- Average car insurance cost in Gary is $2,478 per year, or around $207 per month, for a full-coverage policy.

- Auto insurance rates for a few popular models in Gary include the GMC Sierra at $228 per month, Toyota Corolla at $201, and Ford Explorer at $187.

- Small SUVs like the Toyota Corolla Cross, Nissan Kicks, and Buick Envision are the best options for cheap car insurance in Gary.

- A few models with segment-leading auto insurance rates include the Infiniti QX80, Kia K5, Toyota GR Corolla, and Nissan Titan.

How much does Gary car insurance cost?

Average car insurance rates in Gary cost $2,478 per year, or approximately $207 per month. When compared to the overall U.S. national average rate, Gary car insurance cost is 8.5% more expensive per year.

In the state of Indiana, the average car insurance cost is $2,080 per year, so the average cost in Gary runs about $398 more per year.

When rates are compared to other locations in Indiana, the average cost to insure a car in Gary is approximately $116 per year more than in Hammond, $368 per year more expensive than in Evansville, and $440 per year more than in Fort Wayne.

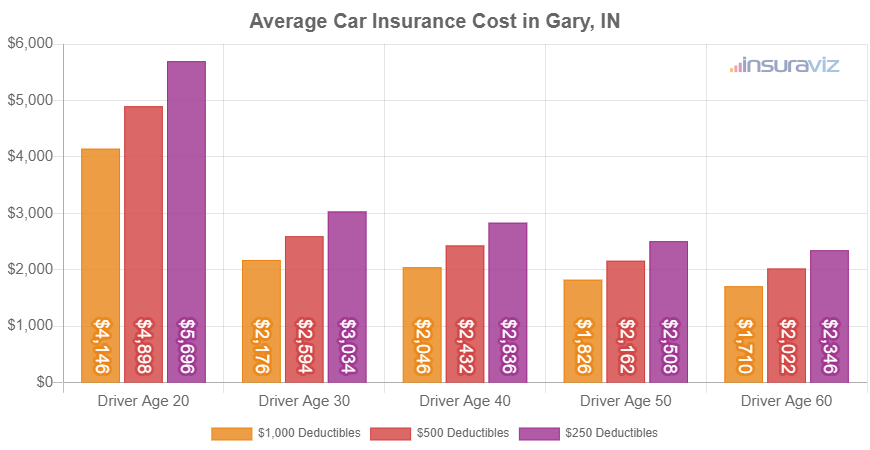

Driver age is the largest factor that influences the cost of car insurance, so the list below illustrates this point by showing the difference in average car insurance rates in Gary for drivers from 16 to 60.

Car insurance cost in Gary, IN, for drivers age 16 to 60

- 16-year-old driver – $8,826 per year or $736 per month

- 17-year-old driver – $8,551 per year or $713 per month

- 18-year-old driver – $7,663 per year or $639 per month

- 19-year-old driver – $6,981 per year or $582 per month

- 20-year-old driver – $4,984 per year or $415 per month

- 30-year-old driver – $2,644 per year or $220 per month

- 40-year-old driver – $2,478 per year or $207 per month

- 50-year-old driver – $2,196 per year or $183 per month

- 60-year-old driver – $2,056 per year or $171 per month

The chart below shows average Gary car insurance rates for 2024 model year vehicles for both different driver ages and physical damage coverage deductibles.

In the chart above, the cost of auto insurance in Gary ranges from $1,738 per year for a 60-year-old driver with a policy with high physical damage deductibles to $5,796 per year for a 20-year-old driver with low physical damage deductibles. From a monthly standpoint, these same average rates range from $145 to $483.

