- Hammond car insurance rates average $1,750 per year for full coverage, or approximately $146 per month.

- Hammond car insurance averages $282 per year more than the Indiana state average cost and $133 per year less than the average rate for all 50 states.

- For cheap auto insurance in Hammond, compact SUV models like the Subaru Crosstrek, Kia Soul, Volkswagen Tiguan, and Honda CR-V cost less than most other vehicles.

- A few models with segment-leading auto insurance rates include the Chevrolet Tahoe, Acura RDX, Chevrolet Colorado, Mercedes-Benz CLA250, and Toyota GR Corolla.

- Car insurance quotes in Hammond have significant variability from as little as $32 per month for just liability insurance to over $691 per month drivers with many accidents and violations.

How much does car insurance cost in Hammond?

Average car insurance cost in Hammond is $1,750 per year, which is about $146 per month. Hammond car insurance costs 7.3% less than the U.S. average rate of $1,883.

Average car insurance cost in Indiana is $1,468 per year, so Hammond drivers pay an average of $282 more per year than the overall Indiana state-wide average rate. When compared to other larger cities in Indiana, the cost of insurance in Hammond is $182 per year more expensive than in Indianapolis, $322 per year more than in Fort Wayne, and $334 per year more expensive than in South Bend.

The chart below shows examples of average Hammond auto insurance cost. Rates are averaged for all Hammond Zip Codes and shown for a variety of driver ages, policy deductibles, and potential risk scenarios.

In the chart above, the cost of auto insurance in Hammond ranges from $1,456 per year for a 40-year-old driver who receives an exceptional discount rate to $4,026 per year for a 30-year-old driver who has a few accidents and violations and has to buy a high risk policy. From a monthly standpoint, the average cost in the previous chart ranges from $121 to $336 per month.

Hammond auto insurance rates have extreme variability and seemingly inconsequential changes in a driver’s risk profile can cause consequential changes in car insurance premiums. The potential for large differences in cost stresses the need for accurate free car insurance quotes when looking for cheaper coverage.

Driver age is one of the biggest determining factors on the price of car insurance. The list below details how driver age influences cost by breaking out average car insurance rates in Hammond for drivers from age 16 to 60.

Hammond, Indiana, car insurance cost for drivers age 16 to 60

- 16-year-old rated driver – $6,239 per year or $520 per month

- 17-year-old rated driver – $6,042 per year or $504 per month

- 18-year-old rated driver – $5,415 per year or $451 per month

- 19-year-old rated driver – $4,931 per year or $411 per month

- 20-year-old rated driver – $3,522 per year or $294 per month

- 30-year-old rated driver – $1,870 per year or $156 per month

- 40-year-old rated driver – $1,750 per year or $146 per month

- 50-year-old rated driver – $1,552 per year or $129 per month

- 60-year-old rated driver – $1,454 per year or $121 per month

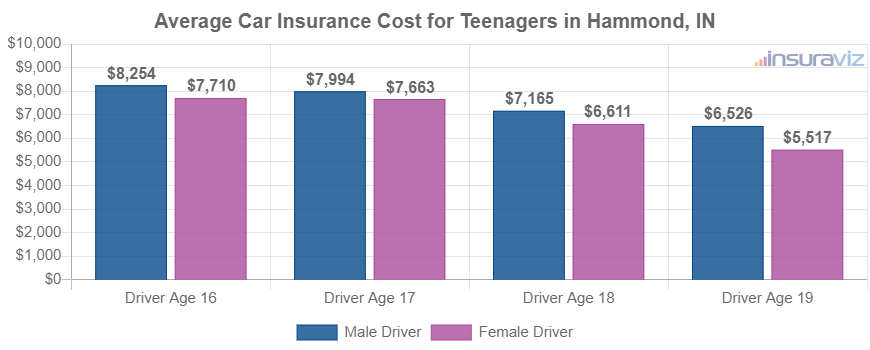

The rates in the list above for the average cost to insure teen drivers assumed a male driver. The next chart gets more specific and breaks out the average cost for car insurance for teen drivers in Hammond by gender. Females are generally cheaper to insure, especially up to age 20.

Auto insurance for a female 16-year-old driver in Hammond costs an average of $416 less per year than the cost for a 16-year-old male, while at age 19, the cost is still $763 less per year.

What vehicles are cheapest to insure?

The models with the cheapest car insurance prices in Hammond, IN, tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, Buick Envision, and Hyundai Venue. Average auto insurance quotes for those small SUVs cost $1,522 or less per year ($127 per month) for full coverage.

Some additional vehicles that are in the top 20 in the comparison table below are the Ford Bronco Sport, Kia Niro, Volkswagen Tiguan, and Nissan Murano. Average insurance cost is somewhat higher for those models than the cheapest crossovers and small SUVs that rank at the top, but they still have an average insurance cost of $134 or less per month.

