- Compact SUV models like the Subaru Crosstrek, Buick Envision, Toyota Corolla Cross, and Chevrolet Trailblazer are good choices for the cheapest auto insurance in Meridian.

- A few vehicles with segment-leading car insurance rates include the Chrysler 300 ($198 per month), Acura Integra ($180 per month), Honda Passport ($161 per month), and Acura RDX ($169 per month).

- Meridian auto insurance costs $52 per year less than the Mississippi state average cost and $148 per year more than the average for all 50 states.

Which cars have cheap insurance in Meridian, MS?

The models with the lowest cost average insurance prices in Meridian tend to be crossovers and compact SUVs like the Kia Soul, Chevrolet Trailblazer, and Toyota Corolla Cross.

Average insurance quotes for cars and SUVs in the top 10 cost $1,988 or less per year for full coverage car insurance.

Some other vehicles that rank in the top 20 in the comparison table below are the Volkswagen Taos, Nissan Murano, Honda CR-V, and Buick Encore. The average rates are slightly higher for those models than the crossovers and small SUVs at the top of the rankings, but they still have average rates of $2,108 or less per year, or $176 per month in Meridian.

The table below details the 40 models with the cheapest car insurance in Meridian, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,742 | $145 |

| 2 | Chevrolet Trailblazer | $1,776 | $148 |

| 3 | Kia Soul | $1,842 | $154 |

| 4 | Nissan Kicks | $1,860 | $155 |

| 5 | Honda Passport | $1,876 | $156 |

| 6 | Buick Envision | $1,886 | $157 |

| 7 | Toyota Corolla Cross | $1,902 | $159 |

| 8 | Hyundai Venue | $1,922 | $160 |

| 9 | Mazda CX-5 | $1,922 | $160 |

| 10 | Ford Bronco Sport | $1,932 | $161 |

| 11 | Volkswagen Tiguan | $1,948 | $162 |

| 12 | Acura RDX | $1,968 | $164 |

| 13 | Nissan Murano | $1,980 | $165 |

| 14 | Buick Encore | $2,004 | $167 |

| 15 | Subaru Outback | $2,006 | $167 |

| 16 | Honda CR-V | $2,010 | $168 |

| 17 | Buick Envista | $2,022 | $169 |

| 18 | Volkswagen Taos | $2,024 | $169 |

| 19 | Kia Niro | $2,030 | $169 |

| 20 | Toyota GR Corolla | $2,044 | $170 |

| 21 | Subaru Ascent | $2,048 | $171 |

| 22 | Honda HR-V | $2,056 | $171 |

| 23 | Nissan Leaf | $2,068 | $172 |

| 24 | Chevrolet Colorado | $2,076 | $173 |

| 25 | Lexus NX 250 | $2,084 | $174 |

| 26 | Volkswagen Atlas | $2,086 | $174 |

| 27 | Honda Civic | $2,088 | $174 |

| 28 | Acura Integra | $2,096 | $175 |

| 29 | Subaru Forester | $2,096 | $175 |

| 30 | Volkswagen Atlas Cross Sport | $2,096 | $175 |

| 31 | Kia Seltos | $2,108 | $176 |

| 32 | GMC Terrain | $2,110 | $176 |

| 33 | Nissan Rogue | $2,122 | $177 |

| 34 | Hyundai Kona | $2,124 | $177 |

| 35 | Cadillac XT4 | $2,128 | $177 |

| 36 | Mazda CX-30 | $2,130 | $178 |

| 37 | Volkswagen ID4 | $2,138 | $178 |

| 38 | Ford Explorer | $2,140 | $178 |

| 39 | Toyota Highlander | $2,142 | $179 |

| 40 | Toyota Venza | $2,148 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Meridian, MS Zip Codes. Updated October 24, 2025

Additional models making the top 40 table above include the Toyota Highlander, the Lexus NX 250, the GMC Terrain, and the Honda HR-V. Insurance rates for those models fall between $2,108 and $2,214 per year.

As a comparison, a few examples of insurance that is considerably higher include the Dodge Charger which costs $3,490 per year, the BMW M240i at an average of $2,954, and the Lexus LX 570 that costs $3,430.

