- Evansville car insurance rates average $1,502 per year for full coverage, or approximately $125 per month.

- For cheap auto insurance in Evansville, small SUV models like the Volkswagen Tiguan, Buick Envision, and Nissan Kicks rank well for overall car insurance cost.

- A few models with the lowest cost car insurance in their segment include the Acura Integra, Subaru Crosstrek, Jaguar E-Pace, Acura RDX, and Chevrolet Tahoe.

- Car insurance quotes in Evansville can range significantly from as low as $29 per month for the minimum required liability coverage to over $674 per month for drivers needing high-risk coverage.

How much is car insurance in Evansville?

Average car insurance cost in Evansville is $1,502 per year, which is 22.5% less than the U.S. overall average rate of $1,883. The average monthly cost of car insurance in Evansville is $125 for a policy with full coverage.

The average car insurance cost in Indiana is $1,468 per year, so Evansville, IN, drivers pay an average of $34 more per year than the overall Indiana state-wide average rate. When compared to other locations in Indiana, the cost of car insurance in Evansville is $86 per year more than in South Bend, $66 per year less than in Indianapolis, and $248 per year cheaper than in Hammond.

The next chart shows examples of average Evansville car insurance cost broken out based on a range of driver ages and policy risk profiles. Rates are averaged for all 2024 model year vehicles including luxury cars and SUVs.

Average car insurance rates in the chart range from $1,246 per year for a 40-year-old driver who qualifies for many discounts to $3,448 per year for a 30-year-old driver with a history of violations and/or at-fault accidents.

When the rates in the chart are converted for monthly budgeting, the average cost of car insurance per month in Evansville ranges from $104 to $287.

Auto insurance rates can have significant differences in cost and small changes in a driver’s risk profile can have large effects on car insurance cost. Since there can be such a large difference in rates, it stresses the need for multiple car insurance quotes when searching online for the cheapest car insurance coverage.

The age of the driver is one of the biggest determining factors on the price you pay for car insurance. The list below illustrates these differences by breaking out average car insurance rates in Evansville for driver ages 16 through 60.

Evansville, IN, car insurance cost by driver age

- 16-year-old driver – $5,341 per year or $445 per month

- 17-year-old driver – $5,174 per year or $431 per month

- 18-year-old driver – $4,637 per year or $386 per month

- 19-year-old driver – $4,224 per year or $352 per month

- 20-year-old driver – $3,016 per year or $251 per month

- 30-year-old driver – $1,602 per year or $134 per month

- 40-year-old driver – $1,502 per year or $125 per month

- 50-year-old driver – $1,326 per year or $111 per month

- 60-year-old driver – $1,244 per year or $104 per month

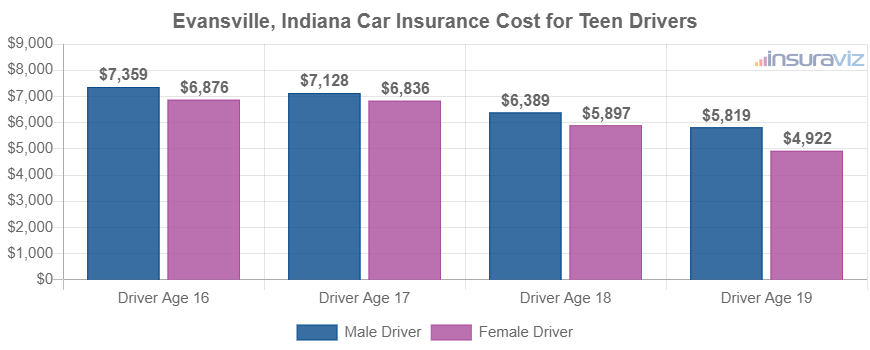

The rates shown above for insuring teenage drivers assumed the driver was male. The chart below goes into more detail regarding the cost of insuring teen drivers and separates average car insurance cost for teenagers in Evansville by gender. Females are usually a little cheaper to insure, especially in the teen years.

Auto insurance for a female 16-year-old driver in Evansville costs an average of $350 less per year than the cost for a 16-year-old male driver, while at age 19, the cost is still $654 less for a female driver.

