The Subaru Crosstrek is well known for it’s standard all-wheel drive, impressive fuel efficiency, nearly 9 inch ground clearance, and it’s good safety ratings.

But how much does insurance cost for a Crosstrek? And if you already own one, what can you do to find cheaper insurance?

Before we tackle these questions, let’s throw out some quick stats on Crosstrek insurance rates.

Subaru Crosstrek Quick Insurance Stats

- Average insurance cost for 2024 model: $1,772 per year or $148 per month

- Average cost for 2022 model: $1,758 per year

- Average cost for 2018 model: $1,480 per year

- Least expensive model to insure: Crosstrek base at $1,684 per year

- Most expensive model: Crosstrek Wilderness at $1,848 per year

- Compared to 2024 small SUV segment average ($2,206): 21.8% cheaper

Driver profile: 40-year-old male, clean driving record, full coverage, and $500 physical damage deductibles

These are impressive numbers for this little crossover SUV. The Crosstrek ranks first out of 47 competitors in the compact SUV segment for the 2024 model year.

Based on this, it’s safe to say you’re already paying pretty decent rates to insure your Crosstrek. But there are always ways to save if you know how car insurance works.

Let’s start by talking about some of the different factors that influence car insurance prices like your age, driving record, credit score, and policy deductibles.

Understanding Crosstrek Insurance Rates

Subaru Crosstrek insurance costs an average of $1,772 per year for a policy with full coverage. Monthly insurance cost for the Crosstrek ranges from $140 to $154, depending on the trim level.

Collision coverage will cost about $746 a year, liability/medical (or PIP) coverage is an estimated $528, and the remaining comprehensive is around $498. These amounts are only estimates, as the cost of coverage is determined by each individual insurance company and there are a lot of factors that impact the actual rate you’ll pay.

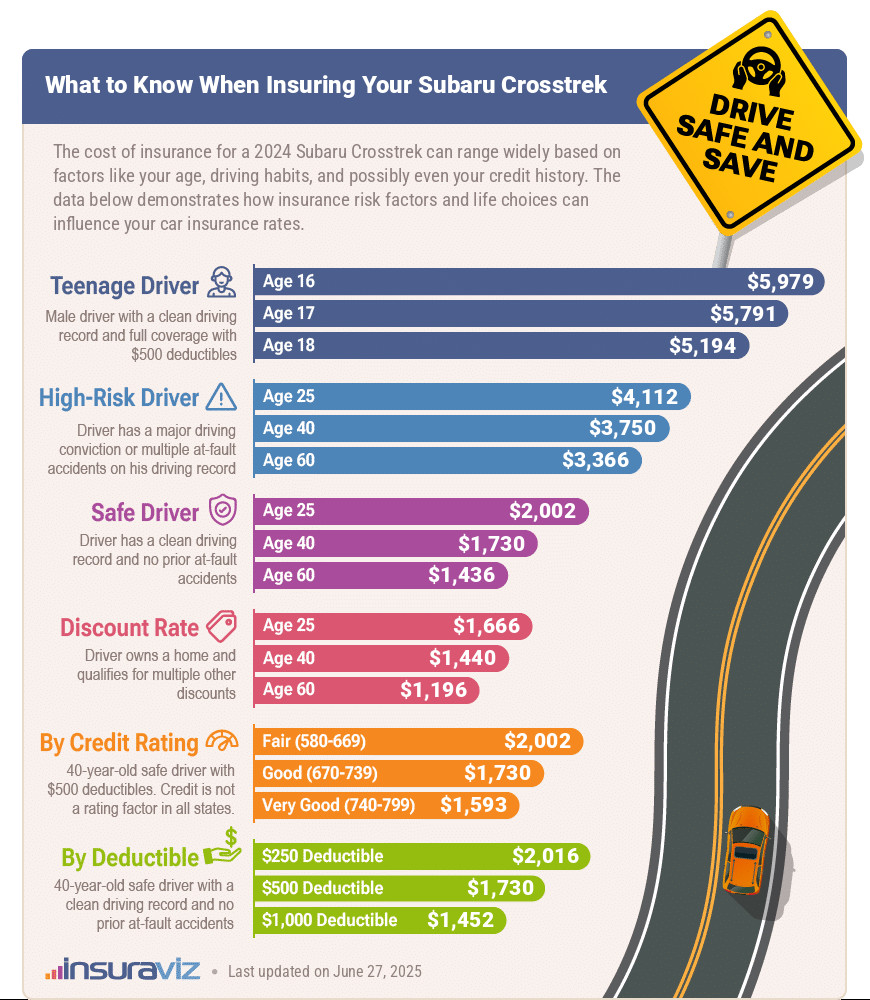

The infographic below breaks down average 2024 Subaru Crosstrek insurance rates using variations of driver age and risk profiles. The overall average rate we use for comparisons is the rate shown for a 40-year-old safe driver.

