- Average car insurance cost is $2,308 per year, which is 1.4% more than the national average rate of $2,276.

- Compact SUVs like the Kia Soul, Chevrolet Trailblazer, and Toyota Corolla Cross are the best options for the cheapest car insurance.

- A few models with segment-leading auto insurance rates include the Mazda MX-5 Miata, Toyota GR Corolla, Jaguar E-Pace, and Acura Integra.

- Car insurance quotes can vary from as low as $26 per month for just liability insurance to over $655 per month for teenage drivers and high-risk drivers.

Average car insurance cost in Corpus Christi

The average price for car insurance in Corpus Christi is $2,308 per year, which is 1.4% more than the overall U.S. national average rate of $2,276. The average cost of car insurance per month in Corpus Christi is $192 for full coverage auto insurance.

In Texas, the average cost of car insurance is $2,394 per year, so the cost of auto insurance in Corpus Christi is $86 less per year. When rates are compared to other locations in Texas, the average cost to insure a vehicle in Corpus Christi is around $26 per year cheaper than in El Paso, $90 per year less than in Arlington, and $84 per year less than in San Antonio.

The age of the rated driver has the single biggest impact on the price you pay for car insurance, so the list below illustrates this point by showing average car insurance rates in Corpus Christi based on the age of the driver.

Average cost of car insurance in Corpus Christi for drivers age 16 to 60

- 16-year-old driver – $8,215 per year or $685 per month

- 17-year-old driver – $7,958 per year or $663 per month

- 18-year-old driver – $7,133 per year or $594 per month

- 19-year-old driver – $6,496 per year or $541 per month

- 20-year-old driver – $4,642 per year or $387 per month

- 30-year-old driver – $2,462 per year or $205 per month

- 40-year-old driver – $2,308 per year or $192 per month

- 50-year-old driver – $2,046 per year or $171 per month

- 60-year-old driver – $1,916 per year or $160 per month

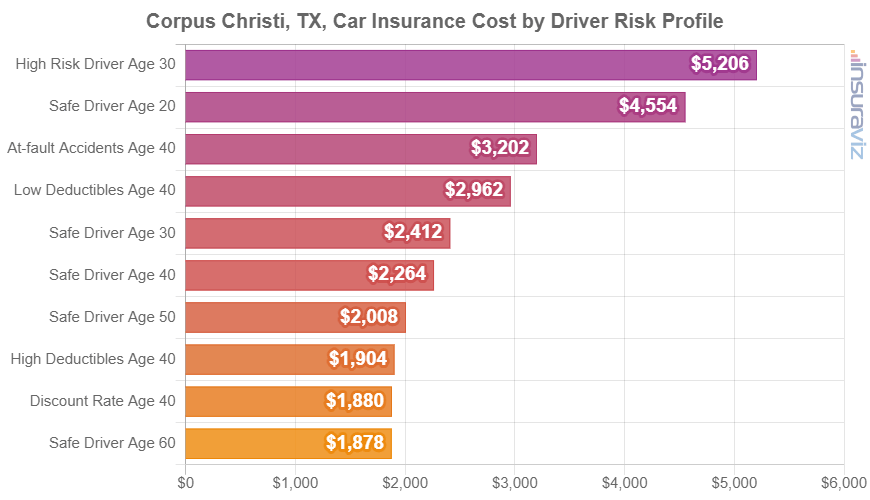

The chart below summarizes auto insurance cost in Corpus Christi, Texas, for different common policy situations. Rates are averaged for all Corpus Christi Zip Codes and shown based on a range of driver ages and risk profiles.

In the chart above, the cost of auto insurance in Corpus Christi ranges from $1,918 per year for a 40-year-old driver with a great rate thanks to policy discounts to $5,306 per year for a 30-year-old driver with too many violations and accidents. From a monthly point of view, the average cost in the previous chart ranges from $160 to $442 per month.

Corpus Christi auto insurance rates are different for every driver and can also be very different depending on the company. Due to the fact that rates are so variable, this emphasizes the need for accurate car insurance quotes when shopping around for cheaper car insurance in Corpus Christi, TX.

