- Shreveport car insurance costs an average of $1,960 per year, or about $163 per month.

- Car insurance rates for a few popular models in Shreveport include the Honda Civic at $1,736 per year, Jeep Grand Cherokee at $1,960, and Honda Accord at $1,894.

- For cheap car insurance in Shreveport, LA, small SUV models like the Honda CR-V, Ford Bronco Sport, Hyundai Venue, and Kia Soul cost less than most other models.

What is average car insurance cost in Shreveport?

The average price for car insurance in Shreveport is $1,960 per year, which is 4% more than the national average rate of $1,883. The average monthly cost of car insurance in Shreveport is $163 for full coverage auto insurance.

In the state of Louisiana, the average car insurance cost is $2,208 per year, so the average cost in Shreveport is $248 less per year. When compared to other locations in Louisiana, the cost of car insurance in Shreveport is about $102 per year cheaper than in Lake Charles, $1,198 per year less than in New Orleans, and $512 per year cheaper than in Baton Rouge.

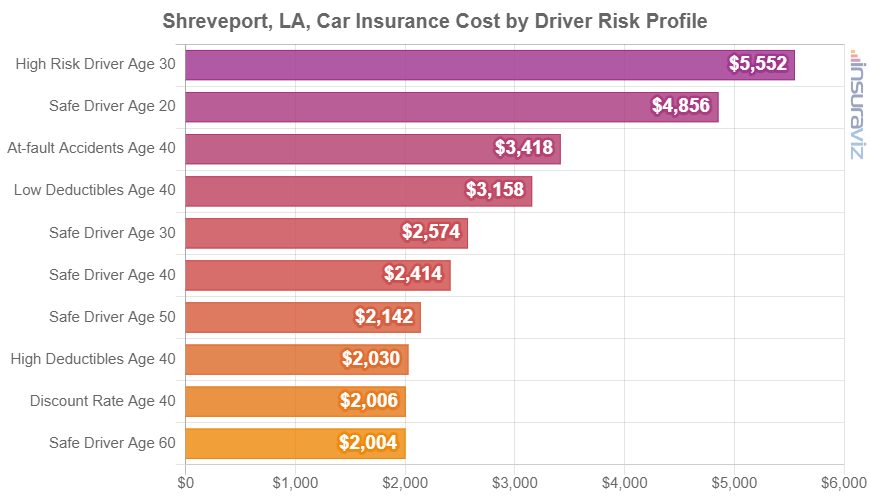

The chart below summarizes average auto insurance cost in Shreveport broken out for a number of different driver ages and risk profiles. Rates are averaged for all 2024 vehicle models including luxury vehicles.

Average rates in the chart above range from $1,628 per year for a 40-year-old driver with a great rate thanks to policy discounts to $4,510 per year for a 20-year-old driver with a lot of violations and accidents. Throughout our site, the rate used for comparison of different models and locations is the 40-year-old safe driver rate, which is an average cost of $1,960 per year.

As a monthly rate, the average cost of car insurance in Shreveport ranges from $136 to $376 for the same annual rate data shown in the chart above.

Shreveport car insurance rates can have significant differences in cost and subtle changes in a driver’s risk profile can cause measureable changes in car insurance premiums. The potential for large variability reinforces the need for accurate auto insurance quotes when shopping for a cheaper policy.

Driver age has a significant impact the price you pay for auto insurance, so the list below illustrates this point by breaking out average car insurance rates for young, middle-age, and senior drivers.

Shreveport, Louisiana, car insurance cost for drivers age 16 to 60

- 16-year-old rated driver – $6,986 per year or $582 per month

- 17-year-old rated driver – $6,766 per year or $564 per month

- 18-year-old rated driver – $6,063 per year or $505 per month

- 19-year-old rated driver – $5,521 per year or $460 per month

- 20-year-old rated driver – $3,946 per year or $329 per month

- 30-year-old rated driver – $2,094 per year or $175 per month

- 40-year-old rated driver – $1,960 per year or $163 per month

- 50-year-old rated driver – $1,738 per year or $145 per month

- 60-year-old rated driver – $1,626 per year or $136 per month

Shreveport’s favorite vehicles and the cost to insure them

The rates referenced earlier in this article consist of an average based on every 2024 vehicle model, which is helpful when making general comparisons like between locations or by driver risk profile.

