- Small SUV models like the Kia Soul, Nissan Kicks, Chevrolet Trailblazer, and Subaru Crosstrek are a few picks for the cheapest car insurance in Plymouth.

- Car insurance in Plymouth cost an average of $1,630 per year, or approximately $136 per month for full coverage.

- Monthly auto insurance rates for a few popular vehicles in Plymouth include the Nissan Altima at $147, Jeep Wrangler at $155, and Toyota RAV4 at $125.

Cheapest cars to insure in Plymouth

From an overall standpoint, the models with the most affordable insurance rates in Plymouth tend to be small SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, and Nissan Kicks.

Average car insurance prices for vehicles in the top 10 cost $1,334 or less per year ($111 per month) to insure for full coverage in Plymouth.

A few other vehicles that rank towards the top in our auto insurance price comparison are the Subaru Outback, Buick Envista, Volkswagen Tiguan, and Nissan Murano.

Insurance rates are slightly more for those models than the compact SUVs and crossovers that rank at the top, but they still have an average cost of $1,398 or less per year ($117 per month).

The next table breaks down the top 30 models with the cheapest car insurance rates in Plymouth, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,204 | $100 |

| 2 | Chevrolet Trailblazer | $1,226 | $102 |

| 3 | Kia Soul | $1,272 | $106 |

| 4 | Nissan Kicks | $1,282 | $107 |

| 5 | Honda Passport | $1,298 | $108 |

| 6 | Buick Envision | $1,306 | $109 |

| 7 | Toyota Corolla Cross | $1,314 | $110 |

| 8 | Hyundai Venue | $1,324 | $110 |

| 9 | Mazda CX-5 | $1,330 | $111 |

| 10 | Ford Bronco Sport | $1,334 | $111 |

| 11 | Volkswagen Tiguan | $1,348 | $112 |

| 12 | Acura RDX | $1,362 | $114 |

| 13 | Nissan Murano | $1,370 | $114 |

| 14 | Buick Encore | $1,384 | $115 |

| 15 | Subaru Outback | $1,388 | $116 |

| 16 | Honda CR-V | $1,390 | $116 |

| 17 | Buick Envista | $1,392 | $116 |

| 18 | Chevrolet Colorado | $1,394 | $116 |

| 19 | Volkswagen Taos | $1,396 | $116 |

| 20 | Kia Niro | $1,398 | $117 |

| 21 | Honda HR-V | $1,418 | $118 |

| 22 | Subaru Ascent | $1,418 | $118 |

| 23 | Toyota GR Corolla | $1,418 | $118 |

| 24 | Nissan Leaf | $1,428 | $119 |

| 25 | Honda Civic | $1,442 | $120 |

| 26 | Lexus NX 250 | $1,442 | $120 |

| 27 | Volkswagen Atlas | $1,446 | $121 |

| 28 | Acura Integra | $1,448 | $121 |

| 29 | Volkswagen Atlas Cross Sport | $1,452 | $121 |

| 30 | Kia Seltos | $1,456 | $121 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Plymouth, MN Zip Codes. Updated February 23, 2024

Some additional models worth noting ranked in the top 30 table above include the Acura Integra, Toyota GR Corolla, Subaru Forester, Lexus NX 250, and Volkswagen Atlas. Car insurance rates for those models cost between $1,398 and $1,452 per year in Plymouth, MN.

To help gauge how cheap these rates are, some models that have much higher car insurance rates include the Tesla Model Y at $150 per month, the Audi S3 at an average of $152, and the Tesla Model X at an average of $171.

For really high auto insurance rates in Plymouth, vehicles like the Audi RS 6, Aston Martin DBX, and BMW 750i have average rates that frequently cost two to three times those of the cheapest cars and SUVs.

How much does car insurance cost in Plymouth?

The average cost of car insurance in Plymouth is $1,630 per year, or approximately $136 per month for a full coverage policy. It costs 14.4% less to insure the average vehicle in Plymouth than the overall national average rate of $1,883.

In the state of Minnesota, the average price for car insurance is $1,664 per year, so the cost in Plymouth averages $34 less per year.

When compared to other locations in Minnesota, the cost to insure a car in Plymouth is approximately $32 per year more than in Duluth, $308 per year less than in St Paul, and $104 per year more than in Rochester.

