- For the cheapest auto insurance in Shawnee, compact SUV models like the Toyota Corolla Cross, Chevrolet Trailblazer, Kia Soul, and Nissan Kicks rank near the top.

- A few models with the most affordable car insurance in Shawnee in their segment include the Nissan Titan (full-size pickup), Mercedes-Benz CLA250 (midsize luxury car), Audi A5 (full-size luxury car), and Kia K5 (midsize car).

Cheapest car insurance in Shawnee

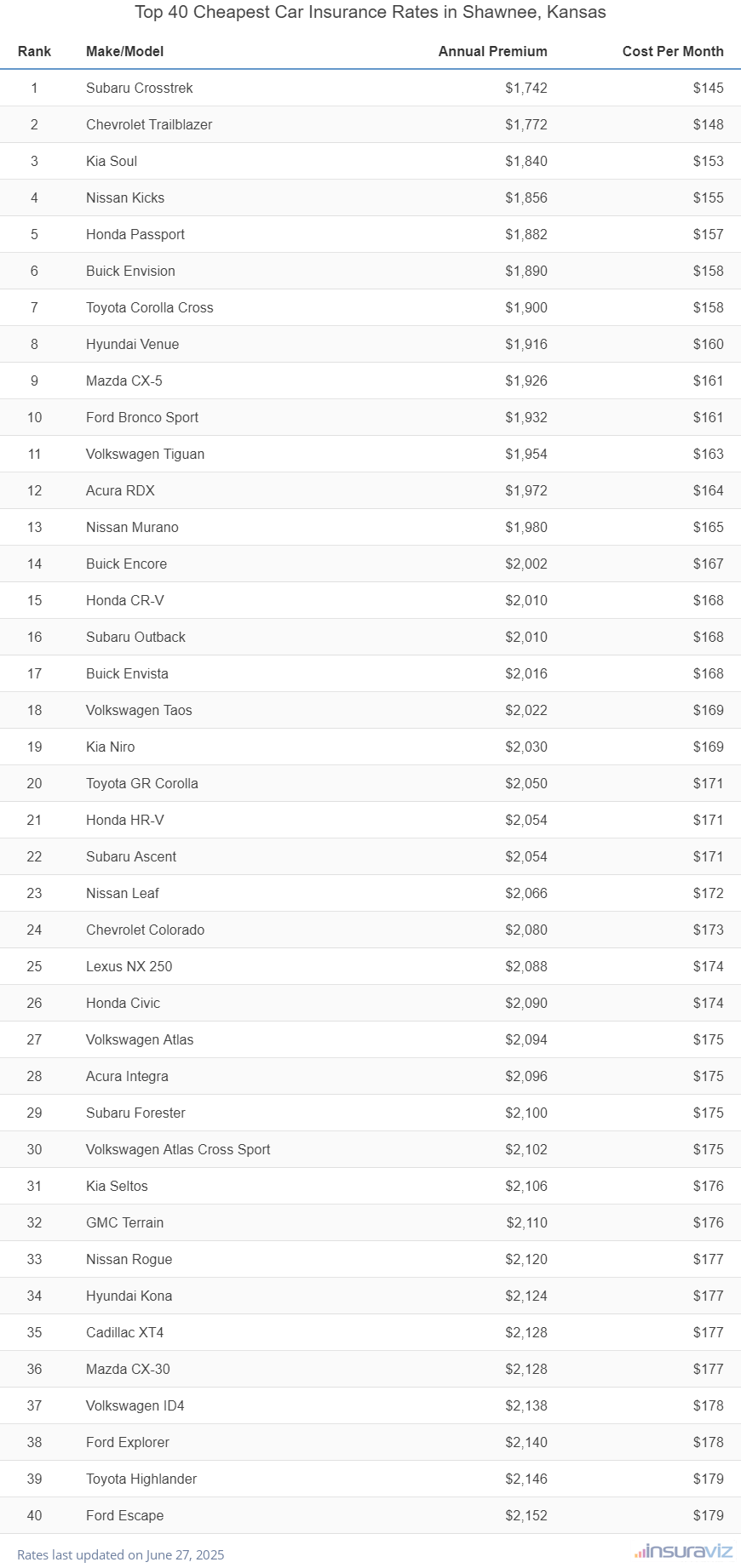

When all car, SUV, and pickup insurance rates are compared, the models with the best car insurance prices in Shawnee tend to be small SUVs like the Subaru Crosstrek, Kia Soul, Toyota Corolla Cross, and Buick Envision. Average car insurance rates for vehicles ranked in the top ten cost $164 or less per month for full coverage.

Some additional vehicles that have affordable insurance prices in our car insurance price comparison are the Ford Bronco Sport, Buick Encore, Buick Envista, and Kia Niro. Average car insurance rates are somewhat higher for those models than the cheapest crossover SUVs at the top of the rankings, but they still have an average cost of $2,088 or less per year ($174 per month).

The next table lists the cheapest vehicles to insure in Shawnee, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,776 | $148 |

| 2 | Chevrolet Trailblazer | $1,806 | $151 |

| 3 | Kia Soul | $1,876 | $156 |

| 4 | Nissan Kicks | $1,892 | $158 |

| 5 | Honda Passport | $1,914 | $160 |

| 6 | Buick Envision | $1,926 | $161 |

| 7 | Toyota Corolla Cross | $1,934 | $161 |

| 8 | Hyundai Venue | $1,952 | $163 |

