- For the cheapest auto insurance in Dothan, Alabama, compact crossovers like the Subaru Crosstrek, Buick Envision, Toyota Corolla Cross, and Nissan Kicks have some of the cheapest rates.

- A few models with segment-leading auto insurance rates in Dothan include the Audi A5 ($1,930 per year), Honda Passport ($1,298 per year), Mazda MX-5 Miata ($1,508 per year), and Chevrolet Colorado ($1,394 per year).

- Dothan, Alabama, car insurance averages $106 per year less than the Alabama state average ($1,736) and $253 per year less than the U.S. national average rate ($1,883).

Top 30 cheapest cars to insure in Dothan

When all car, SUV, and pickup insurance rates are compared, the vehicles with the cheapest average car insurance rates in Dothan, AL, tend to be crossovers and compact SUVs like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Nissan Kicks. Average insurance rates for cars and SUVs that rank in the top ten cost $1,334 or less per year, or $111 per month, for full coverage car insurance.

Some other models that rank well in our cost comparison are the Kia Niro, Buick Envista, Subaru Outback, and Ford Bronco Sport. Insurance rates are a little higher for those models than the cheapest compact SUVs at the top of the rankings, but they still have an average cost of $1,398 or less per year.

The following table ranks the 30 car, truck, and SUV models with the cheapest auto insurance in Dothan, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,204 | $100 |

| 2 | Chevrolet Trailblazer | $1,226 | $102 |

| 3 | Kia Soul | $1,272 | $106 |

| 4 | Nissan Kicks | $1,282 | $107 |

| 5 | Honda Passport | $1,298 | $108 |

| 6 | Buick Envision | $1,306 | $109 |

| 7 | Toyota Corolla Cross | $1,314 | $110 |

| 8 | Hyundai Venue | $1,324 | $110 |

| 9 | Mazda CX-5 | $1,330 | $111 |

| 10 | Ford Bronco Sport | $1,334 | $111 |

| 11 | Volkswagen Tiguan | $1,348 | $112 |

| 12 | Acura RDX | $1,362 | $114 |

| 13 | Nissan Murano | $1,370 | $114 |

| 14 | Buick Encore | $1,384 | $115 |

| 15 | Subaru Outback | $1,388 | $116 |

| 16 | Honda CR-V | $1,390 | $116 |

| 17 | Buick Envista | $1,392 | $116 |

| 18 | Chevrolet Colorado | $1,394 | $116 |

| 19 | Volkswagen Taos | $1,396 | $116 |

| 20 | Kia Niro | $1,398 | $117 |

| 21 | Honda HR-V | $1,418 | $118 |

| 22 | Subaru Ascent | $1,418 | $118 |

| 23 | Toyota GR Corolla | $1,418 | $118 |

| 24 | Nissan Leaf | $1,428 | $119 |

| 25 | Honda Civic | $1,442 | $120 |

| 26 | Lexus NX 250 | $1,442 | $120 |

| 27 | Volkswagen Atlas | $1,446 | $121 |

| 28 | Acura Integra | $1,448 | $121 |

| 29 | Volkswagen Atlas Cross Sport | $1,452 | $121 |

| 30 | Kia Seltos | $1,456 | $121 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Dothan, AL Zip Codes. Updated February 23, 2024

Additional vehicles that made the top 30 above include the Subaru Ascent, Subaru Forester, Lexus NX 250, and Volkswagen Atlas. Average car insurance rates for those models fall between $1,398 and $1,452 per year.

In comparison to the cheapest rates, a few models that cost much more to insure include the Tesla Model Y that costs $150 per month, the Audi A4 at $156, and the Tesla Model X at $171.

For extremely expensive insurance rates in Dothan, luxury and performance cars like the BMW 750i, BMW Alpina B8, Mercedes-Benz Maybach GLS 600, and BMW M8 have rates that cost at least double those of the cheapest models.

