- For cheap insurance in Dickinson, compact crossovers and SUVs like the Nissan Kicks, Toyota Corolla Cross, and Subaru Crosstrek cost less to insure than most other makes and models.

- Average car insurance cost in Dickinson is $2,270 per year, or $189 per month, for a policy with full coverage.

Cheapest car insurance in Dickinson

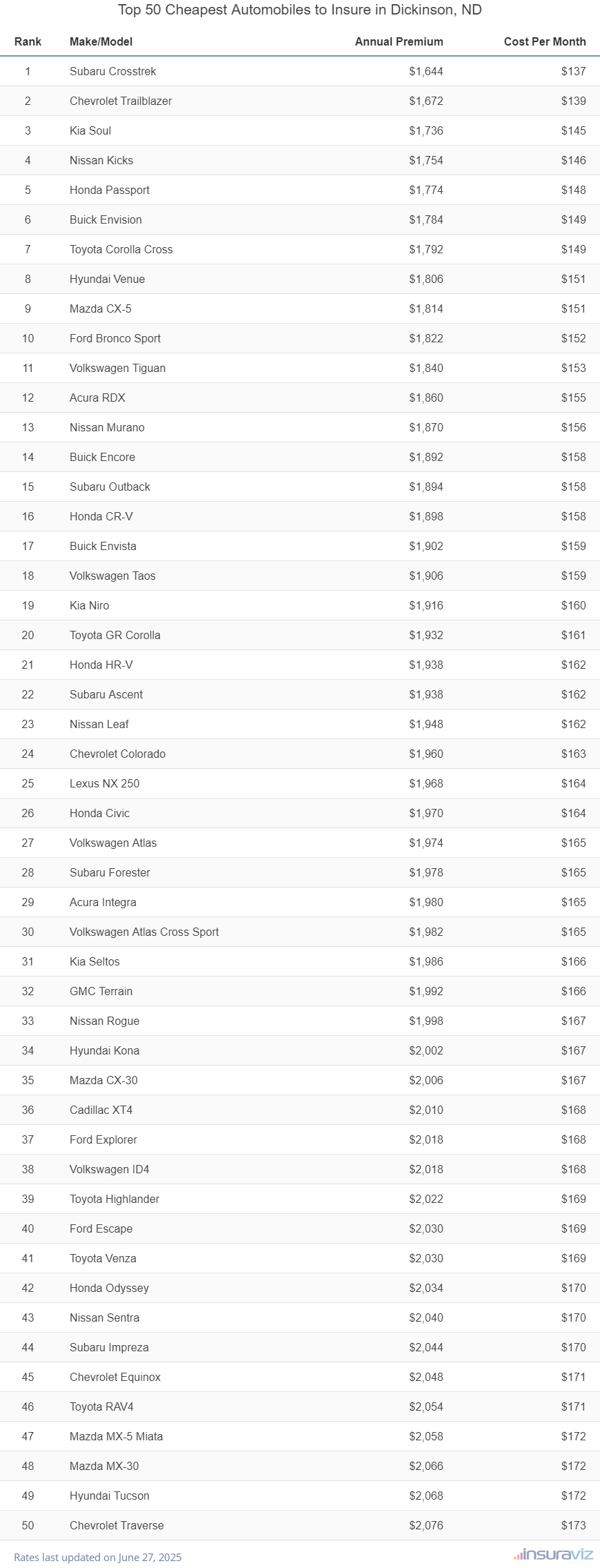

When all models are compared, the vehicles with the lowest cost average insurance quotes in Dickinson tend to be small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Nissan Kicks, and Buick Envision.

Average auto insurance rates for models in the top 10 cost $1,860 or less per year ($155 per month) to get full coverage.

Some additional models that have very good auto insurance quotes in our car insurance cost comparison are the Subaru Outback, Buick Encore, Acura RDX, and Buick Envista. The average insurance cost is a little higher for those models than the cheapest small SUVs and crossovers at the top of the rankings, but they still have an average cost of $1,974 or less per year ($165 per month).