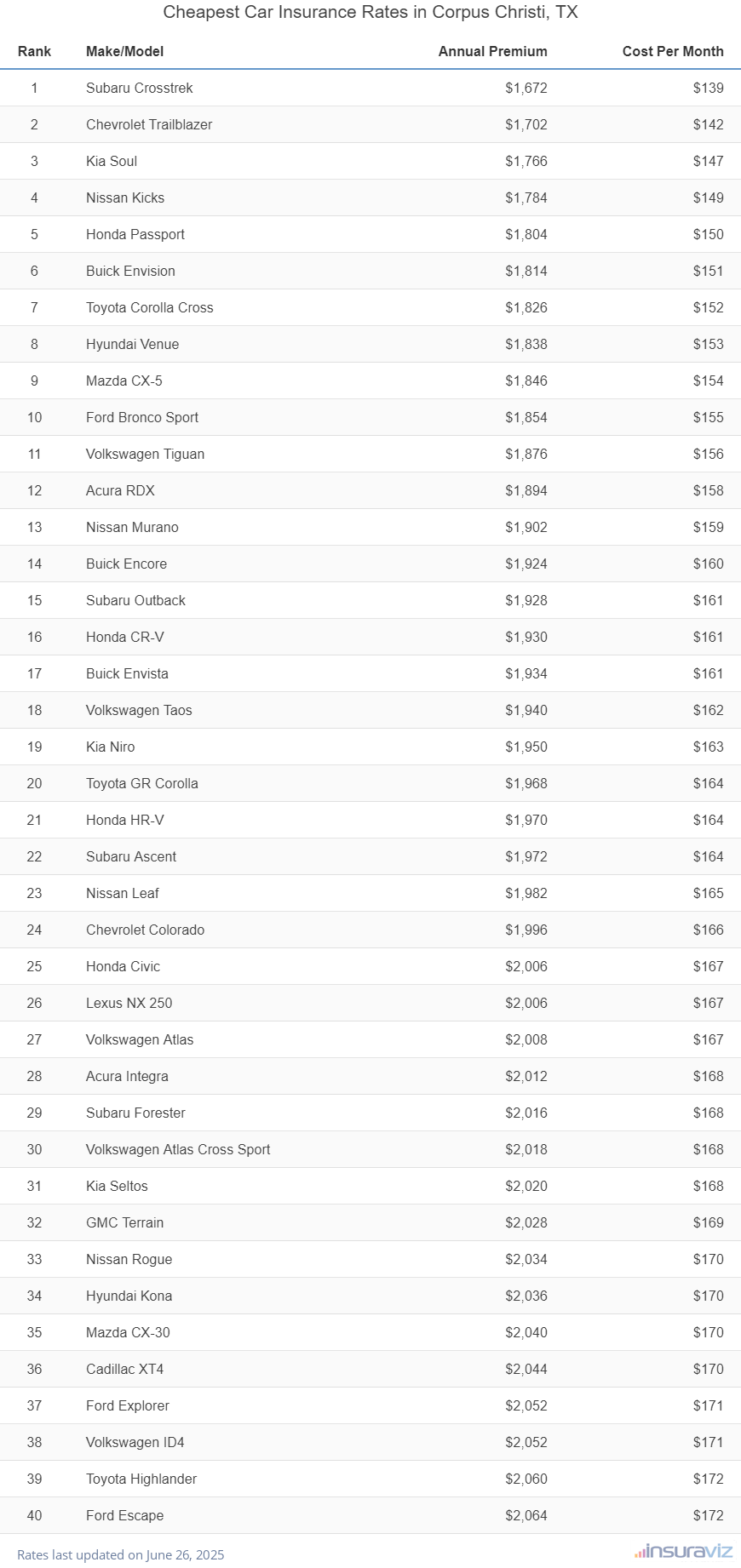

Which cars have cheap insurance in Corpus Christi, TX?

The vehicles with the most affordable car insurance rates in Corpus Christi, TX, tend to be crossover SUVs like the Kia Soul, Subaru Crosstrek, and Toyota Corolla Cross. Average car insurance quotes for vehicles in the top ten cost $1,890 or less per year to have full coverage.

Additional models that have very good insurance quotes in the comparison table below are the Volkswagen Taos, Toyota GR Corolla, Acura RDX, and Nissan Murano. The average insurance cost is slightly higher for those models than the compact SUVs that rank at the top, but they still have an average insurance cost of $2,004 or less per year ($167 per month) in Corpus Christi.