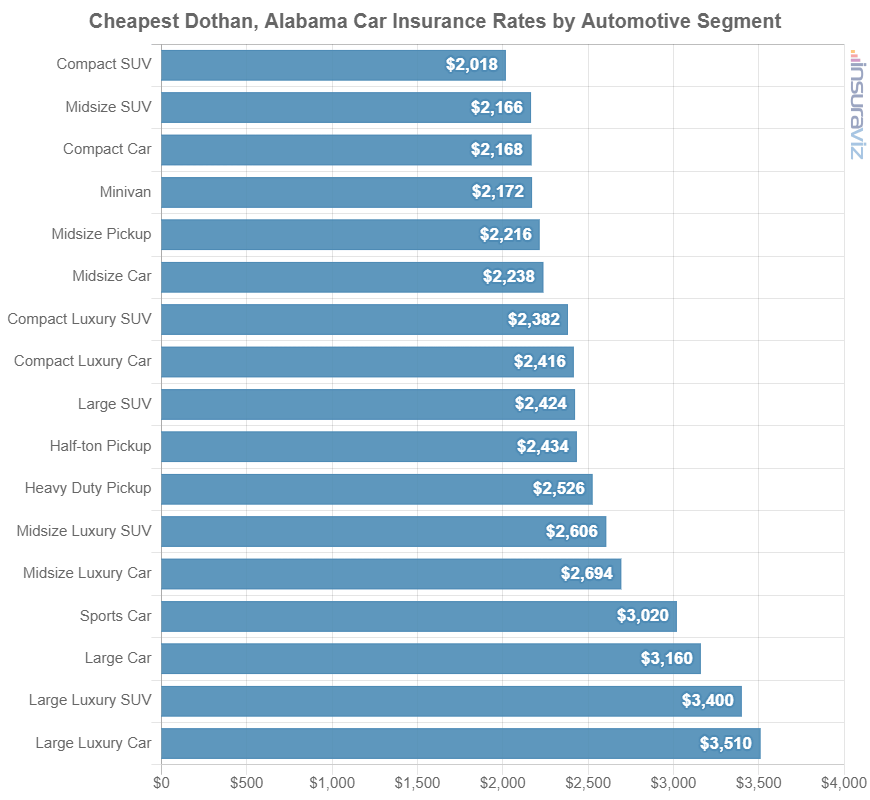

This next section goes into more detail about the average cost of auto insurance for each different vehicle segment. The rates shown in the chart will give you a good idea of the vehicle segments that have the best car insurance rates in Dothan.

Cheapest rates by automotive segment

When car shopping, it’s good to know which categories of vehicles are more affordable to insure. To illustrate this, you may be curious if midsize SUVs have cheaper insurance than full-size SUVs or if sports cars cost less to insure than luxury cars.

The next chart displays average auto insurance rates in Dothan for different vehicle segments. From a segment comparison perspective, compact SUVs, midsize trucks, and minivans have the best average car insurance rates, with exotic performance models having the highest average cost to insure.

Average rates for different segments are fine to make an overall comparison, but insurance rates for specific models range greatly within each automotive segment displayed in the chart above.

For example, in the midsize SUV segment, Dothan insurance rates range from the Honda Passport at $1,298 per year for full coverage insurance up to the Rivian R1S at $2,000 per year, a difference of $702 within that segment. As another example, in the midsize car segment, the average cost of insurance can range from the Hyundai Ioniq 6 at $1,498 per year to the Tesla Model 3 costing $1,914 per year.

The next list identifies the vehicle with the cheapest insurance in Dothan, AL, for each different segment. Annual and monthly average car insurance quotes are calculated for each model. Click on any model for segment comparisons and insurance rates by trim level.

- Cheapest compact car insurance – Toyota GR Corolla at $1,418 per year or $118 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,204 per year or $100 per month

- Cheapest midsize car insurance – Hyundai Ioniq 6 at $1,498 per year or $125 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,298 per year or $108 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,546 per year or $129 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,530 per year or $128 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,394 per year or $116 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,526 per year or $127 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $1,658 per year or $138 per month

- Cheapest minivan insurance – Honda Odyssey at $1,490 per year or $124 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,508 per year or $126 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,448 per year or $121 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,362 per year or $114 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $1,678 per year or $140 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,524 per year or $127 per month

- Cheapest full-size luxury car insurance – Audi A5 at $1,930 per year or $161 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $1,828 per year or $152 per month

What does car insurance cost in Dothan, Alabama?