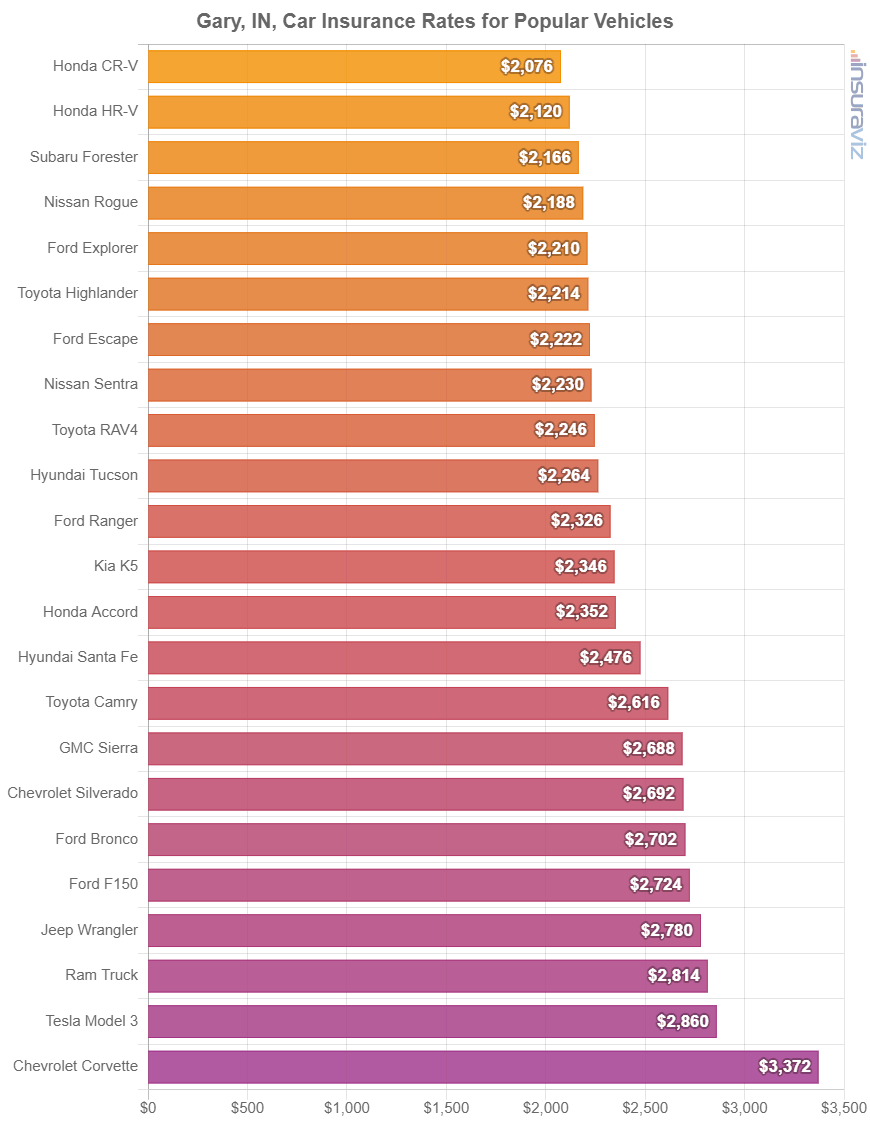

Average car insurance rates for popular vehicles

The rates referenced so far take all 2024 models and come up with an average cost, which is useful for making generalized comparisons such as between two locations, like Gary and Bloomington, or even between two states like Indiana and Illinois.

But for more accurate rate comparisons, the data will be better if we compare rates for the exact make and model of vehicle being insured. Every car, truck, SUV and minivan has it’s own profile for liability and physical damage claims, and this data enables insurance cost projections and comparisons.

The next chart displays average insurance rates in Gary for some of the more popular cars, trucks, and SUVs.

Popular vehicles don’t always have the best car insurance rates, as we will cover in the next section by showing the 30 vehicles with the cheapest insurance quotes in Gary.

If we compare the vehicles in the chart above with the table in the next section, we find that only about four of the popular models qualify to be in the top 30 cheapest to insure table.

Before we move into the most affordable vehicles to insure, the list below summarizes some of the previously covered concepts and also provides some additional data regarding rates.

- Insurance for a teenager can cost a lot – Average cost ranges from $5,901 to $8,826 per year for insurance on a teen driver in Gary, Indiana.

- Low deductible auto insurance costs more – A 50-year-old driver pays an average of $1,032 more per year for $250 deductibles compared to $1,000 deductibles.

- Auto insurance is cheaper as you age – Auto insurance rates for a 50-year-old driver in Gary are $2,788 per year cheaper than for a 20-year-old driver.

- Gary auto insurance prices are more expensive than the Indiana state average – $2,478 (Gary average) versus $2,080 (Indiana average)

- Car insurance rates decrease significantly between ages 20 and 30 – The average 30-year-old Gary, IN, driver will pay $2,340 less each year than a 20-year-old driver, $2,644 compared to $4,984.

