- Kenner car insurance rates average $3,046 per year for full coverage, or about $254 on a monthly basis.

- Models like the Subaru Crosstrek, Toyota Corolla Cross, and Nissan Kicks have the best chance of receiving cheap car insurance in Kenner.

- Models with segment-leading car insurance rates in Kenner include the Mercedes-Benz CLA250, Chrysler 300, Jaguar E-Pace, and Toyota GR Corolla.

How much does car insurance cost in Kenner?

The average car insurance cost in Kenner is $3,046 per year, which is 28.9% more than the national average rate of $2,276. The average cost of car insurance per month in Kenner is $254 for a policy that provides full coverage.

In the state of Louisiana, the average price for car insurance is $2,696 per year, so the cost in Kenner averages $350 more per year. The average cost of car insurance in Kenner compared to other Louisiana locations is $436 per year more than in Lafayette, $596 per year more expensive than in Shreveport, and $492 per year more expensive than in Lake Charles.

The age of the driver has the biggest impact on the price of auto insurance, so the list below details how driver age influences cost by breaking out average car insurance rates for drivers from 16 to 60.

Car insurance cost in Kenner, LA, for drivers age 16 to 60

- 16-year-old rated driver – $10,858 per year or $905 per month

- 17-year-old rated driver – $10,520 per year or $877 per month

- 18-year-old rated driver – $9,430 per year or $786 per month

- 19-year-old rated driver – $8,584 per year or $715 per month

- 20-year-old rated driver – $6,134 per year or $511 per month

- 30-year-old rated driver – $3,252 per year or $271 per month

- 40-year-old rated driver – $3,046 per year or $254 per month

- 50-year-old rated driver – $2,700 per year or $225 per month

- 60-year-old rated driver – $2,530 per year or $211 per month

The chart below shows additional data for the 20 to 60-year-old age groups by including rates for three different comprehensive and collision deductibles. These extra data points can aid in understanding how auto insurance cost increases with lower deductibles, and decreases on a high-deductible policy.

Average car insurance rates in the chart range from $2,140 per year for a high deductible policy for a 60-year-old driver to $7,134 per year for a 20-year-old driver with a low deductible policy.

When the average rates are converted to monthly figures, the average cost of car insurance per month in Kenner ranges from $178 to $595.

Kenner car insurance rates can be extremely variable and small changes in driver risk profiles can have meaningful effects on car insurance cost. The potential for large differences in cost stresses the need to get multiple auto insurance quotes when shopping around for a better price on car insurance in Kenner.

Which vehicles are cheapest to insure?