| 9 | Mazda CX-5 | $1,960 | $163 |

| 10 | Ford Bronco Sport | $1,966 | $164 |

| 11 | Volkswagen Tiguan | $1,990 | $166 |

| 12 | Acura RDX | $2,010 | $168 |

| 13 | Nissan Murano | $2,018 | $168 |

| 14 | Buick Encore | $2,042 | $170 |

| 15 | Subaru Outback | $2,048 | $171 |

| 16 | Honda CR-V | $2,050 | $171 |

| 17 | Buick Envista | $2,052 | $171 |

| 18 | Volkswagen Taos | $2,056 | $171 |

| 19 | Kia Niro | $2,068 | $172 |

| 20 | Toyota GR Corolla | $2,088 | $174 |

| 21 | Honda HR-V | $2,090 | $174 |

| 22 | Subaru Ascent | $2,092 | $174 |

| 23 | Nissan Leaf | $2,104 | $175 |

| 24 | Chevrolet Colorado | $2,116 | $176 |

| 25 | Honda Civic | $2,126 | $177 |

| 26 | Lexus NX 250 | $2,126 | $177 |

| 27 | Volkswagen Atlas | $2,132 | $178 |

| 28 | Acura Integra | $2,136 | $178 |

| 29 | Subaru Forester | $2,138 | $178 |

| 30 | Volkswagen Atlas Cross Sport | $2,142 | $179 |

| 31 | Kia Seltos | $2,144 | $179 |

| 32 | GMC Terrain | $2,150 | $179 |

| 33 | Nissan Rogue | $2,158 | $180 |

| 34 | Hyundai Kona | $2,162 | $180 |

| 35 | Mazda CX-30 | $2,164 | $180 |

| 36 | Cadillac XT4 | $2,170 | $181 |

| 37 | Volkswagen ID4 | $2,178 | $182 |

| 38 | Ford Explorer | $2,180 | $182 |

| 39 | Toyota Highlander | $2,188 | $182 |

| 40 | Ford Escape | $2,192 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shawnee, KS Zip Codes. Updated October 24, 2025

Other models ranked in the top 40 table above include the Ford Explorer, Mazda CX-30, Chevrolet Colorado, Nissan Leaf, and Lexus NX 250. Car insurance rates for those vehicles cost between $2,088 and $2,192 per year in Shawnee, KS.

