- Average car insurance cost in Edmond is $2,128 per year, which is 12.2% more than the national average rate of $1,883.

- Auto insurance rates for a few popular models in Edmond include the Toyota RAV4 at $163 per month, Nissan Altima at $192, and Toyota Camry at $191.

- For the cheapest auto insurance in Edmond, Oklahoma, compact SUVs like the Kia Soul, Chevrolet Trailblazer, Nissan Kicks, and Buick Envision have some of the cheapest rates.

Average car insurance cost in Edmond

The average car insurance expense in Edmond is $2,128 per year, or approximately $177 per month for a policy with full coverage. It costs 12.2% more to insure the average vehicle in Edmond, OK, than the U.S. average rate of $1,883.

In Oklahoma, the average price for car insurance is $2,090 per year, so the average cost of car insurance in Edmond is $38 more per year.

When compared to other cities in Oklahoma, the average cost to insure a vehicle in Edmond is approximately $14 per year more expensive than in Norman, $126 per year less than in Oklahoma City, and $168 per year more expensive than in Lawton.

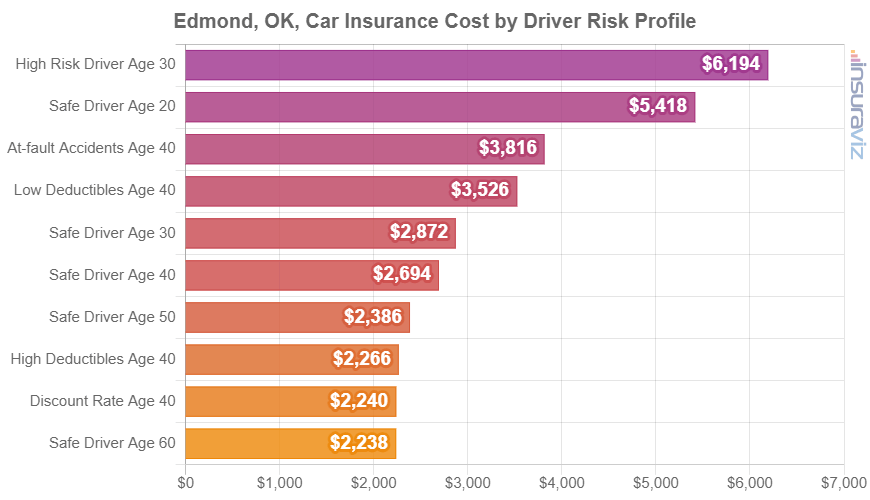

The chart below goes into more detail for drivers age 20 to 60 by showing a range of rates based on a variety of driver ages, risk profiles, and policy deductibles.

Average car insurance rates in the previous chart range from $1,768 per year for a 40-year-old driver who meets the requirements for many policy discounts to $4,894 per year for a 30-year-old driver with a history of violations and/or at-fault accidents.

When the rates shown in the chart are converted to monthly figures, the average cost of car insurance per month in Edmond ranges from $147 to $408.

Auto insurance rates are not static and seemingly inconsequential changes in a driver’s risk profile can have meaningful effects on car insurance cost. This large rate variability emphasizes the need to get multiple car insurance quotes when searching online for more affordable car insurance.

The age of the driver is one of the largest factors in the price of car insurance, so the list below illustrates this by breaking down average car insurance rates in Edmond for drivers from age 16 to 60.

