- Average Hyundai Tucson insurance cost is $2,232 per year, or $186 per month for full coverage.

- The cheapest Hyundai Tucson insurance can be found on the SE trim level, costing around $2,036 per year. The most expensive model to insure is the Plug-in Hybrid Limited at $2,394 per year.

- The Hyundai Tucson is one of the more expensive small SUVs to insure, costing $26 more per year on average as compared to other small SUVs.

Average Insurance Cost and Price Factors

Hyundai Tucson insurance costs an average of $2,232 per year for the 2024 model year. Average cost per month ranges from $170 to $200 depending on the trim level.

When policy cost is broken down by coverage type, collision coverage costs about $1,024 a year, liability and medical (or PIP) coverage costs an estimated $636, and the remaining comprehensive (or other-than-collision) coverage will cost around $572.

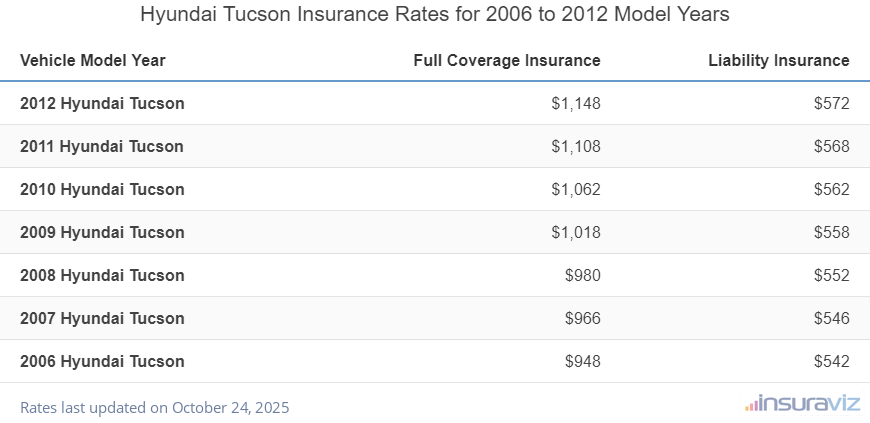

The graphic below demonstrates average Hyundai Tucson car insurance rates using different policy scenarios. More mature drivers tend to have cheaper rates, whereas drivers with more risk or a tendency to have accidents and claims will pay higher rates.

The infographic demonstrates that if you want the best rates possible when insuring your Hyundai Tucson, ideally you are a safe driver, have good credit, and keep your policy deductible on the higher side.

You can’t control your age, obviously, but as you get older car insurance rates tend to drop. And as you become more financially stable and buy a house or insure multiple vehicles, these events can trigger discounts that can save more money.

Here are some other observations that may be helpful when trying to lower the cost of your car insurance:

- Young males pay a lot more for insurance. For a 2024 Hyundai Tucson, a 20-year-old male driver pays an estimated $4,468 per year, while a 20-year-old woman will get a rate of $3,210, a difference of $1,258 per year. Women get significantly cheaper rates. But by age 50, male driver rates are $1,976 and female driver rates are $1,928, a difference of only $48.

- Improve your credit rating to save on insurance. In states that allow a driver’s credit rating to be used as a rate factor, drivers with high 800+ credit scores may see savings of $350 per year over a lower credit rating of 670-739. Conversely, a less-than-perfect credit score could cost as much as $406 more per year.

- Find cheap Tucson car insurance rates by qualifying for policy discounts. Discounts may be available if the insured drivers work in certain occupations, sign their policy early, are military or federal employees, are claim-free, are homeowners, or many other policy discounts which could save the average driver as much as $378 per year on their insurance cost.

- Lower the cost of your policy by increasing deductibles. Jacking up your deductibles from $500 to $1,000 could save around $364 per year for a 40-year-old driver and $704 per year for a 20-year-old driver.

- Low physical damage deductibles increase costs. Decreasing your policy deductibles from $500 to $250 could cost an additional $376 per year for a 40-year-old driver and $744 per year for a 20-year-old driver.

- Obey driving laws to save money. To pay the cheapest price for Tucson insurance rates, it’s necessary to drive safely. Not surprisingly, just a couple of minor lapses of judgment on your driving record could possibly raise the price of a policy as much as $582 per year. Serious citations like DUI and hit-and-run could raise rates by an additional $2,050 or more.

Vehicle Trim Level Impact on Rates

The cheapest model of Hyundai Tucson to insure is the SE at $2,036 per year. The next cheapest trim is the SEL at $2,100 per year, and the third cheapest model to insure is the Hybrid Blue also at $2,180 per year.