To help put these rates in perspective, a few examples that have more expensive insurance rates include the Dodge Charger that costs $288 per month, the Chevrolet Camaro that costs $260, and the Audi e-tron which averages $250.

This next article section goes into more detail about the average cost of auto insurance for each vehicle segment. This should give a good idea of the automotive segments that have the best average car insurance rates.

Cheapest types of vehicles to insure

If you’re shopping around for a different vehicle, it’s useful to have a basic understanding of which kinds of vehicles are less expensive to insure.

For instance, you may be wondering if midsize SUVs are cheaper to insure than full-size SUVs or if luxury cars or SUVs have more expensive insurance than non-luxury models.

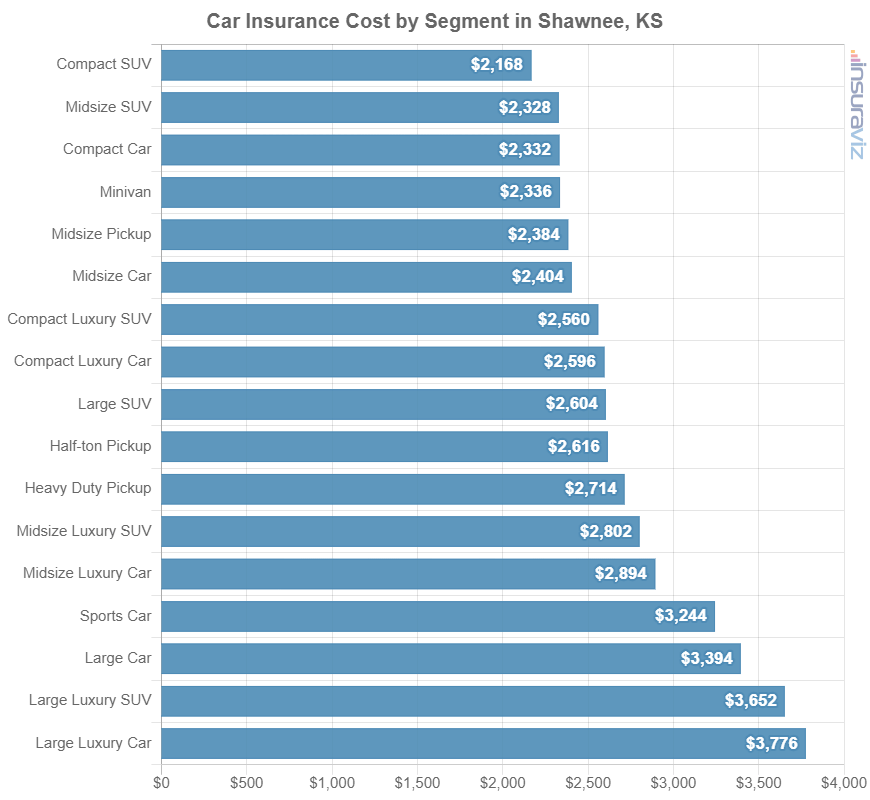

The chart below displays average auto insurance rates in Shawnee for different vehicle segments. From an overall average perspective, compact SUVs and midsize pickup trucks have the least expensive rates, with exotic performance models having the most expensive insurance.

It’s fine to use cost by segment as a starting point, as better rate data is available if you use individual model rates to find the cheapest vehicles to insure in a specific segment.

For example, in the large luxury SUV segment, rates range from the Infiniti QX80 at $2,694 per year to the Mercedes-Benz G63 AMG costing $5,166 per year. Also, in the sports car segment, the average cost of insurance can vary from the Mazda MX-5 Miata at $2,224 per year to the Mercedes-Benz SL 63 at $4,940 per year, a difference of $2,716 just for that segment.

How much does car insurance cost in Shawnee?

In Shawnee, the average car insurance expense is $2,402 per year, which is 5.4% more than the U.S. overall average rate of $2,276. Per month, Shawnee car insurance costs about $200 per month for full coverage auto insurance.

