- Compact crossovers like the Nissan Kicks, Chevrolet Trailblazer, Subaru Crosstrek, and Toyota Corolla Cross are the top picks for the cheapest auto insurance in Lancaster.

- Average car insurance cost is $2,216 per year, or $185 per month, for a policy with full coverage.

- Lancaster, Pennsylvania, auto insurance averages $234 per year less than the Pennsylvania state average ($2,450) and $60 per year less than the average for all 50 states ($2,276).

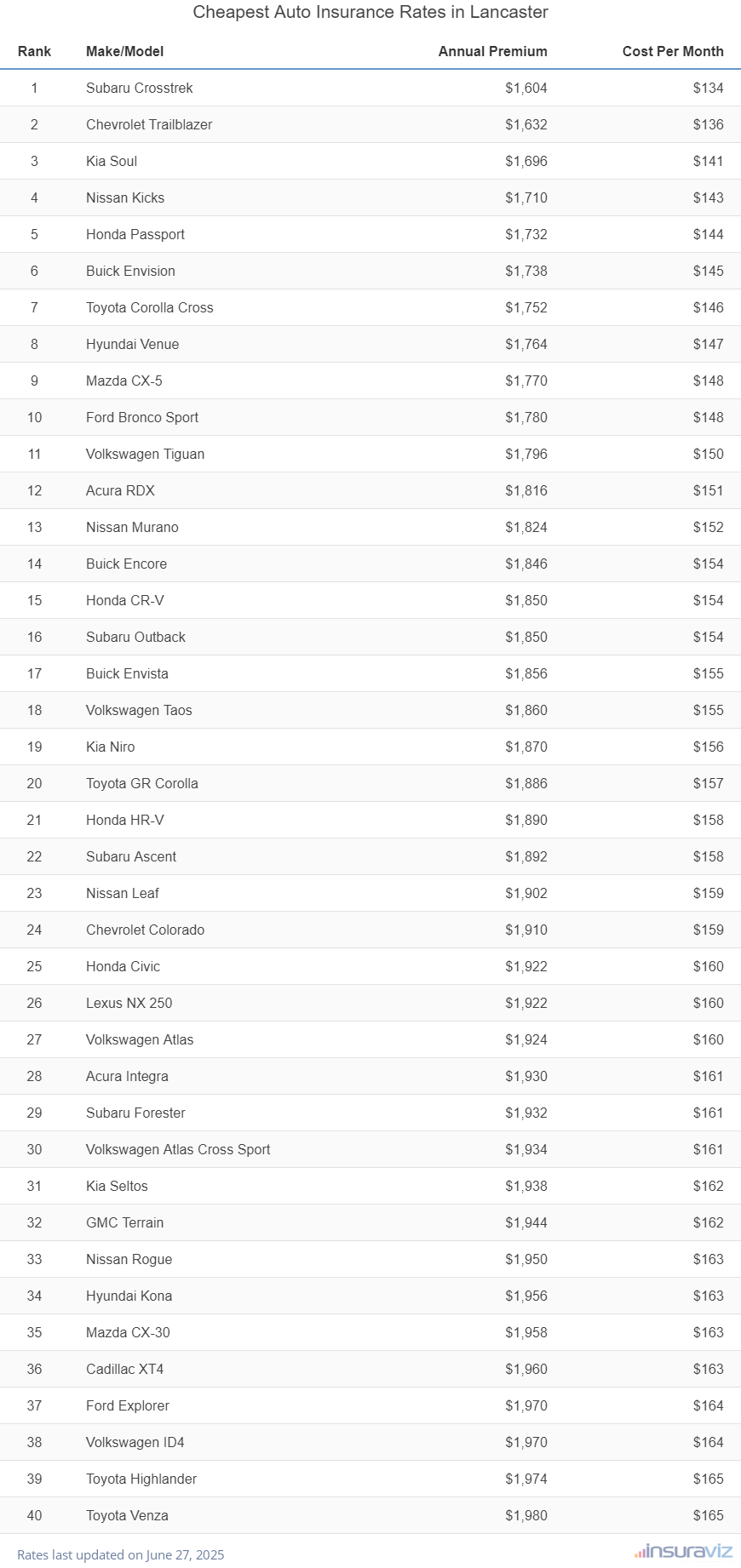

Which cars are cheapest to insure?

