- For the cheapest auto insurance in Dothan, Alabama, compact crossovers like the Subaru Crosstrek, Buick Envision, Toyota Corolla Cross, and Nissan Kicks have some of the cheapest rates.

- A few models with segment-leading auto insurance rates in Dothan include the Audi A5 ($2,660 per year), Honda Passport ($1,784 per year), Mazda MX-5 Miata ($2,070 per year), and Chevrolet Colorado ($1,974 per year).

- Dothan, Alabama, car insurance averages $104 per year less than the Alabama state average ($2,344) and $36 per year less than the U.S. national average rate ($2,276).

Top 30 cheapest cars to insure in Dothan

When all car, SUV, and pickup insurance rates are compared, the vehicles with the cheapest average car insurance rates in Dothan, AL, tend to be crossovers and compact SUVs like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Nissan Kicks. Average insurance rates for cars and SUVs that rank in the top ten cost $1,834 or less per year, or $153 per month, for full coverage car insurance.

Some other models that rank well in our cost comparison are the Toyota GR Corolla, Buick Envista, Honda CR-V, and Ford Bronco Sport. Insurance rates are a little higher for those models than the cheapest compact SUVs at the top of the rankings, but they still have an average cost of $1,944 or less per year.

The following table ranks the 30 car, truck, and SUV models with the cheapest auto insurance in Dothan, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,652 | $138 |

| 2 | Chevrolet Trailblazer | $1,682 | $140 |

| 3 | Kia Soul | $1,748 | $146 |

| 4 | Nissan Kicks | $1,762 | $147 |

| 5 | Honda Passport | $1,784 | $149 |

| 6 | Buick Envision | $1,794 | $150 |

| 7 | Toyota Corolla Cross | $1,806 | $151 |

| 8 | Hyundai Venue | $1,820 | $152 |

| 9 | Mazda CX-5 | $1,826 | $152 |

| 10 | Ford Bronco Sport | $1,834 | $153 |

| 11 | Volkswagen Tiguan | $1,852 | $154 |

| 12 | Acura RDX | $1,870 | $156 |

| 13 | Nissan Murano | $1,880 | $157 |

| 14 | Buick Encore | $1,900 | $158 |

| 15 | Subaru Outback | $1,906 | $159 |

| 16 | Honda CR-V | $1,908 | $159 |

| 17 | Buick Envista | $1,916 | $160 |

| 18 | Volkswagen Taos | $1,920 | $160 |

| 19 | Kia Niro | $1,926 | $161 |

| 20 | Toyota GR Corolla | $1,944 | $162 |

| 21 | Subaru Ascent | $1,948 | $162 |

| 22 | Honda HR-V | $1,950 | $163 |

| 23 | Nissan Leaf | $1,964 | $164 |

| 24 | Chevrolet Colorado | $1,974 | $165 |

| 25 | Honda Civic | $1,982 | $165 |

| 26 | Lexus NX 250 | $1,982 | $165 |

| 27 | Volkswagen Atlas | $1,984 | $165 |

| 28 | Acura Integra | $1,990 | $166 |

| 29 | Subaru Forester | $1,992 | $166 |

| 30 | Volkswagen Atlas Cross Sport | $1,994 | $166 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Dothan, AL Zip Codes. Updated October 24, 2025

Additional vehicles that made the top 30 above include the Subaru Ascent, Subaru Forester, Lexus NX 250, and Volkswagen Atlas. Average car insurance rates for those models fall between $1,944 and $1,994 per year.

In comparison to the cheapest rates, a few models that cost much more to insure include the Tesla Model Y that costs $207 per month, the Audi A4 at $215, and the Tesla Model X at $234.

For extremely expensive insurance rates in Dothan, luxury and performance cars like the BMW 750i, BMW Alpina B8, Mercedes-Benz Maybach GLS 600, and BMW M8 have rates that cost at least double those of the cheapest models.