Average car insurance rates in Edmond, Oklahoma, for drivers age 16 to 60

- 16-year-old driver – $7,577 per year or $631 per month

- 17-year-old driver – $7,341 per year or $612 per month

- 18-year-old driver – $6,578 per year or $548 per month

- 19-year-old driver – $5,992 per year or $499 per month

- 20-year-old driver – $4,282 per year or $357 per month

- 30-year-old driver – $2,270 per year or $189 per month

- 40-year-old driver – $2,128 per year or $177 per month

- 50-year-old driver – $1,888 per year or $157 per month

- 60-year-old driver – $1,768 per year or $147 per month

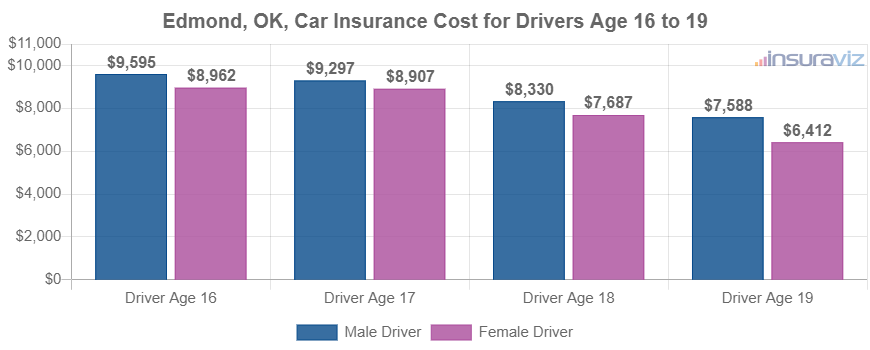

The rates shown above for insuring teen drivers age 16 to 19 were based on the driver being male. The next chart separates the average cost for car insurance for teen drivers in Edmond by gender. Female drivers tend to have slightly cheaper car insurance rates, especially at younger ages.

Auto insurance for a 16-year-old female in Edmond costs an average of $499 less than a male driver per year, while at age 19, the cost difference is much less but is still $927 per year.

The cost to insure Edmond drivers’ favorite vehicles

The auto insurance rates discussed up to this point take all 2024 vehicle models and average them, which is helpful when making generalized comparisons such as the average cost difference by driver age or location.

Average car insurance rates are fantastic when trying to find the answer to questions like “is Edmond auto insurance cheaper than Broken Arrow?” or “is auto insurance in Oklahoma cheaper than Arizona?”.

For more in-depth rate comparisons, however, the data will be more accurate if we look at the exact vehicle being insured. Each individual vehicle model has a unique profile for physical damage and liability claims, and this data allows us to make insurance cost comparisons.

The list below details both annual and monthly average auto insurance rates for the more popular models that you will find in Edmond. Later, there is a section that explores car insurance rates for a few of these models even more in-depth.

Average car insurance rates for popular Edmond vehicles

- Toyota RAV4 – $2,099 per year ($175 per month)

- Nissan Altima – $2,470 per year ($206 per month)

- Toyota Camry – $2,455 per year ($205 per month)

- Hyundai Elantra – $2,477 per year ($206 per month)

- Ram Truck – $2,639 per year ($220 per month)

- Nissan Rogue – $2,047 per year ($171 per month)

- Chevrolet Silverado – $2,521 per year ($210 per month)

- Jeep Cherokee – $2,455 per year ($205 per month)

- Ford Escape – $2,077 per year ($173 per month)

- Toyota Tacoma – $2,308 per year ($192 per month)

Which vehicles have cheap insurance in Edmond?

The vehicles with the best insurance prices in Edmond, OK, tend to be compact SUVs like the Kia Soul, Chevrolet Trailblazer, and Hyundai Venue.

Average auto insurance rates for models ranked in the top 10 cost $156 or less per month to get full coverage.

Additional models that have very good car insurance prices in our cost comparison are the Ford Bronco Sport, Chevrolet Colorado, Nissan Murano, and Kia Niro.

The average insurance cost is a little higher for those models than the crossovers and small SUVs at the top of the list, but they still have an average insurance cost of $163 or less per month.