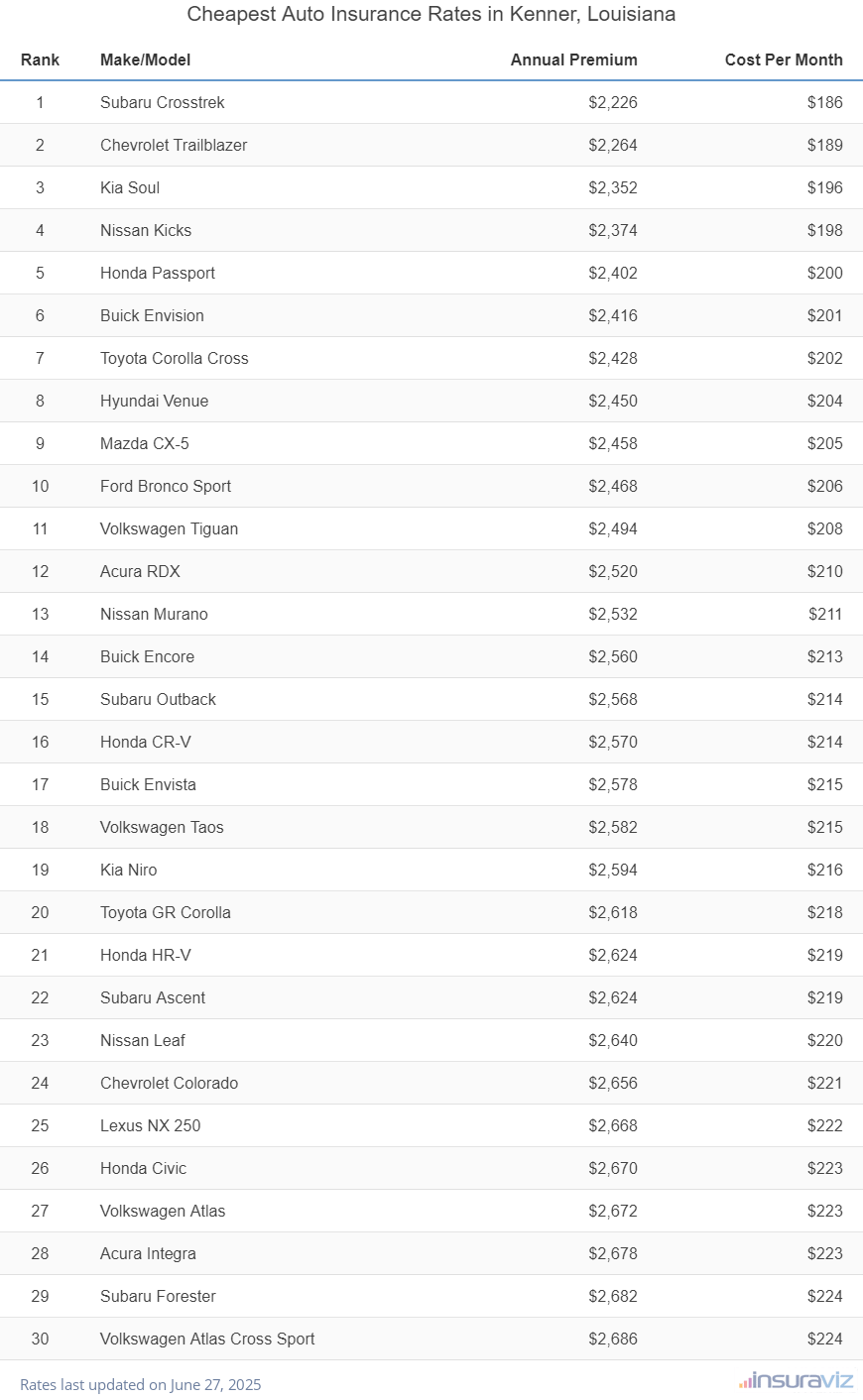

The vehicles with the most affordable insurance prices in Kenner, LA, tend to be crossover SUVs like the Chevrolet Trailblazer, Kia Soul, and Nissan Kicks.

Average auto insurance rates for cars and SUVs in the top 10 cost $2,496 or less per year ($208 per month) for full coverage.

Additional models that are highly ranked in our car insurance price comparison are the Nissan Murano, Buick Envista, Subaru Outback, and Acura RDX. Average cost is a little higher for those models than the small SUVs and crossovers that rank at the top, but they still have an average cost of $2,650 or less per year ($221 per month) in Kenner.

The next table lists the 30 models with the cheapest car insurance in Kenner, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,252 | $188 |