In Kansas, the average cost of car insurance is $2,494 per year, so the average cost of auto insurance in Shawnee is $92 less per year.

The cost to insure a car in Shawnee compared to other Kansas cities is $20 per year more expensive than in Lawrence, $4 per year more than in Olathe, and $8 per year less than in Overland Park.

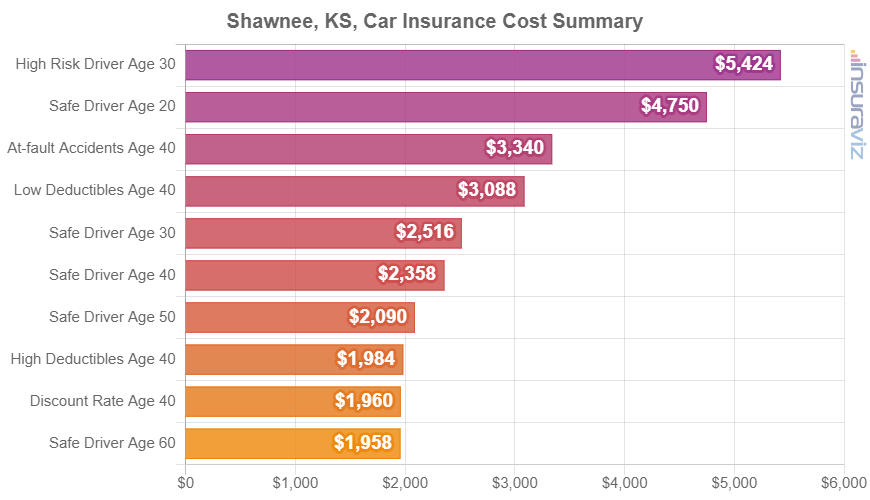

The chart below shows different average Shawnee car insurance rates based on a range of driver ages and common risk profiles.

The average cost of auto insurance per month in Shawnee is $200, with policy premium ranging from $166 to $461 for the data in the chart above.

Shawnee auto insurance rates can have significant differences in cost and depend on a lot of factors. Since there is so much rate volatility, this reinforces the need for accurate car insurance quotes when shopping online for a cheaper auto insurance policy.

Driver age is one of the biggest factors in determining the price you pay for car insurance, so the list below illustrates this by showing the difference in average car insurance rates in Shawnee based on the age of the driver.

Average car insurance cost for Shawnee, Kansas, drivers age 16 to 60

- 16-year-old rated driver – $8,560 per year or $713 per month

- 17-year-old rated driver – $8,294 per year or $691 per month

- 18-year-old rated driver – $7,433 per year or $619 per month

- 19-year-old rated driver – $6,767 per year or $564 per month

- 20-year-old rated driver – $4,836 per year or $403 per month

- 30-year-old rated driver – $2,564 per year or $214 per month

- 40-year-old rated driver – $2,402 per year or $200 per month

- 50-year-old rated driver – $2,130 per year or $178 per month

- 60-year-old rated driver – $1,994 per year or $166 per month

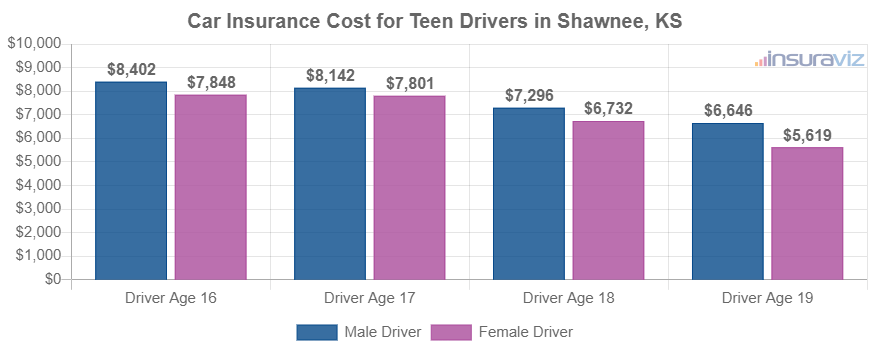

The rates listed above for teenage drivers were based on a male driver. The chart below goes into more detail regarding the cost of insuring teen drivers and separates average teen driver rates in Shawnee by gender. Teenage females tend to have cheaper car insurance rates than their male counterparts.