For more useful auto insurance comparisons, however, the cost data will be more precise if we instead look at the specific model of vehicle being insured. Later in this article, we do lots of cost comparisons for specific makes and models of vehicles, but for now, we will explore just a few popular models to see how car insurance prices measure up in Shreveport.

The following chart details average insurance rates for popular vehicles that you will find driving around Shreveport. Later in this article, we’ll cover rates for some of these vehicles in much more detail.

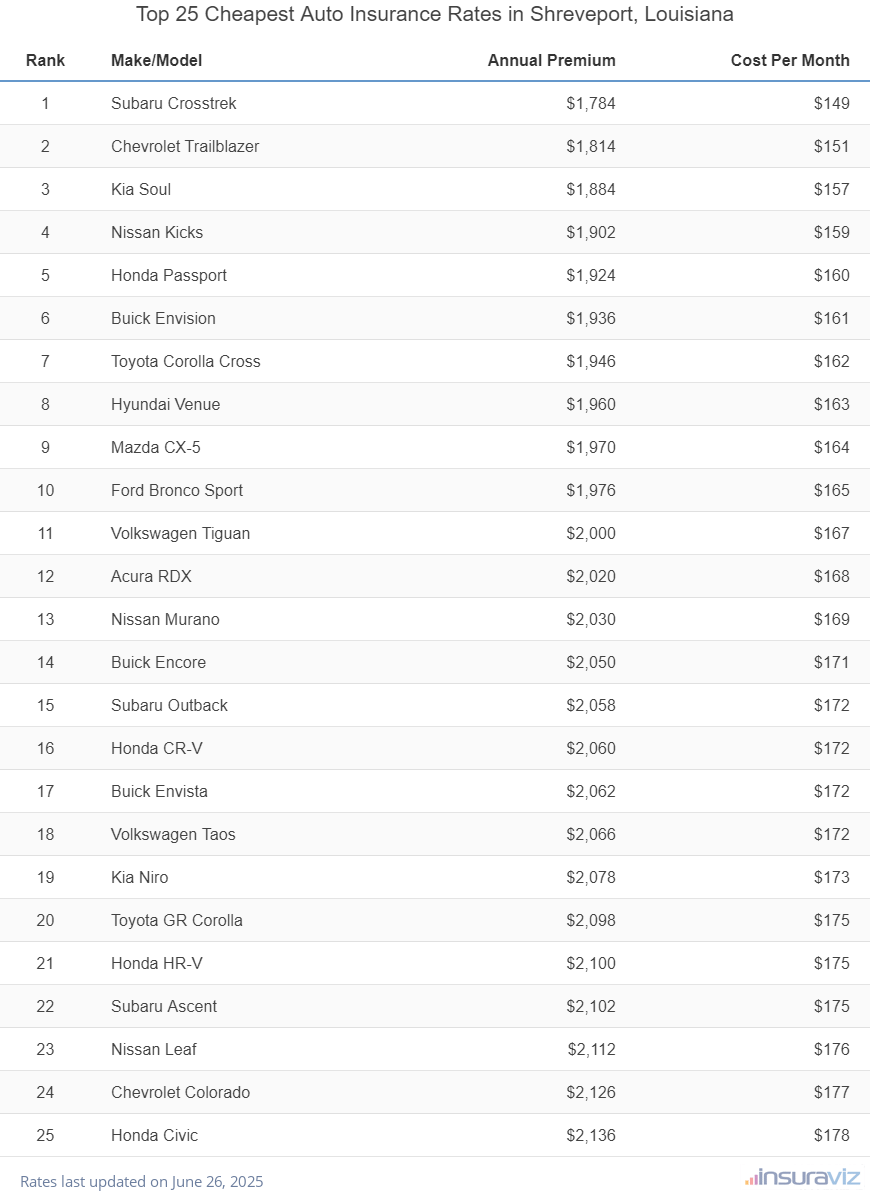

Which cars have cheap insurance in Shreveport?