The table below ranks the 40 cars, trucks, and SUVs with the cheapest insurance rates in Corpus Christi, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,704 | $142 |

| 2 | Chevrolet Trailblazer | $1,734 | $145 |

| 3 | Kia Soul | $1,802 | $150 |

| 4 | Nissan Kicks | $1,814 | $151 |

| 5 | Honda Passport | $1,840 | $153 |

| 6 | Buick Envision | $1,850 | $154 |

| 7 | Toyota Corolla Cross | $1,858 | $155 |

| 8 | Hyundai Venue | $1,874 | $156 |

| 9 | Mazda CX-5 | $1,882 | $157 |

| 10 | Ford Bronco Sport | $1,890 | $158 |

| 11 | Volkswagen Tiguan | $1,910 | $159 |

| 12 | Acura RDX | $1,930 | $161 |

| 13 | Nissan Murano | $1,940 | $162 |

| 14 | Buick Encore | $1,960 | $163 |

| 15 | Subaru Outback | $1,966 | $164 |

| 16 | Honda CR-V | $1,968 | $164 |

| 17 | Buick Envista | $1,972 | $164 |

| 18 | Volkswagen Taos | $1,976 | $165 |

| 19 | Kia Niro | $1,988 | $166 |

| 20 | Toyota GR Corolla | $2,004 | $167 |

| 21 | Honda HR-V | $2,008 | $167 |

| 22 | Subaru Ascent | $2,008 | $167 |

| 23 | Nissan Leaf | $2,020 | $168 |

| 24 | Chevrolet Colorado | $2,032 | $169 |

| 25 | Lexus NX 250 | $2,042 | $170 |

| 26 | Honda Civic | $2,044 | $170 |

| 27 | Volkswagen Atlas | $2,044 | $170 |

| 28 | Acura Integra | $2,052 | $171 |

| 29 | Subaru Forester | $2,052 | $171 |

| 30 | Volkswagen Atlas Cross Sport | $2,054 | $171 |

| 31 | Kia Seltos | $2,062 | $172 |

| 32 | GMC Terrain | $2,066 | $172 |

| 33 | Nissan Rogue | $2,074 | $173 |

| 34 | Hyundai Kona | $2,078 | $173 |

| 35 | Mazda CX-30 | $2,080 | $173 |

| 36 | Cadillac XT4 | $2,084 | $174 |

| 37 | Volkswagen ID4 | $2,092 | $174 |

| 38 | Ford Explorer | $2,094 | $175 |

| 39 | Toyota Highlander | $2,098 | $175 |

| 40 | Ford Escape | $2,104 | $175 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Corpus Christi, TX Zip Codes. Updated October 24, 2025

A few other popular vehicles ranking in the top 40 above include the Volkswagen ID4, the Mazda CX-30, the Acura Integra, and the Volkswagen Atlas Cross Sport. Rates for those models cost between $2,004 and $2,104 per year in Corpus Christi, TX.

In contrast with the cheapest car insurance rates, some models that cost much more to insure include the Ford Mustang Mach-E which averages $225 per month, the Audi S3 that averages $216, and the Infiniti Q50 which costs $218.