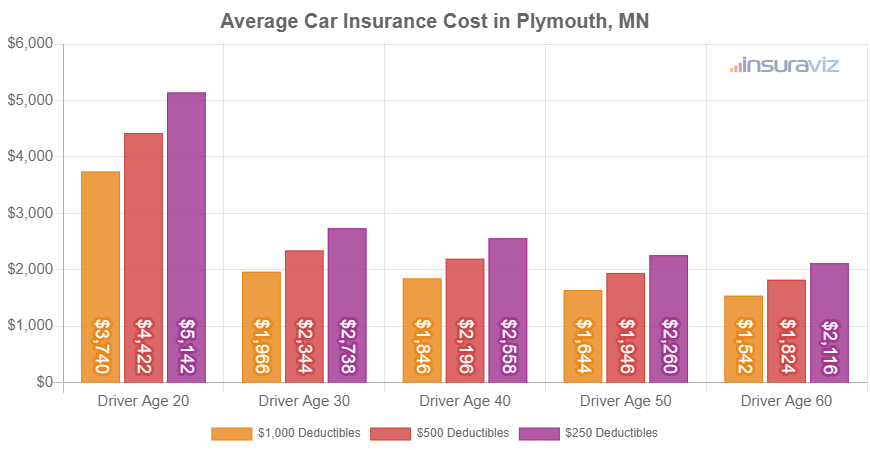

The age of the rated driver makes a big difference in the price of car insurance. The list below details how age impacts cost by showing average car insurance rates for driver ages from 16 to 60.

Plymouth, Minnesota, car insurance cost for drivers age 16 to 60

- 16-year-old driver – $5,802 per year or $484 per month

- 17-year-old driver – $5,620 per year or $468 per month

- 18-year-old driver – $5,040 per year or $420 per month

- 19-year-old driver – $4,590 per year or $383 per month

- 20-year-old driver – $3,278 per year or $273 per month

- 30-year-old driver – $1,738 per year or $145 per month

- 40-year-old driver – $1,630 per year or $136 per month

- 50-year-old driver – $1,444 per year or $120 per month

- 60-year-old driver – $1,352 per year or $113 per month

The next chart shows average auto insurance cost in Plymouth, Minnesota, for all 2024 models. Rates are averaged for all Plymouth Zip Codes and shown by driver age and comprehensive and collision deductibles.

Average rates in the chart range from $1,144 per year for a 60-year-old driver with $1,000 comprehensive and collision coverage deductibles to $3,812 per year for a 20-year-old driver with $250 deductibles. In this article, the rate used to compare different vehicles or locations is a 40-year-old driver with $500 deductibles, which is an average cost of $1,630 per year.

As a monthly expense, the average cost to insure a car in Plymouth ranges from $95 to $318 for the same driver risk profiles shown in the prior chart.

Auto insurance rates have different premiums for every driver and are impacted by a lot of factors. This large rate variability stresses the need to get multiple car insurance quotes when shopping around for the cheapest rate.

