- Car insurance in Hampton costs an average of $1,340 per year, or around $112 per month for full coverage.

- Hampton auto insurance costs an average of $18 per year more than the Virginia state average rate and $543 per year less than the U.S. national average rate of $1,883.

- Compact models like the Toyota Corolla Cross, Chevrolet Trailblazer, Nissan Kicks, and Kia Soul are the best options for the cheapest auto insurance in Hampton.

- Auto insurance quotes in Hampton can range significantly from as little as $36 per month for state minimum liability insurance to well over $667 per month for drivers requiring high-risk coverage.

How much does Hampton car insurance cost?

In Hampton, Virginia, the average price for car insurance is $1,340 per year, which is 33.7% less than the U.S. overall average rate of $1,883. Per month, Hampton drivers can expect to pay an average of $112 for a full coverage policy.

The average price for car insurance in Virginia is $1,322 per year, so Hampton drivers pay an average of $18 more per year than the overall Virginia state-wide rate. The average cost to insure a car in Hampton compared to other Virginia cities is approximately $84 per year cheaper than in Alexandria, $66 per year cheaper than in Norfolk, and $22 per year more than in Newport News.

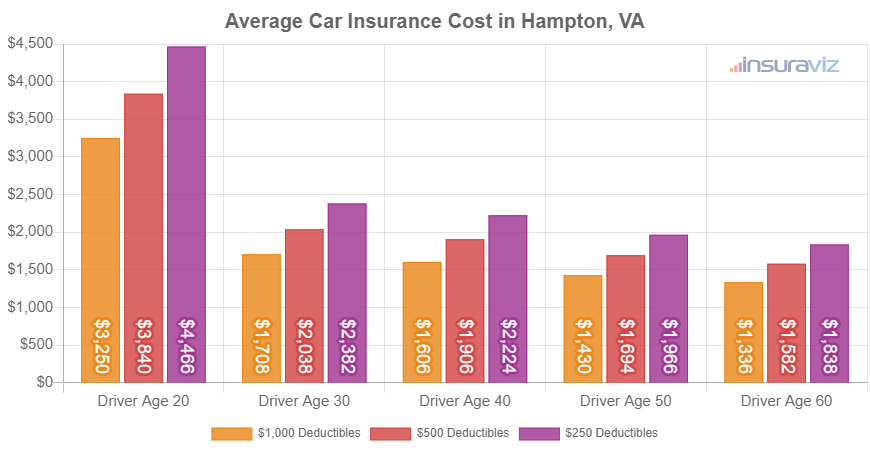

The chart below shows average Hampton auto insurance cost broken out not only for different driver ages, but also for different physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury brands.

Average rates in the chart range from $942 per year for a 60-year-old driver with $1,000 comprehensive and collision coverage deductibles to $3,138 per year for a 20-year-old driver with $250 deductibles.

The average rate we use to compare the cost between models and locations is a 40-year-old driver with $500 deductibles for comprehensive and collision coverage, which has an average cost of $1,340 per year in Hampton.

As a monthly price, which is good for budgeting, the average cost to insure a vehicle in Hampton ranges from $79 to $262 for the same annual rate data shown in the chart above.

The age of the rated driver on the vehicle is one of the largest factors that determines the cost of auto insurance. The list below details how age impacts cost by showing the difference in average car insurance rates in Hampton for a range of driver ages.

Average car insurance rates in Hampton, Virginia, for drivers age 16 to 60

- 16 year old – $4,780 per year or $398 per month

- 17 year old – $4,630 per year or $386 per month

- 18 year old – $4,150 per year or $346 per month

- 19 year old – $3,778 per year or $315 per month

- 20 year old – $2,698 per year or $225 per month

- 30 year old – $1,434 per year or $120 per month

- 40 year old – $1,340 per year or $112 per month

- 50 year old – $1,190 per year or $99 per month

- 60 year old – $1,114 per year or $93 per month

The rates in the list above for teenage drivers are based on the assumption that the driver is male. But rates actually vary depending on whether they are male or female.