| 2 | Chevrolet Trailblazer | $2,292 | $191 |

| 3 | Kia Soul | $2,380 | $198 |

| 4 | Nissan Kicks | $2,402 | $200 |

| 5 | Honda Passport | $2,428 | $202 |

| 6 | Buick Envision | $2,444 | $204 |

| 7 | Toyota Corolla Cross | $2,456 | $205 |

| 8 | Hyundai Venue | $2,474 | $206 |

| 9 | Mazda CX-5 | $2,486 | $207 |

| 10 | Ford Bronco Sport | $2,496 | $208 |

| 11 | Volkswagen Tiguan | $2,524 | $210 |

| 12 | Acura RDX | $2,550 | $213 |

| 13 | Nissan Murano | $2,562 | $214 |

| 14 | Buick Encore | $2,590 | $216 |

| 15 | Subaru Outback | $2,596 | $216 |

| 16 | Honda CR-V | $2,600 | $217 |

| 17 | Buick Envista | $2,606 | $217 |

| 18 | Volkswagen Taos | $2,612 | $218 |

| 19 | Kia Niro | $2,624 | $219 |

| 20 | Toyota GR Corolla | $2,650 | $221 |

| 21 | Subaru Ascent | $2,652 | $221 |

| 22 | Honda HR-V | $2,654 | $221 |

| 23 | Nissan Leaf | $2,670 | $223 |

| 24 | Chevrolet Colorado | $2,686 | $224 |

| 25 | Lexus NX 250 | $2,698 | $225 |

| 26 | Honda Civic | $2,700 | $225 |

| 27 | Volkswagen Atlas | $2,704 | $225 |

| 28 | Acura Integra | $2,712 | $226 |

| 29 | Subaru Forester | $2,714 | $226 |

| 30 | Volkswagen Atlas Cross Sport | $2,716 | $226 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Kenner, LA Zip Codes. Updated October 24, 2025

Some other popular models ranking in the top 30 above include the Chevrolet Colorado, the Volkswagen Atlas, the Honda Civic, and the Nissan Leaf. Rates for those models fall between $2,650 and $2,716 per year in Kenner, LA.

As a comparison, some vehicles that cost more to insure include the Tesla Model 3 that costs $3,580 per year, the Audi A4 that averages $3,508, and the Infiniti Q50 at an average of $3,450.

The section below further discusses the average cost of car insurance in Kenner for each different automotive segment. The average rates shown will provide a good idea of the general vehicle types that have the cheapest rates. Then the sections after the chart break out the cheapest rates for individual vehicles for each automotive segment.

Types of vehicles with the cheapest car insurance

If a different vehicle is in your future, it’s in your best interest to know which kinds of vehicles have less expensive car insurance rates. As an example, some common questions are if minivans are more affordable to insure than SUVs or which size of luxury car has more affordable insurance.

The chart below displays average car insurance cost by vehicle segment in Kenner. As a general rule, compact and midsize SUVs, vans, and midsize pickups have the least expensive rates, with high-performance exotic models having the highest average insurance cost.

Average rates by automotive segment are close enough for overall comparisons, but cost varies significantly within each automotive segment displayed above.

For example, in the small luxury car segment, average Kenner auto insurance rates range from the Acura Integra costing $2,712 per year for a full coverage policy up to the BMW M340i at $3,724 per year, a difference of $1,012 just for that segment. As another example, in the small car segment, average rates can range from the Toyota GR Corolla costing $2,650 per year up to the Toyota Mirai at $3,794 per year.

Risk factors and price variation

In an effort to clarify the extent to which auto insurance cost can fluctuate for different drivers (and also stress the importance of getting multiple quotes), the examples below have a large range of rates for five popular vehicles in Kenner: the Chevrolet Silverado, Honda CR-V, Kia Sorento, Toyota Camry, and Chevrolet Camaro.

Each chart uses a range of risk profiles to demonstrate the variation based on driver risk and policy coverages.