Auto insurance for a 16-year-old female in Shawnee costs an average of $563 less per year than the cost to insure a male driver, while at age 19, the cost difference is significantly less but still $1,044 per year.

To try to clarify how much car insurance cost can vary for different applicants, the sections below show many different rates for five popular vehicles in Shawnee: the Ram Truck, Honda Civic, Toyota Highlander, Toyota Camry, and Ford Mustang.

The example for each vehicle shows average rates for different profiles to demonstrate the cost difference based on multiple scenarios.

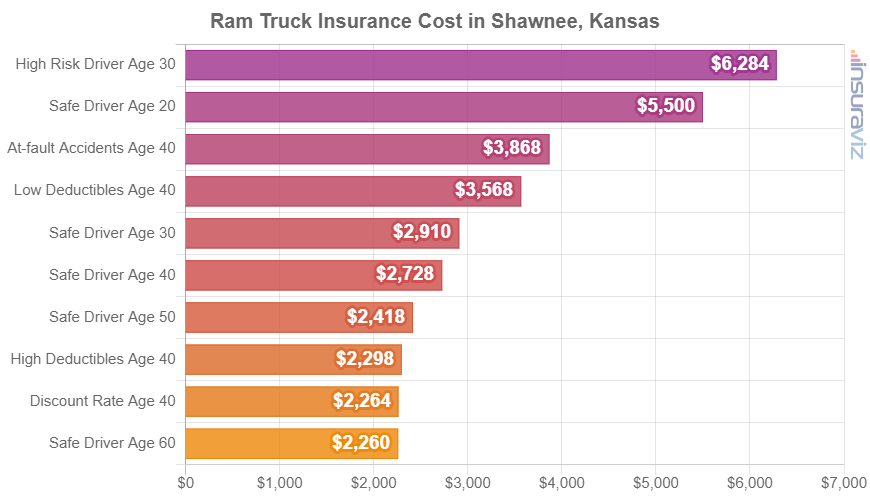

Ram Truck insurance rates

With prices ranging from $43,270 to $109,435, average Shawnee car insurance rates on a Ram Truck range from $2,456 per year on the Ram Truck Tradesman Crew Cab 4WD model up to $3,040 per year for the Ram Truck TRX Final Edition 4WD.

From a cost per month standpoint, full-coverage auto insurance for the Ram Truck for a middle-age safe driver can range from $205 to $253 per month, depending on your car insurance company and exact Zip Code in Shawnee.

The rate chart below may help you understand how insurance rates on a Ram Truck can range considerably for a variety of driver ages and possible risk profiles.

The Ram Truck is considered a full-size truck, and additional similar models include the Toyota Tundra, Ford F150, and GMC Sierra.