The next chart shows the average cost to insure teen drivers in Hampton, Virginia, by gender. Females are usually a little cheaper to insure, especially in the teenage years. Teenage males have the highest cost to insure of any other gender or age group.

As shown in the chart, car insurance for a 16-year-old female in Hampton costs an average of $317 less than a male driver per year, while at age 19, the difference is narrower but is still $582 per year cheaper for females.

As drivers get out of their teen years, the rate difference between genders narrows until there is only a slight difference by age 40.

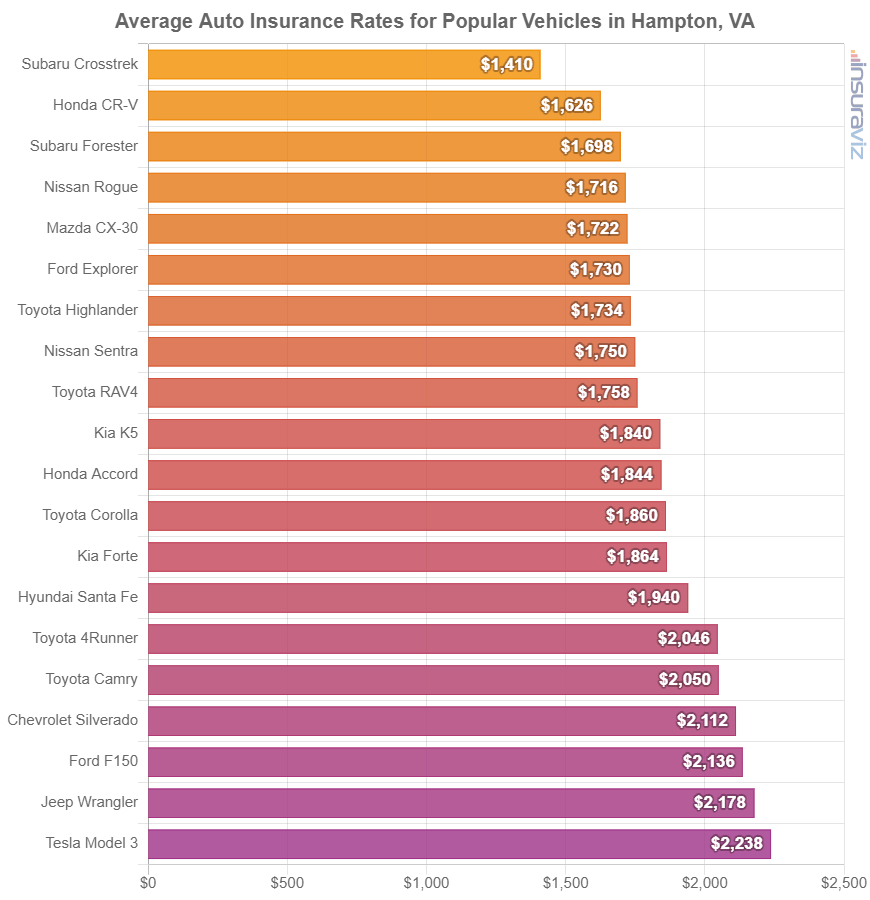

Top-selling vehicles and the cost to insure them

There are a lot of car, pickup, and SUV choices on the market, but there are some brands and models that make up the majority of vehicle sales. Examples would be the Ford F-Series, Chevy Silverado, and Dodge Ram pickups, SUVs like the Toyota RAV4 and Honda CR-V, and sedans like the Toyota Camry and Honda Accord.

The following chart details average insurance rates and how they compare for a small sample of popular cars, pickups, and SUVs on the road in Hampton.

Before we get into the vehicles that have the cheapest overall car insurance rates, let’s review some of the data and concepts we covered in the charts above.

- Cost per month ranges from $93 to $398 – That is the average car insurance price range for drivers aged 16 to 60 in Hampton, VA.

- Car insurance is generally cheaper the older you are – Average car insurance rates for a 50-year-old driver in Hampton are $1,508 per year cheaper than for a 20-year-old driver.