The table below details the top 40 models with the cheapest car insurance rates in Hammond, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,292 | $108 |

| 2 | Chevrolet Trailblazer | $1,316 | $110 |

| 3 | Kia Soul | $1,366 | $114 |

| 4 | Nissan Kicks | $1,378 | $115 |

| 5 | Honda Passport | $1,394 | $116 |

| 6 | Buick Envision | $1,404 | $117 |

| 7 | Toyota Corolla Cross | $1,410 | $118 |

| 8 | Hyundai Venue | $1,422 | $119 |

| 9 | Mazda CX-5 | $1,428 | $119 |

| 10 | Ford Bronco Sport | $1,434 | $120 |

| 11 | Volkswagen Tiguan | $1,448 | $121 |

| 12 | Acura RDX | $1,464 | $122 |

| 13 | Nissan Murano | $1,470 | $123 |

| 14 | Buick Encore | $1,488 | $124 |

| 15 | Subaru Outback | $1,492 | $124 |

| 16 | Honda CR-V | $1,494 | $125 |

| 17 | Buick Envista | $1,496 | $125 |

| 18 | Chevrolet Colorado | $1,498 | $125 |

| 19 | Volkswagen Taos | $1,498 | $125 |

| 20 | Kia Niro | $1,500 | $125 |

| 21 | Honda HR-V | $1,522 | $127 |

| 22 | Subaru Ascent | $1,522 | $127 |

| 23 | Toyota GR Corolla | $1,522 | $127 |

| 24 | Nissan Leaf | $1,532 | $128 |

| 25 | Honda Civic | $1,550 | $129 |

| 26 | Lexus NX 250 | $1,550 | $129 |

| 27 | Volkswagen Atlas | $1,552 | $129 |

| 28 | Acura Integra | $1,556 | $130 |

| 29 | Volkswagen Atlas Cross Sport | $1,560 | $130 |

| 30 | Subaru Forester | $1,562 | $130 |

| 31 | Kia Seltos | $1,564 | $130 |

| 32 | GMC Terrain | $1,568 | $131 |

| 33 | Nissan Rogue | $1,572 | $131 |

| 34 | Hyundai Kona | $1,574 | $131 |

| 35 | Mazda CX-30 | $1,578 | $132 |

| 36 | Cadillac XT4 | $1,580 | $132 |

| 37 | Ford Explorer | $1,588 | $132 |

| 38 | Volkswagen ID4 | $1,588 | $132 |

| 39 | Toyota Highlander | $1,594 | $133 |

| 40 | Ford Escape | $1,596 | $133 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

The table above that contains 40 of the cheapest vehicles to insure in Hammond probably isn’t the best way to show a complete view of the cost of auto insurance. Considering we track over 700 vehicles, the majority of models get omitted from the list. Let’s dig deeper into the data and display the models with the cheapest rates in Hammond a better way.

This next section goes into more detail about the average cost to insure each different vehicle segment. The rates shown will give you a good idea of the general vehicle types that have the overall most affordable rates. Then the six subsequent sections rank the cheapest rates for individual vehicles for the most popular segments.

Average rates by vehicle segment

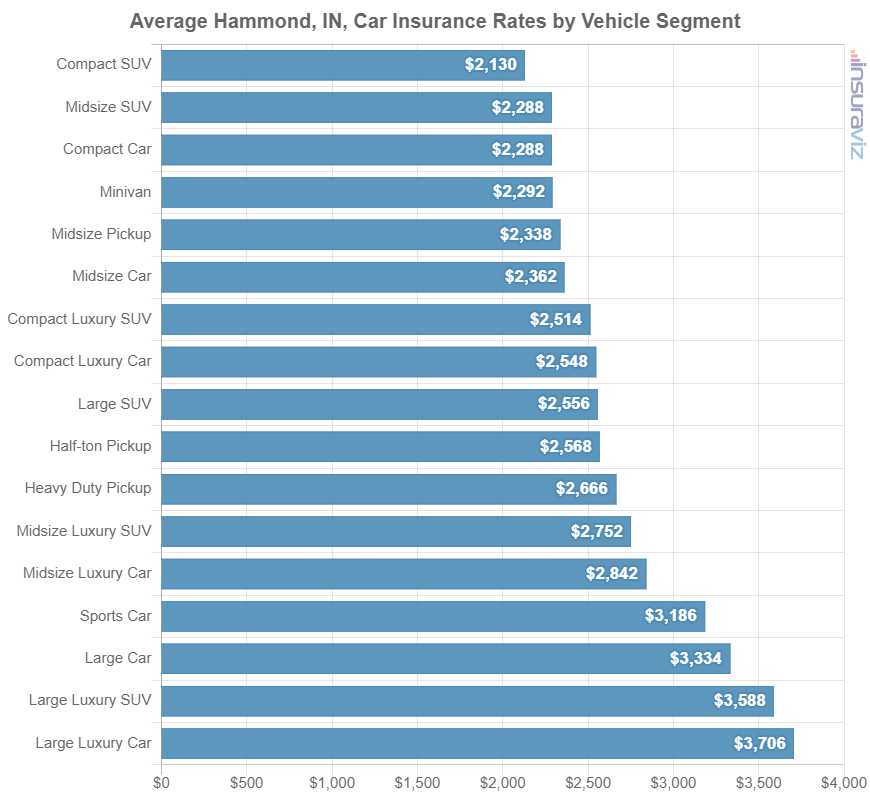

If a different vehicle is in your future, it’s in your best interest to know which categories of vehicles have better insurance rates.