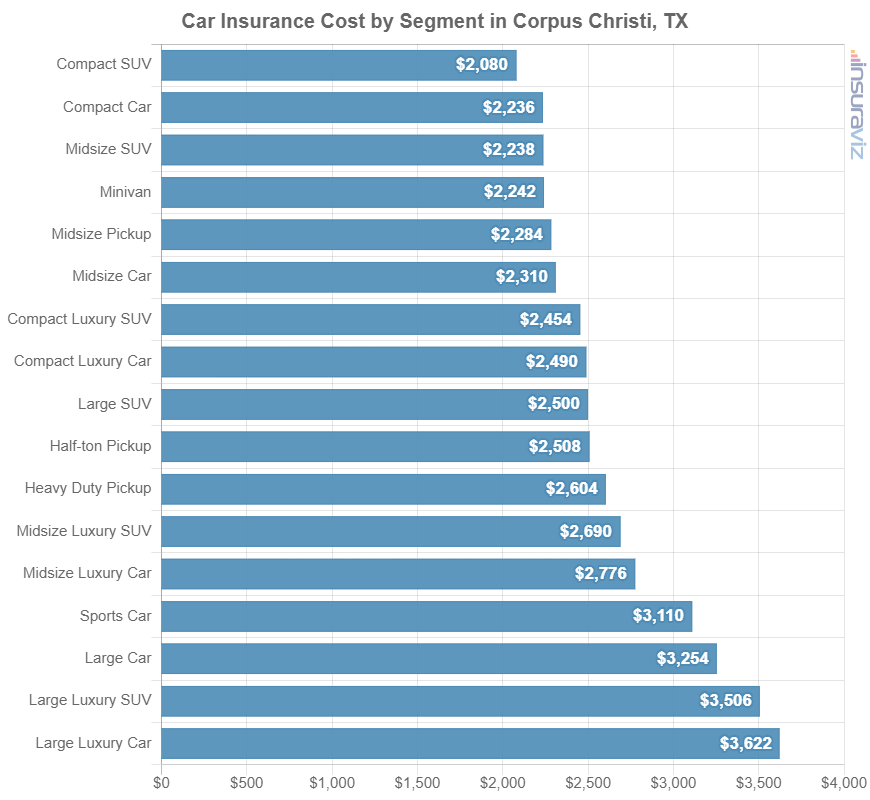

This next section goes into more detail about the different automotive segments and the average cost of auto insurance in Corpus Christi. These rates will give you a good idea of which vehicles have the overall most affordable rates.

Cheapest auto insurance rates by segment

If you’re shopping around for a different vehicle, it’s useful to have an idea of which categories of vehicles have cheaper auto insurance rates in Corpus Christi.

For example, some people wonder if compact SUVs have cheaper car insurance than compact cars or if full-size pickups cost less to insure than midsize pickups.

The next chart shows average auto insurance cost by vehicle segment in Corpus Christi. When comparing rates from a segment perspective, compact SUVs and midsize pickup trucks have the least expensive rates, while sports cars and performance luxury models have the most expensive average insurance cost.

Due to significant variation within each automotive segment, regard insurance cost by segment more as a generality, because better rate data is available if you dig down to the model level to find the cheapest vehicles to insure in a specific segment.

For example, in the midsize car segment, insurance rates range from the Kia K5 at $2,224 per year to the Tesla Model 3 at $2,710 per year.

In the large luxury car segment, rates range from the Audi A5 at $2,742 per year to the Mercedes-Benz Maybach S680 at $4,832 per year.

As a third example, in the midsize SUV segment, average rates can vary from the Honda Passport at $1,840 per year to the Rivian R1S costing $2,836 per year.

Seven tips for finding cheaper car insurance

Corpus Christi drivers should always be looking to reduce the monthly expense for auto insurance, so take a minute to read through the tips in the list below and it’s very possible you can save some money.

- Buy vehicles with cheaper insurance. The make and model of vehicle you drive is one of the primary factors in the price you pay for insurance. For example, a Kia Telluride costs $1,904 less per year to insure in Corpus Christi than a Acura NSX. Lower performance equals cheaper rates.

- Your profession could save you a few bucks. The vast majority of auto insurance providers offer policy discounts for occupations like members of the military, nurses, lawyers, police officers and law enforcement, scientists, accountants, and others. If you can earn this discount, you may save between $69 and $224 on your annual car insurance bill, depending on the coverage levels.

- Obey driving laws to save money. If you want to get the cheapest car insurance in Corpus Christi, it pays to drive within the law. Just one or two minor traffic violations could possibly raise policy cost as much as $614 per year. Serious infractions like driving under the influence could raise rates by an additional $2,140 or more.

- Bring up your credit score and save. Having an excellent credit score over 800 could save around $362 per year over a slightly lower credit score between 670-739. Conversely, a subpar credit rating could cost around $420 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Get cheaper rates by researching policy discounts. Discounts may be available if the insureds are loyal customers, are senior citizens, are homeowners, belong to certain professional organizations, or many other policy discounts which could save the average Corpus Christi driver as much as $390 per year on car insurance.

- Remain claim free. Most auto insurance companies reduce rates a little if you have not filed any claims. Insurance should only be used in the case of large financial hits, not for small claims.

- Be a responsible driver and save. At-fault accidents raise insurance rates, possibly by an extra $3,294 per year for a 20-year-old driver and even $958 per year for a 40-year-old driver. So drive safe and save!