- Average car insurance cost in Mandan is $2,300 per year, or $192 per month for full coverage.

- Car insurance rates for a few popular models in Mandan include the Honda Civic at $170 per month, Toyota Highlander at $175, and Honda Accord at $185.

- For the cheapest car insurance in Mandan, ND, compact crossovers and SUVs like the Nissan Kicks, Toyota Corolla Cross, Buick Envision, and Subaru Crosstrek have the best rates.

- Models with the most affordable auto insurance in Mandan in their segment include the Kia K5 (midsize car), Acura RDX (compact luxury SUV), Chrysler 300 (full-size car), and Acura Integra (compact luxury car).

What is average car insurance cost in Mandan?

Average car insurance cost in Mandan is $2,300 per year, which is 1% more than the U.S. average rate of $2,276. Car insurance in Mandan per month costs approximately $192 per month for full coverage auto insurance.

In the state of North Dakota, the average cost of car insurance is $2,222 per year, so the cost in Mandan is $78 more per year.

When rates are compared to other larger cities in North Dakota, the average cost of car insurance in Mandan is approximately $186 per year more expensive than in Grand Forks, $22 per year more than in Bismarck, and $212 per year more than in West Fargo.

The age of the rated driver is the factor that has the most impact on the cost of auto insurance. The list below details how age impacts cost by showing the difference in average car insurance rates in Mandan based on the age of the driver.

Car insurance cost in Mandan for drivers age 16 to 60

- 16 year old – $8,196 per year or $683 per month

- 17 year old – $7,940 per year or $662 per month

- 18 year old – $7,116 per year or $593 per month

- 19 year old – $6,479 per year or $540 per month

- 20 year old – $4,630 per year or $386 per month

- 30 year old – $2,458 per year or $205 per month

- 40 year old – $2,300 per year or $192 per month

- 50 year old – $2,040 per year or $170 per month

- 60 year old – $1,910 per year or $159 per month

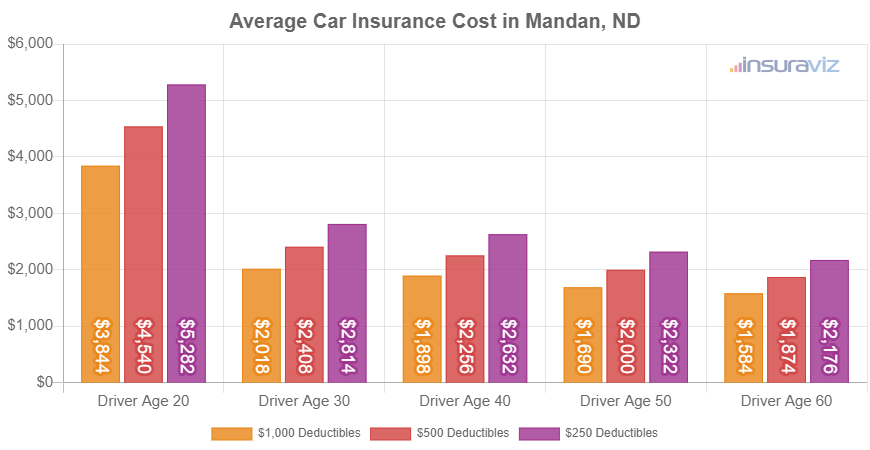

The chart below shows average Mandan car insurance cost for all 2024 models. Rates are averaged for all Mandan Zip Codes and shown by driver age and comprehensive and collision deductibles.

Average rates in the chart range from $1,616 per year for a 60-year-old driver with $1,000 physical damage deductibles to $5,384 per year for a 20-year-old driver with $250 deductibles. The rate for a 40-year-old driver with $500 physical damage deductibles ($2,300 per year) is the overall average rate we use for comparisons throughout this article.

As a monthly price, the average cost of car insurance in Mandan ranges from $135 to $449 for the same annual data shown in the chart.

Car insurance rates vary considerably and can also be very different depending on the company. The potential for large differences in cost reinforces the need for multiple auto insurance quotes when trying to find cheaper car insurance.

Insurance for the most popular vehicles

The car insurance rates mentioned above are averaged for all 2024 vehicle models, which is helpful when making big picture comparisons such as the average cost difference between different locations in North Dakota.

For more in-depth auto insurance rate comparisons, however, it makes good sense to compare rates for specific vehicle models. Let’s look at some of the more popular vehicles to find out how car insurance rates size up in Mandan.

The models that sell well in Mandan tend to be small or midsize cars like the Toyota Corolla and Kia K5 and small or midsize SUVs like the Honda CR-V and Chevy Traverse. Even a few pickups have decent rates, like the Toyota Tacoma and Ford F-150.