- Hampton auto insurance rates are more expensive than the Virginia state average – $1,340 (Hampton average) compared to $1,322 (Virginia average)

- Hampton, VA, average car insurance cost is less than the U.S. average – $1,340 (Hampton average) compared to $1,883 (U.S. average)

- Car insurance with low deductibles costs more – A 20-year-old driver pays an average of $722 more per year for $250 deductibles versus $1,000 deductibles.

- Teenage females pay less than teenage males – Teenage female drivers age 16 to 19 pay $582 to $317 less per year than their male counterparts.

Top 50 cheapest cars to insure in Hampton, Virginia

When shopping for a new vehicle, it’s smart to know which vehicles will cost the least to insure. There is nothing worse than getting that first car insurance bill and finding out it’s more than you budgeted for.

Overall, compact SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, Toyota Corolla Cross, and Nissan Kicks tend to have very good insurance rates. Average insurance quotes for all models ranked in the top ten cost $1,100 or less per year for full coverage in Hampton.

Some other models that are highly ranked in our car insurance cost comparison are the Buick Envista, Ford Bronco Sport, Chevrolet Colorado, and Acura RDX.

Insurance rates are somewhat higher for those models than the crossover SUVs at the top of the list, but they still have average rates of $1,152 or less per year, or about $96 per month.

The next table breaks down the 50 cheapest vehicles to insure in Hampton.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $992 | $83 |