Understanding insurance costs for the 2024 Subaru Crosstrek involves looking at different driver profiles and how each one affects prices.

Teenage drivers face the highest premiums, with a 16-year-old driver paying around $6,127 annually. This is due to the higher risk associated with less experienced drivers.

By contrast, a 40-year-old safe driver pays about $1,772 per year, benefiting from a clean driving record and lower risk.

For high-risk drivers, such as those with serious driving violations or multiple at-fault accidents, premiums increase significantly, with a 25-year-old high-risk driver paying approximately $3,284 annually.

Qualifying for multiple discounts like owning a home, bundling your home and auto policies, or insuring multiple vehicles, can lower insurance costs. A 40-year-old driver with multiple discounts pays around $1,476 annually, which is a savings of $296 per year over the standard rate.

Credit scores may also impact rates depending on the state you live in. The average driver with very good credit pays about $1,632 per year, while having fair credit costs more at around $2,050.

Deductible choices affect premiums more than some other factors. A 40-year-old with a $250 deductible pays about $2,066 annually, whereas opting for a $1,000 deductible reduces the premium to $1,488.

These factors illustrate how insurance rates for the Subaru Crosstrek vary widely based on driver profile and coverage choices. Understanding these variables can help you manage and potentially reduce your insurance costs effectively.

Base Versus Wilderness: Trim Level Matters

Up to this point we’ve talked about a lot of “average” rates. And to get that average rate, we had to remove trim level from the equation.

So now, we are going to break out the cost of insurance for each trim level available for the 2024 Crosstrek.

Why does the trim level matter? It’s primarily due to the increased cost of the vehicle as you step up to each trim level. If you were to drive a base model Crosstrek off the dealer lot and total it, it would cost your insurance company less than if you were driving a Wilderness model.

So due to this increased risk your insurance company assumes by issuing your policy, you’ll have to pay slightly more with each trim level increase.

The cheapest trim level of Subaru Crosstrek to insure is the base model at around $1,684 per year, or about $140 per month. The second cheapest model is the Premium model costing an average of $1,714 per year.

The most expensive trim is the Crosstrek Wilderness at $1,848 per year, or around $154 per month. It will cost about $164 more per year to insure the Wilderness trim level compared to the base model.

The table below details average 2024 Subaru Crosstrek car insurance rates per year and cost per month for all five trims available.

| 2024 Subaru Crosstrek Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Base | $1,684 | $140 |

| Premium | $1,714 | $143 |

| Sport | $1,788 | $149 |

| Limited | $1,826 | $152 |

| Wilderness | $1,848 | $154 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Head-to-Head: Crosstrek vs. Other Compact SUVs

The Subaru Crosstrek ranks first out of 47 comparison vehicles in the 2024 small SUV class. The Crosstrek costs an average of $1,772 per year for full coverage insurance, while the segment average cost is $2,206 per year, a difference of $434.

When compared directly to popular vehicles in the small SUV segment, insurance rates for a Subaru Crosstrek cost $440 less per year than the Toyota RAV4, $274 less than the Honda CR-V, $438 less than the Chevrolet Equinox, and $416 less than the Ford Escape.

The chart below shows how Crosstrek car insurance rates compare to the top 10 best-selling small SUVs for the 2024 model year. Following the chart is a table that ranks all 47 small SUV models for insurance affordability, with the Crosstrek coming in at first.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -- |