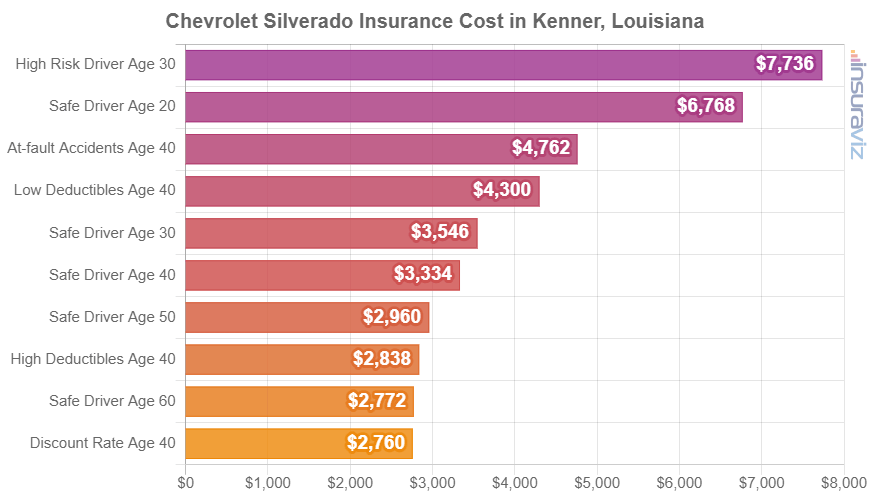

Chevrolet Silverado insurance rates

Average Chevrolet Silverado insurance cost in Kenner ranges from $2,854 to $3,996 per year. The least-expensive model to insure is the $39,900 Chevrolet Silverado EV WT trim, while the most expensive model to insure is the $105,000 Chevrolet Silverado EV RST First Edition.

The next chart should aid in understanding how insurance rates for a Chevrolet Silverado can vary based on driver age, physical damage deductibles, and driver risk profiles. For our selected driver profiles, prices range from $2,792 to $7,828 per year, which is a cost difference of $5,036 per year due primarily to driver risk.

The Chevrolet Silverado is a full-size truck, and other popular models in the same segment include the Ford F150, GMC Sierra, and Toyota Tundra.

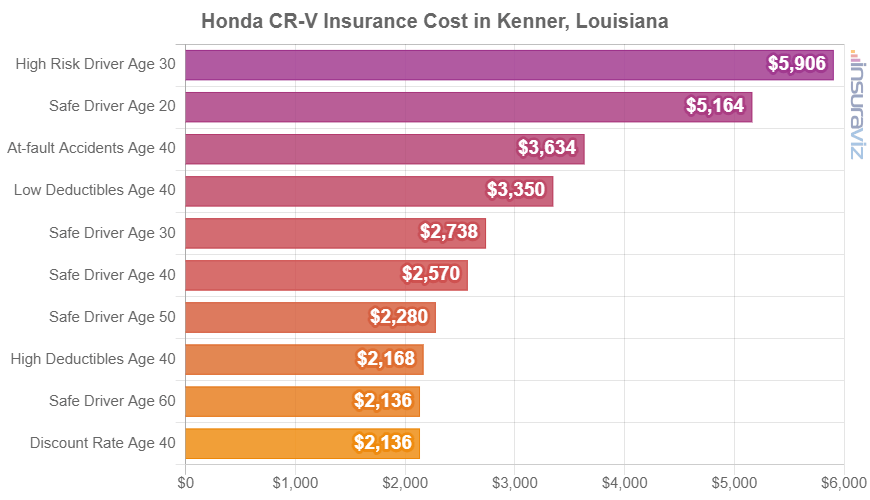

Honda CR-V insurance rates

Average Honda CR-V insurance cost in Kenner costs from $2,466 up to $2,744 per year. The least-expensive insurance will be on the $29,500 Honda CR-V LX trim level, while the trim with the most expensive average rate is the $39,850 Honda CR-V Sport Touring Hybrid AWD model.

When Kenner insurance rates on a Honda CR-V are compared to the national average cost for the same model, rates are anywhere from $524 to $584 more per year in Kenner, depending on the exact model being insured.

The bar chart below should aid in understanding how insurance rates for a Honda CR-V can be very different based on different driver ages and common risk profiles.

The Honda CR-V is part of the compact SUV segment, and other models in the same segment include the Toyota RAV4, Nissan Rogue, and Subaru Forester.

