- Compact crossovers and SUVs like the Buick Envision, Chevrolet Trailblazer, and Kia Soul are good choices for cheap car insurance in Jackson.

- Average car insurance cost in Jackson is $2,500 per year, or around $208 per month.

- Auto insurance rates for a few popular vehicles in Jackson include the Ram Truck at $2,890 per year, Toyota Highlander at $2,272, and Toyota Corolla at $2,434.

Which cars have the cheapest insurance rates?

The models with the most affordable insurance rates in Jackson, TN, tend to be compact SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, Toyota Corolla Cross, and Nissan Kicks.

Average insurance prices for vehicles ranking in the top 10 cost $2,046 or less per year, or $171 per month, for full coverage car insurance.

Additional vehicles that have low-cost auto insurance prices in our car insurance price comparison are the Honda CR-V, Subaru Outback, Toyota GR Corolla, and Ford Bronco Sport.

The average rates are somewhat higher for those models than the crossovers and small SUVs at the top of the list, but they still have an average cost of $2,170 or less per year.

The following table ranks the top 40 cheapest vehicles to insure in Jackson, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,846 | $154 |

| 2 | Chevrolet Trailblazer | $1,878 | $157 |

| 3 | Kia Soul | $1,952 | $163 |

| 4 | Nissan Kicks | $1,966 | $164 |

| 5 | Honda Passport | $1,992 | $166 |

| 6 | Buick Envision | $2,002 | $167 |

| 7 | Toyota Corolla Cross | $2,014 | $168 |

| 8 | Hyundai Venue | $2,030 | $169 |

| 9 | Mazda CX-5 | $2,038 | $170 |

| 10 | Ford Bronco Sport | $2,046 | $171 |

| 11 | Volkswagen Tiguan | $2,066 | $172 |

| 12 | Acura RDX | $2,088 | $174 |

| 13 | Nissan Murano | $2,100 | $175 |

| 14 | Buick Encore | $2,122 | $177 |

| 15 | Subaru Outback | $2,128 | $177 |

| 16 | Honda CR-V | $2,132 | $178 |

| 17 | Buick Envista | $2,138 | $178 |

| 18 | Volkswagen Taos | $2,142 | $179 |

| 19 | Kia Niro | $2,152 | $179 |

| 20 | Toyota GR Corolla | $2,170 | $181 |

| 21 | Honda HR-V | $2,176 | $181 |

| 22 | Subaru Ascent | $2,176 | $181 |

| 23 | Nissan Leaf | $2,190 | $183 |

| 24 | Chevrolet Colorado | $2,202 | $184 |

| 25 | Lexus NX 250 | $2,212 | $184 |

| 26 | Honda Civic | $2,214 | $185 |

| 27 | Volkswagen Atlas | $2,216 | $185 |

| 28 | Acura Integra | $2,222 | $185 |

| 29 | Subaru Forester | $2,224 | $185 |

| 30 | Volkswagen Atlas Cross Sport | $2,228 | $186 |

| 31 | Kia Seltos | $2,232 | $186 |

| 32 | GMC Terrain | $2,238 | $187 |

| 33 | Nissan Rogue | $2,248 | $187 |

| 34 | Hyundai Kona | $2,250 | $188 |

| 35 | Cadillac XT4 | $2,256 | $188 |

| 36 | Mazda CX-30 | $2,256 | $188 |

| 37 | Volkswagen ID4 | $2,266 | $189 |

| 38 | Ford Explorer | $2,268 | $189 |

| 39 | Toyota Highlander | $2,272 | $189 |

| 40 | Toyota Venza | $2,280 | $190 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Jackson, TN Zip Codes. Updated October 24, 2025

Some additional models worth noting making the list of the top 40 table above include the Mazda CX-30, the Honda Civic, the Volkswagen Atlas Cross Sport, the Acura Integra, and the Ford Explorer. Average rates for those vehicles cost between $2,170 and $2,282 per year in Jackson.

To put the rates for the cheapest vehicles in perspective, a few vehicles with much higher insurance rates include the Jeep Grand Wagoneer that averages $242 per month, the Subaru BRZ which averages $249, and the Tesla Model X that costs $262.

The average cost of car insurance in Jackson

The average cost to insure a vehicle in Jackson is $2,500 per year, which is 9.4% more than the U.S. average rate of $2,276. The average cost per month for car insurance in Jackson is $208 for full coverage auto insurance.

Average car insurance cost in Tennessee is $2,432 per year, so drivers in Jackson pay an average of $68 more per year than the Tennessee state-wide average rate.

The average cost of car insurance in Jackson compared to other Tennessee locations is $20 per year more than in Nashville, $124 per year more expensive than in Murfreesboro, and $74 per year more than in Clarksville.

The age of the driver is the factor that has the most impact on the price you pay for car insurance, so the list below details how age impacts cost by showing the difference in average car insurance rates for drivers from 16 to 60.

