- Small SUV models like the Chevrolet Trailblazer, Subaru Crosstrek, and Toyota Corolla Cross get the nod for cheap car insurance in Kaneohe.

- Kaneohe car insurance cost averages $1,956 per year, or approximately $163 per month, for a full-coverage policy.

- Car insurance rates for a few popular vehicles in Kaneohe include the Subaru Outback at $1,662 per year, Nissan Altima at $2,114, and Subaru Forester at $1,738.

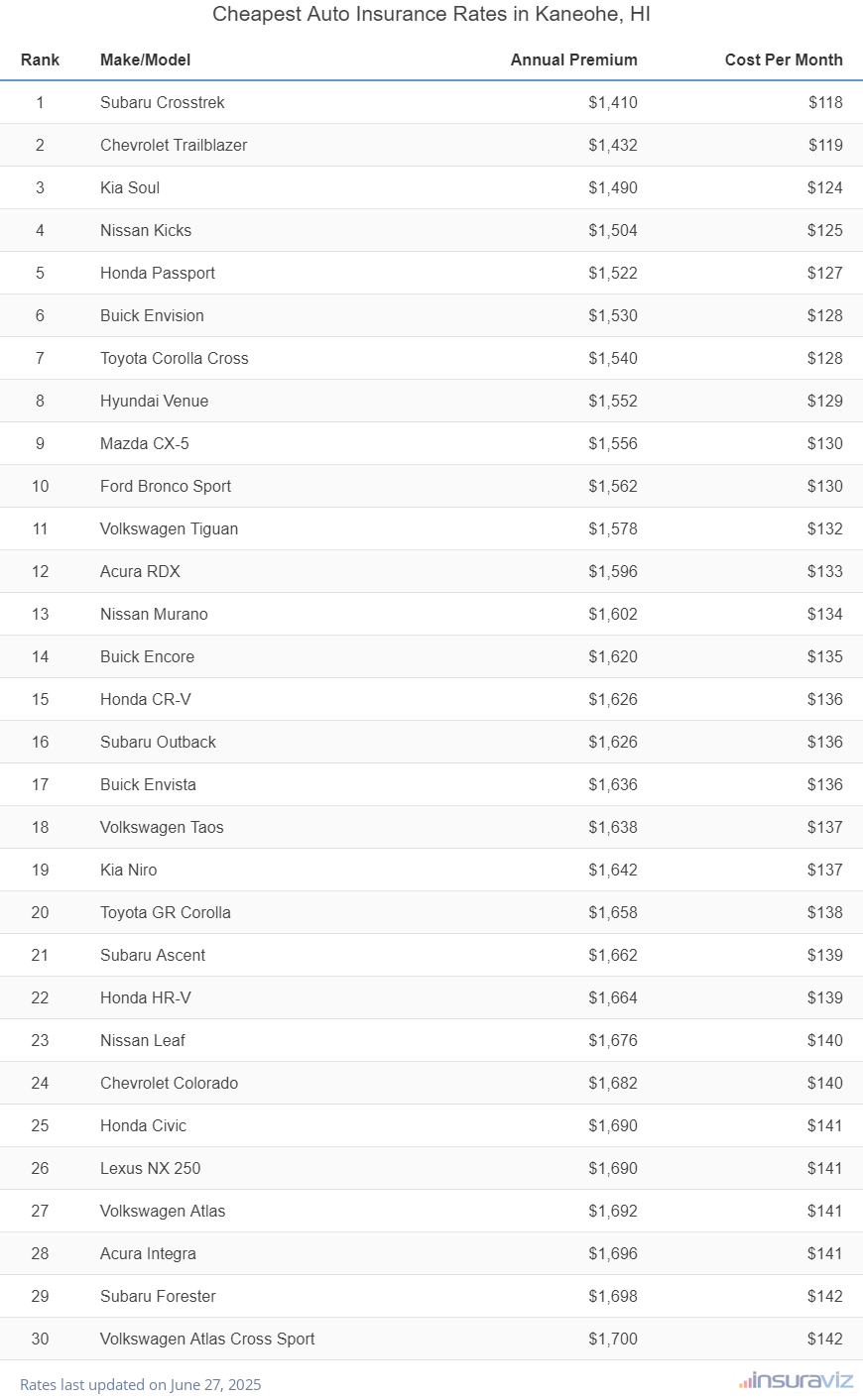

Which vehicles have cheap insurance in Kaneohe?

When comparing all types of vehicles, the models with the cheapest average auto insurance prices in Kaneohe tend to be compact SUVs like the Chevrolet Trailblazer, Kia Soul, Toyota Corolla Cross, and Buick Envision. Average car insurance prices for vehicles ranking in the top 10 cost $1,598 or less per year to insure for full coverage in Kaneohe.