Which vehicles have cheap insurance in Evansville?

When comparing models from every automotive segment, the vehicles with the cheapest average insurance quotes in Evansville tend to be compact SUVs and crossovers like the Kia Soul, Subaru Crosstrek, and Nissan Kicks.

Average auto insurance prices for those models cost $1,304 or less per year for full coverage.

Other models that rank towards the top in our car insurance price comparison are the Ford Bronco Sport, Volkswagen Taos, Buick Envista, and Volkswagen Tiguan. Rates are slightly more for those models than the cheapest compact SUVs at the top of the list, but they still have an average cost of $1,379 or less per year, or about $115 per month.

The table below lists the top 20 cheapest vehicles to insure in Evansville, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,106 | $92 |

| 2 | Chevrolet Trailblazer | $1,128 | $94 |

| 3 | Kia Soul | $1,172 | $98 |

| 4 | Nissan Kicks | $1,180 | $98 |

| 5 | Honda Passport | $1,192 | $99 |

| 6 | Buick Envision | $1,200 | $100 |

| 7 | Toyota Corolla Cross | $1,208 | $101 |

| 8 | Hyundai Venue | $1,218 | $102 |

| 9 | Mazda CX-5 | $1,222 | $102 |

| 10 | Ford Bronco Sport | $1,228 | $102 |

| 11 | Volkswagen Tiguan | $1,242 | $104 |

| 12 | Acura RDX | $1,252 | $104 |

| 13 | Nissan Murano | $1,260 | $105 |

| 14 | Buick Encore | $1,274 | $106 |

| 15 | Subaru Outback | $1,278 | $107 |

| 16 | Honda CR-V | $1,280 | $107 |

| 17 | Chevrolet Colorado | $1,282 | $107 |

| 18 | Buick Envista | $1,284 | $107 |

| 19 | Kia Niro | $1,286 | $107 |

| 20 | Volkswagen Taos | $1,286 | $107 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

A table showing 20 vehicles with the cheapest insurance in Evansville is fine if you just want the absolute lowest rates. A more thorough way to look at rates for different vehicles is by organizing them by the segment they belong to.

The next section of this article further discusses average auto insurance cost by vehicle segment. The average rates shown will give you a good idea of which automotive segments have the overall best car insurance rates in Evansville. The six sections following the chart will break out the cheapest rates for individual models in the most popular segments.