The models with the lowest cost average auto insurance quotes in Lancaster, PA, tend to be small SUVs and crossovers like the Kia Soul, Chevrolet Trailblazer, and Hyundai Venue. Average insurance rates for the vehicles ranked in the top 10 cost $1,814 or less per year, or $151 per month, for a policy with full coverage.

Other vehicles that are in the top 20 in the cost comparison table are the Ford Bronco Sport, Buick Encore, Nissan Murano, and Acura RDX. The average insurance cost is slightly higher for those models than the cheapest crossovers and small SUVs that rank near the top, but they still have an average insurance cost of $1,924 or less per year in Lancaster.

The next table lists the top 40 models with the cheapest car insurance rates in Lancaster, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,636 | $136 |

| 2 | Chevrolet Trailblazer | $1,666 | $139 |

| 3 | Kia Soul | $1,730 | $144 |

| 4 | Nissan Kicks | $1,744 | $145 |

| 5 | Honda Passport | $1,766 | $147 |

| 6 | Buick Envision | $1,776 | $148 |

| 7 | Toyota Corolla Cross | $1,786 | $149 |

| 8 | Hyundai Venue | $1,800 | $150 |

| 9 | Mazda CX-5 | $1,806 | $151 |

| 10 | Ford Bronco Sport | $1,814 | $151 |

| 11 | Volkswagen Tiguan | $1,832 | $153 |

| 12 | Acura RDX | $1,852 | $154 |

| 13 | Nissan Murano | $1,862 | $155 |

| 14 | Buick Encore | $1,884 | $157 |

| 15 | Subaru Outback | $1,886 | $157 |

| 16 | Honda CR-V | $1,890 | $158 |

| 17 | Buick Envista | $1,894 | $158 |

| 18 | Volkswagen Taos | $1,900 | $158 |

| 19 | Kia Niro | $1,908 | $159 |

| 20 | Toyota GR Corolla | $1,924 | $160 |

| 21 | Honda HR-V | $1,928 | $161 |

| 22 | Subaru Ascent | $1,928 | $161 |

| 23 | Nissan Leaf | $1,942 | $162 |

| 24 | Chevrolet Colorado | $1,952 | $163 |

| 25 | Honda Civic | $1,960 | $163 |

| 26 | Lexus NX 250 | $1,960 | $163 |

| 27 | Volkswagen Atlas | $1,964 | $164 |

| 28 | Subaru Forester | $1,970 | $164 |

| 29 | Acura Integra | $1,972 | $164 |

| 30 | Volkswagen Atlas Cross Sport | $1,972 | $164 |

| 31 | Kia Seltos | $1,980 | $165 |

| 32 | GMC Terrain | $1,984 | $165 |

| 33 | Nissan Rogue | $1,990 | $166 |

| 34 | Hyundai Kona | $1,996 | $166 |

| 35 | Mazda CX-30 | $1,998 | $167 |

| 36 | Cadillac XT4 | $2,002 | $167 |

| 37 | Ford Explorer | $2,010 | $168 |

| 38 | Volkswagen ID4 | $2,010 | $168 |

| 39 | Toyota Highlander | $2,016 | $168 |

| 40 | Ford Escape | $2,022 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lancaster, PA Zip Codes. Updated October 24, 2025

Some additional models worth noting ranked in the top 40 above include the Nissan Rogue, Kia Seltos, Cadillac XT4, Chevrolet Colorado, and Subaru Forester. Auto insurance rates for those vehicles fall between $1,924 and $2,022 per year in Lancaster.