Additional vehicles that rank well in our insurance cost comparison are the Ford Bronco Sport, Buick Envista, Acura RDX, and Volkswagen Taos. Average rates are slightly more for those models than the cheapest small SUVs that rank near the top, but they still have an average insurance cost of $1,698 or less per year in Kaneohe.

The next table details the vehicles with the cheapest overall insurance rates in Kaneohe, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,442 | $120 |

| 2 | Chevrolet Trailblazer | $1,466 | $122 |

| 3 | Kia Soul | $1,522 | $127 |

| 4 | Nissan Kicks | $1,536 | $128 |

| 5 | Honda Passport | $1,556 | $130 |

| 6 | Buick Envision | $1,564 | $130 |

| 7 | Toyota Corolla Cross | $1,574 | $131 |

| 8 | Hyundai Venue | $1,586 | $132 |

| 9 | Mazda CX-5 | $1,592 | $133 |

| 10 | Ford Bronco Sport | $1,598 | $133 |

| 11 | Volkswagen Tiguan | $1,616 | $135 |

| 12 | Acura RDX | $1,632 | $136 |

| 13 | Nissan Murano | $1,640 | $137 |

| 14 | Buick Encore | $1,658 | $138 |

| 15 | Subaru Outback | $1,662 | $139 |

| 16 | Honda CR-V | $1,664 | $139 |

| 17 | Buick Envista | $1,668 | $139 |

| 18 | Volkswagen Taos | $1,672 | $139 |

| 19 | Kia Niro | $1,680 | $140 |

| 20 | Honda HR-V | $1,698 | $142 |

| 21 | Toyota GR Corolla | $1,698 | $142 |

| 22 | Subaru Ascent | $1,700 | $142 |

| 23 | Nissan Leaf | $1,708 | $142 |

| 24 | Chevrolet Colorado | $1,720 | $143 |

| 25 | Honda Civic | $1,730 | $144 |

| 26 | Lexus NX 250 | $1,730 | $144 |

| 27 | Volkswagen Atlas | $1,732 | $144 |

| 28 | Acura Integra | $1,734 | $145 |

| 29 | Subaru Forester | $1,738 | $145 |

| 30 | Volkswagen Atlas Cross Sport | $1,740 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Kaneohe, HI Zip Codes. Updated October 24, 2025

Some additional models worth noting making the top 30 above include the Subaru Ascent, the Honda HR-V, the Volkswagen Atlas, and the Acura Integra. Average auto insurance rates for those vehicles cost between $1,698 and $1,740 per year.

To help gauge how cheap these rates are, some examples of more expensive insurance rates include the Ford Mustang Mach-E at $190 per month, the Dodge Challenger at an average of $245, and the Tesla Model X which averages $205.

Kaneohe car insurance cost

Average auto insurance cost in Kaneohe is $1,956 per year, or around $163 per month for a full-coverage car insurance policy. It costs 15.1% less to insure the average vehicle in Kaneohe, HI, than the U.S. average rate of $2,276.

In the state of Hawaii, the average price for car insurance is $1,964 per year, so the average rate in Kaneohe is $8 less per year. The cost of auto insurance in Kaneohe compared to other Hawaii cities is approximately $18 per year cheaper than in Waipahu, $66 per year less than in Hilo, and $10 per year more expensive than in Pearl City.

The age of the rated driver is one of the biggest determining factors on the cost of auto insurance. The list below details how age impacts cost by showing average car insurance rates based on the age of the driver.

Kaneohe, Hawaii, car insurance cost by driver age

- 16-year-old driver – $6,956 per year or $580 per month

- 17-year-old driver – $6,741 per year or $562 per month

- 18-year-old driver – $6,042 per year or $504 per month

- 19-year-old driver – $5,504 per year or $459 per month

- 20-year-old driver – $3,930 per year or $328 per month

- 30-year-old driver – $2,084 per year or $174 per month

- 40-year-old driver – $1,956 per year or $163 per month

- 50-year-old driver – $1,730 per year or $144 per month

- 60-year-old driver – $1,620 per year or $135 per month

The chart below shows average Kaneohe, HI, auto insurance cost broken out not only by driver age, but also by physical damage deductibles. Rates are averaged for all 2024 vehicle models including luxury cars and SUVs.

Average car insurance rates in the previous chart range from $1,370 per year for a policy with high deductibles for a 60-year-old driver to $4,570 per year for a 20-year-old driver with low physical damage deductibles.