Evansville car insurance rates by automotive segment

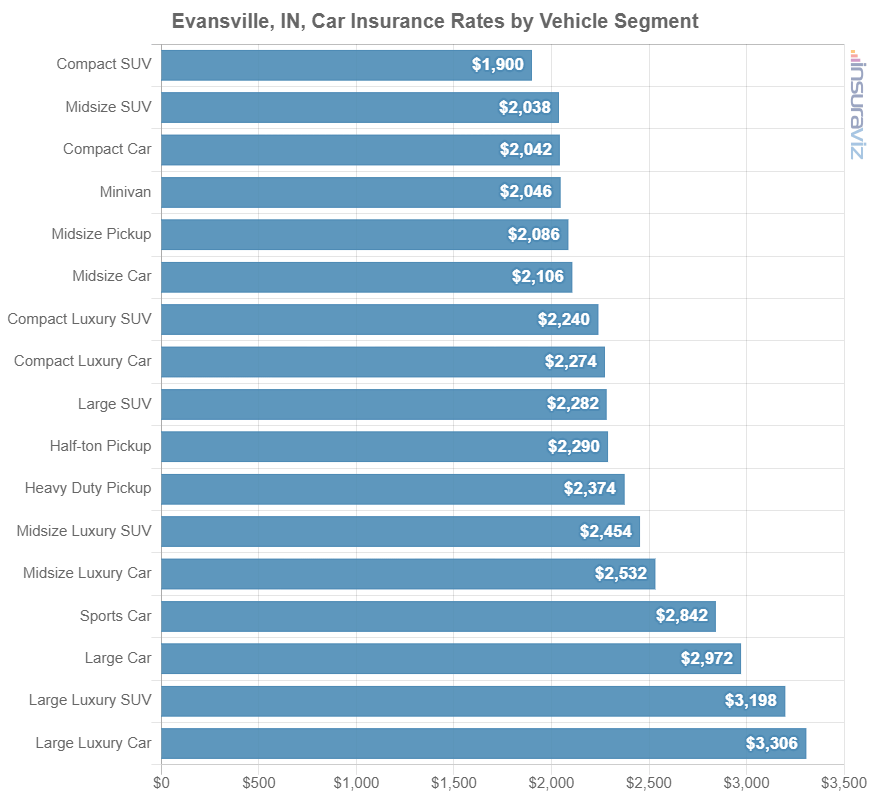

If you’re shopping around for a different vehicle, it’s important to have a basic understanding of which categories of vehicles have less expensive auto insurance rates in Evansville.

For example, you may be wondering if midsize SUVs have more affordable insurance than small SUVs or if luxury models are more expensive to insure than regular vehicles.

The chart below shows the average cost of auto insurance rates in Evansville for different vehicle segments. From an overal segment perspective, small and midsize SUVs, vans and minivans, and midsize pickup trucks have the least expensive average car insurance rates, while sports cars, large luxury cars, and performance exotic cars have the most expensive average insurance cost.

Average auto insurance rates by segment are practical for blanket comparisons, but insurance cost varies greatly within each of the segments listed in the chart above.

For example, in the midsize SUV segment, rates range from the Honda Passport costing $1,192 per year up to the Rivian R1S costing $1,840 per year. As another example, in the large SUV segment, the average cost of insurance ranges from the Chevrolet Tahoe costing $1,410 per year up to the Toyota Sequoia at $1,876 per year.

In the following sections, we will eliminate a lot of this variability by comparing the cost of auto insurance in Evansville for individual models.

Cheapest car insurance rates in Evansville, Indiana

The four cheapest non-luxury two and four door cars to insure in Evansville are the Toyota GR Corolla at $1,302 per year, Nissan Leaf at $1,314 per year, Honda Civic at $1,328 per year, and Nissan Sentra at $1,374 per year.

Rounding out the top 10 are cars like the Kia K5, Toyota Prius, Chevrolet Malibu, and Hyundai Ioniq 6, with average annual insurance rates of $1,456 per year or less.

Ranked in the lower half of the top 20, models like the Mitsubishi Mirage G4, Toyota Crown, Nissan Versa, Hyundai Sonata, and Mazda 3 average between $1,456 and $1,552 per year to insure.

Car insurance for this segment in Evansville for a safe driver starts at around $109 per month, depending on your location.

The most affordable compact car to insure in Evansville is the Toyota GR Corolla at $1,302 per year. For midsize cars, the Hyundai Ioniq 6 is cheapest to insure at $1,378 per year. And for full-size cars, the Chrysler 300 is cheapest to insure at $1,424 per year.

The comparison table below ranks the cars with the lowest-cost insurance in Evansville.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,302 | $109 |

| Nissan Leaf | Compact | $1,314 | $110 |

| Honda Civic | Compact | $1,328 | $111 |

| Nissan Sentra | Compact | $1,374 | $115 |

| Hyundai Ioniq 6 | Midsize | $1,378 | $115 |

| Subaru Impreza | Compact | $1,378 | $115 |

| Toyota Prius | Compact | $1,402 | $117 |

| Kia K5 | Midsize | $1,446 | $121 |

| Honda Accord | Midsize | $1,448 | $121 |

| Chevrolet Malibu | Midsize | $1,456 | $121 |

| Toyota Corolla | Compact | $1,458 | $122 |

| Kia Forte | Compact | $1,464 | $122 |

| Volkswagen Arteon | Midsize | $1,472 | $123 |

| Nissan Versa | Compact | $1,478 | $123 |

| Subaru Legacy | Midsize | $1,480 | $123 |

| Mitsubishi Mirage G4 | Compact | $1,514 | $126 |

| Hyundai Sonata | Midsize | $1,518 | $127 |

| Toyota Crown | Midsize | $1,518 | $127 |

| Volkswagen Jetta | Compact | $1,518 | $127 |

| Mazda 3 | Compact | $1,552 | $129 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

For more car insurance comparisons, see our guides for compact car insurance, midsize car insurance, and full-size car insurance.

