- For the cheapest auto insurance in Gilbert, Arizona, compact SUVs like the Kia Soul, Nissan Kicks, Buick Envision, and Chevrolet Trailblazer rank very well for overall cost.

- The average cost of car insurance in Gilbert is $1,826 per year, or $152 per month.

- Monthly auto insurance rates for a few popular vehicles in Gilbert include the Hyundai Elantra at $166, Nissan Rogue at $137, and Toyota Corolla at $149.

- Gilbert car insurance averages $62 per year more than the Arizona state average and $57 per year less than the average for all 50 states.

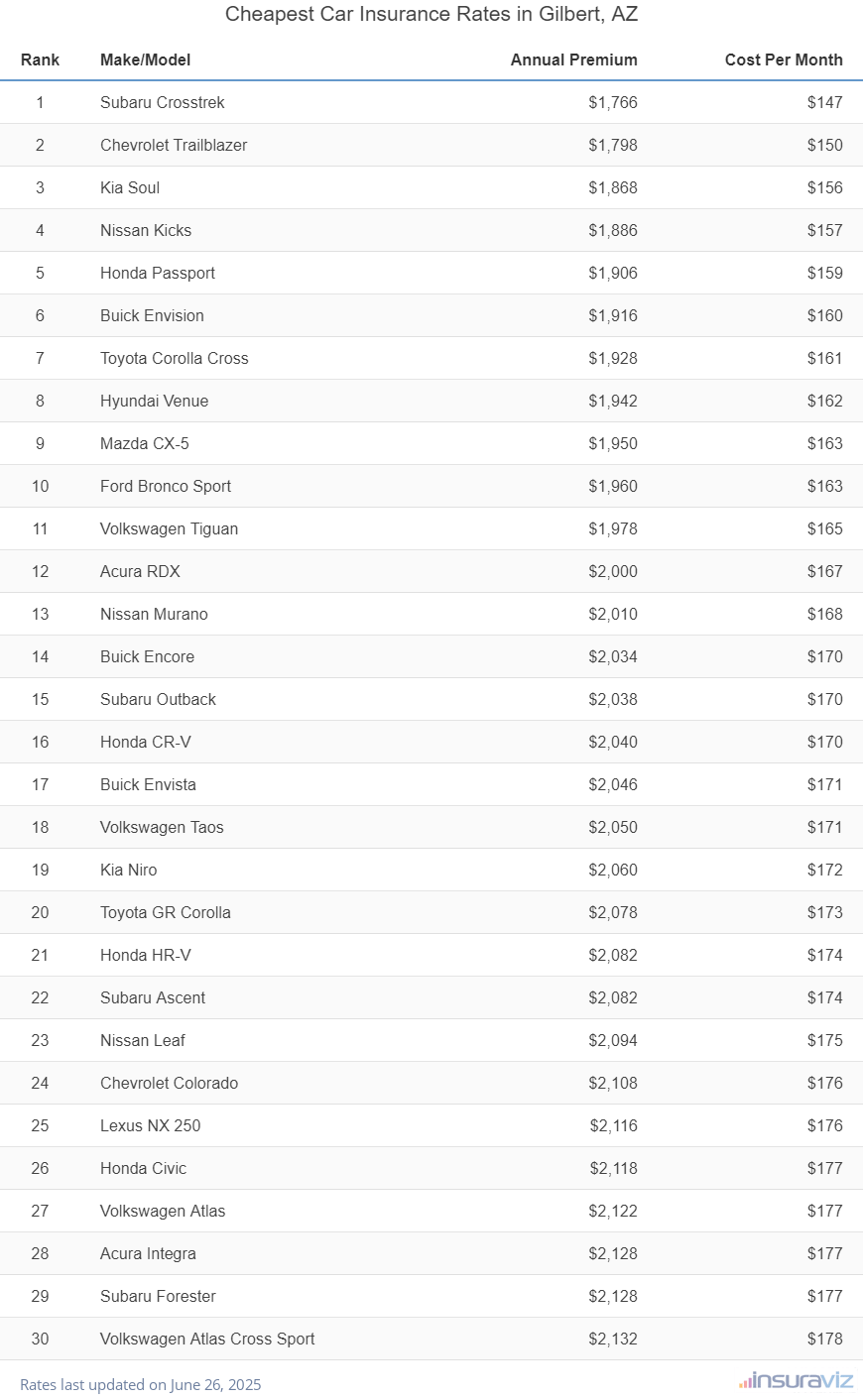

Which cars have the cheapest insurance rates?