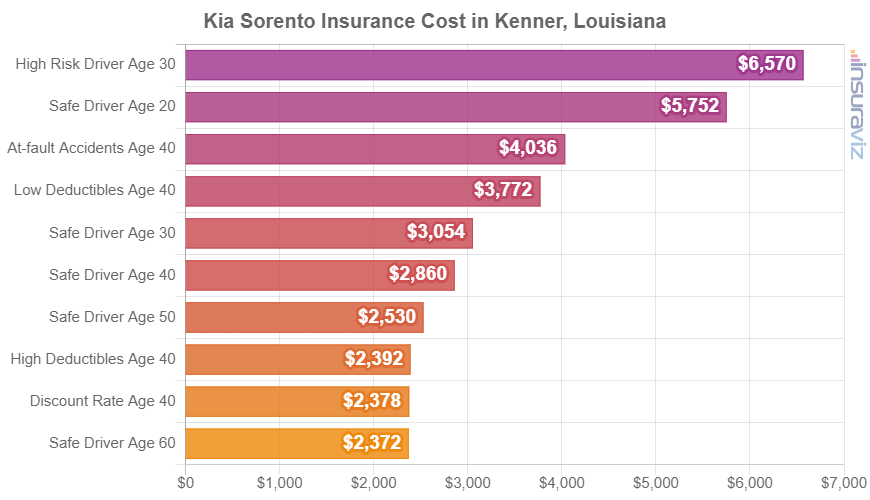

Kia Sorento insurance rates

Kia Sorento insurance in Kenner averages $2,894 per year, with rates ranging from a low of $2,650 per year on the Kia Sorento LX trim level up to $3,112 per year for the Kia Sorento SX Prestige Plug-in Hybrid trim level.

When Kenner car insurance rates for the Kia Sorento are compared with national average insurance rates on the same model, rates are anywhere from $562 to $662 more per year in Kenner, depending on the model being insured.

As a cost per month, full-coverage auto insurance on the Kia Sorento can range from $221 to $259 per month, depending on exactly where you live in Kenner.

The next chart may be useful to help you comprehend how auto insurance quotes for a Kia Sorento can be quite different based on different driver ages, risk profiles, and policy deductibles.

The Kia Sorento is part of the midsize SUV segment, and other similar models include the Kia Telluride, Ford Edge, Honda Pilot, and Ford Explorer.

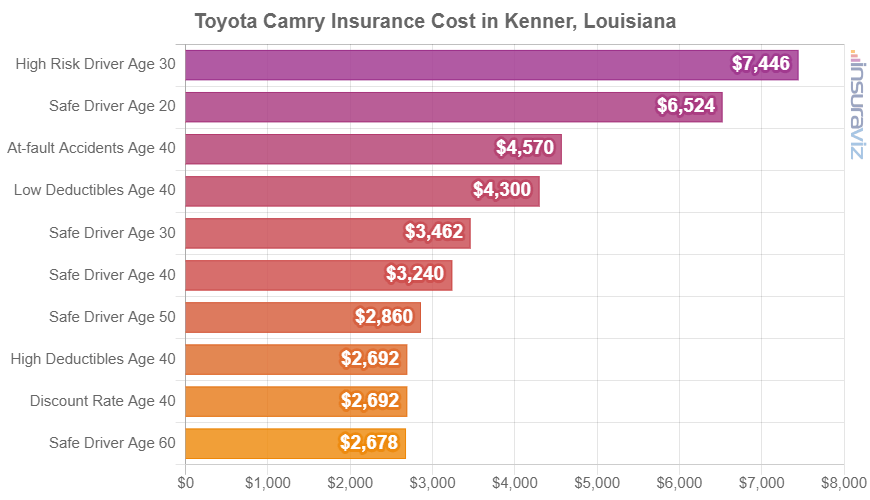

Toyota Camry insurance rates

Toyota Camry insurance in Kenner costs an average of $3,276 per year, ranging from $3,014 per year for the Toyota Camry LE trim (MSRP of $26,420) up to $3,444 per year on the Toyota Camry XSE AWD trim (MSRP of $33,120).

When Kenner car insurance rates for a Toyota Camry are compared with the overall national average cost on the same model, rates are $642 to $736 more per year in Kenner, depending on the specific trim level being insured.

The bar chart below might help to visualize how the cost of insurance on a Toyota Camry can change based on driver age and common risk profiles. In this example, cost ranges from $2,724 to $7,530 per year, which is a difference of $4,806 per year due primarily to driver risk.

The Toyota Camry is a midsize car, and other popular same-segment models include the Nissan Altima, Honda Accord, and Kia K5.