To put the rates for the cheapest vehicles in perspective, some models that have much higher car insurance rates include the Toyota Mirai that costs $230 per month, the Dodge Challenger which costs $278, and the Infiniti Q50 which costs $209.

And for really expensive insurance rates, models like the Nissan GT-R, BMW M8, Acura NSX, and BMW 750i have rates that cost at least double those of the cheapest models.

What is average car insurance cost in Lancaster?

The average cost to insure a vehicle in Lancaster is $2,216 per year, which is 2.7% less than the national average rate of $2,276 per year. Average car insurance cost per month in Lancaster is $185 for full coverage auto insurance.

In the state of Pennsylvania, average car insurance cost is $2,450 per year, so the cost in Lancaster averages $234 less per year. The cost of insurance in Lancaster compared to other Pennsylvania cities is about $204 per year less than in Reading, $118 per year less than in Scranton, and $234 per year cheaper than in Allentown.

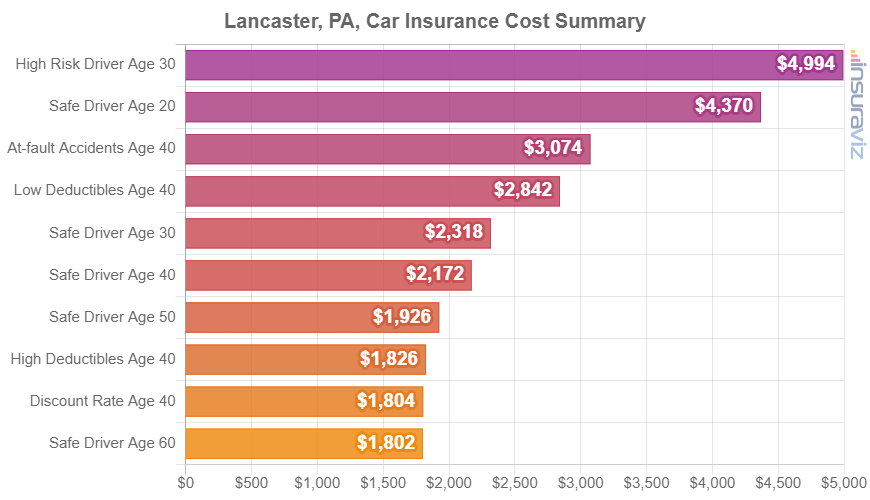

The chart below displays additional costs for drivers age 20 to 60 by showing a range of rates based on a range of driver ages, physical damage deductibles, and driver risk profiles.

The average cost of car insurance per month in Lancaster is $185, with policy prices ranging from $153 to $425 for the data in the prior chart.

Car insurance rates can have wide price ranges and slight changes in a driver’s risk profile can have significant effects on car insurance cost. The high chance of significant rate differences emphasizes the need to get multiple auto insurance quotes when searching online for a better price on car insurance in Lancaster.

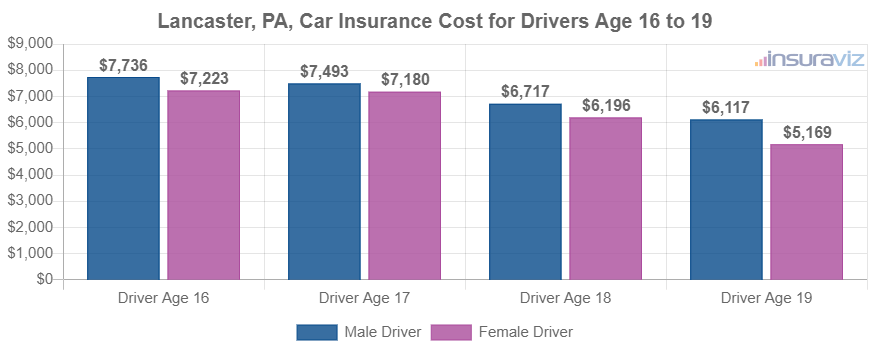

The age of the driver influences the price of auto insurance. The list below details how driver age influences cost by breaking down average car insurance rates in Lancaster for driver ages 16 through 60.