To illustrate this, many people wonder if midsize cars have cheaper car insurance than full-size cars or if midsize pickups are cheaper to insure than full-size pickups.

The next chart shows the average auto insurance cost in Hammond for each automotive segment. In general, compact SUVs, vans, and midsize pickups have the least expensive average car insurance rates, with luxury cars and sports cars having the most expensive overall auto insurance rates.

Average rates by segment are accurate enough for getting an initial comparison, but rates vary greatly within each automotive segment listed in the previous chart.

For example, in the midsize car segment, rates range from the Hyundai Ioniq 6 at $1,610 per year for a full coverage policy up to the Tesla Model 3 costing $2,056 per year, a difference of $446 within that segment.

In the large SUV segment, insurance rates range from the Chevrolet Tahoe costing $1,644 per year up to the Toyota Sequoia costing $2,192 per year, a difference of $548 within that segment.

In the following sections, we eliminate much of the variability by comparing the cost of auto insurance in Hammond on a model level rather than a segment level.

Cheapest cars to insure in Hammond, Indiana

The four lowest-cost non-luxury cars to insure in Hammond are the Toyota GR Corolla at $1,522 per year, Nissan Leaf at $1,532 per year, Honda Civic at $1,550 per year, and Nissan Sentra at $1,606 per year.

Additional models that rank well are the Chevrolet Malibu, Hyundai Ioniq 6, Kia K5, and Toyota Prius, with an average cost to insure of $1,698 per year or less.

Ranked in the lower half of the top 20, cars like the Volkswagen Jetta, Kia Forte, Volkswagen Arteon, Nissan Versa, Hyundai Sonata, and Mitsubishi Mirage G4 cost between $1,698 and $1,810 per year for full-coverage insurance in Hammond.

From a cost per month standpoint, full-coverage auto insurance in this segment starts at around $127 per month, depending on the company.

When ranked by vehicle size, the most budget-friendly compact car to insure in Hammond is the Toyota GR Corolla at $1,522 per year, or $127 per month. For midsize models, the Hyundai Ioniq 6 is cheapest to insure at $1,610 per year, or $134 per month. And for full-size cars, the Chrysler 300 has the cheapest rates at $1,662 per year, or $139 per month.

The table below ranks the cars with the lowest-cost car insurance in Hammond, starting with the Toyota GR Corolla at $1,522 per year and ending with the Mazda 3 at $1,810 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,522 | $127 |

| Nissan Leaf | Compact | $1,532 | $128 |

| Honda Civic | Compact | $1,550 | $129 |

| Nissan Sentra | Compact | $1,606 | $134 |

| Subaru Impreza | Compact | $1,608 | $134 |

| Hyundai Ioniq 6 | Midsize | $1,610 | $134 |

| Toyota Prius | Compact | $1,636 | $136 |

| Kia K5 | Midsize | $1,684 | $140 |

| Honda Accord | Midsize | $1,692 | $141 |

| Chevrolet Malibu | Midsize | $1,698 | $142 |

| Toyota Corolla | Compact | $1,706 | $142 |

| Kia Forte | Compact | $1,710 | $143 |

| Volkswagen Arteon | Midsize | $1,722 | $144 |

| Nissan Versa | Compact | $1,724 | $144 |

| Subaru Legacy | Midsize | $1,728 | $144 |

| Mitsubishi Mirage G4 | Compact | $1,764 | $147 |

| Toyota Crown | Midsize | $1,772 | $148 |

| Volkswagen Jetta | Compact | $1,772 | $148 |

| Hyundai Sonata | Midsize | $1,774 | $148 |

| Mazda 3 | Compact | $1,810 | $151 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

For all vehicle comparisons, see our guides for compact car insurance, midsize car insurance, and full-size car insurance.

Don’t see insurance cost for your vehicle? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Hammond car insurance quotes from top-rated companies in Indiana.