When comparing rates for all models, the vehicles with the most affordable insurance rates in Gilbert, AZ, tend to be crossovers and compact SUVs like the Subaru Crosstrek, Kia Soul, and Hyundai Venue.

Average auto insurance prices for those models cost $1,498 or less per year, or $125 per month, to have full coverage.

Examples of other models that rank very well in the cost comparison table are the Buick Envista, Buick Encore, Kia Niro, and Honda CR-V. The average rates are a little higher for those models than the cheapest compact SUVs and crossovers that rank at the top, but they still have an average insurance cost of $1,568 or less per year, or $131 per month.

The table below ranks the top 30 cheapest vehicles to insure in Gilbert, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,350 | $113 |

| 2 | Chevrolet Trailblazer | $1,374 | $115 |

| 3 | Kia Soul | $1,428 | $119 |

| 4 | Nissan Kicks | $1,440 | $120 |

| 5 | Honda Passport | $1,456 | $121 |

| 6 | Buick Envision | $1,466 | $122 |

| 7 | Toyota Corolla Cross | $1,472 | $123 |

| 8 | Hyundai Venue | $1,484 | $124 |

| 9 | Mazda CX-5 | $1,492 | $124 |

| 10 | Ford Bronco Sport | $1,498 | $125 |

| 11 | Volkswagen Tiguan | $1,514 | $126 |

| 12 | Acura RDX | $1,530 | $128 |

| 13 | Nissan Murano | $1,538 | $128 |

| 14 | Buick Encore | $1,554 | $130 |

| 15 | Subaru Outback | $1,556 | $130 |

| 16 | Buick Envista | $1,560 | $130 |

| 17 | Honda CR-V | $1,560 | $130 |

| 18 | Chevrolet Colorado | $1,562 | $130 |

| 19 | Volkswagen Taos | $1,564 | $130 |

| 20 | Kia Niro | $1,568 | $131 |

| 21 | Honda HR-V | $1,588 | $132 |

| 22 | Toyota GR Corolla | $1,590 | $133 |

| 23 | Subaru Ascent | $1,592 | $133 |

| 24 | Nissan Leaf | $1,600 | $133 |

| 25 | Lexus NX 250 | $1,618 | $135 |

| 26 | Honda Civic | $1,620 | $135 |

| 27 | Volkswagen Atlas | $1,622 | $135 |

| 28 | Acura Integra | $1,626 | $136 |

| 29 | Subaru Forester | $1,630 | $136 |

| 30 | Volkswagen Atlas Cross Sport | $1,630 | $136 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Gilbert, AZ Zip Codes. Updated February 23, 2024

Additional vehicles that rank in the top 30 table above include the Subaru Ascent, Acura Integra, Nissan Leaf, and Subaru Forester. Average auto insurance rates for those vehicles fall between $1,568 and $1,630 per year in Gilbert.

As a comparison to gauge how inexpensive the top models are, some vehicles that cost more to insure include the Jeep Wrangler costing an average of $174 per month, the Ram Truck which costs $176, and the Audi e-tron which averages $190.

For extremely high car insurance rates, luxury and high-performance cars like the BMW M8 and Audi RS 6 have rates that can easily cost double or triple that of the cheapest models.

What is average car insurance cost in Gilbert?

The average price for car insurance in Gilbert is $1,826 per year, or around $152 per month for full coverage. It costs 3.1% less to insure the average vehicle in Gilbert than the U.S. average rate of $1,883.

In Arizona, average auto insurance cost is $1,764 per year, so insuring the average car in Gilbert runs about $62 more per year.

When compared to other locations in Arizona, the average cost of auto insurance in Gilbert is $254 per year less than in Phoenix, $26 per year more expensive than in Tucson, and $8 per year more expensive than in Chandler.