When rates are compared for all models, the vehicles with the best car insurance prices in Shreveport, LA, tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Kia Soul, Hyundai Venue, and Buick Envision.

Average auto insurance prices for those models cost $133 or less per month for full coverage.

Some additional models that come in near the top in the cost comparison table below are the Honda CR-V, Ford Bronco Sport, Subaru Outback, and Kia Niro.

Rates are slightly higher for those models than the compact SUVs and crossovers at the top of the rankings, but they still have average rates of $1,680 or less per year.

The following table shows the 25 cars, trucks, and SUVs with the cheapest insurance rates in Shreveport, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,448 | $121 |

| 2 | Chevrolet Trailblazer | $1,472 | $123 |

| 3 | Kia Soul | $1,528 | $127 |

| 4 | Nissan Kicks | $1,542 | $129 |

| 5 | Honda Passport | $1,560 | $130 |

| 6 | Buick Envision | $1,572 | $131 |

| 7 | Toyota Corolla Cross | $1,580 | $132 |

| 8 | Hyundai Venue | $1,594 | $133 |

| 9 | Mazda CX-5 | $1,600 | $133 |

| 10 | Ford Bronco Sport | $1,604 | $134 |

| 11 | Volkswagen Tiguan | $1,622 | $135 |

| 12 | Acura RDX | $1,640 | $137 |

| 13 | Nissan Murano | $1,646 | $137 |

| 14 | Buick Encore | $1,664 | $139 |

| 15 | Subaru Outback | $1,670 | $139 |

| 16 | Honda CR-V | $1,672 | $139 |

| 17 | Chevrolet Colorado | $1,676 | $140 |

| 18 | Buick Envista | $1,678 | $140 |

| 19 | Kia Niro | $1,680 | $140 |

| 20 | Volkswagen Taos | $1,680 | $140 |

| 21 | Toyota GR Corolla | $1,704 | $142 |

| 22 | Honda HR-V | $1,706 | $142 |

| 23 | Subaru Ascent | $1,706 | $142 |

| 24 | Nissan Leaf | $1,716 | $143 |

| 25 | Honda Civic | $1,736 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

A table showing 25 vehicle rankings serves the purpose if you’re just looking for any vehicle with cheap insurance rates. Considering we track over 700 makes and models of vehicles, there are a lot of rates not being shown.

Let’s dig deeper into the data and display the models with the cheapest rates in Shreveport in a better format, by segment. The following sections break out the vehicles with the most affordable car insurance rates for each of the primary vehicle segments.

Cheapest car insurance rates in Shreveport, Louisiana

The three highest ranking 2-door and 4-door sedans and hatchbacks with the cheapest average auto insurance rates in Shreveport are the Toyota GR Corolla at $1,704 per year, the Nissan Leaf at $1,716 per year, and the Honda Civic at $1,736 per year.

Other cars that are affordable to insure are the Toyota Prius, Chevrolet Malibu, Kia K5, and Hyundai Ioniq 6, with average annual insurance rates of $1,900 per year or less.

Some additional models that made the list include the Hyundai Sonata, Subaru Legacy, Volkswagen Jetta, and Toyota Corolla, which average between $1,900 and $2,026 to insure per year.

Full-coverage auto insurance for this segment in Shreveport for a middle-age safe driver starts at around $142 per month, depending on the company and where you live.