- Gary car insurance cost is more than the U.S. average – $2,478 (Gary average) compared to $2,276 (U.S. average)

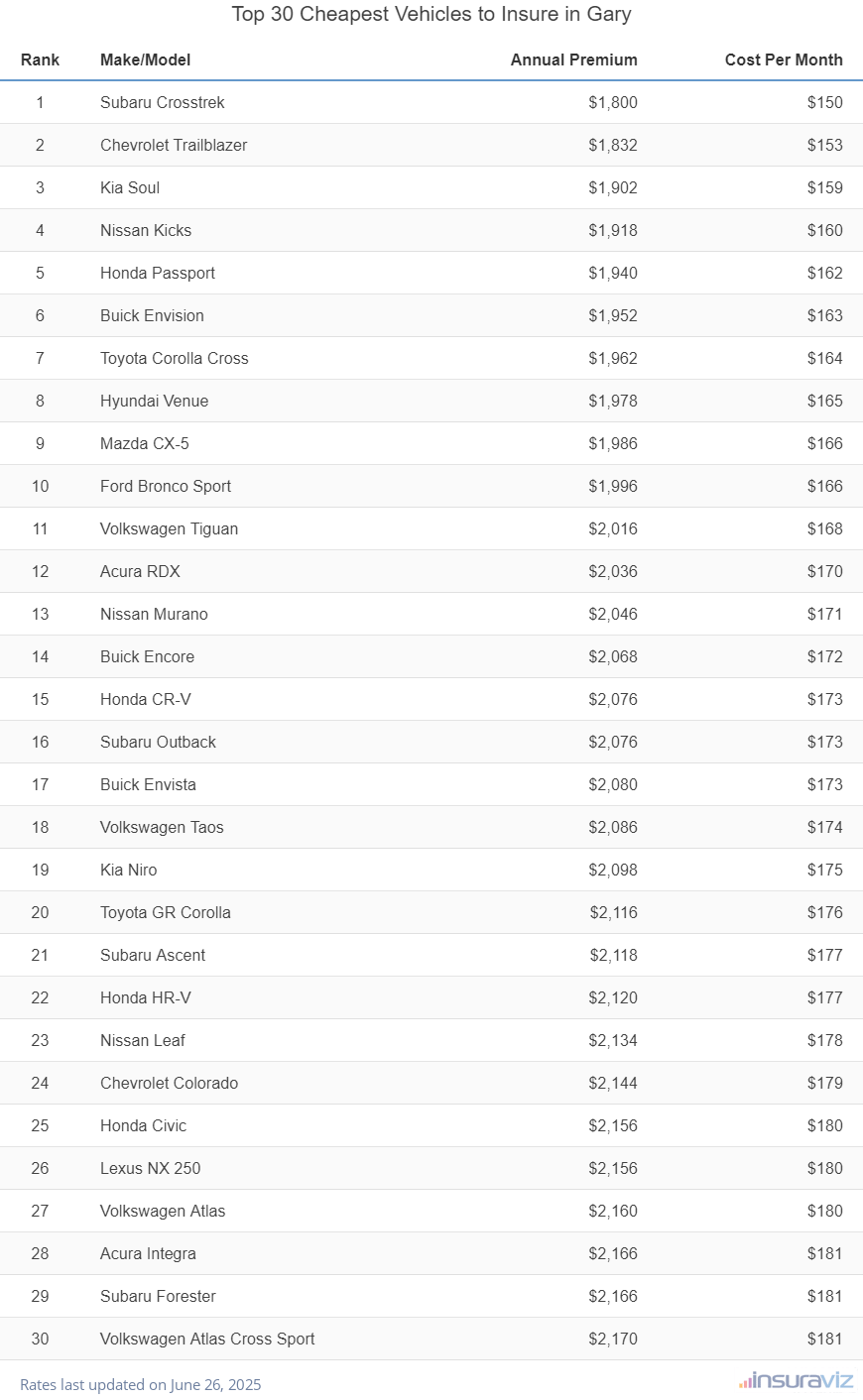

Cheapest cars to insure in Gary, IN

When comparing all makes and models, the vehicles with the most affordable auto insurance quotes in Gary tend to be small SUVs and crossovers like the Chevrolet Trailblazer, Kia Soul, and Toyota Corolla Cross.

Average auto insurance rates for the models ranking in the top 10 cost $2,028 or less per year ($169 per month) for a full coverage policy.

Some other models that have affordable insurance quotes in the cost comparison table are the Ford Bronco Sport, Nissan Murano, Acura RDX, and Honda CR-V. The average cost is slightly higher for those models than the compact SUVs and crossovers that rank at the top, but they still have an average insurance cost of $2,152 or less per year, or $179 per month.