A few additional popular vehicles in Mandan from different automotive segments include luxury cars like the BMW 530i, Lexus ES 350, and Acura ILX, luxury SUVs like the Cadillac XT5, Infiniti QX60, and Lexus RX 350, and pickup trucks like the Chevy Colorado and Ford Ranger.

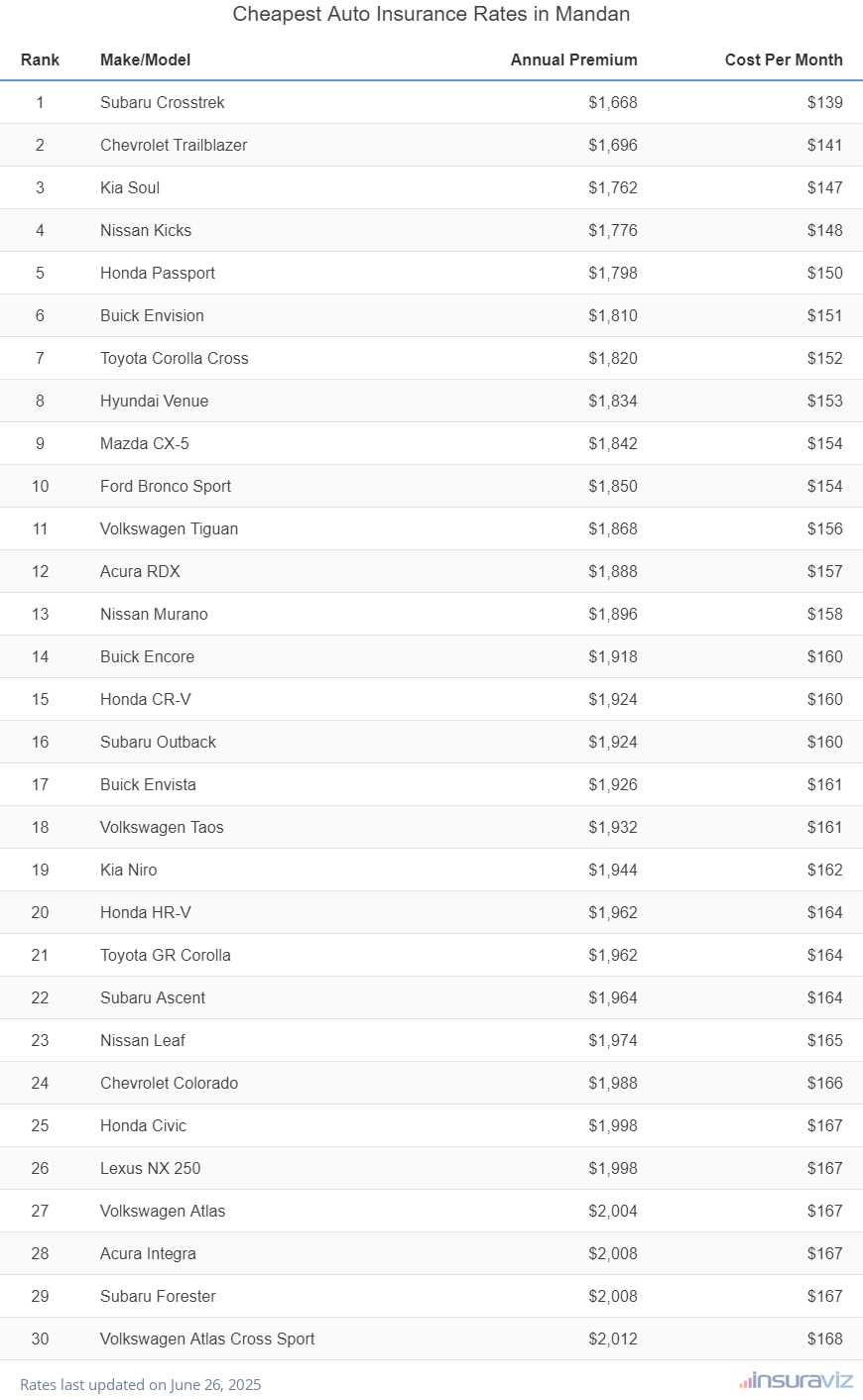

Which vehicles are cheapest to insure?

The vehicles with the most affordable car insurance rates in Mandan tend to be compact SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, Nissan Kicks, and Buick Envision. Average insurance rates for vehicles ranking in the top 10 cost $1,884 or less per year ($157 per month) for a full coverage policy.