Average car insurance rates in Lancaster for drivers age 16 to 60

- 16-year-old driver – $7,888 per year or $657 per month

- 17-year-old driver – $7,643 per year or $637 per month

- 18-year-old driver – $6,850 per year or $571 per month

- 19-year-old driver – $6,241 per year or $520 per month

- 20-year-old driver – $4,458 per year or $372 per month

- 30-year-old driver – $2,364 per year or $197 per month

- 40-year-old driver – $2,216 per year or $185 per month

- 50-year-old driver – $1,964 per year or $164 per month

- 60-year-old driver – $1,840 per year or $153 per month

The rates in the list above for teen drivers were based on the rated driver being male. The next chart goes into more detail for teenage car insurance rates and separates the average cost to insure teen drivers in Lancaster, PA, by gender. Females generally have cheaper auto insurance rates, especially as teenagers.

Car insurance for a 16-year-old female driver in Lancaster costs an average of $516 less than male drivers each year, while at age 19, the cost difference is less but females still cost $965 less per year.

Teens are without a doubt the most expensive age group of drivers to insure. But there are a lot of other factors that can affect the price you pay.

To illustrate how much auto insurance prices can fluctuate for different drivers (and also reiterate the importance of getting lots of rate quotes), the charts below visualize a wide range of car insurance rates for five popular vehicles in Lancaster: the Chevrolet Silverado, Nissan Rogue, Honda Pilot, Honda Accord, and Chevrolet Camaro.

Each illustration uses different driver and policy risk profiles to illustrate the possible cost variation when using different driver profiles.

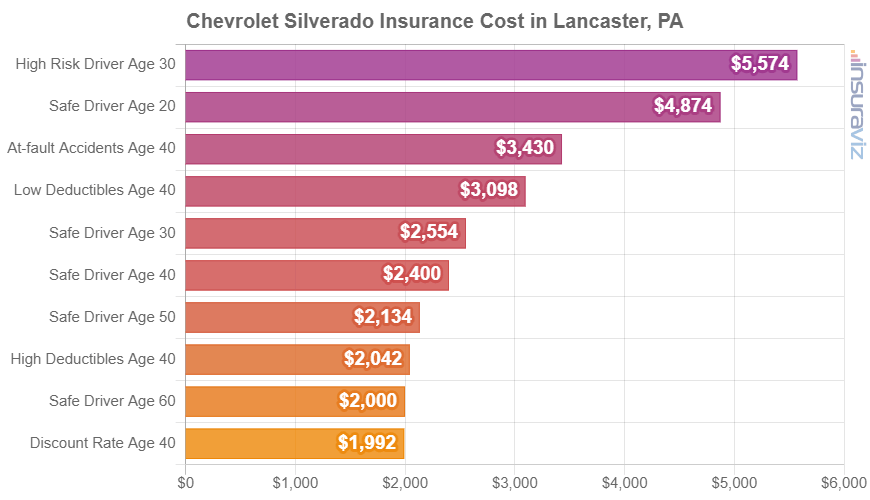

Chevrolet Silverado insurance rates

Chevrolet Silverado insurance in Lancaster costs an average of $2,626 per year, with a range of $2,078 per year on the Chevrolet Silverado EV WT trim level up to $2,906 per year on the Chevrolet Silverado EV RST First Edition trim level.

When Lancaster insurance rates for the Chevrolet Silverado are compared to the overall national average cost for the same vehicle, rates are anywhere from $170 to $240 more expensive per year in Lancaster, depending on the specific trim level being insured.

The next chart shows how car insurance quotes for a Chevrolet Silverado can range considerably based on different driver ages, policy deductibles, and risk profiles.

In this example, cost ranges from $2,030 to $5,686 per year, which is a difference in cost of $3,656 for the same vehicle.