If insurance rates are ranked by vehicle size, the cheapest non-luxury compact car to insure in Shreveport is the Toyota GR Corolla at $1,704 per year. For midsize models, the Hyundai Ioniq 6 is the cheapest model to insure at $1,802 per year. And for full-size cars, the Chrysler 300 is most affordable to insure at $1,860 per year.

The comparison table below ranks the cars with the most affordable insurance in Shreveport, starting with the Toyota GR Corolla at $1,704 per year ($142 per month) and ending with the Mazda 3 at $2,026 per year ($169 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,704 | $142 |

| Nissan Leaf | Compact | $1,716 | $143 |

| Honda Civic | Compact | $1,736 | $145 |

| Nissan Sentra | Compact | $1,794 | $150 |

| Hyundai Ioniq 6 | Midsize | $1,802 | $150 |

| Subaru Impreza | Compact | $1,802 | $150 |

| Toyota Prius | Compact | $1,832 | $153 |

| Kia K5 | Midsize | $1,888 | $157 |

| Honda Accord | Midsize | $1,894 | $158 |

| Chevrolet Malibu | Midsize | $1,900 | $158 |

| Toyota Corolla | Compact | $1,910 | $159 |

| Kia Forte | Compact | $1,912 | $159 |

| Volkswagen Arteon | Midsize | $1,928 | $161 |

| Nissan Versa | Compact | $1,932 | $161 |

| Subaru Legacy | Midsize | $1,934 | $161 |

| Mitsubishi Mirage G4 | Compact | $1,978 | $165 |

| Volkswagen Jetta | Compact | $1,980 | $165 |

| Toyota Crown | Midsize | $1,982 | $165 |

| Hyundai Sonata | Midsize | $1,988 | $166 |

| Mazda 3 | Compact | $2,026 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to view any vehicles not shown in the table.

Don’t see your vehicle? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Louisiana.

Cheapest SUV insurance rates

Out of all 2024 models, the top five cheapest SUVs to insure in Shreveport are the Subaru Crosstrek, Chevrolet Trailblazer, Kia Soul, Nissan Kicks, and Honda Passport. Average insurance rates for for these vehicles range from $1,448 to $1,560 per year.

Other models that rank well are the Ford Bronco Sport, Hyundai Venue, Toyota Corolla Cross, and Mazda CX-5, with an average cost to insure of $1,604 per year or less.

Ranked in the bottom half of the top 20 cheapest SUVs to insure, models like the Honda CR-V, Subaru Ascent, Nissan Murano, Buick Envista, and Buick Encore average between $1,604 and $1,706 per year for auto insurance in Shreveport.

From a cost per month standpoint, car insurance rates in this segment starts at an average of $121 per month, depending on where you live.

When ranked by vehicle size, the cheapest non-luxury compact SUV to insure in Shreveport is the Subaru Crosstrek at $1,448 per year. For midsize 2024 models, the Honda Passport is cheapest to insure at $1,560 per year. And for large SUVs, the Chevrolet Tahoe has the cheapest rates at $1,838 per year.

The next table ranks the twenty SUVs with the most affordable auto insurance rates in Shreveport.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,448 | $121 |

| Chevrolet Trailblazer | Compact | $1,472 | $123 |

| Kia Soul | Compact | $1,528 | $127 |

| Nissan Kicks | Compact | $1,542 | $129 |

| Honda Passport | Midsize | $1,560 | $130 |

| Buick Envision | Compact | $1,572 | $131 |

| Toyota Corolla Cross | Compact | $1,580 | $132 |

| Hyundai Venue | Compact | $1,594 | $133 |

| Mazda CX-5 | Compact | $1,600 | $133 |

| Ford Bronco Sport | Compact | $1,604 | $134 |

| Volkswagen Tiguan | Compact | $1,622 | $135 |

| Nissan Murano | Midsize | $1,646 | $137 |

| Buick Encore | Compact | $1,664 | $139 |

| Subaru Outback | Midsize | $1,670 | $139 |

| Honda CR-V | Compact | $1,672 | $139 |

| Buick Envista | Midsize | $1,678 | $140 |

| Kia Niro | Compact | $1,680 | $140 |

| Volkswagen Taos | Compact | $1,680 | $140 |

| Honda HR-V | Compact | $1,706 | $142 |

| Subaru Ascent | Midsize | $1,706 | $142 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

For more car insurance comparisons, see our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance.