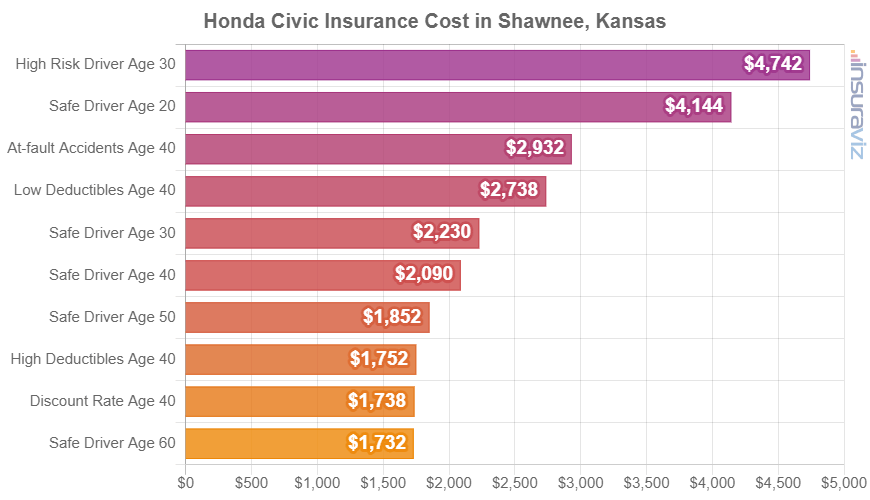

Honda Civic insurance rates

The average rate paid for Honda Civic insurance in Shawnee is $2,126 per year. With a purchase price ranging from $23,950 to $43,795, average car insurance quotes on a Honda Civic range from $1,902 per year for the Honda Civic LX model up to $2,520 per year for the Honda Civic Type R trim.

The chart below demonstrates how insurance quotes for a Honda Civic can change based on driver age, policy deductibles, and risk profiles.

For our example drivers, rates range from $1,770 to $4,830 per year, which is a difference of $3,060 caused by changes to the driver risk profile.

The Honda Civic belongs to the compact car segment, and other similar models that are popular in Shawnee include the Hyundai Elantra, Chevrolet Cruze, and Toyota Corolla.

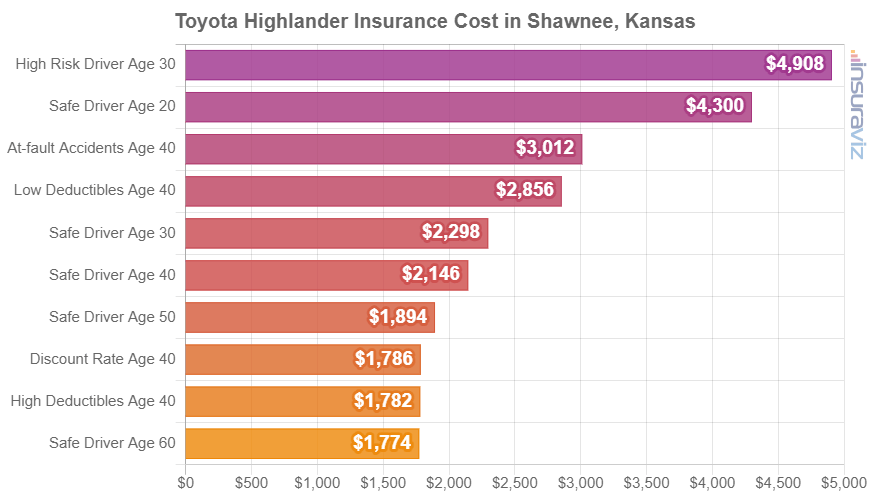

Toyota Highlander insurance rates

Average Toyota Highlander insurance cost in Shawnee ranges from $2,010 up to $2,374 per year. The most affordable model to insure is the $37,625 Toyota Highlander LE 2WD, while the most expensive to insure is the $43,825 Toyota Highlander Hybrid XLE AWD trim level.

The next chart illustrates how the cost of car insurance for a Toyota Highlander can range significantly based on a number of different driver ages and policy risk profiles.

For our example drivers, rates range from $1,818 to $4,998 per year, which is a difference in cost of $3,180 caused by changes in driver risk.

The Toyota Highlander is classified as a midsize SUV, and other similar models from the same segment include the Kia Sorento, Kia Telluride, and Ford Explorer.