The Chevrolet Silverado is considered a full-size truck, and other popular models include the Toyota Tundra, Ram Truck, and GMC Sierra.

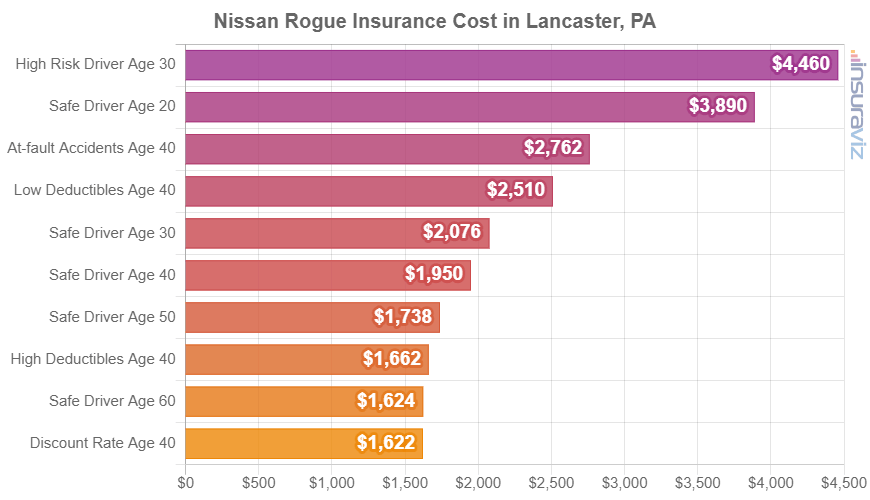

Nissan Rogue insurance rates

In Lancaster, the least-expensive auto insurance rates for a 2024 Nissan Rogue are on the S 2WD trim, costing an average of $1,886 per year, or around $157 per month. This model has a retail price of $29,360.

The most expensive 2022 Nissan Rogue to insure in Lancaster is the Platinum AWD model, costing an average of $2,086 per year, or around $174 per month. The sticker price for this model is $39,230, before documentation and delivery charges.

When Lancaster car insurance quotes on the Nissan Rogue are compared with national average insurance rates for the same model, rates are anywhere from $158 to $172 more expensive per year in Lancaster, depending on the specific model being insured.

From a cost per month standpoint, car insurance quotes on a 2024 Nissan Rogue can cost from $157 to $174 per month, but your final cost can vary considerably based on your address in Lancaster.

The chart displayed below should aid in understanding how the cost of car insurance for a Nissan Rogue can range considerably for different driver ages and common risk profiles. For our example drivers, rates range from $1,652 to $4,550 per year, which is a cost difference of $2,898 to insure the same vehicle using different rated drivers.

The Nissan Rogue is classified as a compact SUV, and other models popular in Lancaster include the Chevrolet Equinox, Honda CR-V, and Subaru Forester.