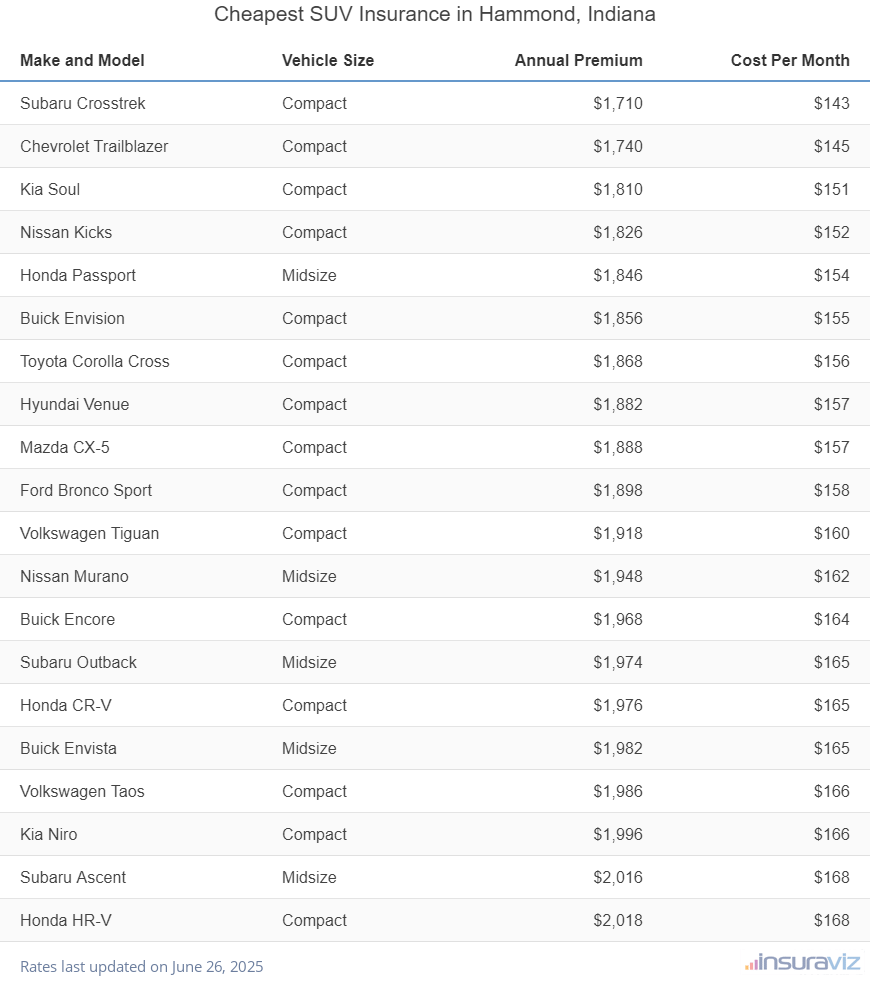

Cheapest SUVs to insure in Hammond

The lowest-cost non-luxury SUVs to insure in Hammond are the Subaru Crosstrek at $1,292 per year, the Chevrolet Trailblazer at $1,316 per year, and the Kia Soul at $1,366 per year.

Not the cheapest, but still in the top 10, are models like the Hyundai Venue, Buick Envision, Toyota Corolla Cross, and Ford Bronco Sport, with average rates of $1,434 per year or less.

Car insurance rates for this segment in Hammond for an average middle-age driver starts at around $108 per month, depending on the company and your location.

If SUV size is considered, the most affordable non-luxury compact SUV to insure in Hammond is the Subaru Crosstrek at $1,292 per year, or $108 per month. For midsize 2024 models, the Honda Passport is the cheapest model to insure at $1,394 per year, or $116 per month. And for full-size non-luxury SUVs, the Chevrolet Tahoe has the cheapest rates at $1,644 per year, or $137 per month.

The comparison table below ranks the SUVs with the cheapest insurance rates in Hammond, starting with the Subaru Crosstrek at $1,292 per year ($108 per month) and ending with the Honda HR-V at $1,522 per year ($127 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,292 | $108 |

| Chevrolet Trailblazer | Compact | $1,316 | $110 |

| Kia Soul | Compact | $1,366 | $114 |

| Nissan Kicks | Compact | $1,378 | $115 |

| Honda Passport | Midsize | $1,394 | $116 |

| Buick Envision | Compact | $1,404 | $117 |

| Toyota Corolla Cross | Compact | $1,410 | $118 |

| Hyundai Venue | Compact | $1,422 | $119 |

| Mazda CX-5 | Compact | $1,428 | $119 |

| Ford Bronco Sport | Compact | $1,434 | $120 |

| Volkswagen Tiguan | Compact | $1,448 | $121 |

| Nissan Murano | Midsize | $1,470 | $123 |

| Buick Encore | Compact | $1,488 | $124 |

| Subaru Outback | Midsize | $1,492 | $124 |

| Honda CR-V | Compact | $1,494 | $125 |

| Buick Envista | Midsize | $1,496 | $125 |

| Volkswagen Taos | Compact | $1,498 | $125 |

| Kia Niro | Compact | $1,500 | $125 |

| Honda HR-V | Compact | $1,522 | $127 |

| Subaru Ascent | Midsize | $1,522 | $127 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 22, 2024

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to compare rates for all makes and models.

Don’t see your SUV in the list? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Hammond car insurance quotes from top-rated car insurance companies in Indiana.

Cheapest sports car insurance rates

The Mazda MX-5 Miata ranks in the top spot for the cheapest sports car to insure in Hammond, followed by the Toyota GR86, Ford Mustang, BMW Z4, and Subaru WRX. The 2024 model has an average cost of $1,620 per year for full-coverage insurance.

Also ranking in the top 10 are cars like the Lexus RC F, BMW M2, Nissan Z, and Toyota GR Supra, with average cost of $2,090 per year or less.

From a monthly standpoint, car insurance in this segment for a middle-age safe driver will start around $135 per month, depending on your company and location.