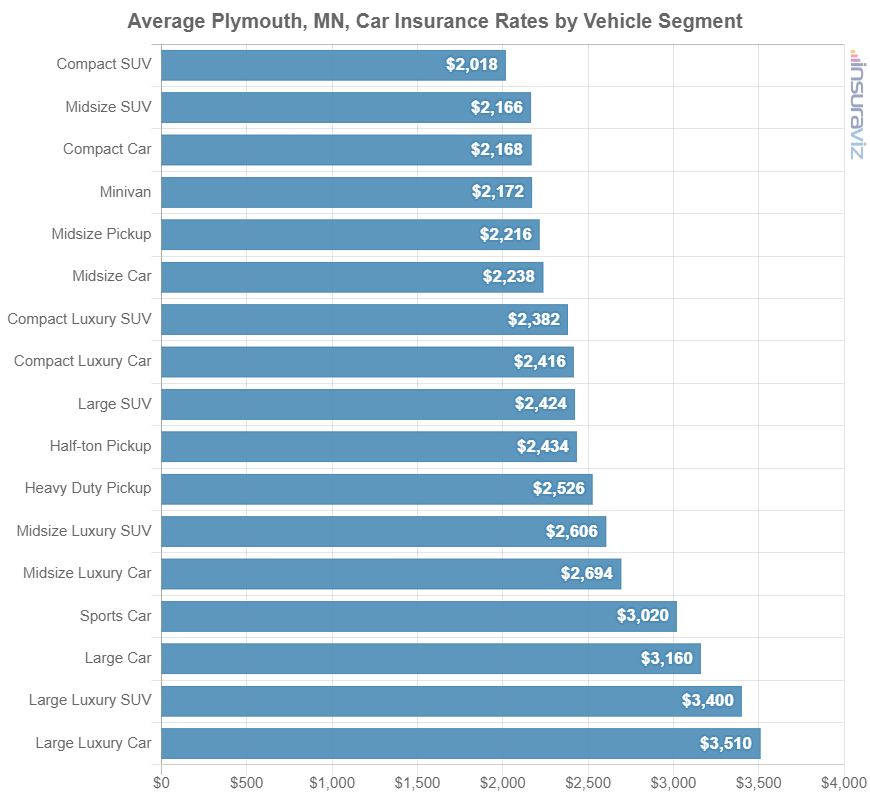

The next section of this article discusses the average cost of auto insurance for each different vehicle segment. The rates shown should provide a decent idea of which automotive segments have the cheapest car insurance rates in Plymouth.

Cheapest car insurance rates by segment

If you’re considering buying a different vehicle, it’s a good idea to have a basic understanding of which categories of vehicles are less expensive to insure.

To illustrate this, you may be curious if midsize cars have more affordable insurance than full-size cars or which size of pickup is more affordable to insure.

The next chart displays average auto insurance cost by vehicle segment in Plymouth. In general, compact SUVs, midsize trucks, and minivans tend to have the least expensive rates, while exotic performance cars have the most expensive overall rates.

For comparison purposes, it’s a good idea to apply the average rates by segment as a rough guide, as you’ll have better data if you dig down to the model level to find the best insurance rates in a particular segment.

For example, in the sports car segment, car insurance rates in Plymouth range from the Mazda MX-5 Miata at $1,508 per year for full coverage insurance up to the Mercedes-Benz SL 63 at $3,350 per year. In the midsize luxury car segment, rates can range from the Mercedes-Benz CLA250 costing $1,678 per year to the BMW M8 costing $2,746 per year, a difference of $1,068 just for that segment.

The list below details the individual model with the cheapest insurance in Plymouth, MN, for each automotive segment. Annual and monthly insurance rates are shown for each vehicle.

- Cheapest compact car to insure – Toyota GR Corolla at $1,418 per year or $118 per month

- Cheapest compact SUV to insure – Subaru Crosstrek at $1,204 per year or $100 per month

- Cheapest midsize car to insure – Hyundai Ioniq 6 at $1,498 per year or $125 per month

- Cheapest midsize SUV to insure – Honda Passport at $1,298 per year or $108 per month

- Cheapest full-size car to insure – Chrysler 300 at $1,546 per year or $129 per month

- Cheapest full-size SUV to insure – Chevrolet Tahoe at $1,530 per year or $128 per month

- Cheapest midsize pickup to insure – Chevrolet Colorado at $1,394 per year or $116 per month

- Cheapest full-size pickup to insure – Nissan Titan at $1,526 per year or $127 per month

- Cheapest heavy duty pickup to insure – GMC Sierra 2500 HD at $1,658 per year or $138 per month

- Cheapest minivan to insure – Honda Odyssey at $1,490 per year or $124 per month

- Cheapest sports car to insure – Mazda MX-5 Miata at $1,508 per year or $126 per month

- Cheapest compact luxury car to insure – Acura Integra at $1,448 per year or $121 per month

- Cheapest compact luxury SUV to insure – Acura RDX at $1,362 per year or $114 per month

- Cheapest midsize luxury car to insure – Mercedes-Benz CLA250 at $1,678 per year or $140 per month

- Cheapest midsize luxury SUV to insure – Jaguar E-Pace at $1,524 per year or $127 per month

- Cheapest full-size luxury car to insure – Audi A5 at $1,930 per year or $161 per month

- Cheapest full-size luxury SUV to insure – Infiniti QX80 at $1,828 per year or $152 per month