Need rates for a different SUV? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best companies in Louisiana.

Cheapest pickup truck insurance rates

The Chevrolet Colorado comes in at #1 as the most budget-friendly pickup to insure in Shreveport, followed by the Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. The 2024 model has an average cost of $1,676 per year to insure for full coverage.

Other models that have cheaper rates include the GMC Sierra 2500 HD, GMC Canyon, Hyundai Santa Cruz, and Toyota Tacoma, with average insurance cost of $2,018 per year or less.

Auto insurance for this segment in Shreveport can cost as low as $140 per month, depending on the company and where you live.

The table below ranks the pickups with the most affordable car insurance in Shreveport.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,676 | $140 |

| Nissan Titan | Full-size | $1,834 | $153 |

| Nissan Frontier | Midsize | $1,856 | $155 |

| Ford Ranger | Midsize | $1,874 | $156 |

| Ford Maverick | Midsize | $1,902 | $159 |

| Honda Ridgeline | Midsize | $1,946 | $162 |

| Hyundai Santa Cruz | Midsize | $1,978 | $165 |

| Toyota Tacoma | Midsize | $1,984 | $165 |

| GMC Sierra 2500 HD | Heavy Duty | $1,994 | $166 |

| GMC Canyon | Midsize | $2,018 | $168 |

| Jeep Gladiator | Midsize | $2,064 | $172 |

| GMC Sierra 3500 | Heavy Duty | $2,078 | $173 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,096 | $175 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,152 | $179 |

| GMC Sierra | Full-size | $2,166 | $181 |

| Nissan Titan XD | Heavy Duty | $2,168 | $181 |

| Chevrolet Silverado | Full-size | $2,170 | $181 |

| Ford F150 | Full-size | $2,194 | $183 |

| GMC Hummer EV Pickup | Full-size | $2,248 | $187 |

| Ram Truck | Full-size | $2,268 | $189 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Don’t see your pickup model? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Shreveport car insurance quotes from top-rated auto insurance companies in Louisiana.

Cheapest sports car insurance rates

The top-ranked model in Shreveport for the lowest-cost insurance in the sports car segment is the Mazda MX-5 Miata, with a cost of $1,812 per year. Second place is the Toyota GR86 costing $2,064 per year, and ranking third is the Ford Mustang, costing an average of $2,156 per year.

Not the cheapest sports cars to insure, but still very reasonable, are cars like the Subaru BRZ, Lexus RC F, Nissan Z, and Toyota GR Supra, with average annual insurance rates of $2,344 per year or less.

In the bottom half of the top 20, models like the Porsche 718, BMW M4, Jaguar F-Type, Mercedes-Benz AMG GT53, and Chevrolet Camaro average between $2,344 and $3,320 per year to insure in Shreveport.

Car insurance for this segment in Shreveport for the average driver will start around $151 per month, depending on the company. The comparison table below ranks the sports cars with the lowest-cost insurance rates in Shreveport, starting with the Mazda MX-5 Miata at $1,812 per year ($151 per month) and ending with the Porsche Taycan at $3,320 per year ($277 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $1,812 | $151 |