Other models that are ranked high in our auto insurance price comparison are the Buick Encore, Buick Envista, Volkswagen Tiguan, and Nissan Murano.

The average cost is a little higher for those models than the cheapest compact SUVs that rank at the top, but they still have an average cost of $2,000 or less per year ($167 per month) in Mandan.

The next table details the 30 models with the cheapest car insurance in Mandan, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,700 | $142 |

| 2 | Chevrolet Trailblazer | $1,730 | $144 |

| 3 | Kia Soul | $1,796 | $150 |

| 4 | Nissan Kicks | $1,812 | $151 |

| 5 | Honda Passport | $1,832 | $153 |

| 6 | Buick Envision | $1,846 | $154 |

| 7 | Toyota Corolla Cross | $1,856 | $155 |

| 8 | Hyundai Venue | $1,872 | $156 |

| 9 | Mazda CX-5 | $1,876 | $156 |

| 10 | Ford Bronco Sport | $1,884 | $157 |

| 11 | Volkswagen Tiguan | $1,906 | $159 |

| 12 | Acura RDX | $1,926 | $161 |

| 13 | Nissan Murano | $1,934 | $161 |

| 14 | Buick Encore | $1,956 | $163 |

| 15 | Subaru Outback | $1,960 | $163 |

| 16 | Honda CR-V | $1,962 | $164 |

| 17 | Buick Envista | $1,968 | $164 |

| 18 | Volkswagen Taos | $1,972 | $164 |

| 19 | Kia Niro | $1,982 | $165 |

| 20 | Toyota GR Corolla | $2,000 | $167 |

| 21 | Honda HR-V | $2,002 | $167 |

| 22 | Subaru Ascent | $2,002 | $167 |

| 23 | Nissan Leaf | $2,016 | $168 |

| 24 | Chevrolet Colorado | $2,026 | $169 |

| 25 | Honda Civic | $2,038 | $170 |

| 26 | Lexus NX 250 | $2,038 | $170 |

| 27 | Volkswagen Atlas | $2,042 | $170 |

| 28 | Acura Integra | $2,046 | $171 |

| 29 | Subaru Forester | $2,050 | $171 |

| 30 | Volkswagen Atlas Cross Sport | $2,052 | $171 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mandan, ND Zip Codes. Updated October 24, 2025

Additional vehicles ranking in the top 30 above include the Honda HR-V, Chevrolet Colorado, Nissan Leaf, Lexus NX 250, and Subaru Ascent. Auto insurance rates for those models fall between $2,000 and $2,052 per year in Mandan.

To help put these rates in perspective, a few models that have much higher car insurance rates include the Toyota Mirai which averages $2,864 per year, the Audi S3 that costs $2,580, and the Mercedes-Benz S560 at an average of $4,044.

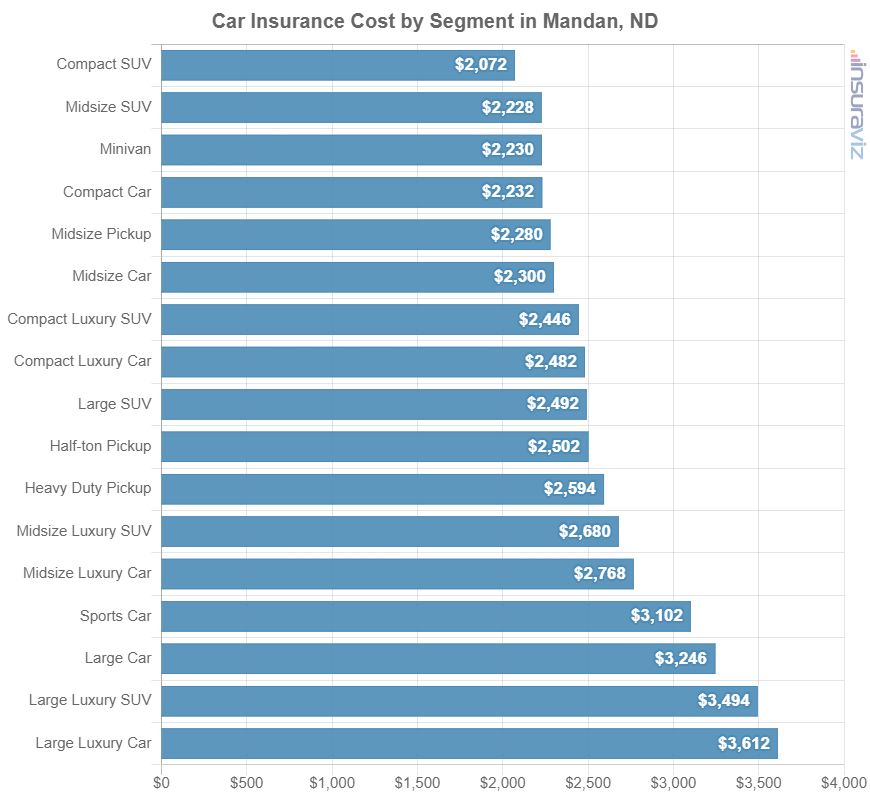

The next section details the average cost of car insurance in Mandan for each different automotive segment. The rates shown will give you a good understanding of which types of vehicles have the overall best average auto insurance rates.

