly different for a variety of different driver ages, policy deductibles, and driver risk scenarios.

The Ford Mustang belongs to the sports car segment, and other popular models in the same segment include the Nissan 370Z, Subaru BRZ, Chevrolet Corvette, and Toyota GR Supra.

How to save on auto insurance in Yankton

Yankton drivers should always be searching for ways to reduce their monthly car insurance expenses, so browse the money-saving ideas in this next list to see if you can save some money.

- Earn a discount from your occupation. The vast majority of auto insurance providers offer policy discounts for certain professions like college professors, architects, emergency medical technicians, police officers and law enforcement, engineers, scientists, and others. Qualifying for this discount may save between $59 and $191 on your car insurance premium.

- Choose a vehicle that is cheaper to insure. Vehicle performance is a big factor in the cost of car insurance in Yankton. For example, a Subaru Impreza costs $1,154 less per year to insure in Yankton than a Dodge Challenger. Lower performance vehicles cost less to insure.

- Be a careful driver and pay less for car insurance in Yankton. At-fault accidents raise insurance rates, potentially as much as $952 per year for a 30-year-old driver and even $482 per year for a 60-year-old driver. So drive safe and save!

- Don’t file small claims. Most insurers give a discounted rate if you have no claims on your account. Car insurance should only be used to protect you from large financial hits, not minor claims that should be paid out-of-pocket.

- Compare insurance costs before buying a car. Different cars can have significantly different car insurance premiums, and insurance companies can price policies with a wide range of costs. Get multiple insurance quotes before you purchase in order to avoid insurance sticker shock when insuring your new vehicle.

- Qualify for policy discounts to save money. Savings may be available if the insured drivers drive a vehicle with safety or anti-theft features, are accident-free, insure multiple vehicles on the same policy, are homeowners, or many other policy discounts which could save the average Yankton driver as much as $334 per year on car insurance.