For the pricier trim levels, the two most expensive Tucson trim levels to insure are the Hyundai Tucson Hybrid Limited and the Plug-in Hybrid Limited models at around $2,316 and $2,394 per year, respectively.

The table below illustrates the average annual and monthly car insurance cost by trim level for the Tucson.

| 2024 Hyundai Tucson Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $2,036 | $170 |

| SEL | $2,100 | $175 |

| Hybrid Blue | $2,180 | $182 |

| XRT | $2,214 | $185 |

| Hybrid SEL Convenience | $2,238 | $187 |

| Limited | $2,264 | $189 |

| N Line | $2,264 | $189 |

| Plug-in Hybrid SEL | $2,302 | $192 |

| Hybrid Limited | $2,316 | $193 |

| Plug-in Hybrid Limited | $2,394 | $200 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Hyundai Tucson Versus the Competition

The Hyundai Tucson ranks 27th out of 47 total comparison vehicles in the small SUV segment. The Tucson costs an estimated $2,232 per year for insurance, while the segment average is $2,206 annually, a difference of $26 per year.

When compared to the most popular models in the small SUV segment, Tucson car insurance rates cost $20 more per year than the Toyota RAV4, $186 more than the Honda CR-V, $22 more than the Chevrolet Equinox, and $78 more than the Nissan Rogue.

The table below shows all 47 models in the 2024 small SUV class ranked by insurance cost and compared to the Hyundai Tucson rate.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$460 |

| 2 | Chevrolet Trailblazer | $1,804 | -$428 |

| 3 | Kia Soul | $1,872 | -$360 |

| 4 | Nissan Kicks | $1,888 | -$344 |

| 5 | Buick Envision | $1,922 | -$310 |

| 6 | Toyota Corolla Cross | $1,932 | -$300 |

| 7 | Hyundai Venue | $1,950 | -$282 |

| 8 | Mazda CX-5 | $1,956 | -$276 |

| 9 | Ford Bronco Sport | $1,966 | -$266 |

| 10 | Volkswagen Tiguan | $1,984 | -$248 |

| 11 | Buick Encore | $2,038 | -$194 |

| 12 | Honda CR-V | $2,046 | -$186 |

| 13 | Volkswagen Taos | $2,056 | -$176 |

| 14 | Kia Niro | $2,066 | -$166 |

| 15 | Honda HR-V | $2,088 | -$144 |

| 16 | Subaru Forester | $2,134 | -$98 |

| 17 | Kia Seltos | $2,144 | -$88 |

| 18 | GMC Terrain | $2,148 | -$84 |

| 19 | Nissan Rogue | $2,154 | -$78 |

| 20 | Hyundai Kona | $2,158 | -$74 |

| 21 | Mazda CX-30 | $2,164 | -$68 |

| 22 | Volkswagen ID4 | $2,176 | -$56 |

| 23 | Ford Escape | $2,188 | -$44 |

| 24 | Chevrolet Equinox | $2,210 | -$22 |

| 25 | Toyota RAV4 | $2,212 | -$20 |

| 26 | Mazda MX-30 | $2,226 | -$6 |

| 27 | Hyundai Tucson | $2,232 | -- |

| 28 | Chevrolet Trax | $2,264 | $32 |

| 29 | Mini Cooper Clubman | $2,274 | $42 |

| 30 | Mini Cooper | $2,278 | $46 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $70 |

| 32 | Jeep Renegade | $2,308 | $76 |

| 33 | Mitsubishi Outlander | $2,336 | $104 |

| 34 | Kia Sportage | $2,350 | $118 |

| 35 | Hyundai Ioniq 5 | $2,358 | $126 |

| 36 | Fiat 500X | $2,368 | $136 |

| 37 | Mini Cooper Countryman | $2,374 | $142 |

| 38 | Subaru Solterra | $2,376 | $144 |

| 39 | Mazda CX-50 | $2,380 | $148 |

| 40 | Nissan Ariya | $2,386 | $154 |

| 41 | Toyota bz4X | $2,390 | $158 |

| 42 | Mitsubishi Mirage | $2,398 | $166 |

| 43 | Kia EV6 | $2,474 | $242 |

| 44 | Dodge Hornet | $2,554 | $322 |

| 45 | Jeep Compass | $2,594 | $362 |

| 46 | Hyundai Nexo | $2,648 | $416 |

| 47 | Ford Mustang Mach-E | $2,806 | $574 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

New vs. Used: How do Rates Compare?

Insuring a 2013 model Tucson rather than a new 2024 model could save around $1,030 each year, depending on policy coverage levels.

Insuring a vehicle that is old enough to justify dropping full coverage completely could save an additional $622 annually, depending on what the comprehensive and collision deductibles were set to and the age of the driver.