Looking for a different vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Evansville car insurance quotes from the best companies in Indiana.

Cheapest SUVs to insure in Evansville, Indiana

The four highest ranking non-luxury SUVs with the cheapest insurance rates in Evansville are the Subaru Crosstrek at $1,106 per year, Chevrolet Trailblazer at $1,128 per year, Kia Soul at $1,172 per year, and Nissan Kicks at $1,180 per year.

Some other SUVs that have affordable average insurance rates are the Hyundai Venue, Toyota Corolla Cross, Mazda CX-5, and Buick Envision, with an average cost of $1,228 per year or less.

Some additional 2024 models that rank well include the Honda HR-V, Honda CR-V, Nissan Murano, Volkswagen Tiguan, and Subaru Ascent, which average between $1,228 and $1,306 per year for full-coverage insurance in Evansville.

On a monthly basis, full-coverage car insurance on this segment in Evansville can cost as low as $92 per month, depending on the company and where you live. The rate comparison table below ranks the twenty SUVs with the cheapest average auto insurance rates in Evansville, starting with the Subaru Crosstrek at $92 per month and ending with the Honda HR-V at $109 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,106 | $92 |

| Chevrolet Trailblazer | Compact | $1,128 | $94 |

| Kia Soul | Compact | $1,172 | $98 |

| Nissan Kicks | Compact | $1,180 | $98 |

| Honda Passport | Midsize | $1,192 | $99 |

| Buick Envision | Compact | $1,200 | $100 |

| Toyota Corolla Cross | Compact | $1,208 | $101 |

| Hyundai Venue | Compact | $1,218 | $102 |

| Mazda CX-5 | Compact | $1,222 | $102 |

| Ford Bronco Sport | Compact | $1,228 | $102 |

| Volkswagen Tiguan | Compact | $1,242 | $104 |

| Nissan Murano | Midsize | $1,260 | $105 |

| Buick Encore | Compact | $1,274 | $106 |

| Subaru Outback | Midsize | $1,278 | $107 |

| Honda CR-V | Compact | $1,280 | $107 |

| Buick Envista | Midsize | $1,284 | $107 |

| Kia Niro | Compact | $1,286 | $107 |

| Volkswagen Taos | Compact | $1,286 | $107 |

| Subaru Ascent | Midsize | $1,304 | $109 |

| Honda HR-V | Compact | $1,306 | $109 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Looking for rates for a different SUV? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Evansville car insurance quotes from the best car insurance companies in Indiana.

Cheapest pickup trucks to insure in Evansville

The Chevrolet Colorado takes the top ranking for the cheapest pickup to insure in Evansville, followed closely by the Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. The 2024 model costs an average of $1,282 per year for a policy with full coverage.

Other pickups that rank well in our comparison are the Honda Ridgeline, Hyundai Santa Cruz, GMC Canyon, and Toyota Tacoma, with average rates of $1,544 per year or less.

Car insurance for this segment in Evansville starts at an average of $107 per month, depending on your location and insurance company. The next table ranks the twenty pickups with the cheapest average auto insurance rates in Evansville, starting with the Chevrolet Colorado at $107 per month and ending with the Ram Truck at $144 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,282 | $107 |

| Nissan Titan | Full-size | $1,402 | $117 |

| Nissan Frontier | Midsize | $1,418 | $118 |

| Ford Ranger | Midsize | $1,434 | $120 |

| Ford Maverick | Midsize | $1,454 | $121 |

| Honda Ridgeline | Midsize | $1,490 | $124 |

| Hyundai Santa Cruz | Midsize | $1,514 | $126 |

| Toyota Tacoma | Midsize | $1,518 | $127 |

| GMC Sierra 2500 HD | Heavy Duty | $1,526 | $127 |

| GMC Canyon | Midsize | $1,544 | $129 |

| Jeep Gladiator | Midsize | $1,580 | $132 |

| GMC Sierra 3500 | Heavy Duty | $1,588 | $132 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $1,604 | $134 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $1,646 | $137 |

| GMC Sierra | Full-size | $1,656 | $138 |

| Chevrolet Silverado | Full-size | $1,658 | $138 |

| Nissan Titan XD | Heavy Duty | $1,660 | $138 |

| Ford F150 | Full-size | $1,678 | $140 |

| GMC Hummer EV Pickup | Full-size | $1,718 | $143 |

| Ram Truck | Full-size | $1,732 | $144 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

See our comprehensive guides for midsize pickup insurance and large pickup insurance to view data for pickups not featured in the table.