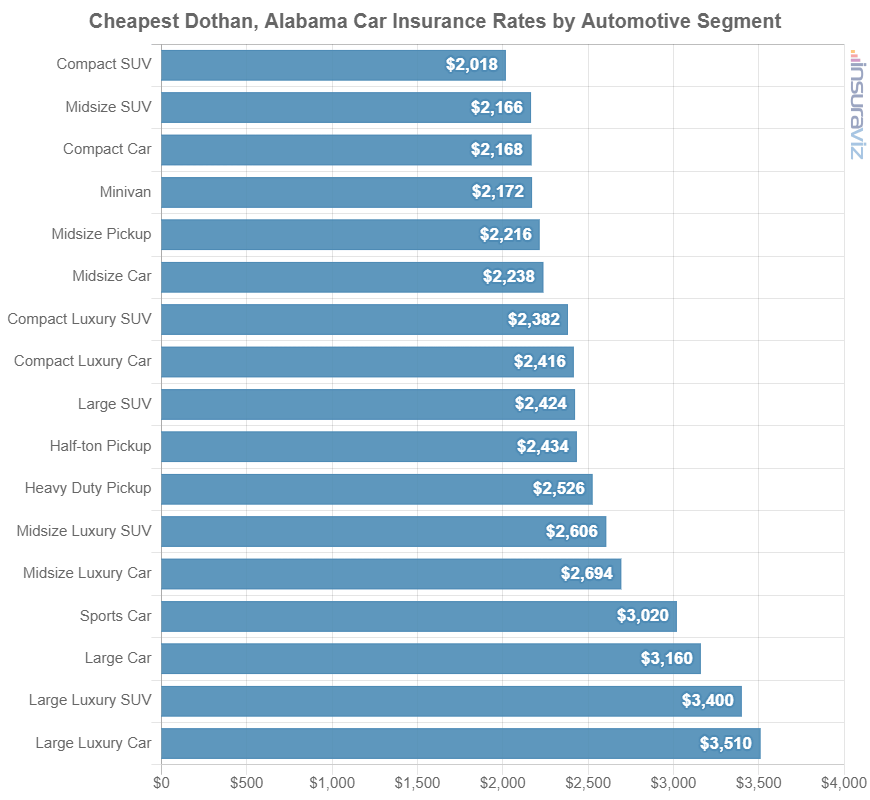

This next section goes into more detail about the average cost of auto insurance for each different vehicle segment. The rates shown in the chart will give you a good idea of the vehicle segments that have the best car insurance rates in Dothan.

Cheapest rates by automotive segment

When car shopping, it’s good to know which categories of vehicles are more affordable to insure. To illustrate this, you may be curious if midsize SUVs have cheaper insurance than full-size SUVs or if sports cars cost less to insure than luxury cars.

The next chart displays average auto insurance rates in Dothan for different vehicle segments. From a segment comparison perspective, compact SUVs, midsize trucks, and minivans have the best average car insurance rates, with exotic performance models having the highest average cost to insure.

Average rates for different segments are fine to make an overall comparison, but insurance rates for specific models range greatly within each automotive segment displayed in the chart above.

For example, in the midsize SUV segment, Dothan insurance rates range from the Honda Passport at $1,784 per year for full coverage insurance up to the Rivian R1S at $2,756 per year, a difference of $972 within that segment. As another example, in the midsize car segment, the average cost of insurance can range from the Kia K5 at $2,160 per year to the Tesla Model 3 costing $2,628 per year.

The next list identifies the vehicle with the cheapest insurance in Dothan, AL, for each different segment. Annual and monthly average car insurance quotes are calculated for each model. Click on any model for segment comparisons and insurance rates by trim level.

- Cheapest compact car insurance – Toyota GR Corolla at $1,944 per year or $162 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,652 per year or $138 per month

- Cheapest midsize car insurance – Kia K5 at $2,160 per year or $180 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,784 per year or $149 per month

- Cheapest full-size car insurance – Chrysler 300 at $2,130 per year or $178 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $2,102 per year or $175 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,974 per year or $165 per month

- Cheapest full-size pickup insurance – Nissan Titan at $2,094 per year or $175 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $2,280 per year or $190 per month

- Cheapest minivan insurance – Honda Odyssey at $2,046 per year or $171 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $2,070 per year or $173 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,990 per year or $166 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,870 per year or $156 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,304 per year or $192 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $2,094 per year or $175 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,660 per year or $222 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,510 per year or $209 per month

What does car insurance cost in Dothan, Alabama?

The average cost to insure a vehicle in Dothan is $2,240 per year, which is 1.6% less than the U.S. average rate of $2,276. The average cost of car insurance per month in Dothan is $187 for a policy that provides full coverage.

The average cost of car insurance in Alabama is $2,344 per year, so drivers in Dothan pay an average of $104 less per year than the overall Alabama rate.

When compared to other locations in Alabama, the average cost of car insurance in Dothan is approximately $80 per year cheaper than in Huntsville, $240 per year less than in Hoover, and $238 per year cheaper than in Mobile.