The data below illustrates typical Hyundai Tucson auto insurance costs for the 2013 through 2024 model years. Annual policy costs range from the most affordable rate of $1,200 for a 2013 Hyundai Tucson to the most expensive yearly cost of $2,232 for a 2024 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Hyundai Tucson | $2,232 | $186 |

| 2023 Hyundai Tucson | $2,130 | $178 |

| 2022 Hyundai Tucson | $2,032 | $169 |

| 2021 Hyundai Tucson | $1,812 | $151 |

| 2020 Hyundai Tucson | $1,760 | $147 |

| 2019 Hyundai Tucson | $1,832 | $153 |

| 2018 Hyundai Tucson | $1,738 | $145 |

| 2017 Hyundai Tucson | $1,680 | $140 |

| 2016 Hyundai Tucson | $1,594 | $133 |

| 2015 Hyundai Tucson | $1,452 | $121 |

| 2014 Hyundai Tucson | $1,442 | $120 |

| 2013 Hyundai Tucson | $1,200 | $100 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Hyundai Tucson trim levels for each model year. Updated October 24, 2025

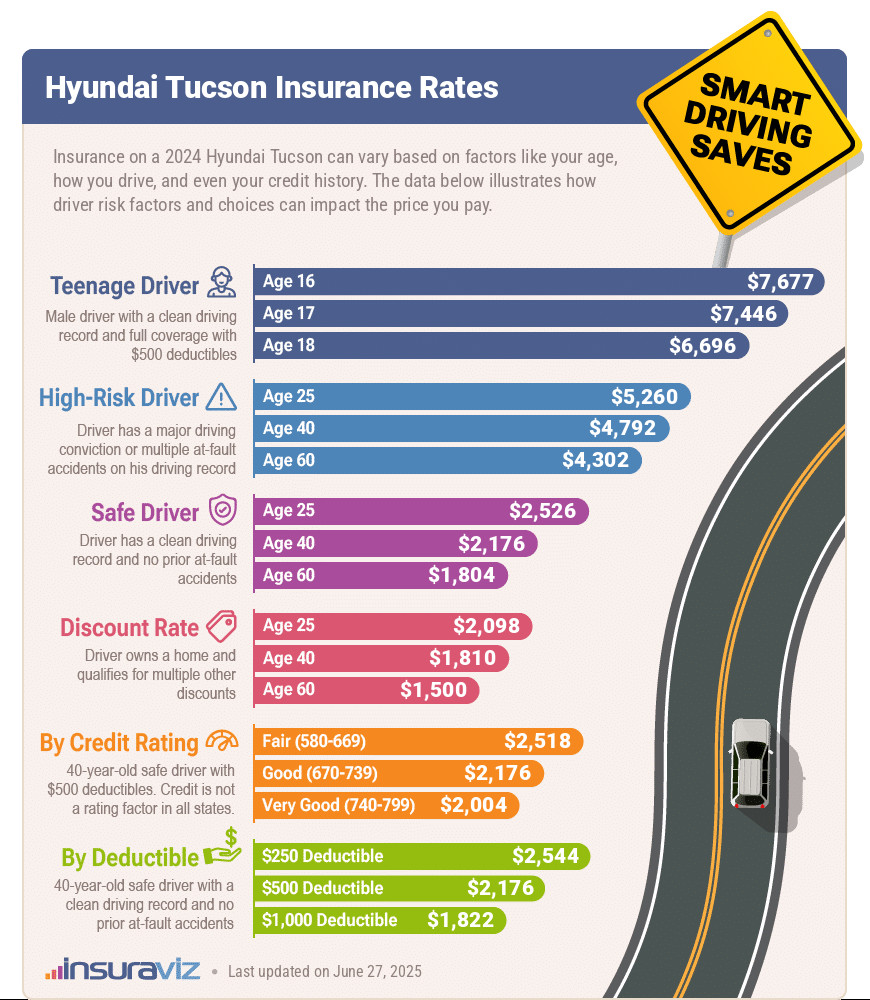

Hyundai Tucson Full Coverage vs. Liability Only

Insuring an older model year Tucson for only liability insurance is a good way to reduce the cost of insurance. The table below shows liability-only car insurance rates for the 2006 to 2012 Tucson model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Hyundai Tucson | $1,148 | $572 |

| 2011 Hyundai Tucson | $1,108 | $568 |

| 2010 Hyundai Tucson | $1,062 | $562 |

| 2009 Hyundai Tucson | $1,018 | $558 |

| 2008 Hyundai Tucson | $980 | $552 |

| 2007 Hyundai Tucson | $966 | $546 |

| 2006 Hyundai Tucson | $948 | $542 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025