- Nissan Sentra insurance rates average $2,200 per year or $1,100 for a semi-annual policy, depending on the trim level.

- The cheapest Sentra insurance is on the S trim level at an estimated $2,150 per year.

- The Sentra SR is the most expensive to insure at $2,260 per year.

- The Nissan Sentra is one of the cheaper small cars to insure for the 2024 model year, costing $171 less per year on average as compared to the rest of the cars in the segment.

How much does Nissan Sentra insurance cost?

Nissan Sentra car insurance costs on average $2,200 annually for full coverage, or about $183 each month. Plan on paying around $171 less per year for Nissan Sentra insurance compared to the average rate for small cars, and $76 less per year than the $2,276 national average.

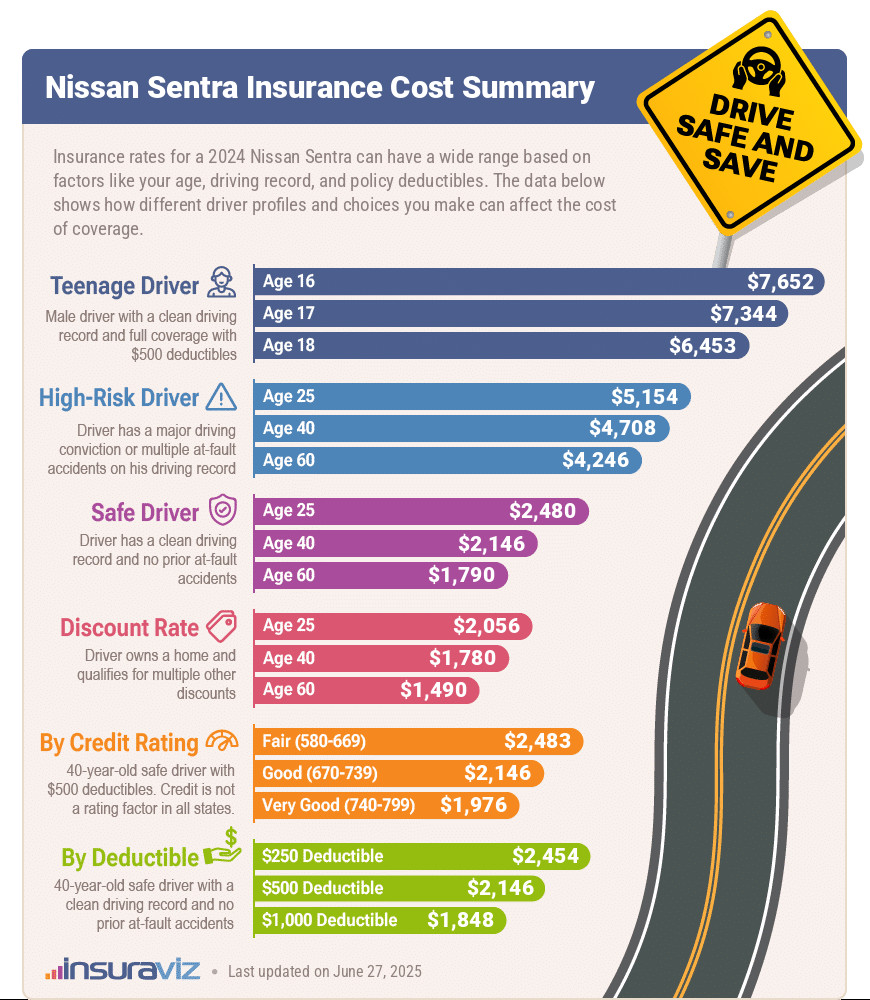

The graphic below showcases the average insurance cost for a 2024 Nissan Sentra using different driver ages and risk profiles.

To give you a better understanding of how variable rates are for a Sentra, keep in mind that insuring a Nissan Sentra for only liability insurance in the most affordable parts of Virginia or North Carolina can be as cheap as $221 a year.

For an identical Nissan Sentra, a teen driver with a bad speeding habit in some areas of Louisiana could get a bill for $16,448 a year for full coverage.