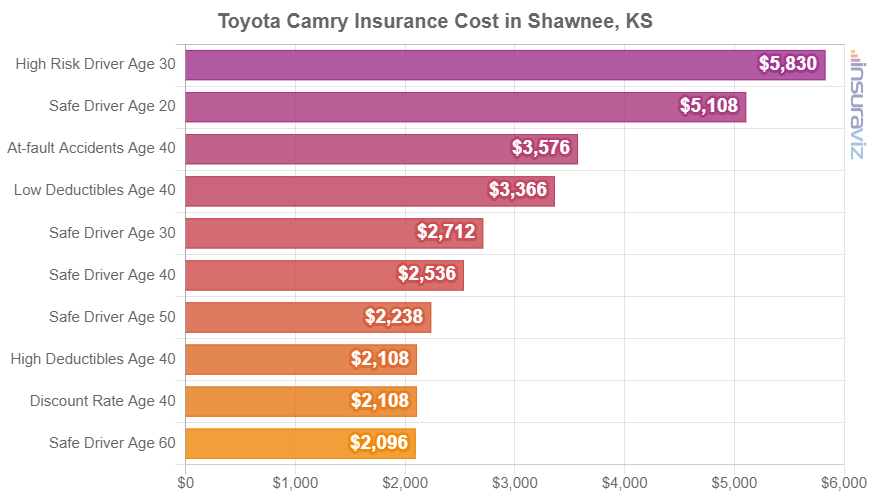

Toyota Camry insurance rates

Toyota Camry insurance in Shawnee averages $2,582 per year, ranging from $2,374 per year on the Toyota Camry LE model up to $2,712 per year for the Toyota Camry XSE AWD model.

The chart displayed below shows how the cost of insurance on a Toyota Camry can range significantly based on different driver ages, physical damage deductibles, and driver risk profiles. In this example, rates range from $2,146 to $5,936 per year, which is a cost difference of $3,790 for insurance on the same vehicle.

The Toyota Camry is classified as a midsize car, and other similar models include the Nissan Altima, Chevrolet Malibu, and Honda Accord.

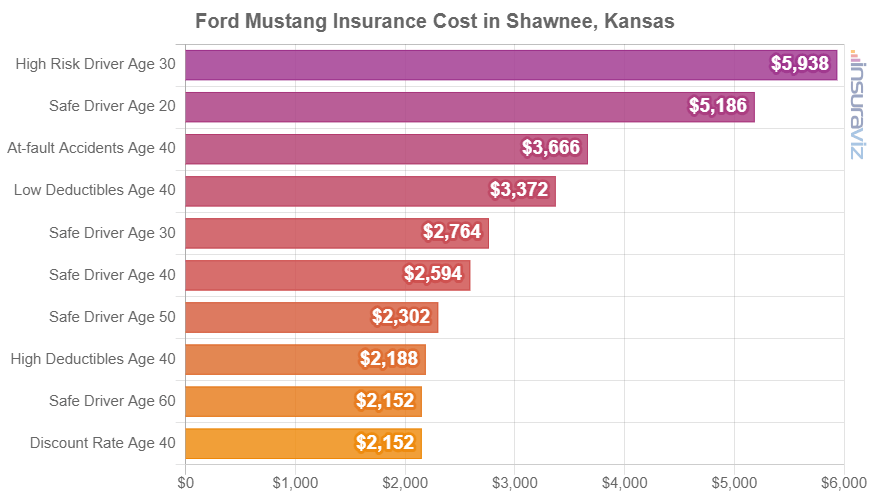

Ford Mustang insurance rates

With a purchase price ranging from $30,920 to $63,265, average Shawnee insurance rates for a 2024 Ford Mustang range from $2,260 per year for the Ford Mustang Ecoboost Fastback model up to $2,882 per year for the Ford Mustang Dark Horse Premium trim.

The rate chart below shows how auto insurance quotes on a Ford Mustang can change based on different driver ages, policy deductibles, and potential risk scenarios. In this example, cost ranges from $2,192 to $6,048 per year, which is a cost difference of $3,856.

The Ford Mustang is classified as a sports car, and other models from that segment that are popular in Shawnee, KS, include the Subaru BRZ, Chevrolet Camaro, Toyota GR Supra, and Chevrolet Corvette.