When these rates are converted to a cost per month, the average cost of car insurance per month in Kaneohe ranges from $114 to $381.

The next section goes into detail about the average cost of car insurance by vehicle segment. The average rates shown in the chart will give you a decent understanding of which types of cars, trucks, and SUVs that have the best average auto insurance rates.

Cheapest auto insurance rates by vehicle type

If you’re shopping for a new vehicle, it is useful to know which types of vehicles have more favorable car insurance rates.

As an example, many people wonder if compact SUVs are more affordable to insure than minivans or if luxury cars cost less to insure than sports cars.

The chart below shows average car insurance rates in Kaneohe for different vehicle segments. From an overall average perspective, small SUVs and midsize pickups have the best average auto insurance rates, while large luxury, performance, and sports cars have the highest average cost to insure.

It’s best to use the average rates by segment as a general guide to which types of vehicles have the cheapest car insurance. But you’ll want to dig down to the model level to find out which vehicles in each segment have the best rates.

For example, in the small SUV segment, average Kaneohe insurance rates range from the Subaru Crosstrek costing $1,442 per year to the Ford Mustang Mach-E costing $2,282 per year. Also, in the midsize luxury car segment, insurance rates vary from the Mercedes-Benz CLA250 costing $2,008 per year to the BMW M8 costing $3,290 per year, a difference of $1,282 just for that segment.

In the following list, you can see the individual model with the cheapest insurance in Kaneohe, HI, for each different segment.

- Cheapest compact car insurance – Toyota GR Corolla at $1,698 per year or $142 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,442 per year or $120 per month

- Cheapest midsize car insurance – Kia K5 at $1,880 per year or $157 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,556 per year or $130 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,858 per year or $155 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,834 per year or $153 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,720 per year or $143 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,826 per year or $152 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $1,988 per year or $166 per month

- Cheapest minivan insurance – Honda Odyssey at $1,782 per year or $149 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,806 per year or $151 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,734 per year or $145 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,632 per year or $136 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,008 per year or $167 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,826 per year or $152 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,320 per year or $193 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,190 per year or $183 per month