How much does car insurance cost in Meridian?

Meridian car insurance costs an average of $2,424 per year, which is 6.3% more than the U.S. average rate of $2,276. Average car insurance cost per month in Meridian is $202 for full coverage auto insurance.

In the state of Mississippi, the average price for car insurance is $2,476 per year, so the average rate in Meridian is $52 less per year. When compared to other larger cities in Mississippi, the cost of car insurance in Meridian is $48 per year less than in Southaven, $114 per year less than in Biloxi, and $2 per year more expensive than in Hattiesburg.

Driver age is probably the number one factor that determines the cost of auto insurance, so the list below details how age impacts cost by breaking down average car insurance rates in Meridian based on the age of the driver.

Average car insurance cost for Meridian, MS, drivers age 16 to 60

- 16-year-old driver – $8,637 per year or $720 per month

- 17-year-old driver – $8,369 per year or $697 per month

- 18-year-old driver – $7,500 per year or $625 per month

- 19-year-old driver – $6,831 per year or $569 per month

- 20-year-old driver – $4,880 per year or $407 per month

- 30-year-old driver – $2,588 per year or $216 per month

- 40-year-old driver – $2,424 per year or $202 per month

- 50-year-old driver – $2,152 per year or $179 per month

- 60-year-old driver – $2,014 per year or $168 per month

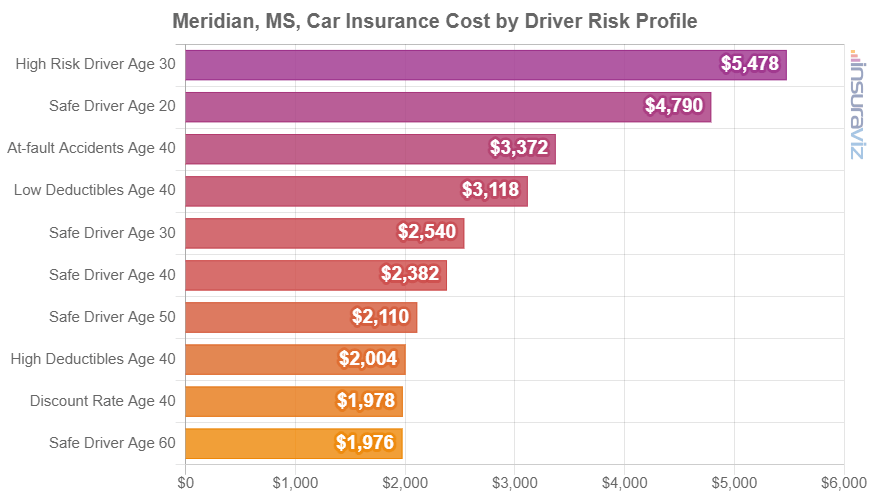

The chart below summarizes car insurance cost in Meridian for different common policy situations. Rates are averaged for all Meridian Zip Codes and shown based on a variety of driver ages, physical damage coverage deductibles, and driver risk profiles.

In the chart above, the cost of car insurance in Meridian ranges from $2,014 per year for a 40-year-old driver who receives many policy discounts to $5,578 per year for a 30-year-old driver who has a subpar driving record and has to buy high risk car insurance. From a monthly point of view, the average cost in the prior chart ranges from $168 to $465 per month.

Car insurance rates can cost very different amounts for different drivers and depend on a lot of factors. Due to the high likelihood of rate variability, this increases the need to get multiple auto insurance quotes when shopping around for the cheapest auto insurance.

To supplement the earlier data and reinforce the amount that auto insurance cost can vary between drivers, the charts below present a large range of rates for three popular models in Meridian: the Chevrolet Silverado, Honda Civic, and Honda CR-V.

Each illustration displays average rates for different profiles to illustrate how rates can vary based on changes in the risk profile of the driver.