The next table lists the top 30 models with the cheapest car insurance rates in Gary, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,830 | $153 |

| 2 | Chevrolet Trailblazer | $1,862 | $155 |

| 3 | Kia Soul | $1,932 | $161 |

| 4 | Nissan Kicks | $1,952 | $163 |

| 5 | Honda Passport | $1,974 | $165 |

| 6 | Buick Envision | $1,986 | $166 |

| 7 | Toyota Corolla Cross | $1,996 | $166 |

| 8 | Hyundai Venue | $2,014 | $168 |

| 9 | Mazda CX-5 | $2,020 | $168 |

| 10 | Ford Bronco Sport | $2,028 | $169 |

| 11 | Volkswagen Tiguan | $2,050 | $171 |

| 12 | Acura RDX | $2,072 | $173 |

| 13 | Nissan Murano | $2,082 | $174 |

| 14 | Buick Encore | $2,104 | $175 |

| 15 | Subaru Outback | $2,110 | $176 |

| 16 | Honda CR-V | $2,112 | $176 |

| 17 | Buick Envista | $2,118 | $177 |

| 18 | Volkswagen Taos | $2,122 | $177 |

| 19 | Kia Niro | $2,134 | $178 |

| 20 | Toyota GR Corolla | $2,152 | $179 |

| 21 | Honda HR-V | $2,156 | $180 |

| 22 | Subaru Ascent | $2,156 | $180 |

| 23 | Nissan Leaf | $2,168 | $181 |

| 24 | Chevrolet Colorado | $2,184 | $182 |

| 25 | Lexus NX 250 | $2,192 | $183 |

| 26 | Honda Civic | $2,194 | $183 |

| 27 | Volkswagen Atlas | $2,198 | $183 |

| 28 | Acura Integra | $2,202 | $184 |

| 29 | Subaru Forester | $2,206 | $184 |

| 30 | Volkswagen Atlas Cross Sport | $2,208 | $184 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Gary, IN Zip Codes. Updated October 24, 2025

Some additional models worth noting ranking in the top 30 table above include the Lexus NX 250, Subaru Forester, Volkswagen Atlas, Honda Civic, and Chevrolet Colorado. Rates for those vehicles fall between $2,152 and $2,208 per year in Gary.

In contrast to the vehicles with cheap rates, some examples that have more expensive insurance rates include the Toyota Mirai that averages $257 per month, the Audi S3 at an average of $232, and the Audi e-tron at an average of $258.

For very expensive coverage in Gary, luxury and high-performance cars like the BMW Alpina B8 and BMW M5 have rates that frequently cost two to three times more than the cheapest vehicles.

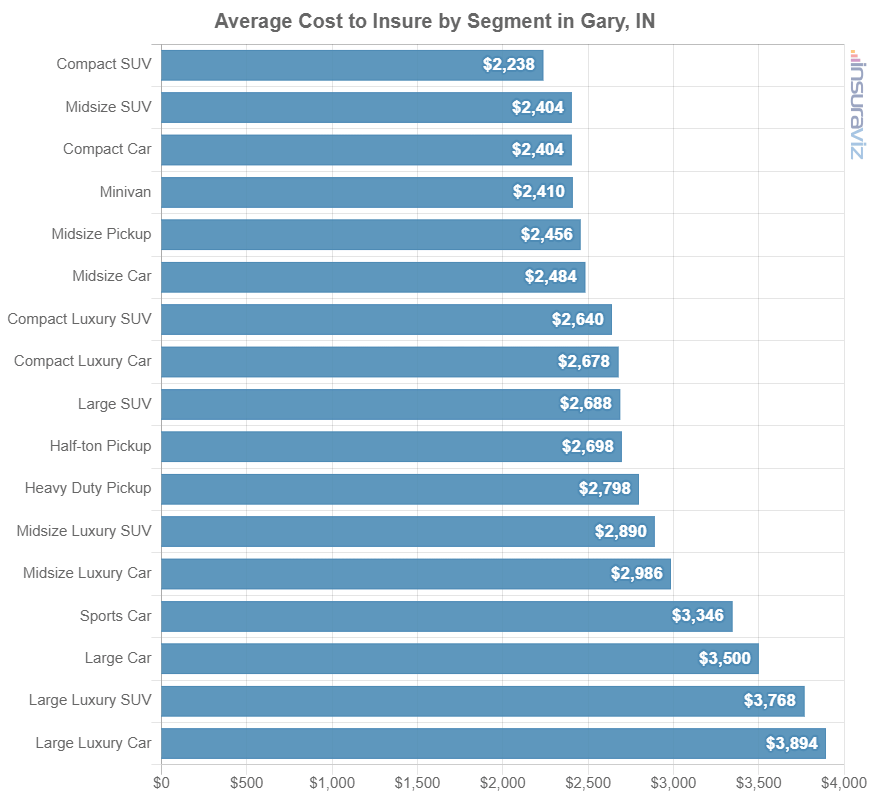

This next article section illustrates the average price of auto insurance in Gary for each vehicle segment. The rates shown in the chart should give you a decent understanding of which types of vehicles have the cheapest car insurance rates in Gary.