The table below breaks down the vehicles with the cheapest overall insurance rates in Edmond, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,528 | $127 |

| 2 | Chevrolet Trailblazer | $1,558 | $130 |

| 3 | Kia Soul | $1,616 | $135 |

| 4 | Nissan Kicks | $1,630 | $136 |

| 5 | Honda Passport | $1,646 | $137 |

| 6 | Buick Envision | $1,656 | $138 |

| 7 | Toyota Corolla Cross | $1,670 | $139 |

| 8 | Hyundai Venue | $1,682 | $140 |

| 9 | Mazda CX-5 | $1,686 | $141 |

| 10 | Ford Bronco Sport | $1,696 | $141 |

| 11 | Volkswagen Tiguan | $1,710 | $143 |

| 12 | Acura RDX | $1,728 | $144 |

| 13 | Nissan Murano | $1,738 | $145 |

| 14 | Buick Encore | $1,758 | $147 |

| 15 | Subaru Outback | $1,760 | $147 |

| 16 | Honda CR-V | $1,766 | $147 |

| 17 | Buick Envista | $1,770 | $148 |

| 18 | Chevrolet Colorado | $1,772 | $148 |

| 19 | Kia Niro | $1,774 | $148 |

| 20 | Volkswagen Taos | $1,774 | $148 |

| 21 | Toyota GR Corolla | $1,794 | $150 |

| 22 | Subaru Ascent | $1,796 | $150 |

| 23 | Honda HR-V | $1,802 | $150 |

| 24 | Nissan Leaf | $1,812 | $151 |

| 25 | Honda Civic | $1,830 | $153 |

| 26 | Lexus NX 250 | $1,830 | $153 |

| 27 | Volkswagen Atlas | $1,832 | $153 |

| 28 | Acura Integra | $1,838 | $153 |

| 29 | Volkswagen Atlas Cross Sport | $1,840 | $153 |

| 30 | Subaru Forester | $1,844 | $154 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Edmond, OK Zip Codes. Updated February 23, 2024

A few additional vehicles worth noting that rank in the top 30 above include the Subaru Forester, the Subaru Ascent, the Nissan Leaf, and the Toyota GR Corolla. Rates for those models cost between $1,826 and $1,896 per year.

In contrast to the vehicles with cheap rates, a few models that cost much more to insure include the Hyundai Nexo which averages $196 per month, the Audi A4 at $204, and the BMW X3 at an average of $209.

For really high-priced auto insurance in Edmond, performance and luxury models like the Mercedes-Benz Maybach GLS 600, BMW M760i, Aston Martin DBX, and BMW M8 have rates that can easily exceed three times the cost of the cheapest models.

The highs and lows of Edmond car insurance

To help illustrate the amount the cost of auto insurance can deviate from one driver to the next (and also underscore the importance of getting multiple quotes), the sections below show comprehensive rates for four popular models in Edmond: the Chevrolet Silverado, Toyota Corolla, Toyota RAV4, and Toyota Highlander.

Each example shows rates for a variety of different driver profiles to show the possible variation with only small changes to the policy rating factors.

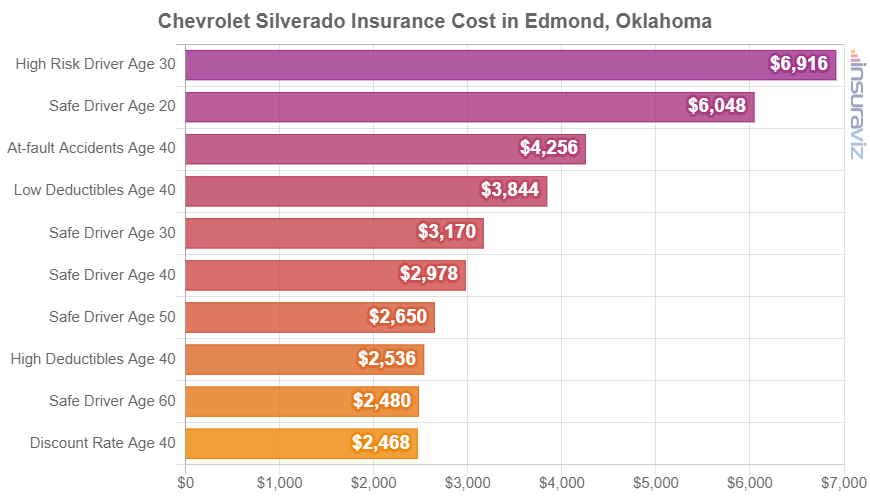

Chevrolet Silverado insurance rates

Average Chevrolet Silverado insurance cost in Edmond ranges from $1,994 to $2,790 per year. The least-expensive model to insure is the $39,900 Chevrolet Silverado EV WT model, while the model with the most expensive insurance rates is the $105,000 Chevrolet Silverado EV RST First Edition.