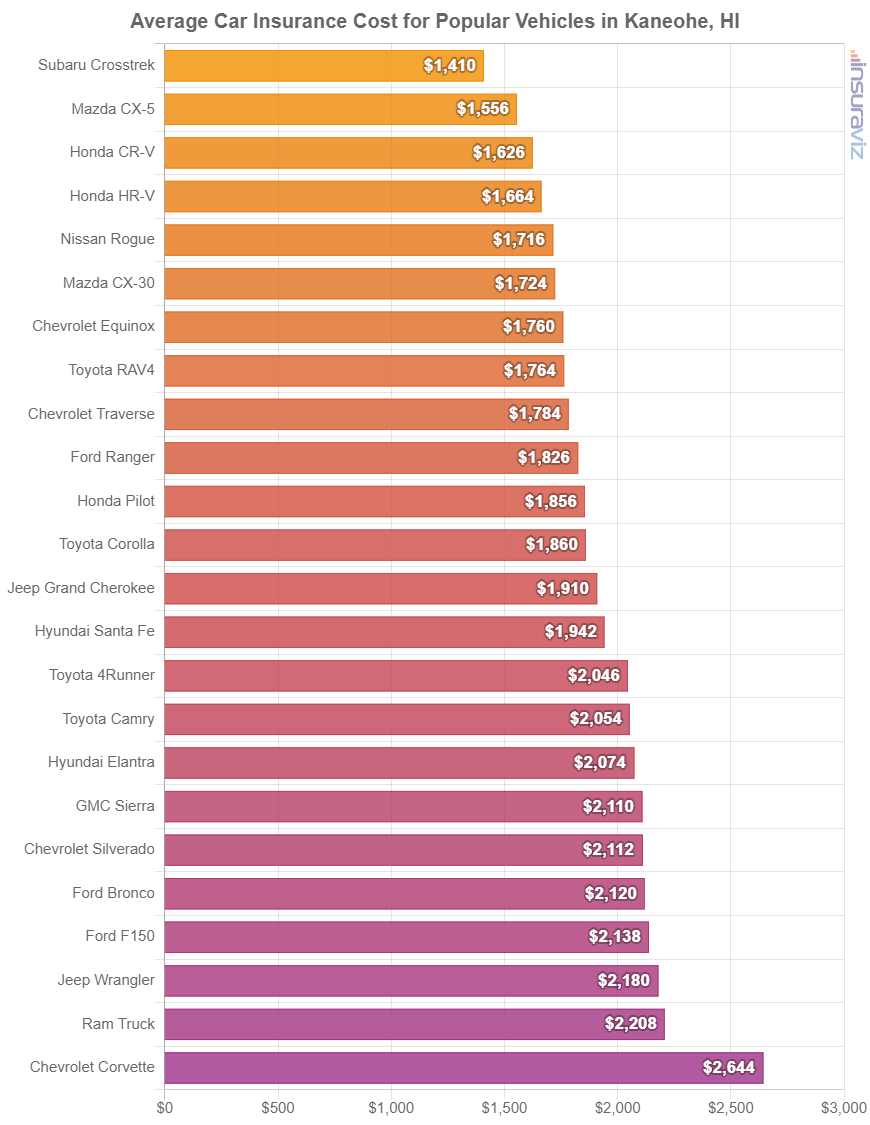

Popular models and the cost of insurance

The car insurance rates mentioned up to this point consist of an average based on every 2024 vehicle model, which is practical for making generalized comparisons such as the cost difference between two locations.

Average auto insurance rates are great when presented with a question like “are Kaneohe car insurance rates cheaper than in Honolulu?” or “is car insurance in Hawaii cheaper than Colorado?”.

But for more useful price comparisons, we get better data if we do a rate analysis for the exact make and model of vehicle being insured. Each individual model has slightly different risk exposures for physical damage and liability claims, and this data allows us to make more detailed cost analysis.

The following chart shows average insurance cost for some of the more popular models that you’ll see on the streets of Kaneohe.

Vehicles popular with drivers in Kaneohe tend to be compact or midsize sedans like the Toyota Corolla and Toyota Camry and compact or midsize SUVs like the Chevy Equinox, Ford Escape, and Toyota Highlander.

Additional popular vehicles from other segments include luxury SUVs like the Acura MDX and Lexus RX 350, luxury cars like the Acura ILX and BMW 530i, and pickup trucks like the Toyota Tacoma and Ford Ranger.

If we see how many popular models from the chart above are included in the prior table that ranked the 30 vehicles with the cheapest insurance, most of the top-selling models don’t even rank in the top 30.

This could be the result of a high replacement cost for the vehicle, like a BMW X5 with an average MSRP of $65,200 or a Porsche Taycan that has an average price of $90,900, or perhaps higher liability insurance cost like a GMC Yukon XL, Jeep Wrangler, or Ford F-250 Super Duty pickup.

We covered a lot of data up to this point, so here is a quick summary of the most relevant points.

- Kaneohe, Hawaii, car insurance cost is less than the U.S. average – $1,956 (Kaneohe average) compared to $2,276 (U.S. average)

- Car insurance is generally cheaper as you get older – Car insurance rates for a 60-year-old driver in Kaneohe are $2,310 per year cheaper than for a 20-year-old driver.

- Insuring teens gets very expensive – Average cost ranges from $4,652 to $6,956 per year for teenage driver insurance in Kaneohe, Hawaii.

- Kaneohe auto insurance prices are cheaper than the Hawaii state average – $1,956 (Kaneohe average) compared to $1,964 (Hawaii average)

- Teenage girls pay less than teen males – Teenage females pay $852 to $454 less each year than males of the same age.

- Lower deductible car insurance is more expensive than high deductible – A 20-year-old driver pays an average of $1,048 more per year for $250 physical damage deductibles versus $1,000.

Tips for cheaper Kaneohe car insurance rates

Kaneohe drivers should always be looking to save money on insurance. So take a minute and read through the money-saving ideas in this next list and maybe you can save a little cash on your next renewal.

- Compare auto insurance rates before buying a car. Different models, and even different trim levels of the same model, have significantly different auto insurance rates, and companies charge a wide range of prices. Get plenty of comparison quotes before you purchase in order to avoid insurance sticker shock when you receive your first bill.

- Safer drivers pay lower rates. Causing too many accidents will raise rates, potentially as much as $2,786 per year for a 20-year-old driver and as much as $474 per year for a 60-year-old driver. So be a cautious driver and save.

- Avoid tickets to save money. If you want affordable auto insurance in Kaneohe, it pays to be a good, safe driver. Not surprisingly, just a couple of blemishes on your driving record could end up increasing policy cost as much as $516 per year. Serious violations like driving on a suspended license could raise rates by an additional $1,814 or more.

- Cheaper rates come with better credit scores. Having a credit score above 800 could save as much as $307 per year compared to a good rating of 670-739. Conversely, a credit score below 579 could cost as much as $356 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Policy discounts save money. Discounted rates may be available if the insureds belong to certain professional organizations, are military or federal employees, choose electronic billing, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average Kaneohe driver as much as $334 per year on their insurance cost.