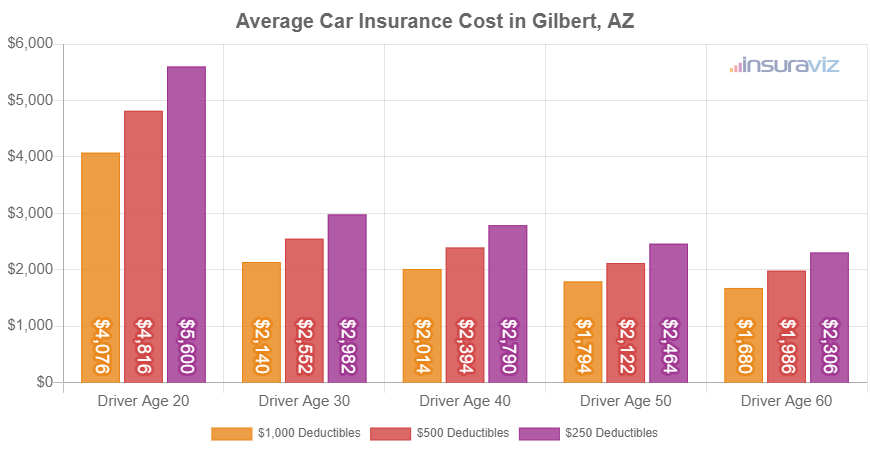

The age of the rated driver is one of the largest influencers on the price of car insurance, so the list below illustrates this point by showing the difference in average car insurance rates for young, middle-age, and senior drivers.

Average cost of car insurance in Gilbert by driver age

- 16-year-old driver – $6,508 per year or $542 per month

- 17-year-old driver – $6,304 per year or $525 per month

- 18-year-old driver – $5,649 per year or $471 per month

- 19-year-old driver – $5,146 per year or $429 per month

- 20-year-old driver – $3,676 per year or $306 per month

- 30-year-old driver – $1,950 per year or $163 per month

- 40-year-old driver – $1,826 per year or $152 per month

- 50-year-old driver – $1,622 per year or $135 per month

- 60-year-old driver – $1,518 per year or $127 per month

The next chart shows average car insurance cost in Gilbert broken out by driver age and physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury and performance vehicles.

Average car insurance rates in the chart range from $1,284 per year for a high deductible policy for a 60-year-old driver to $4,274 per year for a 20-year-old driver with a low deductible policy.

When the rates in the chart are converted for monthly budgeting, the average cost of car insurance per month in Gilbert ranges from $107 to $356.

The cost to insure top-selling vehicles in Gilbert, Arizona

The previous auto insurance rates in this article are averaged for every 2024 model year vehicle, which is suitable for making general comparisons like the cost difference between two locations.

Average car insurance rates are a good metric for answering questions like “are auto insurance rates in Gilbert cheaper than in Mesa?” or “are Arizona auto insurance rates cheaper than in Illinois?”.

But for more comprehensive car insurance rate comparisons, the cost data will be more precise if we do a rate analysis for the specific vehicle being insured. Every make and model has a slightly different risk profile for rating purposes and this data makes it possible to do more detailed cost comparisons.

The following list displays the cost of auto insurance for both annual and monthly terms in Gilbert for a handful of the more popular vehicles you’ll find driving down the Santan Freeway.

Average auto insurance cost for popular models in Gilbert

- Hyundai Elantra – $1,986 per year ($166 per month)

- Nissan Rogue – $1,640 per year ($137 per month)

- Toyota Corolla – $1,782 per year ($149 per month)

- Subaru Forester – $1,630 per year ($136 per month)

- Tesla Model 3 – $2,146 per year ($179 per month)

- Chevrolet Silverado – $2,020 per year ($168 per month)

- Ram Truck – $2,112 per year ($176 per month)

- Subaru Outback – $1,556 per year ($130 per month)

- Mazda CX-5 – $1,492 per year ($124 per month)

- Honda Civic – $1,620 per year ($135 per month)

The most popular vehicles in Gilbert tend to be small or midsize sedans like the Volkswagen Jetta, Honda Civic, and Honda Accord and small or midsize SUVs like the Honda CR-V and Jeep Grand Cherokee.

Additional popular models from other vehicle segments include luxury cars like the Tesla Model S and Acura ILX, luxury SUVs like the BMW X5 and Acura MDX, and models from the pickup truck segment like the Chevy Silverado and Ford Ranger.

When the list of popular vehicles is compared to the prior list of the 30 cheapest models to insure, most popular vehicles do not make the cut. Only the Subaru Forester and Mazda CX-5 had rates cheap enough to be considered one of the cheapest vehicles to insure.

Higher rates could be caused by a couple of reasons, the first being a higher purchase price. Models like a Lexus LX 570 with an average MSRP of $89,160 or a Tesla Model Y with an average MSRP of $31,890 cost more to insure due to a higher replacement cost in the event that the vehicle is totaled in an accident.

Another possible cause of higher rates could be a greater likelihood of liability or passenger medical claims like a Jeep Wrangler or a Volkswagen Jetta. Models that have characteristics that either lend themselves to more careless usage or maybe don’t have as good of safety ratings fall into this group.

Let’s review the key concepts and comparisons covered so far in the data above.