Don’t see your truck in the table above? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Evansville car insurance quotes from the best companies in Indiana.

Cheapest luxury car insurance rates in Evansville

The most affordable luxury cars to insure in Evansville are the Acura Integra at $1,334 per year, the BMW 330i at $1,528 per year, and the Mercedes-Benz CLA250 at $1,542 per year.

Also ranking in the top 10 are cars like the Mercedes-Benz AMG CLA35, Lexus RC 300, Cadillac CT4, and Genesis G70, with an average cost to insure of $1,578 per year or less.

Additional models on the list include the BMW 330e, Lexus ES 300h, Lexus RC 350, and Jaguar XF, which cost between $1,578 and $1,682 per year to insure.

From a cost per month standpoint, full-coverage car insurance in this segment can cost as low as $111 per month, depending on your location and insurance company. The rate comparison table below ranks the cars with the most affordable car insurance rates in Evansville, starting with the Acura Integra at $111 per month and ending with the Audi S3 at $140 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,334 | $111 |

| BMW 330i | Compact | $1,528 | $127 |

| Mercedes-Benz CLA250 | Midsize | $1,542 | $129 |

| Lexus IS 300 | Midsize | $1,544 | $129 |

| Acura TLX | Compact | $1,552 | $129 |

| Cadillac CT4 | Compact | $1,568 | $131 |

| Lexus ES 350 | Midsize | $1,568 | $131 |

| Genesis G70 | Compact | $1,570 | $131 |

| Mercedes-Benz AMG CLA35 | Midsize | $1,572 | $131 |

| Lexus RC 300 | Midsize | $1,578 | $132 |

| Lexus IS 350 | Compact | $1,580 | $132 |

| Jaguar XF | Midsize | $1,586 | $132 |

| Cadillac CT5 | Midsize | $1,618 | $135 |

| Lexus ES 250 | Midsize | $1,622 | $135 |

| Lexus RC 350 | Compact | $1,626 | $136 |

| BMW 330e | Compact | $1,628 | $136 |

| BMW 228i | Compact | $1,632 | $136 |

| BMW 230i | Compact | $1,644 | $137 |

| Lexus ES 300h | Midsize | $1,648 | $137 |

| Audi S3 | Compact | $1,682 | $140 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 22, 2024

See our guide for luxury car insurance to compare rates for all makes and models.

Need rates for a different vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top companies in Indiana.