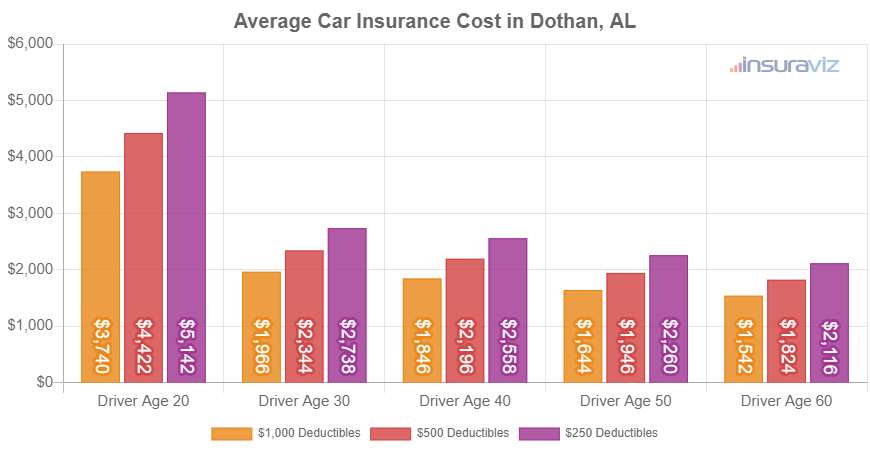

The average cost to insure a vehicle in Dothan is $1,630 per year, which is 14.4% less than the U.S. average rate of $1,883. The average cost of car insurance per month in Dothan is $136 for a policy that provides full coverage.

The average cost of car insurance in Alabama is $1,736 per year, so drivers in Dothan pay an average of $106 less per year than the overall Alabama rate.

When compared to other locations in Alabama, the average cost of car insurance in Dothan is approximately $82 per year cheaper than in Huntsville, $242 per year less than in Hoover, and $238 per year cheaper than in Mobile.

The chart below shows average Dothan, AL, auto insurance cost for all 2024 models. Rates are averaged for all Dothan Zip Codes and shown not only by driver age, but also by comprehensive and collision deductibles.

The average cost of auto insurance per month in Dothan is $136, with policy premium ranging from $95 to $318 for drivers age 20 to 60 and policy deductibles from $250 to $1,000.

The age of the rated driver is one of the biggest factors in determining the price you pay for car insurance, so the list below details how age impacts cost by showing the difference in average car insurance rates in Dothan for different driver ages.

Average car insurance rates in Dothan, AL, for drivers age 16 to 60

- 16-year-old rated driver – $5,802 per year or $484 per month

- 17-year-old rated driver – $5,620 per year or $468 per month

- 18-year-old rated driver – $5,040 per year or $420 per month

- 19-year-old rated driver – $4,590 per year or $383 per month

- 20-year-old rated driver – $3,278 per year or $273 per month

- 30-year-old rated driver – $1,738 per year or $145 per month

- 40-year-old rated driver – $1,630 per year or $136 per month

- 50-year-old rated driver – $1,444 per year or $120 per month

- 60-year-old rated driver – $1,352 per year or $113 per month

The rates shown above for average cost of car insurance for teen drivers were based on the rated driver being male. The next chart goes into more detail for teenage car insurance rates and illustrates average car insurance cost for teenagers by gender. Teenage female drivers cost a lot to insure, but they are usually cheaper than male drivers of the same age.

Auto insurance for a 16-year-old female in Dothan costs an average of $383 less per year than male drivers, while at age 19, the cost difference is less but males still pay an average of $708 more per year.

Seven tips to save on auto insurance

Not all drivers qualify for the best insurance rates, but there are steps you can take to ensure you’re paying the lowest rate possible for your age, location, and vehicle.

- Choose a vehicle that is cheaper to insure. The make and model of vehicle you drive is an important factor in the price you pay for car insurance. For example, a Kia Sportage costs $246 less per year to insure in Dothan than a Nissan 370Z. Lower performance vehicles cost less to insure.

- Compare insurance cost before buying a car. Different models, and even different trim levels of the same model, can have significantly different car insurance premiums, and insurance companies can charge a wide range of costs. Check the cost of insurance before you purchase to prevent price shock when insuring your new vehicle.

- Avoid tickets to save money. To get cheap auto insurance in Dothan, it pays to follow the law. In fact, just a few minor infractions have the consequences of raising the price of a policy by at least $434 per year.

- Remove optional coverage on older vehicles. Removing physical damage coverage from vehicles whose value has dropped to the point where coverage is not cost effective can trim the cost considerably.

- Get a discount from your choice of occupation. Just about all car insurance providers offer discounts for certain occupations like high school and elementary teachers, lawyers, emergency medical technicians, accountants, scientists, and others. Earning this discount may save between $49 and $158 on your auto insurance bill, depending on the age of the rated driver.

- Great credit can mean great car insurance rates. Having an excellent credit rating above 800 could save around $256 per year when compared to a rating of 670-739. Conversely, a mediocre credit rating could cost as much as $297 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Raising physical damage deductibles lowers cost. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.