| 2 | Chevrolet Trailblazer | $1,804 | $32 |

| 3 | Kia Soul | $1,872 | $100 |

| 4 | Nissan Kicks | $1,888 | $116 |

| 5 | Buick Envision | $1,922 | $150 |

| 6 | Toyota Corolla Cross | $1,932 | $160 |

| 7 | Hyundai Venue | $1,950 | $178 |

| 8 | Mazda CX-5 | $1,956 | $184 |

| 9 | Ford Bronco Sport | $1,966 | $194 |

| 10 | Volkswagen Tiguan | $1,984 | $212 |

| 11 | Buick Encore | $2,038 | $266 |

| 12 | Honda CR-V | $2,046 | $274 |

| 13 | Volkswagen Taos | $2,056 | $284 |

| 14 | Kia Niro | $2,066 | $294 |

| 15 | Honda HR-V | $2,088 | $316 |

| 16 | Subaru Forester | $2,134 | $362 |

| 17 | Kia Seltos | $2,144 | $372 |

| 18 | GMC Terrain | $2,148 | $376 |

| 19 | Nissan Rogue | $2,154 | $382 |

| 20 | Hyundai Kona | $2,158 | $386 |

| 21 | Mazda CX-30 | $2,164 | $392 |

| 22 | Volkswagen ID4 | $2,176 | $404 |

| 23 | Ford Escape | $2,188 | $416 |

| 24 | Chevrolet Equinox | $2,210 | $438 |

| 25 | Toyota RAV4 | $2,212 | $440 |

| 26 | Mazda MX-30 | $2,226 | $454 |

| 27 | Hyundai Tucson | $2,232 | $460 |

| 28 | Chevrolet Trax | $2,264 | $492 |

| 29 | Mini Cooper Clubman | $2,274 | $502 |

| 30 | Mini Cooper | $2,278 | $506 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $530 |

| 32 | Jeep Renegade | $2,308 | $536 |

| 33 | Mitsubishi Outlander | $2,336 | $564 |

| 34 | Kia Sportage | $2,350 | $578 |

| 35 | Hyundai Ioniq 5 | $2,358 | $586 |

| 36 | Fiat 500X | $2,368 | $596 |

| 37 | Mini Cooper Countryman | $2,374 | $602 |

| 38 | Subaru Solterra | $2,376 | $604 |

| 39 | Mazda CX-50 | $2,380 | $608 |

| 40 | Nissan Ariya | $2,386 | $614 |

| 41 | Toyota bz4X | $2,390 | $618 |

| 42 | Mitsubishi Mirage | $2,398 | $626 |

| 43 | Kia EV6 | $2,474 | $702 |

| 44 | Dodge Hornet | $2,554 | $782 |

| 45 | Jeep Compass | $2,594 | $822 |

| 46 | Hyundai Nexo | $2,648 | $876 |

| 47 | Ford Mustang Mach-E | $2,806 | $1,034 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

New vs. Used Crosstrek Insurance Rates

Forgoing the newest 2024 model and instead insuring a 2016 Subaru Crosstrek could save $432 per year, depending on policy limits. Even a nearly-new 2019 model could save $174 per year.

The data table below details average Subaru Crosstrek car insurance rates for drivers aged 20 to 60 for the 2016 through 2024 model years.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Subaru Crosstrek | $3,488 | $1,772 | $1,470 |

| 2023 Subaru Crosstrek | $3,602 | $1,782 | $1,480 |

| 2022 Subaru Crosstrek | $3,560 | $1,758 | $1,462 |

| 2021 Subaru Crosstrek | $3,908 | $1,922 | $1,600 |

| 2020 Subaru Crosstrek | $3,794 | $1,862 | $1,552 |

| 2019 Subaru Crosstrek | $3,224 | $1,598 | $1,330 |

| 2018 Subaru Crosstrek | $2,980 | $1,480 | $1,234 |

| 2017 Subaru Crosstrek | $2,934 | $1,456 | $1,218 |

| 2016 Subaru Crosstrek | $2,672 | $1,340 | $1,114 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Subaru Crosstrek trim levels for each model year. Updated October 24, 2025

Additional Subaru Crosstrek car insurance rates

If the tables and charts above weren’t enough data to absorb, here are a few more tidbits of information that could lower rates or potentially save you money.

- Find cheaper rates by qualifying for policy discounts. Discounts may be available if the policyholders insure their home and car with the same company, work in certain occupations, belong to certain professional organizations, are loyal customers, are accident-free, or many other policy discounts which could save the average driver as much as $296 per year on the cost of insuring a Crosstrek.

- A clean driving record saves money. If you want to pay the best price on Crosstrek insurance, it’s necessary to drive conservatively. A few minor moving violations have the ramification of spiking the price of a policy as much as $450 per year. Major infractions such as DWI and leaving the scene of an accident could raise rates by an additional $1,582 or more.

- Subaru Crosstrek insurance rates for teenagers are high. Average rates for full coverage Crosstrek insurance costs $6,127 per year for a 16-year-old driver, $5,933 per year for a 17-year-old driver, and $5,319 per year for an 18-year-old driver.

- High-risk insurance is expensive. For a 20-year-old driver, having to buy a high-risk insurance policy could trigger a rate increase of $2,688 or more per year.

- Get cheaper Crosstrek auto insurance rates because of your profession. Some insurance companies offer policy discounts for being employed in occupations like firefighters, nurses, architects, emergency medical technicians, lawyers, and others. If your occupation qualifies you for this discount, you may save between $53 and $233 on your annual auto insurance bill, depending on the age of the driver.