Your location is a very big factor when it comes to car insurance rates, so we included a Zip Code box below the graphic above. This allows you to get price quotes based on your exact location and also the exact trim level of Sentra you drive, which we discuss in the next section.

What is the cheapest Nissan Sentra insurance?

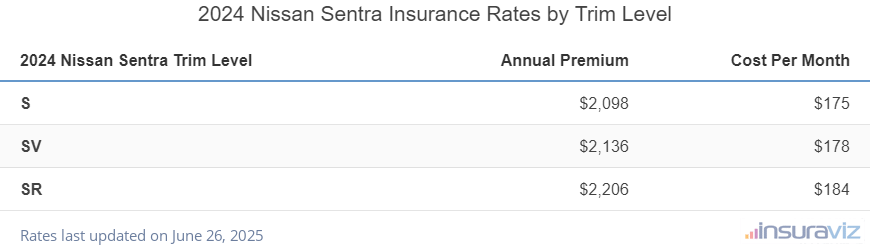

With Nissan Sentra car insurance rates ranging from $2,150 to $2,260 per year, the cheapest model to insure is the S trim. The next cheapest model to insure is the SV at $2,188 per year.

The least budget-friendly model of Nissan Sentra to insure is the SR at $2,260 per year.

The next table details the average annual and semi-annual policy costs, plus a monthly insurance rate, for each Nissan Sentra trim for the 2024 model year.

| 2024 Nissan Sentra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S | $2,150 | $179 |

| SV | $2,188 | $182 |

| SR | $2,260 | $188 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

What are average Sentra insurance rates by model year?

Nissan Sentra car insurance rates average $2,200 for a new 2024 model. Older models cost slightly less to insure each year. The table below shows average full coverage car insurance rates for 2010 to 2024 Nissan Sentra models.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Nissan Sentra | $4,348 | $2,200 | $1,836 |

| 2023 Nissan Sentra | $4,274 | $2,160 | $1,802 |

| 2022 Nissan Sentra | $4,238 | $2,132 | $1,780 |

| 2021 Nissan Sentra | $3,798 | $1,918 | $1,596 |

| 2020 Nissan Sentra | $3,694 | $1,864 | $1,554 |

| 2019 Nissan Sentra | $3,738 | $1,888 | $1,582 |

| 2018 Nissan Sentra | $3,572 | $1,804 | $1,514 |

| 2017 Nissan Sentra | $3,320 | $1,682 | $1,414 |

| 2016 Nissan Sentra | $3,224 | $1,630 | $1,372 |

| 2015 Nissan Sentra | $2,820 | $1,430 | $1,204 |

| 2014 Nissan Sentra | $2,650 | $1,342 | $1,130 |

| 2013 Nissan Sentra | $2,698 | $1,360 | $1,146 |

| 2012 Nissan Sentra | $2,644 | $1,333 | $1,123 |

| 2011 Nissan Sentra | $2,591 | $1,306 | $1,101 |

| 2010 Nissan Sentra | $2,539 | $1,280 | $1,079 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Nissan Sentra trim levels for each model year. Updated October 24, 2025

Is Nissan Sentra insurance expensive?

The Nissan Sentra ranks fourth out of 15 total vehicles in the 2024 compact car segment. The Sentra costs an average of $2,200 per year for full coverage insurance and the class median average cost is $2,371 annually, a difference of $171 per year.

When Sentra insurance cost is compared directly to top-selling vehicles in the small car class, insurance for a Nissan Sentra costs $76 more per year than Honda Civic insurance cost, $136 less than the cost of Toyota Corolla insurance, $408 less than Hyundai Elantra insurance rates, and $226 less than Jetta insurance cost.