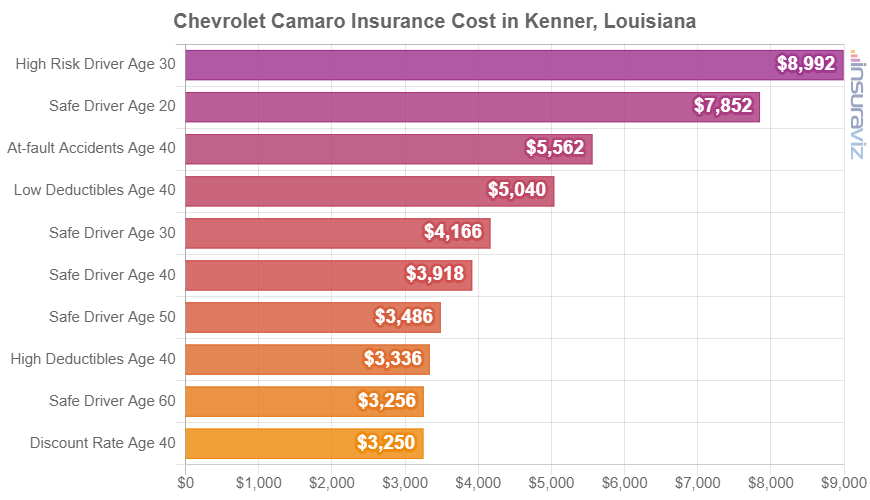

Chevrolet Camaro insurance rates

Chevrolet Camaro insurance in Kenner costs an average of $3,960 per year, with a range of $3,338 per year for the Chevrolet Camaro 1LT Convertible trim level up to $4,848 per year on the Chevrolet Camaro ZL1 Coupe trim level.

When Kenner insurance rates on a Chevrolet Camaro are compared with the national average cost for the same vehicle, rates are $710 to $1,034 more expensive per year in Kenner, depending on the trim level being insured.

From a cost per month standpoint, full-coverage car insurance on a Chevrolet Camaro for a safe driver can range from $278 to $404 per month, depending on exactly where you live in Kenner.

The chart below might help to visualize how insurance quotes for a Chevrolet Camaro can vary based on driver age, policy physical damage deductibles, and risk scenarios.

For our selected driver profiles, prices range from $3,286 to $9,100 per year, which is a difference in cost of $5,814.

The Chevrolet Camaro is a sports car, and additional similar models from the same segment include the Subaru BRZ, Toyota GR Supra, Chevrolet Corvette, and Ford Mustang.

Helpful tips to save on auto insurance

Kenner drivers are always searching for ways to pay less for insurance. So browse the tips and ideas below and see if you can save some money on your next policy.

- Buy vehicles with low cost car insurance rates. The make and model of vehicle you drive has a big impact on the cost of car insurance. For example, a Hyundai Kona costs $2,952 less per year to insure in Kenner than a Acura NSX. Lower performance vehicles save money.

- Compare insurance cost before buying a car. Different cars, and even different trim levels of the same car, can have significantly different car insurance rates, and auto insurance companies charge a wide range of costs. Check the cost of insurance before you buy a different vehicle in order to prevent price shock when you get your insurance bill.

- Shop around. Taking a couple of minutes every year or so to get a few free car insurance quotes is the best way to save money. Rates are always changing and switching to a different company is very easy to do.

- Good credit can save money. Having an excellent credit rating above 800 could save a minimum of $478 per year versus a credit score between 670-739. Conversely, a less-than-perfect credit score could cost around $554 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Remove optional coverage on older vehicles. Deleting physical damage coverage from older vehicles that are no longer worth much will reduce the cost of auto insurance significantly.

- Get better rates due to your profession. Some auto insurance providers offer discounts for certain occupations like accountants, police officers and law enforcement, lawyers, members of the military, firefighters, and others. If you work in a qualifying profession, you could save between $91 and $296 on your yearly auto insurance cost, depending on the policy coverages.

- Find cheaper rates by qualifying for discounts. Savings may be available if the insured drivers drive a vehicle with safety or anti-theft features, insure multiple vehicles on the same policy, are claim-free, work in certain occupations, are homeowners, or many other discounts which could save the average Kenner driver as much as $512 per year.