Auto insurance rates by automotive segment

If you’re looking to buy a different vehicle, it’s useful to know which types of vehicles have less expensive car insurance rates in Mandan. As an example, maybe you’re curious if midsize SUVs are cheaper to insure than full-size SUVs or which size of luxury car has cheaper insurance.

The chart below shows average car insurance rates in Mandan for different vehicle segments. When comparing rates from a segment perspective, small SUVs and midsize pickups tend to have the cheapest rates, while sports cars, large luxury cars, and performance exotic cars tend to have the most expensive overall car insurance rates.

Average rates for each segment are intended to give you a general understanding of which types of vehicles cost the least to insure. But within each segment, rates can vary quite a bit.

For example, in the midsize luxury car segment, auto insurance rates in Mandan range from the Mercedes-Benz CLA250 costing $2,368 per year to the BMW M8 costing $3,878 per year.

As another example, in the small SUV segment, average rates vary from the Subaru Crosstrek costing $1,700 per year up to the Ford Mustang Mach-E costing $2,692 per year, a difference of $992 within that segment.

The next list identifies the model with the cheapest average car insurance cost in Mandan, ND, for each individual category. Annual and monthly insurance quotes are calculated for each one.

- Cheapest compact car insurance – Toyota GR Corolla at $2,000 per year or $167 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,700 per year or $142 per month

- Cheapest midsize car insurance – Kia K5 at $2,216 per year or $185 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,832 per year or $153 per month

- Cheapest full-size car insurance – Chrysler 300 at $2,192 per year or $183 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $2,160 per year or $180 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $2,026 per year or $169 per month

- Cheapest full-size pickup insurance – Nissan Titan at $2,152 per year or $179 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $2,342 per year or $195 per month

- Cheapest minivan insurance – Honda Odyssey at $2,104 per year or $175 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $2,130 per year or $178 per month

- Cheapest compact luxury car insurance – Acura Integra at $2,046 per year or $171 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,926 per year or $161 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,368 per year or $197 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $2,152 per year or $179 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,736 per year or $228 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,580 per year or $215 per month

How to find cheaper auto insurance in Mandan

As you probably noticed from the data above, there are a lot of things that can impact the rate you pay for car insurance. Nobody wants to pay high rates, so the list below offers some tips for keep rates down.

Some factors are out of your control, like your age and gender, but other things, like how you drive, the type of vehicle you buy, and your financial responsibility rating, are all within your control.

- Remain claim free. Insurance companies give a discount for not having any claims. Car insurance should only be used in the case of large financial hits, not for minor claims.

- Don’t be a negligent driver. Having frequent accidents may increase rates, potentially by an extra $3,290 per year for a 20-year-old driver and even $696 per year for a 50-year-old driver. So be a careful driver and save!

- Avoid tickets to save money. If you want to get the cheapest auto insurance in Mandan, it pays to drive safe. In fact, just a few minor infractions could increase the price of a policy by as much as $612 per year. Being convicted of a major violation like DUI and hit-and-run could raise rates by an additional $2,138 or more.

- Qualify for policy discounts to lower insurance cost. Discounts may be available if the insured drivers take a defensive driving course, insure their home and car with the same company, belong to certain professional organizations, insure multiple vehicles on the same policy, or many other policy discounts which could save the average Mandan driver as much as $388 per year.

- Compare car insurance quote before buying a car. Different vehicles, and even different trims of the same vehicle, have very different costs for insurance, and auto insurance companies can charge widely varying rates. Get quotes to see the cost of insurance before you buy a new car to prevent price shock when insuring your new car.

- Your employment could save you a few bucks. The vast majority of auto insurance providers offer policy discounts for specific professions like firefighters, engineers, scientists, accountants, members of the military, and others. Getting this discount applied to your policy could save between $69 and $224 on your car insurance premium, depending on the level of coverage purchased.

- Shop around for better rates. Taking the time to get a few free car insurance quotes is the best way to save money. Companies change rates often and switching to a different company is very easy to do.