Cheapest luxury SUVs to insure in Evansville, IN

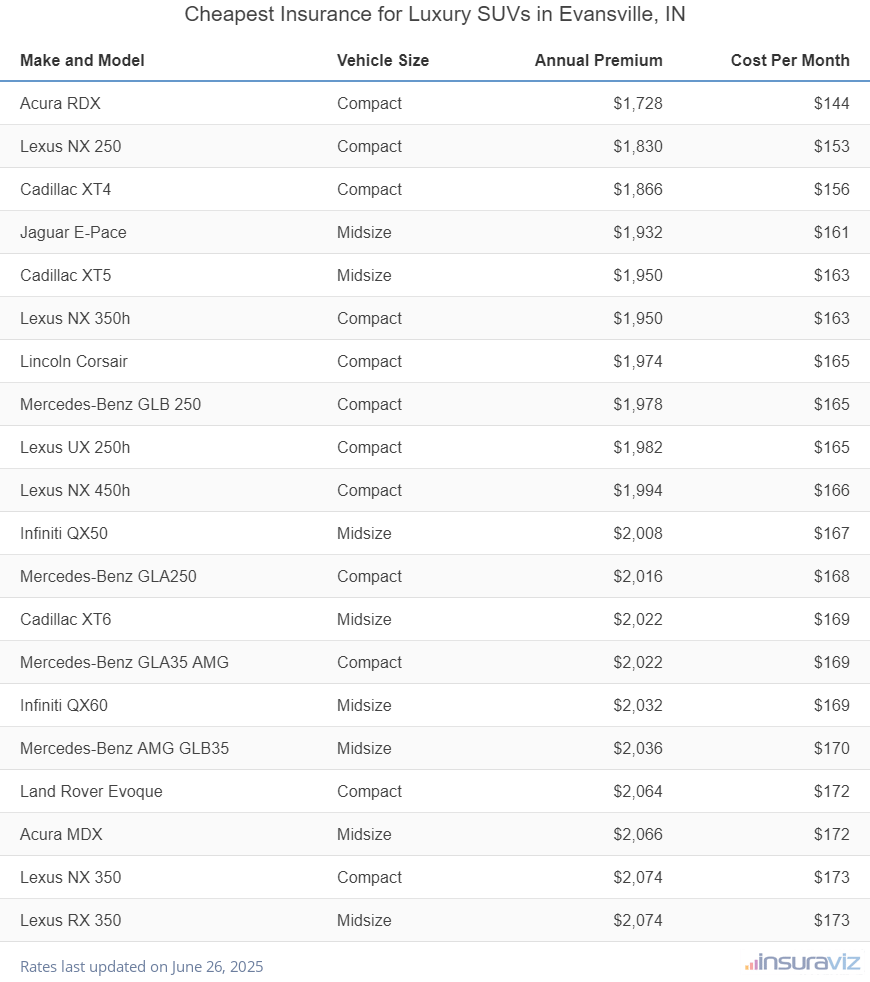

The Acura RDX ranks in the top spot for the most budget-friendly luxury SUV model to insure in Evansville, followed by the Lexus NX 250, Cadillac XT4, Jaguar E-Pace, and Cadillac XT5. The 2024 model has an average cost of $1,252 per year for a policy with full coverage.

Not the cheapest to insure, but still ranked well, are luxury SUVs like the Lincoln Corsair, Lexus NX 350h, Lexus UX 250h, and Mercedes-Benz GLB 250, with average cost of $1,444 per year or less.

Ranked between 10th and 20th place, models like the Land Rover Evoque, Lexus RX 350, Infiniti QX60, Cadillac XT6, Lexus NX 350, and Mercedes-Benz GLA250 average between $1,444 and $1,506 to insure per year in Evansville.

Car insurance for this segment in Evansville for a good driver will start around $104 per month, depending on your location.

The cheapest small luxury SUV to insure in Evansville is the Acura RDX at $1,252 per year. For midsize 2024 models, the Jaguar E-Pace is the cheapest model to insure at $1,402 per year. And for full-size models, the Infiniti QX80 is cheapest to insure at $1,682 per year.

The next table ranks the twenty SUVs with the cheapest average car insurance rates in Evansville, starting with the Acura RDX at $104 per month and ending with the Lexus NX 350 at $126 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,252 | $104 |

| Lexus NX 250 | Compact | $1,328 | $111 |

| Cadillac XT4 | Compact | $1,356 | $113 |

| Jaguar E-Pace | Midsize | $1,402 | $117 |

| Cadillac XT5 | Midsize | $1,414 | $118 |

| Lexus NX 350h | Compact | $1,416 | $118 |

| Lincoln Corsair | Compact | $1,434 | $120 |

| Mercedes-Benz GLB 250 | Compact | $1,436 | $120 |

| Lexus UX 250h | Compact | $1,438 | $120 |

| Lexus NX 450h | Compact | $1,444 | $120 |

| Infiniti QX50 | Midsize | $1,458 | $122 |

| Mercedes-Benz GLA250 | Compact | $1,460 | $122 |

| Cadillac XT6 | Midsize | $1,466 | $122 |

| Mercedes-Benz GLA35 AMG | Compact | $1,468 | $122 |

| Infiniti QX60 | Midsize | $1,474 | $123 |

| Mercedes-Benz AMG GLB35 | Midsize | $1,478 | $123 |

| Acura MDX | Midsize | $1,498 | $125 |

| Land Rover Evoque | Compact | $1,498 | $125 |

| Lexus RX 350 | Midsize | $1,500 | $125 |

| Lexus NX 350 | Compact | $1,506 | $126 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Need rates for a different luxury SUV? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Evansville car insurance quotes from top-rated companies in Indiana.