| 2 | Chevrolet Trailblazer | $1,008 | $84 |

| 3 | Kia Soul | $1,048 | $87 |

| 4 | Nissan Kicks | $1,058 | $88 |

| 5 | Honda Passport | $1,068 | $89 |

| 6 | Buick Envision | $1,074 | $90 |

| 7 | Toyota Corolla Cross | $1,078 | $90 |

| 8 | Hyundai Venue | $1,088 | $91 |

| 9 | Mazda CX-5 | $1,096 | $91 |

| 10 | Ford Bronco Sport | $1,100 | $92 |

| 11 | Volkswagen Tiguan | $1,112 | $93 |

| 12 | Acura RDX | $1,122 | $94 |

| 13 | Nissan Murano | $1,128 | $94 |

| 14 | Buick Encore | $1,140 | $95 |

| 15 | Subaru Outback | $1,142 | $95 |

| 16 | Honda CR-V | $1,144 | $95 |

| 17 | Buick Envista | $1,146 | $96 |

| 18 | Chevrolet Colorado | $1,148 | $96 |

| 19 | Volkswagen Taos | $1,148 | $96 |

| 20 | Kia Niro | $1,152 | $96 |

| 21 | Toyota GR Corolla | $1,166 | $97 |

| 22 | Honda HR-V | $1,168 | $97 |

| 23 | Subaru Ascent | $1,168 | $97 |

| 24 | Nissan Leaf | $1,176 | $98 |

| 25 | Honda Civic | $1,188 | $99 |

| 26 | Lexus NX 250 | $1,188 | $99 |

| 27 | Volkswagen Atlas | $1,190 | $99 |

| 28 | Acura Integra | $1,194 | $100 |

| 29 | Subaru Forester | $1,196 | $100 |

| 30 | Volkswagen Atlas Cross Sport | $1,196 | $100 |

| 31 | Kia Seltos | $1,198 | $100 |

| 32 | GMC Terrain | $1,200 | $100 |

| 33 | Nissan Rogue | $1,204 | $100 |

| 34 | Hyundai Kona | $1,208 | $101 |

| 35 | Mazda CX-30 | $1,210 | $101 |

| 36 | Cadillac XT4 | $1,212 | $101 |

| 37 | Ford Explorer | $1,218 | $102 |

| 38 | Toyota Highlander | $1,218 | $102 |

| 39 | Volkswagen ID4 | $1,218 | $102 |

| 40 | Ford Escape | $1,224 | $102 |

| 41 | Toyota Venza | $1,224 | $102 |

| 42 | Honda Odyssey | $1,226 | $102 |

| 43 | Nissan Sentra | $1,228 | $102 |

| 44 | Hyundai Ioniq 6 | $1,232 | $103 |

| 45 | Subaru Impreza | $1,232 | $103 |

| 46 | Chevrolet Equinox | $1,236 | $103 |

| 47 | Toyota RAV4 | $1,238 | $103 |

| 48 | Mazda MX-5 Miata | $1,244 | $104 |

| 49 | Mazda MX-30 | $1,246 | $104 |

| 50 | Hyundai Tucson | $1,248 | $104 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hampton, VA Zip Codes. Updated February 23, 2024

Some other popular models making the list of the top 50 above include the Subaru Impreza, the Subaru Forester, the Subaru Ascent, the Hyundai Kona, and the Nissan Sentra. Average rates for those models fall between $1,152 and $1,252 per year in Hampton, VA.

To help gauge how cheap these rates are, a few random models that have more expensive insurance rates include the Dodge Charger that averages $1,928 per year, the Subaru BRZ which costs $1,604, and the Lexus LC 500h at $2,010.

For really high-priced insurance, models like the Nissan GT-R and Acura NSX have average rates that often cost three times as much as the cheapest models.

Hampton auto insurance rates by automotive segment

If you’re looking for a different vehicle but haven’t decided on the style, the next chart can help visualize which types of vehicles have the best auto insurance rates.

For instance, maybe maybe you need something that can carry a family of five but can’t decide between a minivan or a full-size SUV. Or maybe a sports car is in your future but you don’t know if you can swing the higher premiums.

The chart below shows average car insurance rates by segment in Hampton. From an overall average perspective, compact SUVs, midsize trucks, and minivans tend to have the least expensive rates, while performance and luxury models tend to have the most expensive overall rates.

Because of the rate variation within each segment, regard automotive segment averages as a starting point rather than a deciding factor.

For example, in the midsize car segment, average Hampton auto insurance rates range from the Hyundai Ioniq 6 costing $1,232 per year to the Tesla Model 3 costing $1,576 per year.

In the midsize truck segment, average rates vary from the Chevrolet Colorado at $1,148 per year to the Rivian R1T costing $1,674 per year, a difference of $526 within that segment.

Finally, in the small car segment, the average insurance cost can range from the Toyota GR Corolla costing $1,166 per year up to the Toyota Mirai costing $1,670 per year.

These examples just show how much rates can vary within any particular segment, so it’s important to compare rates for specific vehicle models once you get to that point.

How to save on auto insurance

Hampton car insurance rates are good, so you’re lucky in that respect. However, it can be easy to turn a good rate into an expensive rate just by making some poor decisions.

The list below can help you keep rates down simply by doing simple things like driving smart, shopping around, and being aware of potential savings.

- Get a discount from your choice of occupation. Most auto insurance companies offer policy discounts for specific professions like dentists, lawyers, scientists, college professors, architects, and others. Qualifying for an occupational discount could potentially save between $40 and $130 on your annual auto insurance cost, subject to policy limits.

- Shop around for better rates. Setting aside a few minutes every year or so to get some free car insurance quotes is our top recommendation for saving money on car insurance. Rates are always changing and you are not locked into any one company.

- Raise your credit score for cheaper insurance rates. Having excellent credit of 800+ may save $210 per year versus a credit rating of 670-739. Conversely, an imperfect credit score below 579 could cost around $244 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Buy vehicles that are cheaper to insure. The vehicle you drive is a huge factor in the price you pay for insurance. As an example, a Kia Telluride costs $1,186 less per year to insure in Hampton than a Audi R8. Lower performance equals cheaper rates.

- Safe drivers pay less. Having frequent at-fault accidents will raise rates, as much as $1,916 per year for a 20-year-old driver and as much as $406 per year for a 50-year-old driver. So be a cautious driver and save.

- Reduce coverage on older vehicles. Removing comprehensive and/or collision coverage from older vehicles whose value has decreased can cut the cost of insurance considerably.