- Gilbert car insurance prices are more expensive than the Arizona state average – $1,826 (Gilbert average) versus $1,764 (Arizona average)

- Gilbert car insurance costs less than the U.S. average – $1,826 (Gilbert average) versus $1,883 (U.S. average)

- Teenage girls have cheaper rates than teen males – Teenage females pay $797 to $434 less per year than male drivers of the same age.

- Lower deductible car insurance is more expensive than high deductible – A 50-year-old driver pays an average of $758 more per year for $250 physical damage deductibles versus $1,000.

- Average car insurance cost per month ranges from $127 to $542 – That’s the average auto insurance price range for drivers age 16 to 60 in Gilbert.

- Auto insurance cost decreases as you age – Average rates for a 50-year-old driver in Gilbert are $2,054 per year cheaper than for a 20-year-old driver.

To help show how much the cost of the same car insurance policy can range between drivers (and also underscore the importance of accurate rate quotes), the charts below have multiple rates for three popular models in Gilbert: the Chevrolet Silverado, Honda Civic, and Honda CR-V.

Each illustration uses a range of risk profiles to illustrate the price fluctuation with only minor risk factor changes.

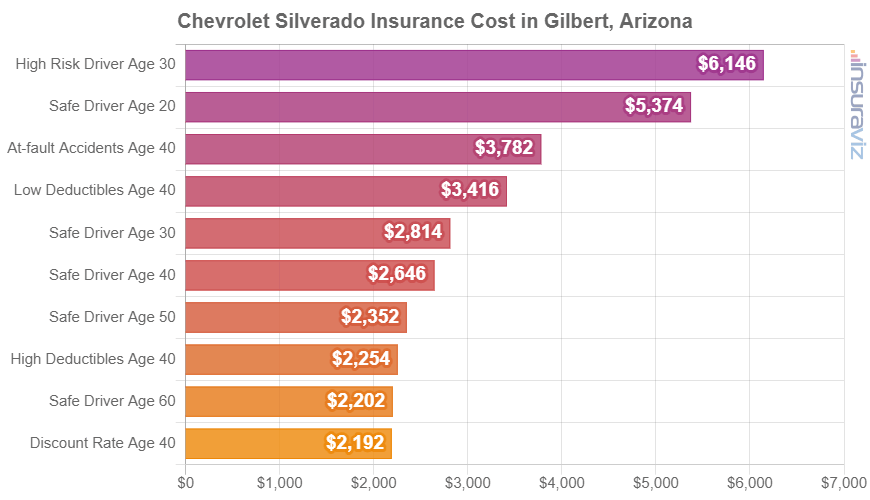

Chevrolet Silverado insurance rates

Average Chevrolet Silverado insurance cost in Gilbert ranges from $1,710 to $2,394 per year. The least-expensive insurance rates are on the $39,900 Chevrolet Silverado EV WT model, while the model with the most expensive insurance rates is the $105,000 Chevrolet Silverado EV RST First Edition model.

When Gilbert car insurance quotes for the Chevrolet Silverado are compared with the national average cost on the same model, rates are $68 to $92 less per year in Gilbert, depending on the model being insured.

The chart below shows how the price of car insurance on a Chevrolet Silverado can range significantly for a variety of driver ages, physical damage deductibles, and driver risk profiles.

The Chevrolet Silverado is considered a full-size truck, and additional similar models from the same segment include the Ram Truck, Toyota Tundra, GMC Sierra, and Nissan Titan.

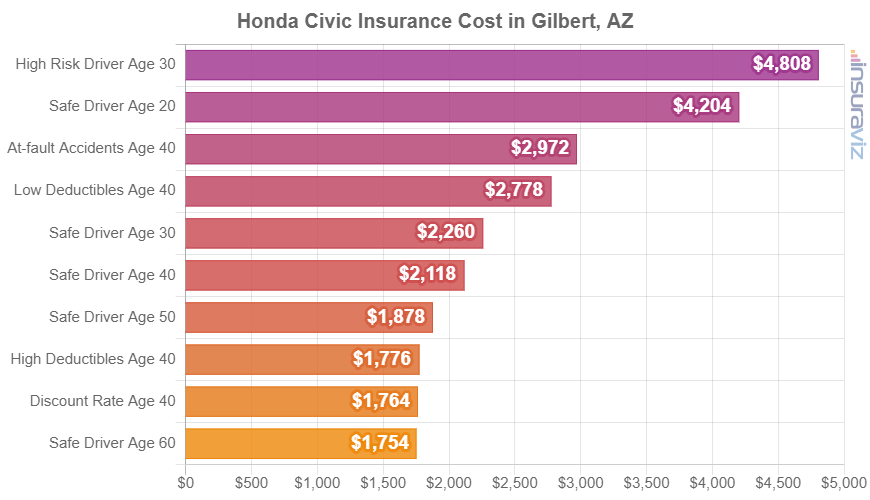

Honda Civic insurance rates

Honda Civic insurance in Gilbert averages $1,620 per year, with a range of $1,448 per year on the Honda Civic LX trim level (MSRP of $23,950) up to $1,916 per year for the Honda Civic Type R (MSRP of $43,795).