| Toyota GR86 | Sports Car | $2,064 | $172 |

| Ford Mustang | Sports Car | $2,156 | $180 |

| BMW Z4 | Sports Car | $2,166 | $181 |

| Subaru WRX | Sports Car | $2,200 | $183 |

| Toyota GR Supra | Sports Car | $2,202 | $184 |

| BMW M2 | Sports Car | $2,266 | $189 |

| Nissan Z | Sports Car | $2,272 | $189 |

| Lexus RC F | Sports Car | $2,316 | $193 |

| Subaru BRZ | Sports Car | $2,344 | $195 |

| BMW M3 | Sports Car | $2,476 | $206 |

| Porsche 718 | Sports Car | $2,526 | $211 |

| Chevrolet Camaro | Sports Car | $2,548 | $212 |

| Chevrolet Corvette | Sports Car | $2,718 | $227 |

| Porsche 911 | Sports Car | $2,810 | $234 |

| BMW M4 | Sports Car | $2,928 | $244 |

| Lexus LC 500 | Sports Car | $2,942 | $245 |

| Jaguar F-Type | Sports Car | $3,094 | $258 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,244 | $270 |

| Porsche Taycan | Sports Car | $3,320 | $277 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

Need rates for a different vehicle? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top-rated companies in Louisiana.

Cheapest luxury car insurance rates

Ranking at the top of the list for the most affordable Shreveport car insurance rates in the luxury car segment are the BMW 330i, Acura Integra, Acura TLX, Lexus IS 300, and Mercedes-Benz CLA250. Auto insurance quotes for these models average $169 or less per month.

Some other luxury cars that rank well in our comparison include the Lexus RC 300, Lexus ES 350, Cadillac CT4, and Mercedes-Benz AMG CLA35, with average cost of $2,058 per year or less.

Full-coverage car insurance in this segment can cost as low as $145 per month, depending on your location and insurance company.

The most affordable small luxury car to insure in Shreveport is the Acura Integra at $1,742 per year. For midsize luxury models, the Mercedes-Benz CLA250 is cheapest to insure at $2,016 per year. And for full-size models, the Audi A5 has the most affordable rates at $2,320 per year.

The rate comparison table below ranks the twenty cars with the cheapest insurance in Shreveport, starting with the Acura Integra at $145 per month and ending with the Audi S3 at $183 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,742 | $145 |

| BMW 330i | Compact | $1,996 | $166 |

| Mercedes-Benz CLA250 | Midsize | $2,016 | $168 |

| Lexus IS 300 | Midsize | $2,020 | $168 |

| Acura TLX | Compact | $2,026 | $169 |

| Cadillac CT4 | Compact | $2,046 | $171 |

| Lexus ES 350 | Midsize | $2,046 | $171 |

| Genesis G70 | Compact | $2,050 | $171 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,056 | $171 |

| Lexus RC 300 | Midsize | $2,058 | $172 |

| Lexus IS 350 | Compact | $2,062 | $172 |

| Jaguar XF | Midsize | $2,072 | $173 |

| Cadillac CT5 | Midsize | $2,112 | $176 |

| Lexus ES 250 | Midsize | $2,120 | $177 |

| Lexus RC 350 | Compact | $2,124 | $177 |

| BMW 330e | Compact | $2,130 | $178 |

| BMW 228i | Compact | $2,132 | $178 |

| BMW 230i | Compact | $2,148 | $179 |

| Lexus ES 300h | Midsize | $2,152 | $179 |

| Audi S3 | Compact | $2,198 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

See our comprehensive guide for luxury car insurance to view data for vehicles not featured in the table.

Don’t see your luxury car in the list? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Louisiana.

Cheapest luxury SUVs to insure

The cheapest luxury SUVs to insure in Shreveport are the Acura RDX at $1,640 per year, the Lexus NX 250 at $1,736 per year, and the Cadillac XT4 at $1,770 per year.

Additional luxury SUVs that rank well in our comparison are the Lexus UX 250h, Mercedes-Benz GLB 250, Lexus NX 350h, and Lexus NX 450h, with average annual insurance rates of $1,890 per year or less.