Average cost to insure by segment

If you’re shopping for a new vehicle, it’s a good idea to have a basic understanding of which styles of vehicles are more affordable to insure. Maybe you’re curious if midsize cars have cheaper car insurance than midsize SUVs or if midsize pickups cost less to insure than full-size pickups.

The next chart shows average auto insurance rates by segment in Gary. From an overall average perspective, small SUVs and midsize pickups tend to have the cheapest rates, while exotic high-performance models have the most expensive rates.

It’s important to note that rates within any particular segment can vary considerably, and we don’t recommend purchasing a vehicle simply because the that TYPE of vehicle tends to have affordable car insurance rates.

For example, in the midsize SUV segment, car insurance rates in Gary range from the Honda Passport at $1,974 per year up to the Rivian R1S costing $3,046 per year, a difference of $1,072 just for that segment.

As another example, in the small car segment, rates vary from the Toyota GR Corolla at $2,152 per year to the Toyota Mirai at $3,082 per year, a difference of $930 just for that segment.

For the best car insurance cost comparison, quotes based on the exact model of vehicle will always be more accurate. The next sections detail rates for some popular models in several different automotive segments.

Risk factors and price variation

To reinforce the concept of how much the cost of a car insurance policy can vary for different applicants, the sections below go into extensive detail for three popular models in Gary: the Chevy Silverado, Toyota Corolla, and Honda Pilot.

Each illustration shows average rates for different driver profiles to illustrate the difference in car insurance cost with only small risk factor changes.

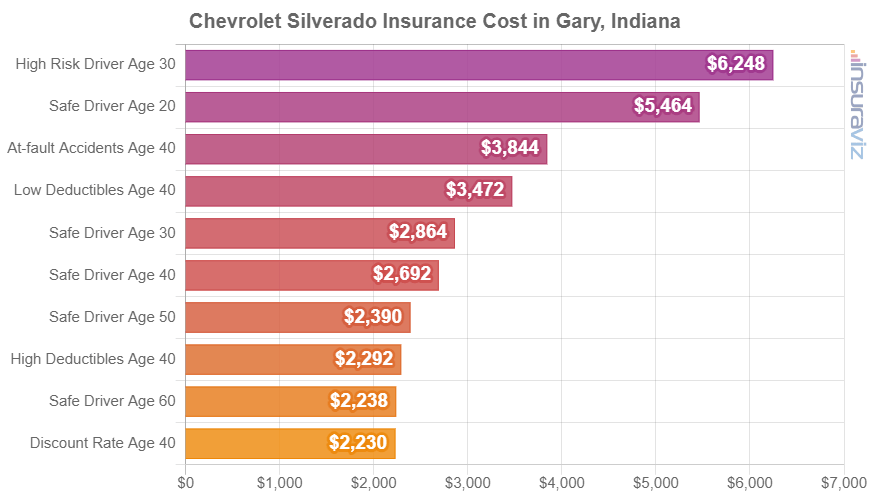

Chevrolet Silverado insurance rates

Chevrolet Silverado insurance in Gary averages $2,740 per year, with rates ranging from a low of $2,322 per year on the Chevrolet Silverado EV WT model up to $3,250 per year for the Chevrolet Silverado EV RST First Edition model.

On a monthly basis, car insurance on the Chevrolet Silverado can range from $194 to $271 per month, depending on policy coverages and your Zip Code in Gary.

The chart displayed below may help illustrate how the cost of insurance for a Chevrolet Silverado can be very different based on different driver ages, risk profiles, and policy deductibles.

The rates in the chart range from $2,270 to $6,362 per year, which is a difference of $4,092 when insuring the same vehicle.

The Chevrolet Silverado is considered a full-size truck, and other popular same-segment models include the GMC Sierra, Ford F150, and Ram Truck.