As a cost per month, auto insurance rates for the Honda Civic for the average driver can cost from $121 to $160 per month, depending on exact policy limits and your Zip Code in Gilbert.

The next chart illustrates how the cost of car insurance on a Honda Civic can change for a number of different driver ages, physical damage deductibles, and driver risk profiles.

For this example, rates vary from $1,346 to $3,670 per year, which is a difference of $2,324 to insure the same vehicle with different rated drivers.

The Honda Civic belongs to the compact car segment, and other top-selling models from the same segment include the Hyundai Elantra, Toyota Corolla, Chevrolet Cruze, and Nissan Sentra.

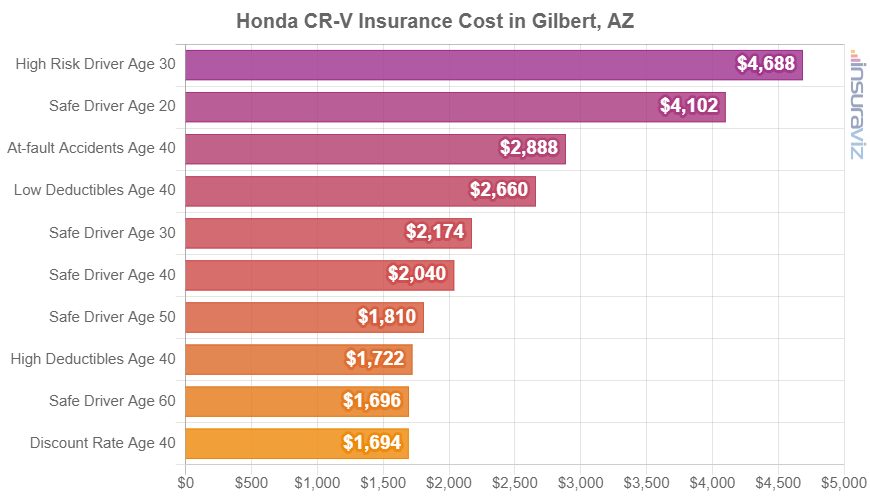

Honda CR-V insurance rates

With sticker prices ranging from $29,500 to $39,850, average Gilbert car insurance rates on a 2024 Honda CR-V range from $1,480 per year on the Honda CR-V LX model up to $1,646 per year for the Honda CR-V Sport Touring Hybrid AWD trim.

From a cost per month standpoint, car insurance quotes on the Honda CR-V can cost from $123 to $137 per month, depending on exactly where you live in Gilbert.

The rate chart below might be helpful in explaining how car insurance rates for a Honda CR-V can be quite different for different driver ages and policy risk profiles.

The Honda CR-V is classified as a compact SUV, and additional models from the same segment that are popular in Gilbert include the Subaru Forester, Mazda CX-5, Chevrolet Equinox, and Toyota RAV4.

Money-saving tips for finding cheaper Gilbert auto insurance

Drivers should always be thinking of ways to reduce the monthly expense for car insurance, so take a minute and read through the money-saving ideas in this next list and see if you can save a little dough on your next car insurance policy.

- Break the law and you’ll pay more. In order to get affordable car insurance in Gilbert, it’s necessary to follow traffic laws. As few as two minor blemishes on your driving record can potentially raise the price of a policy by as much as $486 per year. Serious moving violations like a DUI could raise rates by an additional $1,696 or more.

- Lower policy cost by raising deductibles. Boosting your physical damage deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Don’t file small claims. Auto insurance companies give a discount for not having any claims. Insurance should be used for significant financial loss, not minor claims that should be paid out-of-pocket.

- Careful drivers have lower car insurance rates. Causing too many accidents will raise rates, to the tune of $2,610 per year for a 20-year-old driver and as much as $760 per year for a 40-year-old driver. So be a cautious driver and save.

- Improve your credit for cheaper auto insurance rates. Having a credit score over 800 could save $287 per year over a credit score ranging from 670-739. Conversely, an imperfect credit score below 579 could cost as much as $332 more per year. Not all states use credit score as a rating factor, so check with your agent or company.