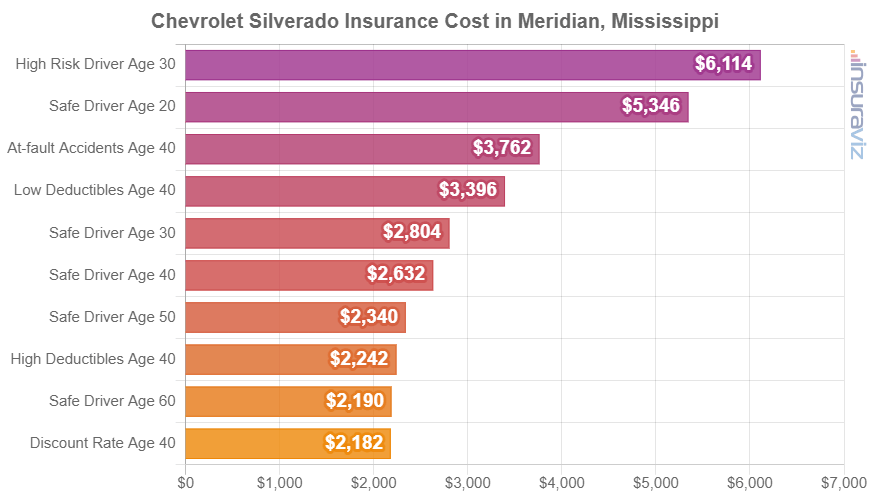

Chevrolet Silverado insurance rates

Chevrolet Silverado insurance in Meridian costs an average of $2,684 per year, with rates ranging from a low of $2,270 per year on the Chevrolet Silverado EV WT trim level (MSRP of $39,900) up to $3,178 per year for the Chevrolet Silverado EV RST First Edition (MSRP of $105,000).

On a monthly basis, car insurance quotes for the Chevrolet Silverado for an average middle-age driver can cost from $189 to $265 per month, but your final cost can vary based on your address in Meridian.

The next rate chart demonstrates how the price of car insurance on a Chevrolet Silverado can range significantly based on changes in the age of the driver, policy deductibles, and risk profiles.

The Chevrolet Silverado belongs to the full-size truck segment, and other models in the same segment include the Ford F150, Nissan Titan, and Ram Truck.

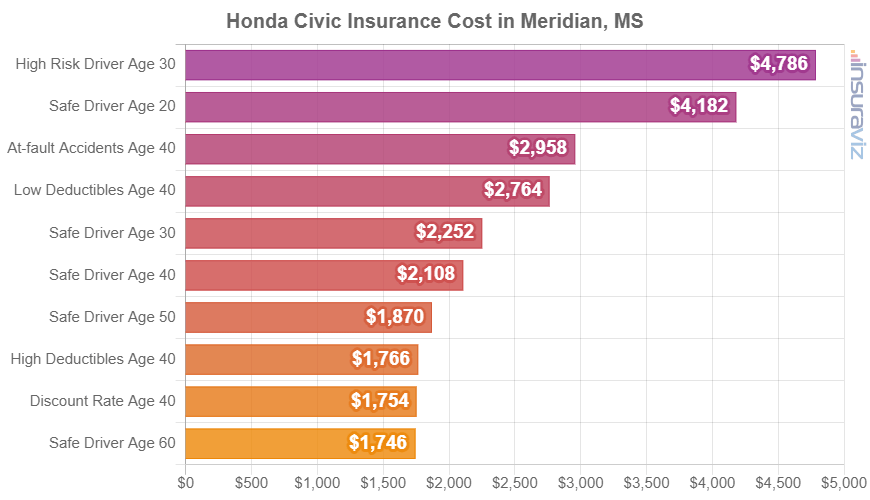

Honda Civic insurance rates

Honda Civic insurance in Meridian costs an average of $2,148 per year, ranging from a low of $1,920 per year for the Honda Civic LX model (MSRP of $23,950) up to $2,546 per year on the Honda Civic Type R trim level (MSRP of $43,795).

When Meridian car insurance quotes on the Honda Civic are compared to the average cost for the entire U.S. on the same model, rates are anywhere from $20 to $30 more per year in Meridian, depending on trim level.

The next chart helps to visualize how the cost to insure a Honda Civic can range significantly based on different driver ages, policy deductibles, and potential risk scenarios. In this example, rates range from $1,788 to $4,872 per year, which is a price difference of $3,084 caused by changes in driver risk.

The Honda Civic is classified as a compact car, and other similar models from the same segment include the Chevrolet Cruze, Volkswagen Jetta, Nissan Sentra, and Kia Forte.