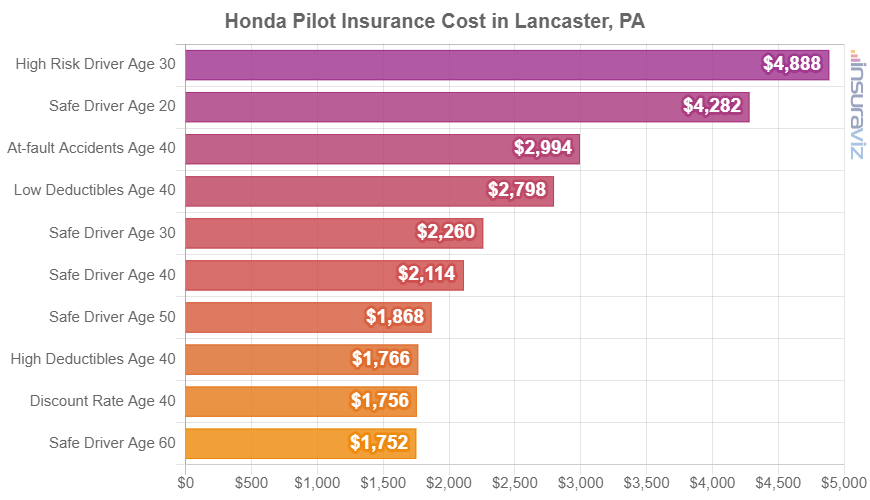

Honda Pilot insurance rates

Honda Pilot insurance in Lancaster costs an average of $2,156 per year, with rates ranging from a low of $2,018 per year on the Honda Pilot LX model (MSRP of $37,090) up to $2,292 per year on the Honda Pilot Elite AWD (MSRP of $52,480).

When Lancaster auto insurance rates for a Honda Pilot are compared to the average cost for the entire U.S. on the same vehicle, the cost is $168 to $190 more per year in Lancaster, depending on the trim being insured.

As a cost per month, auto insurance quotes on the Honda Pilot for an average middle-age driver can range from $168 to $191 per month, depending on the insurance company and your Zip Code in Lancaster.

The next chart should help you understand how the cost to insure a Honda Pilot can be quite different based on a variety of different driver ages, policy deductibles, and potential risk scenarios. In this example, cost ranges from $1,790 to $4,984 per year, which is a cost difference of $3,194 to insure the same make and model of vehicle.

The Honda Pilot is classified as a midsize SUV, and additional models from the same segment that are popular in Lancaster, Pennsylvania, include the Kia Sorento, Jeep Grand Cherokee, Ford Explorer, and Toyota Highlander.

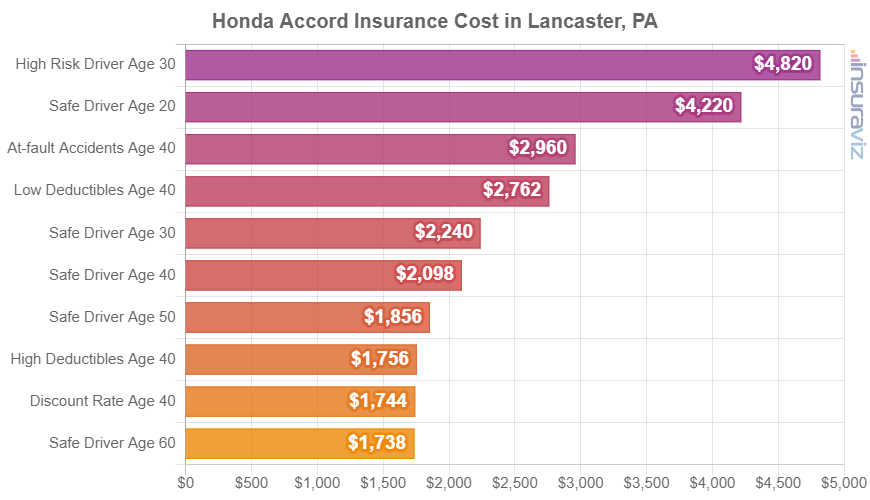

Honda Accord insurance rates

Average Honda Accord insurance cost in Lancaster costs from $2,062 to $2,196 per year. The most affordable model to insure is the $34,190 Honda Accord EX-L Hybrid model, while the most expensive model to insure is the $27,895 Honda Accord LX model.

When Lancaster car insurance rates on the Honda Accord are compared to the cost averaged for the entire U.S. on the same model, rates are anywhere from $170 to $182 more expensive per year in Lancaster, depending on the model being insured.

The bar chart below shows how the prices of car insurance for a Honda Accord can be very different based on driver age and policy risk profiles.

The Honda Accord belongs to the midsize car segment, and additional similar models include the Kia K5, Nissan Altima, Chevrolet Malibu, and Hyundai Sonata.