The following table ranks the 50 models with the cheapest car insurance in Dickinson, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,678 | $140 |

| 2 | Chevrolet Trailblazer | $1,706 | $142 |

| 3 | Kia Soul | $1,772 | $148 |

| 4 | Nissan Kicks | $1,786 | $149 |

| 5 | Honda Passport | $1,808 | $151 |

| 6 | Buick Envision | $1,820 | $152 |

| 7 | Toyota Corolla Cross | $1,830 | $153 |

| 8 | Hyundai Venue | $1,842 | $154 |

| 9 | Mazda CX-5 | $1,852 | $154 |

| 10 | Ford Bronco Sport | $1,860 | $155 |

| 11 | Volkswagen Tiguan | $1,880 | $157 |

| 12 | Acura RDX | $1,898 | $158 |

| 13 | Nissan Murano | $1,906 | $159 |

| 14 | Buick Encore | $1,928 | $161 |

| 15 | Subaru Outback | $1,934 | $161 |

| 16 | Honda CR-V | $1,936 | $161 |

| 17 | Buick Envista | $1,938 | $162 |

| 18 | Volkswagen Taos | $1,944 | $162 |

| 19 | Kia Niro | $1,954 | $163 |

| 20 | Subaru Ascent | $1,974 | $165 |

| 21 | Toyota GR Corolla | $1,974 | $165 |

| 22 | Honda HR-V | $1,976 | $165 |

| 23 | Nissan Leaf | $1,988 | $166 |

| 24 | Chevrolet Colorado | $2,000 | $167 |

| 25 | Honda Civic | $2,010 | $168 |

| 26 | Lexus NX 250 | $2,010 | $168 |

| 27 | Volkswagen Atlas | $2,014 | $168 |

| 28 | Acura Integra | $2,018 | $168 |

| 29 | Subaru Forester | $2,022 | $169 |

| 30 | Volkswagen Atlas Cross Sport | $2,022 | $169 |

| 31 | Kia Seltos | $2,028 | $169 |

| 32 | GMC Terrain | $2,032 | $169 |

| 33 | Nissan Rogue | $2,038 | $170 |

| 34 | Hyundai Kona | $2,042 | $170 |

| 35 | Mazda CX-30 | $2,046 | $171 |

| 36 | Cadillac XT4 | $2,048 | $171 |

| 37 | Volkswagen ID4 | $2,058 | $172 |

| 38 | Ford Explorer | $2,060 | $172 |

| 39 | Toyota Highlander | $2,066 | $172 |

| 40 | Ford Escape | $2,070 | $173 |

| 41 | Toyota Venza | $2,072 | $173 |

| 42 | Honda Odyssey | $2,074 | $173 |

| 43 | Nissan Sentra | $2,080 | $173 |

| 44 | Subaru Impreza | $2,086 | $174 |

| 45 | Chevrolet Equinox | $2,090 | $174 |

| 46 | Toyota RAV4 | $2,092 | $174 |

| 47 | Mazda MX-5 Miata | $2,100 | $175 |

| 48 | Mazda MX-30 | $2,106 | $176 |

| 49 | Hyundai Tucson | $2,110 | $176 |

| 50 | Chevrolet Traverse | $2,118 | $177 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Dickinson, ND Zip Codes. Updated October 24, 2025

Some additional models worth noting ranking in the top 50 table above include the Subaru Impreza, Mazda MX-30, Volkswagen ID4, and Hyundai Kona. Average auto insurance rates for those vehicles cost between $1,974 and $2,122 per year in Dickinson, ND.

In contrast to the cheapest vehicles to insure, a few examples of much higher insurance rates include the Kia Stinger which averages $2,574 per year, the Audi S3 that costs $2,544, and the BMW X3 that averages $2,676.

What is average car insurance cost in Dickinson?

The average cost of car insurance in Dickinson is $2,270 per year, or about $189 per month for full coverage. It costs 0.3% less to insure the average vehicle in Dickinson, North Dakota, than the U.S. overall average rate of $2,276.