The table below shows how the average Sentra car insurance rate compares to other models in the compact car segment like the Chevy Spark, Kia Rio, and Toyota Prius.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota GR Corolla | $2,084 | -$116 |

| 2 | Nissan Leaf | $2,100 | -$100 |

| 3 | Honda Civic | $2,124 | -$76 |

| 4 | Nissan Sentra | $2,200 | -- |

| 5 | Subaru Impreza | $2,204 | $4 |

| 6 | Toyota Prius | $2,242 | $42 |

| 7 | Toyota Corolla | $2,336 | $136 |

| 8 | Kia Forte | $2,342 | $142 |

| 9 | Nissan Versa | $2,364 | $164 |

| 10 | Mitsubishi Mirage G4 | $2,422 | $222 |

| 11 | Volkswagen Jetta | $2,426 | $226 |

| 12 | Mazda 3 | $2,480 | $280 |

| 13 | Hyundai Elantra | $2,608 | $408 |

| 14 | Volkswagen Golf | $2,650 | $450 |

| 15 | Toyota Mirai | $2,986 | $786 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

The 2024 Sentra has an average purchase price of $21,970 which ranges from $20,630 to $23,720, depending on the trim level and options. How does the cost to insure a Sentra compare to other similarly-priced vehicles? Let’s take a look.

The four compact car models with a purchase price closest to the Sentra for the 2024 model year are the Kia Forte, Toyota Corolla, Subaru Impreza, and Mitsubishi Mirage G4. The data below shows how those models compare to a 2024 Nissan Sentra for both initial purchase price and average car insurance policy cost.

- Compared to the Kia Forte – The Kia Forte has an average MSRP of $22,410 ($19,790 to $25,190), which is $440 more expensive than the average MSRP for the Nissan Sentra. Drivers can expect to pay around $142 more every 12 months to insure the Kia Forte compared to a Sentra.

- Compared to the Toyota Corolla – The average MSRP for a 2024 Nissan Sentra is $3,228 cheaper than the Toyota Corolla, at $21,970 compared to $25,198. Buying car insurance for the Toyota Corolla costs an average of $136 more each year than the Nissan Sentra.

- Compared to the Subaru Impreza – For a new model, the sticker price on the Subaru Impreza averages $3,322 more than the average cost of the Nissan Sentra ($25,292 compared to $21,970). Anticipate paying an average of $4 more each year for insurance on the Subaru Impreza compared to a Sentra.

- Compared to the Mitsubishi Mirage G4 – The 2024 Nissan Sentra has an average MSRP that is $3,375 more expensive than the Mitsubishi Mirage G4 ($21,970 versus $18,595). Insurance on a Nissan Sentra costs an average of $222 less per year than the Mitsubishi Mirage G4.

For additional comparisons, please see our cost comparison index page which provides links to many more makes and models.