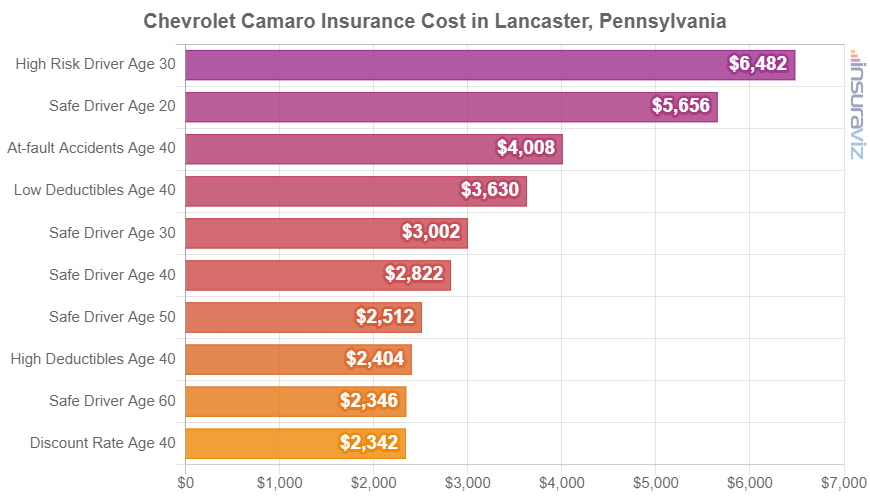

Chevrolet Camaro insurance rates

In Lancaster, the lowest-cost auto insurance rates on a 2024 Chevrolet Camaro are on the 1LT Convertible trim version, costing an average of $2,426 per year, or about $202 per month. This model has a MSRP of $38,495.

The most expensive 2022 Chevrolet Camaro trim level to insure in Lancaster is the ZL1 Coupe model, costing an average of $3,524 per year, or around $294 per month. The retail price for this model is $73,695, not including charges and fees.

When Lancaster car insurance rates for a Chevrolet Camaro are compared to the average cost for the entire U.S. for the same vehicle, the cost is $202 to $290 more expensive per year in Lancaster, depending on the trim being insured.

As a cost per month, full-coverage car insurance on a 2024 Chevrolet Camaro for a good driver can range from $202 to $294 per month, depending on exactly where you live in Lancaster.

The chart below may be useful to help you comprehend how the cost of insurance on a Chevrolet Camaro can range considerably based on a number of different driver ages, policy deductibles, and potential risk scenarios.

For our example risk profiles, the cost ranges from $2,388 to $6,610 per year, which is a cost difference of $4,222 based on different drivers.

The Chevrolet Camaro is part of the sports car segment, and other popular models include the Toyota GR Supra, Nissan 370Z, Subaru BRZ, and Chevrolet Corvette.

Five ways to reduce the cost of car insurance

If you own a vehicle, you have to have insurance, it’s just a fact of life. But there are some ways to help ensure you’re not paying too much. The five tips below are a few of the best ways to help keep costs down.

- Get a discount from your profession. Some auto insurance providers offer discounts for certain occupations like scientists, doctors, high school and elementary teachers, emergency medical technicians, college professors, architects, and others. By qualifying for an occupational discount, you may save between $66 and $215 on your yearly auto insurance cost, subject to policy limits.

- Obey driving laws to save money. In order to get the cheapest auto insurance in Lancaster, it pays to drive safe. Just a couple of minor traffic violations could end up increasing the cost of a policy by as much as $586 per year.

- Improve your credit for cheaper car insurance. Having excellent credit of 800+ could save $348 per year when compared to a lower credit score of 670-739. Conversely, a poor credit score could cost as much as $403 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Pay small claims out-of-pocket. Car insurance companies reduce rates a little if you have no claims on your account. Auto insurance should be used to protect you from larger claims, not for small claims.

- Compare insurance cost before you buy the car. Different vehicles have significantly different auto insurance rates, and insurers can charge very different rates. Get quotes to compare the cost of insurance before you buy a new vehicle in order to avoid any surprises when you receive your bill.