Cheapest sports car insurance rates in Evansville, Indiana

The three top-ranked sports cars with the most affordable insurance in Evansville are the Mazda MX-5 Miata at $1,388 per year, the Toyota GR86 at $1,582 per year, and the Ford Mustang at $1,648 per year.

Not the cheapest in the list, but still ranking well, are cars like the Subaru BRZ, Toyota GR Supra, BMW M2, and Nissan Z, with average insurance cost of $1,794 per year or less.

As a cost per month, auto insurance in Evansville on this segment for a middle-age safe driver starts at an average of $116 per month, depending on your location. The table below ranks the twenty sports cars with the cheapest average insurance rates in Evansville, starting with the Mazda MX-5 Miata at $1,388 per year and ending with the Porsche Taycan at $2,540 per year.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $1,388 | $116 |

| Toyota GR86 | Sports Car | $1,582 | $132 |

| Ford Mustang | Sports Car | $1,648 | $137 |

| BMW Z4 | Sports Car | $1,656 | $138 |

| Subaru WRX | Sports Car | $1,680 | $140 |

| Toyota GR Supra | Sports Car | $1,684 | $140 |

| BMW M2 | Sports Car | $1,734 | $145 |

| Nissan Z | Sports Car | $1,738 | $145 |

| Lexus RC F | Sports Car | $1,772 | $148 |

| Subaru BRZ | Sports Car | $1,794 | $150 |

| BMW M3 | Sports Car | $1,894 | $158 |

| Porsche 718 | Sports Car | $1,930 | $161 |

| Chevrolet Camaro | Sports Car | $1,950 | $163 |

| Chevrolet Corvette | Sports Car | $2,076 | $173 |

| Porsche 911 | Sports Car | $2,148 | $179 |

| BMW M4 | Sports Car | $2,236 | $186 |

| Lexus LC 500 | Sports Car | $2,248 | $187 |

| Jaguar F-Type | Sports Car | $2,366 | $197 |

| Mercedes-Benz AMG GT53 | Sports Car | $2,482 | $207 |

| Porsche Taycan | Sports Car | $2,540 | $212 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Evansville, IN Zip Codes. Updated February 23, 2024

Don’t see rates for your sports car? Not a problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top car insurance companies in Evansville.

Tips for finding cheaper Evansville car insurance

Resourceful drivers in Evansville should always be searching for ways to reduce the monthly expense for insurance, so glance at the tips and ideas below and maybe you can save a little dough on your next car insurance policy.

- Compare auto insurance rates before buying a car. Different models, and even different trim levels of the same model, can have significantly different car insurance premiums, and insurers can sell policies with very different rates. Check the price before you purchase in order to avoid insurance sticker shock when you receive your bill.

- Excellent credit equals excellent rates. Having a high credit score of 800+ could save a minimum of $236 per year versus a slightly lower credit score between 670-739. Conversely, a weak credit rating could cost as much as $273 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Your occupation could save you a few bucks. Just about all auto insurance companies offer policy discounts for occupations like police officers and law enforcement, dentists, engineers, nurses, doctors, and others. Obtaining this discount could save between $45 and $146 on your car insurance premium, depending on the age of the rated driver.

- Increasing deductibles makes car insurance cheaper. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Fewer violations means cheaper policy cost. In order to get the cheapest car insurance in Evansville, it can pay off to be a safe driver. Just one or two minor driving infractions can raise insurance policy rates by at least $398 per year. Being convicted of a crime like driving under the influence of drugs or alcohol could raise rates by an additional $1,392 or more.

- Reduce coverage on older vehicles. Dropping full coverage from older vehicles whose value has decreased can cheapen the cost to insure considerably.

- Stay claim free. Most insurance companies give a discounted rate if you do not file any claims. Car insurance should be used for significant financial loss, not small claims that can be paid out-of-pocket.