The comparison table below ranks the sports cars with the cheapest car insurance rates in Hammond, starting with the Mazda MX-5 Miata at $1,620 per year and ending with the Porsche Taycan at $2,964 per year.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $1,620 | $135 |

| Toyota GR86 | Sports Car | $1,844 | $154 |

| Ford Mustang | Sports Car | $1,924 | $160 |

| BMW Z4 | Sports Car | $1,932 | $161 |

| Subaru WRX | Sports Car | $1,966 | $164 |

| Toyota GR Supra | Sports Car | $1,966 | $164 |

| BMW M2 | Sports Car | $2,022 | $169 |

| Nissan Z | Sports Car | $2,028 | $169 |

| Lexus RC F | Sports Car | $2,070 | $173 |

| Subaru BRZ | Sports Car | $2,090 | $174 |

| BMW M3 | Sports Car | $2,210 | $184 |

| Porsche 718 | Sports Car | $2,254 | $188 |

| Chevrolet Camaro | Sports Car | $2,272 | $189 |

| Chevrolet Corvette | Sports Car | $2,426 | $202 |

| Porsche 911 | Sports Car | $2,510 | $209 |

| BMW M4 | Sports Car | $2,612 | $218 |

| Lexus LC 500 | Sports Car | $2,626 | $219 |

| Jaguar F-Type | Sports Car | $2,762 | $230 |

| Mercedes-Benz AMG GT53 | Sports Car | $2,898 | $242 |

| Porsche Taycan | Sports Car | $2,964 | $247 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

Need rates for a different vehicle? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best car insurance companies in Hammond.

Cheapest pickups to insure in Hammond

Out of all 2024 models, the top five cheapest pickup trucks to insure in Hammond are the Chevrolet Colorado, Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. Rates for for these five pickups range from $1,498 to $1,698 per year.

Additional models that have cheaper rates include the GMC Sierra 2500 HD, Honda Ridgeline, GMC Canyon, and Hyundai Santa Cruz, with average cost of $1,800 per year or less.

From a monthly standpoint, full-coverage car insurance in Hammond on this segment for a middle-age safe driver starts at around $125 per month, depending on the company and your location.

The next table ranks the pickups with the most affordable car insurance in Hammond, starting with the Chevrolet Colorado at $125 per month and ending with the Ram Truck at $169 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,498 | $125 |

| Nissan Titan | Full-size | $1,638 | $137 |

| Nissan Frontier | Midsize | $1,656 | $138 |

| Ford Ranger | Midsize | $1,672 | $139 |

| Ford Maverick | Midsize | $1,698 | $142 |

| Honda Ridgeline | Midsize | $1,736 | $145 |

| Hyundai Santa Cruz | Midsize | $1,766 | $147 |

| Toyota Tacoma | Midsize | $1,774 | $148 |

| GMC Sierra 2500 HD | Heavy Duty | $1,782 | $149 |

| GMC Canyon | Midsize | $1,800 | $150 |

| Jeep Gladiator | Midsize | $1,844 | $154 |

| GMC Sierra 3500 | Heavy Duty | $1,856 | $155 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $1,872 | $156 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $1,922 | $160 |

| GMC Sierra | Full-size | $1,932 | $161 |

| Nissan Titan XD | Heavy Duty | $1,934 | $161 |

| Chevrolet Silverado | Full-size | $1,936 | $161 |

| Ford F150 | Full-size | $1,960 | $163 |

| GMC Hummer EV Pickup | Full-size | $2,008 | $167 |

| Ram Truck | Full-size | $2,024 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Don’t see rates for your pickup? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Hammond car insurance quotes from top-rated companies in Indiana.

Cheapest luxury car insurance rates

Ranking at the top of the list for the lowest-cost Hammond car insurance rates in the luxury car segment are the Mercedes-Benz CLA250, Acura Integra, BMW 330i, Lexus IS 300, and Acura TLX. Auto insurance quotes for these vehicles average $1,810 or less per year, or around $151 per month.

Some other luxury cars that are affordable to insure are the Genesis G70, Lexus RC 300, Cadillac CT4, and Lexus ES 350, with average insurance cost of $1,840 per year or less.

Car insurance rates in this segment starts at around $130 per month, depending on where you live.

If vehicle size is considered, the cheapest compact luxury car to insure in Hammond is the Acura Integra at $1,556 per year. For midsize luxury cars, the Mercedes-Benz CLA250 has the best rates at $1,802 per year. And for full-size luxury models, the Audi A5 has the most affordable rates at $2,074 per year.

The next table ranks the twenty luxury cars with the cheapest average insurance rates in Hammond, starting with the Acura Integra at $1,556 per year and ending with the Audi S3 at $1,962 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,556 | $130 |

| BMW 330i | Compact | $1,782 | $149 |

| Mercedes-Benz CLA250 | Midsize | $1,802 | $150 |

| Lexus IS 300 | Midsize | $1,804 | $150 |

| Acura TLX | Compact | $1,810 | $151 |

| Cadillac CT4 | Compact | $1,828 | $152 |

| Lexus ES 350 | Midsize | $1,830 | $153 |

| Genesis G70 | Compact | $1,834 | $153 |

| Mercedes-Benz AMG CLA35 | Midsize | $1,836 | $153 |

| Lexus RC 300 | Midsize | $1,840 | $153 |

| Lexus IS 350 | Compact | $1,844 | $154 |

| Jaguar XF | Midsize | $1,852 | $154 |

| Cadillac CT5 | Midsize | $1,886 | $157 |

| Lexus ES 250 | Midsize | $1,894 | $158 |

| Lexus RC 350 | Compact | $1,898 | $158 |

| BMW 330e | Compact | $1,900 | $158 |

| BMW 228i | Compact | $1,904 | $159 |

| BMW 230i | Compact | $1,918 | $160 |

| Lexus ES 300h | Midsize | $1,922 | $160 |

| Audi S3 | Compact | $1,962 | $164 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

For all luxury car insurance comparisons, see our full luxury car insurance guide.