Some additional vehicles that rank well include the Cadillac XT6, Lexus RX 350, Mercedes-Benz GLA35 AMG, and Mercedes-Benz GLA250, which average between $1,890 and $1,964 per year for full-coverage insurance in Shreveport.

On a monthly basis, auto insurance in this segment for a good driver starts at an average of $137 per month, depending on your company and location.

When rates are compared by vehicle size, the most affordable small luxury SUV to insure in Shreveport is the Acura RDX at $1,640 per year. For midsize luxury SUVs, the Jaguar E-Pace is the cheapest model to insure at $1,834 per year. And for full-size luxury SUVs, the Infiniti QX80 is cheapest to insure at $2,198 per year.

The rate comparison table below ranks the twenty SUVs with the most affordable insurance rates in Shreveport, starting with the Acura RDX at $137 per month and ending with the Lexus NX 350 at $164 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,640 | $137 |

| Lexus NX 250 | Compact | $1,736 | $145 |

| Cadillac XT4 | Compact | $1,770 | $148 |

| Jaguar E-Pace | Midsize | $1,834 | $153 |

| Cadillac XT5 | Midsize | $1,848 | $154 |

| Lexus NX 350h | Compact | $1,848 | $154 |

| Lincoln Corsair | Compact | $1,870 | $156 |

| Mercedes-Benz GLB 250 | Compact | $1,876 | $156 |

| Lexus UX 250h | Compact | $1,880 | $157 |

| Lexus NX 450h | Compact | $1,890 | $158 |

| Infiniti QX50 | Midsize | $1,904 | $159 |

| Mercedes-Benz GLA250 | Compact | $1,906 | $159 |

| Mercedes-Benz GLA35 AMG | Compact | $1,916 | $160 |

| Cadillac XT6 | Midsize | $1,920 | $160 |

| Infiniti QX60 | Midsize | $1,930 | $161 |

| Mercedes-Benz AMG GLB35 | Midsize | $1,930 | $161 |

| Land Rover Evoque | Compact | $1,956 | $163 |

| Acura MDX | Midsize | $1,960 | $163 |

| Lexus RX 350 | Midsize | $1,962 | $164 |

| Lexus NX 350 | Compact | $1,964 | $164 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Shreveport, LA Zip Codes. Updated February 23, 2024

See our guides for luxury SUV insurance to compare rates for additional makes and models.

Looking for rates for a different luxury SUV? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in Louisiana.

How to find cheaper car insurance in Shreveport

Shrewd drivers in Shreveport are always looking to reduce their monthly auto insurance expenses. So glance at the money-saving ideas in this next list to see if you can save a few bucks on your next policy.

- Stay claim free. Most insurers give a discount if you do not file any claims. Insurance should only be used to protect you from larger claims, not nickel-and-dime type claims.

- Buy vehicles with low cost car insurance rates. The vehicle you choose to drive is a primary factor in the price you pay for car insurance in Shreveport. For example, a Kia Telluride costs $1,552 less per year to insure in Shreveport than a BMW i8. Lower performance vehicles save money.

- If your vehicle is older, remove optional coverages. Removing comprehensive and/or collision coverage from older vehicles that are not worth a lot can cut the cost of auto insurance substantially.

- Compare rates before you buy the car. Different cars, trucks, and SUVs can have very different insurance premiums, and insurance companies can price policies with a wide range of prices. Check prices before you buy in order to avoid price shock when insuring your new vehicle.

- Excellent credit equals excellent rates. Having a credit score over 800 could save $308 per year compared to a good credit rating of 670-739. Conversely, a weaker credit score below 579 could cost around $357 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Shop around for a better deal. Setting aside a few minutes to get free car insurance quotes could significantly reduce the cost of insurance. Rates change more often that you might think and switching companies is very easy to do.

- Safer drivers pay lower rates. Causing frequent accidents will increase insurance cost, potentially up to $948 per year for a 30-year-old driver and even $592 per year for a 50-year-old driver. So be a cautious driver and save.