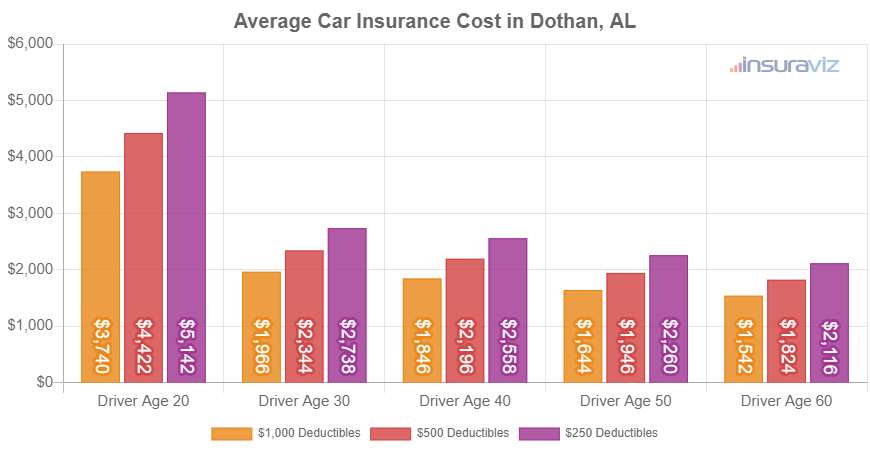

The chart below shows average Dothan, AL, auto insurance cost for all 2024 models. Rates are averaged for all Dothan Zip Codes and shown not only by driver age, but also by comprehensive and collision deductibles.

The average cost of auto insurance per month in Dothan is $187, with policy premium ranging from $131 to $437 for drivers age 20 to 60 and policy deductibles from $250 to $1,000.

The age of the rated driver is one of the biggest factors in determining the price you pay for car insurance, so the list below details how age impacts cost by showing the difference in average car insurance rates in Dothan for different driver ages.

Average car insurance rates in Dothan, AL, for drivers age 16 to 60

- 16-year-old rated driver – $7,978 per year or $665 per month

- 17-year-old rated driver – $7,729 per year or $644 per month

- 18-year-old rated driver – $6,927 per year or $577 per month

- 19-year-old rated driver – $6,308 per year or $526 per month

- 20-year-old rated driver – $4,508 per year or $376 per month

- 30-year-old rated driver – $2,390 per year or $199 per month

- 40-year-old rated driver – $2,240 per year or $187 per month

- 50-year-old rated driver – $1,984 per year or $165 per month

- 60-year-old rated driver – $1,858 per year or $155 per month

The rates shown above for average cost of car insurance for teen drivers were based on the rated driver being male. The next chart goes into more detail for teenage car insurance rates and illustrates average car insurance cost for teenagers by gender. Teenage female drivers cost a lot to insure, but they are usually cheaper than male drivers of the same age.

Auto insurance for a 16-year-old female in Dothan costs an average of $527 less per year than male drivers, while at age 19, the cost difference is less but males still pay an average of $975 more per year.

Seven tips to save on auto insurance

Not all drivers qualify for the best insurance rates, but there are steps you can take to ensure you’re paying the lowest rate possible for your age, location, and vehicle.

- Choose a vehicle that is cheaper to insure. The make and model of vehicle you drive is an important factor in the price you pay for car insurance. For example, a Kia Sportage costs $338 less per year to insure in Dothan than a Nissan 370Z. Lower performance vehicles cost less to insure.

- Compare insurance cost before buying a car. Different models, and even different trim levels of the same model, can have significantly different car insurance premiums, and insurance companies can charge a wide range of costs. Check the cost of insurance before you purchase to prevent price shock when insuring your new vehicle.

- Avoid tickets to save money. To get cheap auto insurance in Dothan, it pays to follow the law. In fact, just a few minor infractions have the consequences of raising the price of a policy by at least $598 per year.

- Remove optional coverage on older vehicles. Removing physical damage coverage from vehicles whose value has dropped to the point where coverage is not cost effective can trim the cost considerably.

- Get a discount from your choice of occupation. Just about all car insurance providers offer discounts for certain occupations like high school and elementary teachers, lawyers, emergency medical technicians, accountants, scientists, and others. Earning this discount may save between $67 and $218 on your auto insurance bill, depending on the age of the rated driver.

- Great credit can mean great car insurance rates. Having an excellent credit rating above 800 could save around $352 per year when compared to a rating of 670-739. Conversely, a mediocre credit rating could cost as much as $408 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Raising physical damage deductibles lowers cost. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.