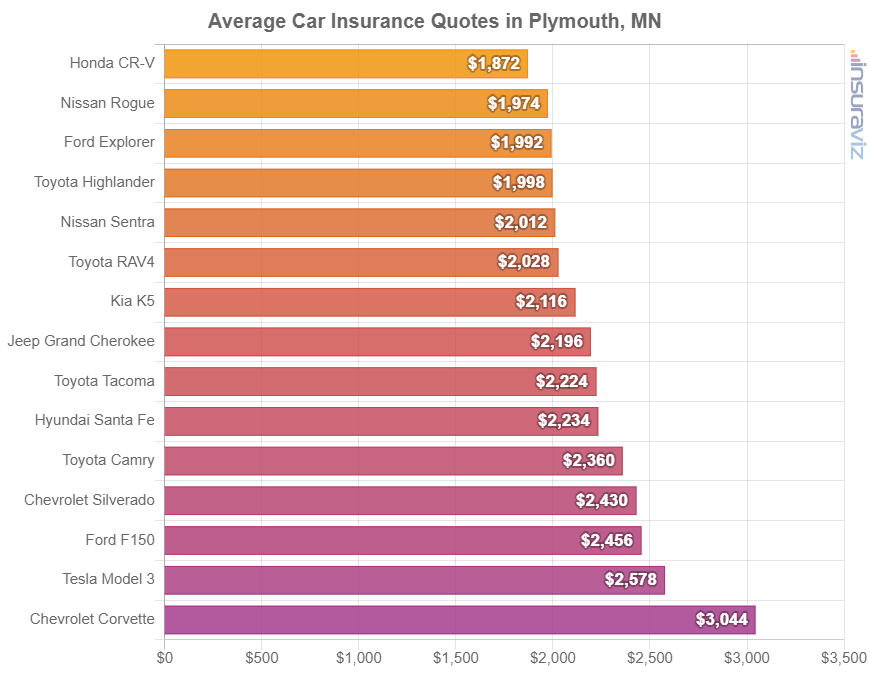

Insuring Plymouth’s favorite cars, trucks, and SUVs

The auto insurance rates mentioned above take all 2024 vehicle models and average them, which is suitable when making general comparisons such as the cost for different driver ages or locations.

Average car insurance rates work well when trying to find the answer to questions like “is Plymouth auto insurance cheaper than Minneapolis?” or “is Minnesota auto insurance cheaper than Arizona?”.

For deeper car insurance cost comparisons, however, the data will be better if we do a rate analysis for the specific vehicle being insured. Every make and model has unique characteristics for calculating how much car insurance costs and this data allows for detailed comparisons.

The chart below breaks down average auto insurance rates in Plymouth for some of the most popular cars, trucks, and SUVs.

When popular vehicles are compared to the earlier rankings table showing the top 30 models with the cheapest average auto insurance quotes, the vast majority cost more to insure.

Expensive rates could be due to things like a more expensive vehicle, like an Audi RS 6 that has an average MSRP of $125,800 or a Tesla Model X which has an average cost of $68,590, or perhaps a higher potential for liability or medical claims like a Mazda 3, GMC Yukon XL, or Chevy Camaro.

Let’s quickly review some of the concepts that were covered up to this point.

- Insurance for teenagers is not cheap – Average rates range from $3,882 to $5,802 per year for car insurance for teens in Plymouth, MN.

- Teen females pay lower rates than teenage males – Teenage female drivers pay $708 to $383 less annually than their male counterparts.

- Plymouth, Minnesota, car insurance costs less than the U.S. average – $1,630 (Plymouth average) versus $1,883 (U.S. average)

- Auto insurance gets more affordable the older you are – Car insurance rates for a 40-year-old driver in Plymouth are $1,648 per year cheaper than for a 20-year-old driver.

- Average car insurance cost per month ranges from $113 to $484 – That is the average auto insurance cost range for drivers aged 16 to 60 in Plymouth, Minnesota.

- Plymouth auto insurance rates are cheaper than the Minnesota state average – $1,630 (Plymouth average) compared to $1,664 (Minnesota average)

Saving money on auto insurance

Resourceful drivers in Plymouth should always be searching for ways to reduce the monthly expense for insurance, so take a minute to read through the savings concepts in this next list and it’s very possible you can save a little cash on your next renewal.

- Stay claim free. Auto insurance companies offer a discount if you have no claims. Insurance is intended to be used for significant claims, not small claims.

- Auto insurance is cheaper with higher deductibles. Increasing deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Check your credit score. Insureds with excellent credit scores of 800+ could save as much as $256 per year compared to a lower credit rating of 670-739. Conversely, a weak credit rating could cost up to $297 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- If your car is older, remove unneeded coverages. Dropping physical damage coverage (comprehensive and collision) from older vehicles whose value has decreased will reduce the cost of car insurance substantially.

- Shop your coverage around. Taking 5-10 minutes before every policy renewal to get some free car insurance quotes can save more money than you might think. Rates change often and you can switch anytime.

- Compare rates before buying a car. Different models, and even different trim levels of the same model, have significantly different auto insurance rates, and auto insurance companies can sell policies with widely varying rates. Get quotes to compare the cost of insurance before you buy a new car so you can avoid insurance sticker shock when you see your first insurance bill.