When Edmond car insurance rates on the Chevrolet Silverado are compared to the cost averaged for the entire U.S. on the same vehicle, the cost is anywhere from $216 to $304 more expensive per year in Edmond, depending on which trim level is insured.

The chart displayed below shows how the cost to insure a Chevrolet Silverado can change for different driver ages, physical damage deductibles, and driver risk profiles.

The Chevrolet Silverado belongs to the full-size truck segment, and other models in the same segment include the GMC Sierra, Toyota Tundra, Ford F150, and Nissan Titan.

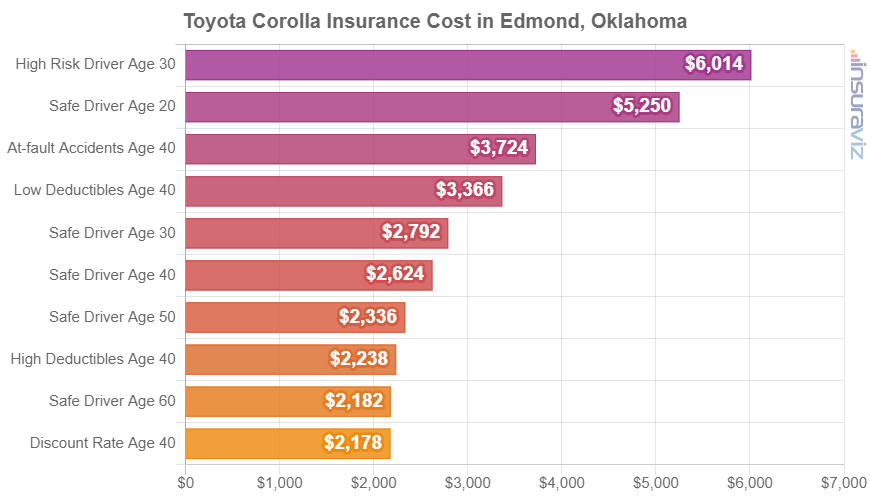

Toyota Corolla insurance rates

Average Toyota Corolla insurance cost in Edmond ranges from $1,884 to $2,344 per year. The cheapest car insurance quotes are on the $21,900 Toyota Corolla LE model, while the most expensive model to insure is the $26,655 Toyota Corolla XSE Hatchback.

As a cost per month, full-coverage car insurance on a 2024 Toyota Corolla for an average middle-age driver can cost from $157 to $195 per month, depending on your exact location in Edmond.

The chart displayed below may help illustrate how car insurance quotes for a Toyota Corolla can change based on a variety of driver ages and possible risk profiles.

For our example, prices range from $1,720 to $4,750 per year, which is a difference of $3,030 to insure the same vehicle using different rated drivers.

The Toyota Corolla is a compact car, and other models popular in Edmond include the Nissan Sentra, Volkswagen Jetta, and Kia Forte.

Toyota RAV4 insurance rates

Toyota RAV4 insurance in Edmond averages $1,958 per year, ranging from a low of $1,736 per year for the Toyota RAV4 LE AWD trim level (MSRP of $29,875) up to $2,294 per year for the Toyota RAV4 Prime XSE AWD model (MSRP of $47,310).

When Edmond insurance rates on the Toyota RAV4 are compared to the average cost for the entire U.S. for the same model, the cost is $190 to $248 more expensive per year in Edmond, depending on the exact trim being insured.

From a monthly standpoint, full-coverage car insurance for a Toyota RAV4 for a middle-age safe driver can cost from $145 to $191 per month, depending on the company and your exact location in Edmond.