Don’t see your luxury car? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Hammond car insurance quotes from top-rated car insurance companies in Indiana.

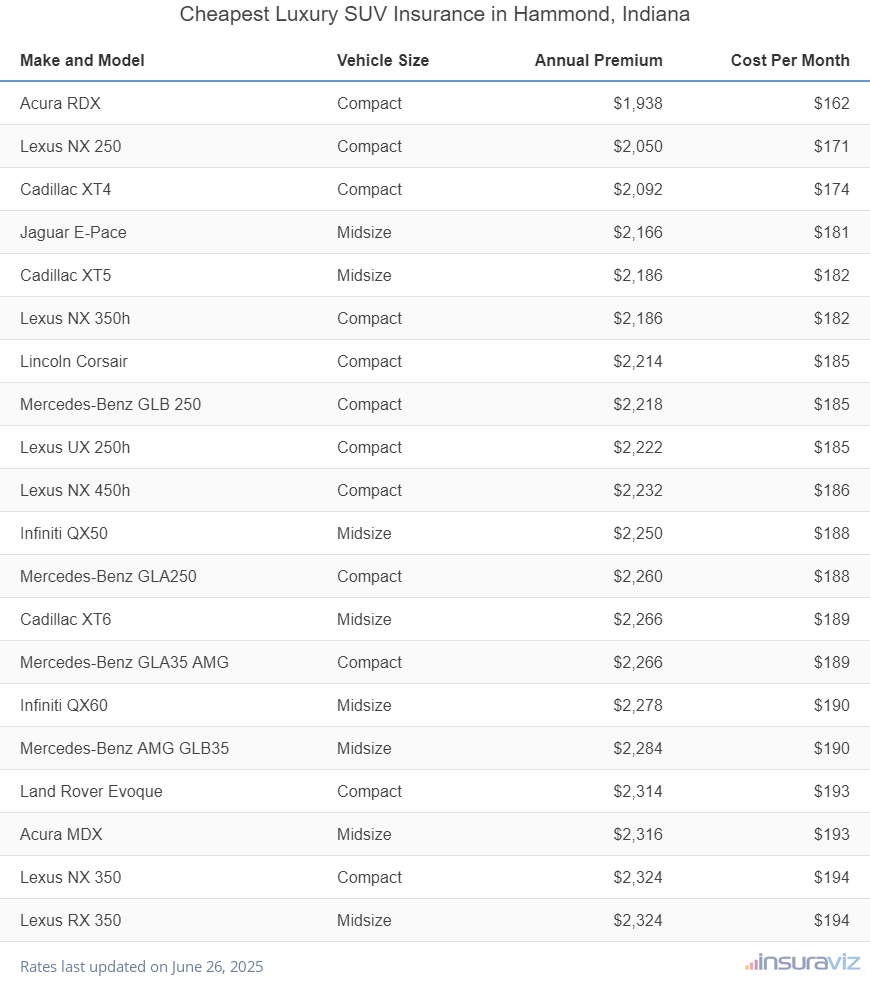

Cheapest luxury SUVs to insure

The #1 ranking in Hammond for cheapest average insurance rates in the luxury SUV segment is the Acura RDX, coming in at $1,464 per year. Second place is the Lexus NX 250 at $1,550 per year, ranking third is the Cadillac XT4, costing an average of $1,580 per year, and in fourth place is the Jaguar E-Pace, at an average of $1,638 per year.

Also ranking well are SUVs like the Mercedes-Benz GLB 250, Lexus NX 350h, Lexus UX 250h, and Lincoln Corsair, with an average car insurance cost of $1,688 per year or less.

Car insurance in Hammond for this segment for the average driver starts at around $122 per month, depending on the company and your location. The next table ranks the twenty luxury SUVs with the lowest-cost average auto insurance rates in Hammond, starting with the Acura RDX at $1,464 per year and ending with the Lexus NX 350 at $1,756 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,464 | $122 |

| Lexus NX 250 | Compact | $1,550 | $129 |

| Cadillac XT4 | Compact | $1,580 | $132 |

| Jaguar E-Pace | Midsize | $1,638 | $137 |

| Cadillac XT5 | Midsize | $1,652 | $138 |

| Lexus NX 350h | Compact | $1,652 | $138 |

| Lincoln Corsair | Compact | $1,672 | $139 |

| Mercedes-Benz GLB 250 | Compact | $1,674 | $140 |

| Lexus UX 250h | Compact | $1,678 | $140 |

| Lexus NX 450h | Compact | $1,688 | $141 |

| Infiniti QX50 | Midsize | $1,702 | $142 |

| Mercedes-Benz GLA250 | Compact | $1,702 | $142 |

| Mercedes-Benz GLA35 AMG | Compact | $1,712 | $143 |

| Cadillac XT6 | Midsize | $1,714 | $143 |

| Infiniti QX60 | Midsize | $1,722 | $144 |

| Mercedes-Benz AMG GLB35 | Midsize | $1,724 | $144 |

| Land Rover Evoque | Compact | $1,748 | $146 |

| Acura MDX | Midsize | $1,750 | $146 |

| Lexus RX 350 | Midsize | $1,750 | $146 |

| Lexus NX 350 | Compact | $1,756 | $146 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hammond, IN Zip Codes. Updated February 23, 2024

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Don’t see your luxury SUV in the table above? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Hammond car insurance quotes from top companies in Indiana.