Average insurance rates by location

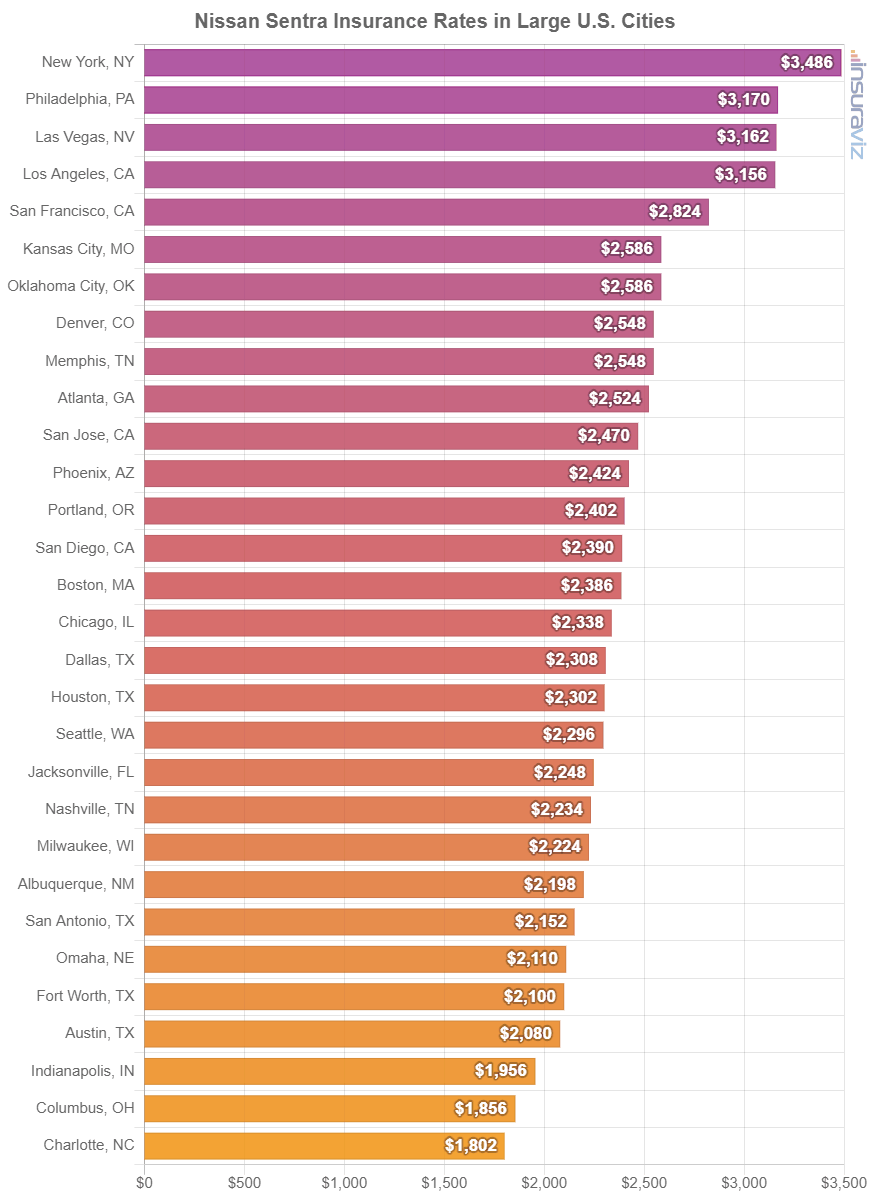

The cost of insuring your Sentra can range widely, from lower rates like $1,842 a year in Charlotte, NC, or $1,896 in Columbus, OH, to higher rates like $3,526 a year in New York City, NY, and $2,870 in Miami, FL.

Sentra auto insurance rates in other cities include El Paso, TX, averaging $2,140 per year, Kansas City, MO, at $2,624, Seattle, WA, costing $2,338, and Fresno, CA, at an estimated $2,524.

The next chart shows average full coverage car insurance costs for a Nissan Sentra for some of the largest cities in the U.S.

Some additional noteworthy observations as they relate to Nissan Sentra insurance cost include:

- Teenagers are the most expensive age group to insure. Average rates for full coverage Sentra insurance costs $7,840 per year for a 16-year-old driver, $7,523 per year for a 17-year-old driver, and $6,614 per year for an 18-year-old driver.

- Avoid tickets to save money. To receive the lowest Sentra insurance rates, it pays to follow the law. Not surprisingly, just one or two traffic citations could raise the price of a policy by as much as $576 per year. Major violations such as a DUI could raise rates by an additional $2,000 or more.

- Your job could save you money. Some car insurance providers offer policy discounts for being employed in occupations like police officers and law enforcement, firefighters, engineers, members of the military, college professors, and other occupations. By qualifying for an occupational discount, you may save between $66 and $233 on your annual Sentra insurance bill, depending on the level of coverage purchased.

- More policy discounts mean cheap Nissan Sentra car insurance rates. Discounts may be available if the insured drivers are senior citizens, drive low annual mileage, are military or federal employees, insure multiple vehicles on the same policy, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average driver as much as $374 per year on their insurance cost.

- Improve your credit for cheaper auto insurance rates. An excellent credit rating above 800 could save as much as $345 per year compared to a good credit rating of 670-739. Conversely, an imperfect credit score below 579 could cost around $400 more per year.

- Lower the cost of your policy by increasing deductibles. Boosting your physical damage deductibles from $500 to $1,000 could save around $308 per year for a 40-year-old driver and $574 per year for a 20-year-old driver.

- Low physical damage deductibles may be wasting money. Decreasing deductibles from $500 to $250 could cost an additional $316 per year for a 40-year-old driver and $602 per year for a 20-year-old driver.

- Prepare for sticker shock for high-risk insurance. For a 50-year-old driver, being required to buy a high-risk insurance policy could inflate rates by $2,552 or more per year.

During his career as an independent insurance agent,

During his career as an independent insurance agent,