The chart below can help visualize how the cost of car insurance on a Toyota RAV4 can vary for a number of different driver ages, policy physical damage deductibles, and risk scenarios.

In this example, rates range from $1,628 to $4,504 per year, which is a cost difference of $2,876 per year to insure the same vehicle.

The Toyota RAV4 belongs to the compact SUV segment, and other popular models include the Nissan Rogue, Honda CR-V, Chevrolet Equinox, and Ford Escape.

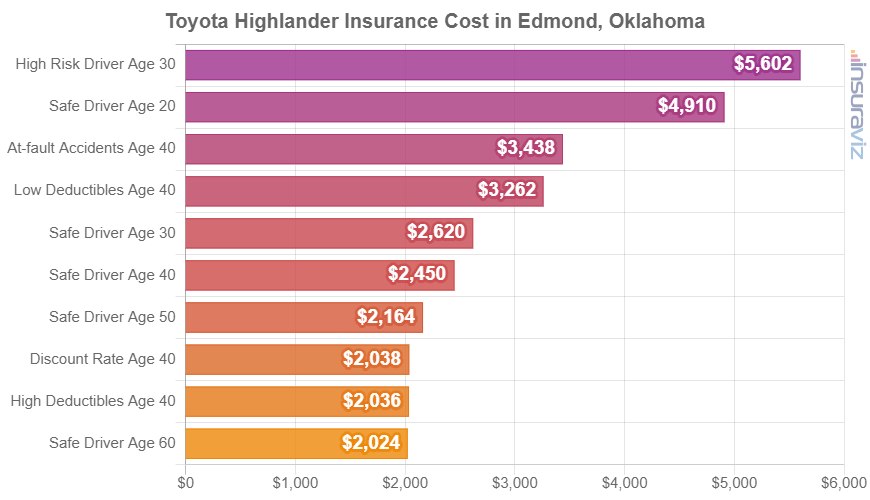

Toyota Highlander insurance rates

Toyota Highlander insurance in Edmond averages $1,938 per year, with rates ranging from a low of $1,780 per year for the Toyota Highlander LE 2WD trim level (MSRP of $37,625) up to $2,100 per year on the Toyota Highlander Hybrid XLE AWD (MSRP of $43,825).

As a cost per month, car insurance on a 2024 Toyota Highlander for a middle-age safe driver can range from $148 to $175 per month, depending on your exact location in Edmond.

The next rate chart may help illustrate how the cost of insurance on a Toyota Highlander can range significantly based on different driver ages and possible risk profiles.

The Toyota Highlander is considered a midsize SUV, and additional similar models include the Jeep Grand Cherokee, Ford Explorer, and Ford Edge.

Tips for getting cheaper Edmond car insurance quotes

Shrewd drivers in Edmond are always looking to cut the monthly cost of insurance, so glance at the savings tips below and it’s very likely you can save a little dough on your next car insurance policy.

- Safe drivers pay less. Having frequent accidents may increase rates, possibly as much as $3,040 per year for a 20-year-old driver and even as much as $884 per year for a 40-year-old driver. So drive safe and save!

- Buy vehicles with cheaper auto insurance rates. Vehicle performance is a huge factor in the price you pay for auto insurance. As an example, a Honda CR-V costs $728 less per year to insure in Edmond than a Subaru BRZ. Buy cheaper models and save money.

- Remove optional coverage on older vehicles. Dropping comprehensive and collision coverage from vehicles whose value does not support the cost of the coverage can cheapen the cost considerably.

- Find cheaper rates by qualifying for discounts. Discounts may be available if the insured drivers are homeowners, drive a vehicle with safety or anti-theft features, insure their home and car with the same company, are loyal customers, or many other discounts which could save the average Edmond driver as much as $360 per year on auto insurance.

- Your job could save you a few bucks. Some car insurance companies offer discounts for being employed in professions like firefighters, police officers and law enforcement, accountants, engineers, dentists, and others. Earning this discount could save between $64 and $207 on your annual car insurance bill, subject to policy limits.