Price variation for driver risk

In an effort to help you understand the amount the cost of a car insurance policy can vary from one driver to the next (and also emphasize the importance of accurate rate quotes), the charts below visualize detailed car insurance rates for five popular vehicles in Hammond: the Nissan Sentra, Honda CR-V, Honda Pilot, Honda Accord, and Toyota Supra.

Each example uses different driver and policy risk profiles to demonstrate how rates can vary with only minor changes to the policy rating factors.

Nissan Sentra insurance rates

In Hammond, Nissan Sentra insurance averages $1,606 per year ($134 per month) and has a range of $1,334 to $3,646 per year.

The Nissan Sentra is part of the compact car segment, and other top-selling models from the same segment include the Chevrolet Cruze, Honda Civic, Hyundai Elantra, and Toyota Corolla.

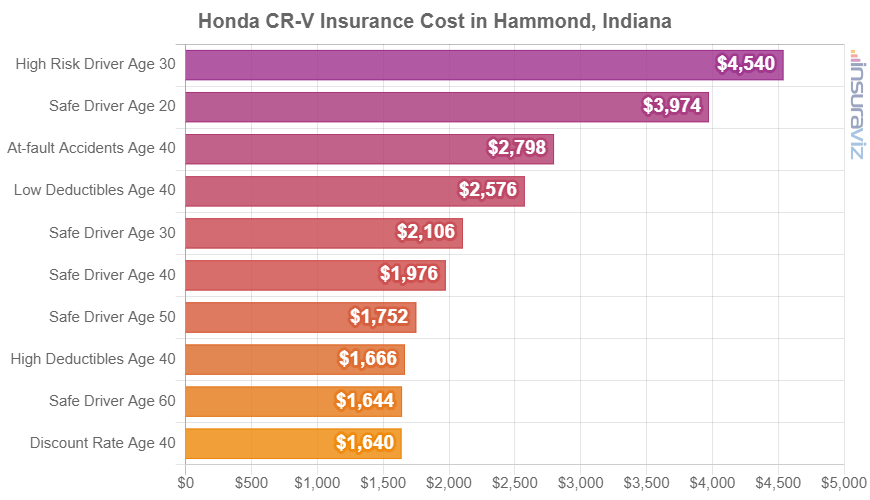

Honda CR-V insurance rates

Insurance for a Honda CR-V in Hammond costs an average of $1,494 per year, or about $125 per month, and ranges from $1,240 to $3,430 per year.

The Honda CR-V is part of the compact SUV segment, and additional similar models from the same segment include the Ford Escape, Toyota RAV4, Chevrolet Equinox, and Subaru Forester.

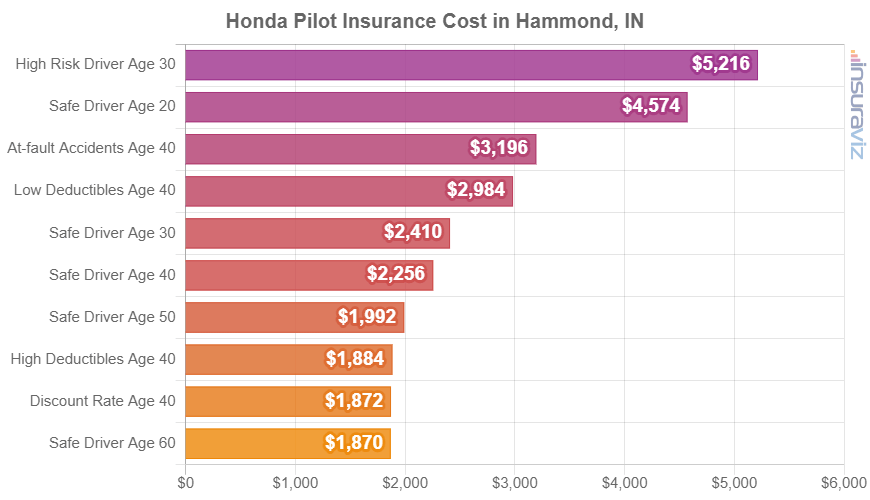

Honda Pilot insurance rates

Insurance for a Honda Pilot in Hammond costs an average of $1,704 per year (about $142 per month) and has a range of $1,416 to $3,940.

The Honda Pilot is classified as a midsize SUV, and other similar models that are popular in Hammond, Indiana, include the Ford Edge, Jeep Grand Cherokee, and Toyota Highlander.