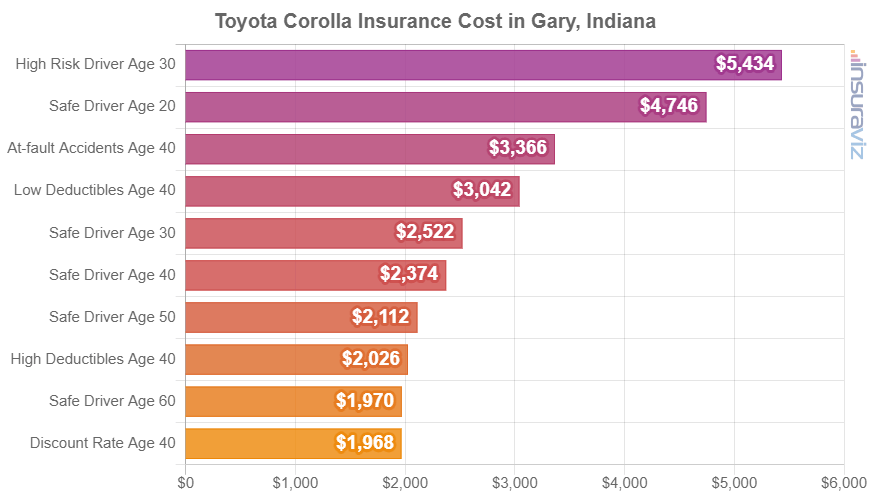

Toyota Corolla insurance rates

In Gary, the most affordable auto insurance rates on a 2024 Toyota Corolla are on the LE trim level, costing an average of $2,196 per year, or about $183 per month. This model stickers at $21,900.

The most expensive 2022 Toyota Corolla trim level to insure in Gary is the XSE Hatchback model, costing an average of $2,730 per year, or about $228 per month. The MSRP for this trim is $26,655, before destination and documentation fees.

The bar chart below shows how car insurance rates for a Toyota Corolla can be significantly different based on different driver ages, policy deductibles, and driver risk scenarios. In this example, cost varies from $2,002 to $5,536 per year, which is a difference in cost of $3,534 per year simply by increasing driver risk.

The Toyota Corolla belongs to the compact car segment, and other popular models include the Kia Forte, Volkswagen Jetta, Honda Civic, and Hyundai Elantra.

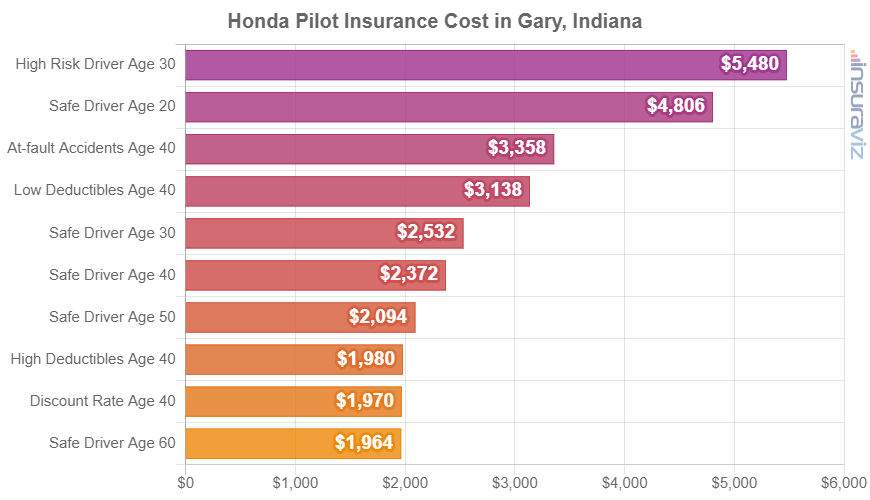

Honda Pilot insurance rates

The overall average cost of Honda Pilot insurance in Gary is $2,412 per year. With a purchase price ranging from $37,090 to $52,480, average insurance rates on a 2024 Honda Pilot range from $2,254 per year on the Honda Pilot LX model up to $2,560 per year on the Honda Pilot Elite AWD model.

From a monthly standpoint, car insurance on a Honda Pilot for an average middle-age driver can range from $188 to $213 per month, depending on the car insurance company you’re using in Gary.

The next chart illustrates how car insurance quotes for a Honda Pilot can range significantly for different driver ages, risk profiles, and policy deductibles.

The Honda Pilot is classified as a midsize SUV, and additional similar models include the Jeep Grand Cherokee, Ford Edge, and Ford Explorer.