In North Dakota, average auto insurance cost is $2,222 per year, so the average cost in Dickinson is $48 more per year. When prices are compared to other cities in North Dakota, the cost of insurance in Dickinson is around $182 per year more than in West Fargo, $14 per year more expensive than in Minot, and $8 per year less than in Bismarck.

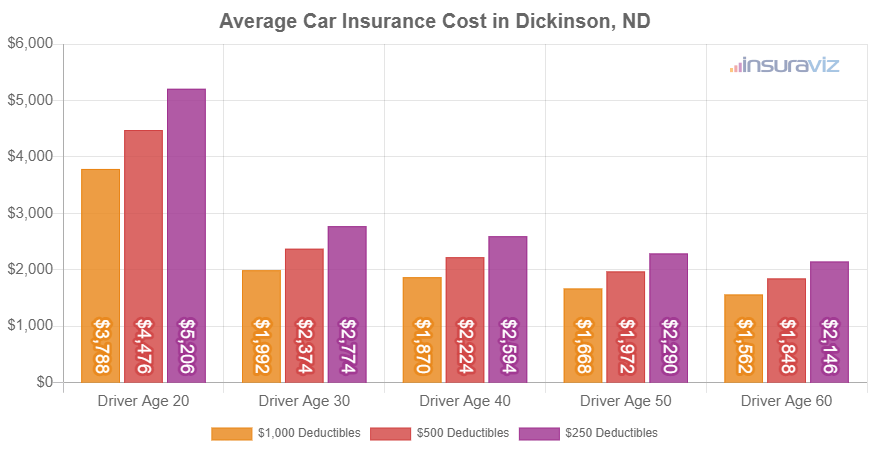

The chart below shows average Dickinson, North Dakota, auto insurance cost for all 2024 models. Rates are averaged for all Dickinson Zip Codes and shown not only by the age of the driver, but also by three different physical damage deductibles.

In the chart above, the cost of auto insurance in Dickinson ranges from $1,592 per year for a 60-year-old driver with a high deductible policy to $5,310 per year for a 20-year-old driver with a low deductible. From a monthly point of view, the average cost in the chart above ranges from $133 to $443 per month.

The age of the driver is the one factor that has the largest impact on the cost of car insurance, so the list below details how age impacts cost by breaking down average car insurance rates in Dickinson based on the age of the driver.

Average cost of car insurance in Dickinson, ND, for drivers age 16 to 60

- 16 year old – $8,083 per year or $674 per month

- 17 year old – $7,831 per year or $653 per month

- 18 year old – $7,020 per year or $585 per month

- 19 year old – $6,391 per year or $533 per month

- 20 year old – $4,566 per year or $381 per month

- 30 year old – $2,422 per year or $202 per month

- 40 year old – $2,270 per year or $189 per month

- 50 year old – $2,012 per year or $168 per month

- 60 year old – $1,884 per year or $157 per month

Five ways to save money on car insurance

Most drivers are trying to find ways to pay less for insurance. So take a minute and read through the tips and ideas in the list below and maybe you’ll be able to save some money the next time you need to insure a vehicle.

- Lower the cost of your policy by increasing deductibles. Boosting your physical damage deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Reduce coverage on older cars. Dropping comprehensive and collision coverage from older vehicles whose value has decreased will cut the cost of insurance considerably.

- Research discounts to save money. Discounts may be available if the insureds are senior citizens, choose electronic billing, are military or federal employees, belong to certain professional organizations, or many other discounts which could save the average Dickinson driver as much as $382 per year on their insurance cost.

- Remain claim free and save. Car insurance companies reduce rates a little for not having any claims. Insurance should be used for significant claims, not minor claims that should be paid out-of-pocket.

- Your job could save you a few bucks. The large majority of car insurance providers offer discounts for being employed in professions like police officers and law enforcement, scientists, members of the military, doctors, college professors, and others. Having this discount applied to your policy may save between $68 and $221 on your yearly insurance bill, depending on the age of the rated driver.