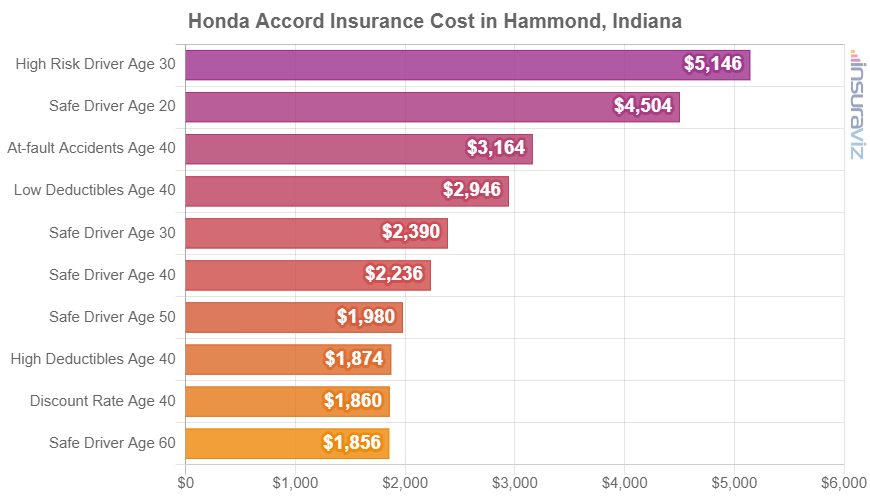

Honda Accord insurance rates

Honda Accord insurance in Hammond costs an average of $1,692 per year, or about $141 per month, and varies from $1,408 to $3,888 per year.

The Honda Accord is part of the midsize car segment, and other popular models in the same segment include the Nissan Altima, Hyundai Sonata, and Chevrolet Malibu.

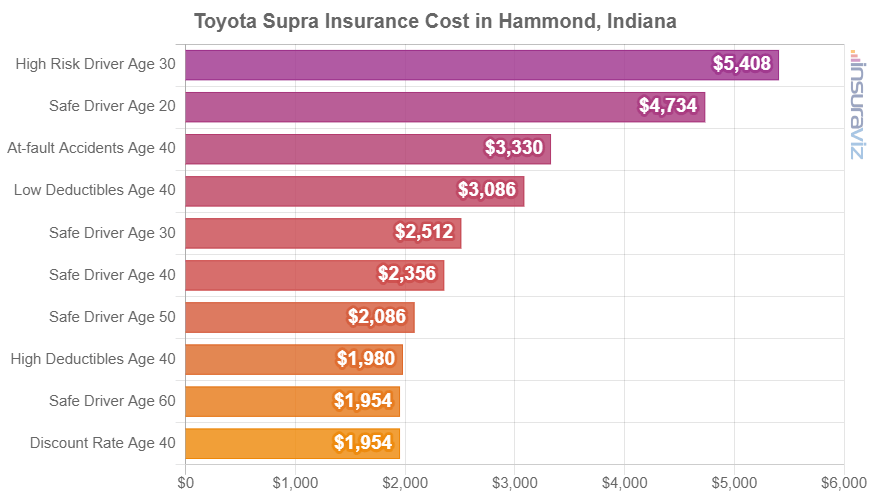

Toyota Supra insurance rates

Toyota Supra insurance in Hammond averages $1,910 per year ($159 per month) and ranges from $1,478 to $4,086 per year for the driver characteristics in the next chart.

The Toyota Supra belongs to the sports car segment, and other models in the same segment include the Chevrolet Camaro, Ford Mustang, Chevrolet Corvette, and Nissan 370Z.

Tips for cheaper auto insurance rates

Drivers are always searching for ways to save money on insurance, so glance through the savings concepts below and maybe you’ll be able to save a few bucks when buying auto insurance.

- Compare insurance cost before you buy the car. Different vehicle models can have significantly different car insurance rates, and insurance companies can sell coverages with a wide range of costs. Get plenty of quotes to compare the cost of insurance before you upgrade you car in order to avoid any surprises when you receive your bill.

- Bring up your credit score and save. Drivers who maintain a credit score over 800 could save up to $275 per year when compared to a good credit rating of 670-739. Conversely, a below average credit score could cost as much as $319 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Avoid filing small claims. Insurance companies give a discount if you do not file any claims. Auto insurance should only be used for significant financial loss, not nickel-and-dime type claims.

- Your profession could save you money. The large majority of auto insurance providers offer policy discounts for specific occupations like members of the military, college professors, architects, accountants, high school and elementary teachers, police officers and law enforcement, and others. Obtaining this discount could save between $53 and $170 on your yearly insurance cost, subject to policy limits.

- Reduce coverage on older cars. Removing physical damage coverage (comprehensive and collision) from older vehicles that are no longer worth much will trim the cost substantially.

- Don’t be dumb behind the wheel. To get cheap auto insurance in Hammond, it’s necessary to drive conservatively. As a matter of fact, just one or two moving violations could possibly increase insurance rates by up to $466 per year. Serious violations such as driving under the influence of drugs or alcohol could raise rates by an additional $1,628 or more.

- Choose vehicles that have low cost car insurance. The make and model of vehicle you drive is an important factor in the price you pay for insurance. As an example, a Volvo XC40 costs $192 less per year to insure in Hammond than a Nissan 370Z. Less performance equals cheaper rates.