Jackson, TN, car insurance cost for drivers age 16 to 60

- 16-year-old driver – $8,903 per year or $742 per month

- 17-year-old driver – $8,624 per year or $719 per month

- 18-year-old driver – $7,732 per year or $644 per month

- 19-year-old driver – $7,039 per year or $587 per month

- 20-year-old driver – $5,030 per year or $419 per month

- 30-year-old driver – $2,668 per year or $222 per month

- 40-year-old driver – $2,500 per year or $208 per month

- 50-year-old driver – $2,216 per year or $185 per month

- 60-year-old driver – $2,076 per year or $173 per month

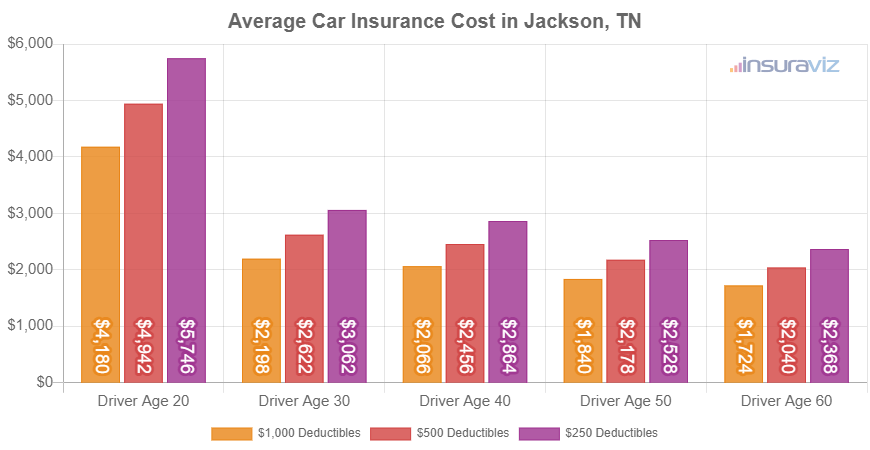

The next chart shows average car insurance rates in Jackson for 2024 model year vehicles for both different driver ages and physical damage coverage deductibles.

Average rates in the chart above range from $1,754 per year for a 60-year-old driver with $1,000 deductibles to $5,848 per year for a 20-year-old driver with $250 deductibles. The rate used in this article for comparison of different segments, models, and locations is a 40-year-old driver with $500 comprehensive and collision coverage deductibles, which is an average cost of $2,500 per year in Jackson.

As a monthly cost, average car insurance cost in Jackson ranges from $146 to $487 for the same risk profiles and driver ages shown in the previous chart.

Auto insurance rates can vary considerably and seemingly inconsequential changes in personal situations can cause substantial price changes. This large rate variability emphasizes the need to get multiple car insurance quotes when shopping online for a better price on car insurance.

Insurance cost for top-selling models

We covered the cheapest vehicles to insure and average rates in Jackson, but the most popular vehicles are not always the cheapest to insure.

This next list breaks down the cost of auto insurance for both annual and monthly policy terms for some of the more popular cars, trucks, and SUVs that you can find cruising the hills of Tennessee. Click any model for more in-depth rate details.

Average car insurance cost for popular vehicles

- Ram Truck – $2,890 per year ($241 per month)

- Toyota Highlander – $2,272 per year ($189 per month)

- Toyota Corolla – $2,434 per year ($203 per month)

- Nissan Sentra – $2,294 per year ($191 per month)

- Toyota RAV4 – $2,306 per year ($192 per month)

- Subaru Outback – $2,128 per year ($177 per month)

- Hyundai Elantra – $2,716 per year ($226 per month)

- Chevrolet Silverado – $2,764 per year ($230 per month)

- Chevrolet Equinox – $2,302 per year ($192 per month)

- GMC Sierra – $2,762 per year ($230 per month)

The models that are popular in Jackson tend to be compact or midsize sedans like the Nissan Sentra, Toyota Corolla, and Nissan Altima and compact or midsize SUVs like the Chevy Equinox and Jeep Grand Cherokee.

Additional popular vehicles from other vehicle segments include luxury models like the Lexus ES 350, Cadillac XT5, and BMW X5 and sports cars like the Porsche 911, Chevy Corvette, and Audi TT.

When the list above is compared to the table with the cheapest cars to insure, only about two models made the cut.

A large factor in the cost of insurance is the cost of the vehicle, so more expensive models tend to also have higher insurance premiums.

For example, you won’t find models like the $90,900 Porsche Taycan or the $71,090 Tesla Model S on the list of cheapest vehicles to insure.

The cost of liability insurance is also a big factor that can impact the rate you pay. Some vehicles have excellent track records for passenger safety and those models are rewarded with cheaper rates.

How to save on car insurance in Jackson

Everyone wants to pay less for car insurance. That’s just a fact.

Personal factors like your age or gender are not something you can change (for the most part), but there are a lot of things you CAN control that result in cheaper car insurance.

The list below covers a few of the things you can do to help keep insurance rates as low as possible.

- Fewer accidents saves money. Having frequent at-fault accidents will raise rates, potentially up to $1,208 per year for a 30-year-old driver and even $610 per year for a 60-year-old driver. So be safe and save.

- Shop around for better prices. Setting aside the time to get a few free car insurance quotes could save you more than you think. Rates change often and switching to a different company is very easy to do.

- Obey the law and pay less. To get cheap car insurance in Jackson, it makes good sense to be a safe driver. Not surprisingly, just a couple of speeding tickets have the ramification of raising policy cost by as much as $664 per year. Being convicted of a major violation such as driving under the influence or reckless driving could raise rates by an additional $2,322 or more.

- Save money due to your job. Some auto insurance providers offer discounts for being employed in occupations like dentists, firefighters, accountants, architects, police officers and law enforcement, lawyers, and others. By qualifying for this discount, you could potentially save between $75 and $243 on your annual car insurance premium, depending on the age of the driver.

- Compare insurance costs before buying a car. Different cars can have very different insurance premiums, and car insurance companies charge a wide range of prices. Check prices before you upgrade you car in order to avoid any surprises when insuring your new vehicle.

- Keep your claim-free discount. Insurance companies offer a discount if you do not file any claims. Car insurance should be used to protect you from larger claims, not minor claims.