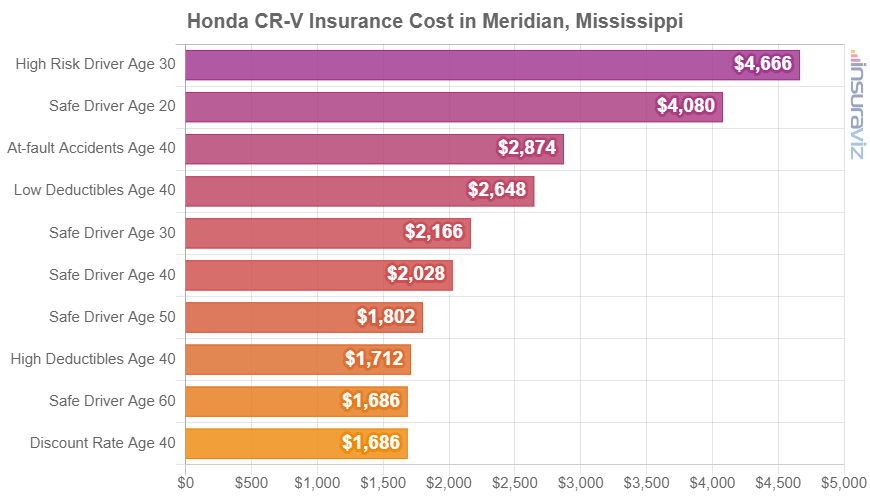

Honda CR-V insurance rates

Honda CR-V insurance in Meridian averages $2,070 per year, ranging from $1,962 per year on the Honda CR-V LX trim (MSRP of $29,500) up to $2,182 per year for the Honda CR-V Sport Touring Hybrid AWD trim level (MSRP of $39,850).

As a cost per month, auto insurance quotes for a Honda CR-V for the average driver can range from $164 to $182 per month, depending on exactly where you live in Meridian.

The chart below should aid in understanding how auto insurance quotes for a Honda CR-V can range significantly based on a variety of driver ages, policy deductibles, and driver risk scenarios. For our selected driver profiles, prices range from $1,718 to $4,752 per year, which is a cost difference of $3,034 for insurance on the same vehicle with different rated drivers.

The Honda CR-V is considered a compact SUV, and additional similar models from the same segment include the Subaru Forester, Nissan Rogue, Mazda CX-5, and Ford Escape.

How to find cheaper auto insurance

Meridian drivers are always looking to reduce their monthly car insurance expenses. So look through the tips and ideas below and it’s very possible you can save a little cash on your next renewal.

- Compare the cost of insurance before buying a car. Different cars can have very different insurance premiums, and companies can price policies with widely varying rates. Get plenty of car insurance quotes before you buy a different vehicle in order to avoid insurance sticker shock when buying coverage for your new car.

- Lower the cost of your policy by increasing deductibles. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Violations and tickets cost more than a fine. In order to have affordable auto insurance in Meridian, it pays to drive conservatively. Just a couple of minor blemishes on your driving record can raise policy rates by up to $646 per year. Being convicted of a serious infraction like reckless driving could raise rates by an additional $2,254 or more.

- Find cheaper rates by qualifying for policy discounts. Discounts may be available if the insured drivers sign their policy early, take a defensive driving course, insure multiple vehicles on the same policy, are senior citizens, or many other policy discounts which could save the average Meridian driver as much as $410 per year.

- Choose vehicles that have cheaper insurance. The vehicle you drive is one of the biggest factors in the price you pay for car insurance. For example, a Volvo XC40 costs $460 less per year to insure in Meridian than a Subaru BRZ. Lower performance vehicles cost less to insure.

- Polish up your credit rating for lower rates. Having a credit score above 800 could save around $381 per year compared to a credit score ranging from 670-739. Conversely, a credit score lower than 579 could cost up to $441 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Get cheaper rates because of your job. Most auto insurance providers offer policy discounts for specific professions like high school and elementary teachers, doctors, accountants, college professors, engineers, nurses, and others. If you qualify, you could save between $73 and $236 on your annual insurance bill, subject to the policy coverages selected.