- Roanoke car insurance rates cost an average of $1,196 per year, or around $100 per month, for a full coverage policy.

- Auto insurance rates for a few popular vehicles include the Tesla Model 3 at $1,408 per year, Subaru Outback at $1,022, and Toyota Tacoma at $1,214.

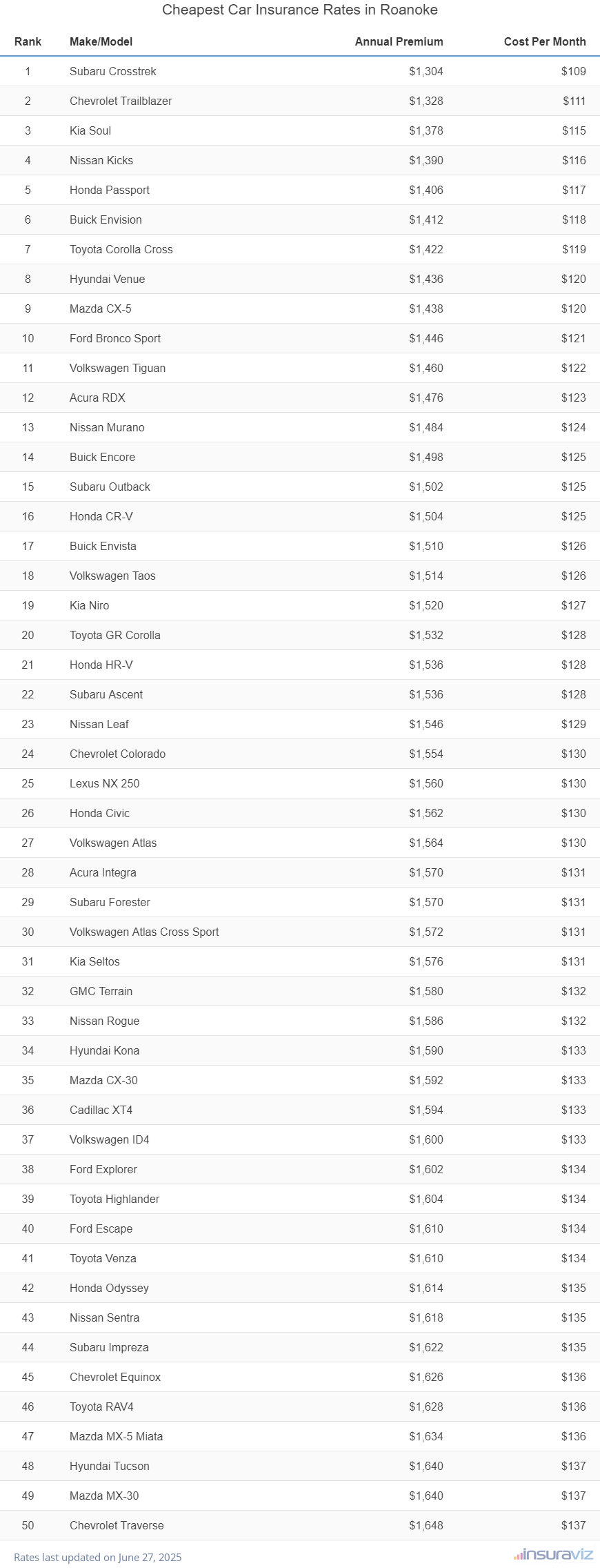

- For the cheapest auto insurance, small SUV models like the Nissan Kicks, Chevrolet Trailblazer, and Kia Soul have the best rates.

- Models with segment-leading auto insurance rates include the Mazda MX-5 Miata ($1,110 per year), Subaru Crosstrek ($884 per year), Honda Passport ($956 per year), and Jaguar E-Pace ($1,120 per year).

- Car insurance quotes can vary from as little as $30 per month for minimum liability insurance to well over $711 per month for high-risk drivers.

What is average car insurance cost in Roanoke?

In Roanoke, the average car insurance cost is $1,196 per year, which is 44.6% less than the overall U.S. national average rate of $1,883. Per month, Roanoke drivers can expect to pay an average of $100 for full coverage auto insurance.

In the state of Virginia, average auto insurance cost is $1,322 per year, so the average rate in Roanoke is $126 less per year. The cost of car insurance in Roanoke compared to other Virginia locations is approximately $228 per year cheaper than in Alexandria, $210 per year cheaper than in Norfolk, and $126 per year less than in Chesapeake.

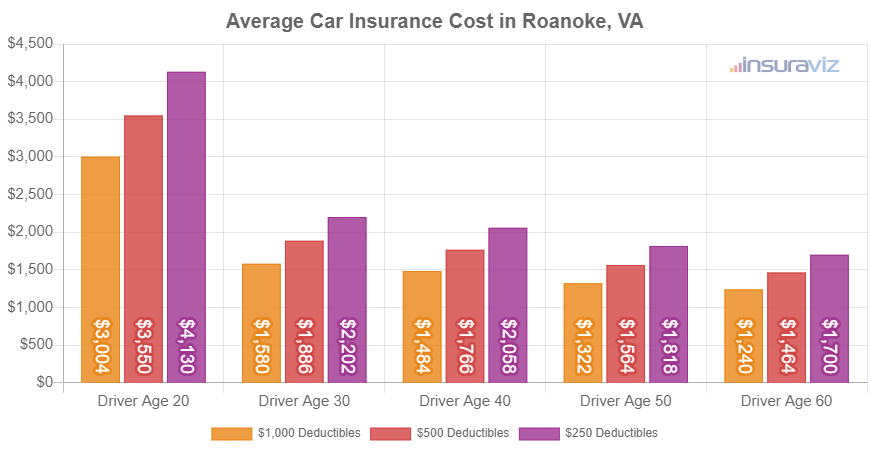

The next chart shows average auto insurance cost in Roanoke, Virginia, for all 2024 models. Rates are averaged for all Roanoke Zip Codes and shown not only by driver age, but also by policy deductible limits.

The average cost of auto insurance per month in Roanoke is $100, with policy premium ranging from $70 to $234 for the data shown in the chart above.

Roanoke auto insurance rates can be extremely variable and can also be significantly different between companies. The likelihood of significant rate variability increases the need to get accurate car insurance quotes when shopping for the cheapest car insurance in Roanoke.

The age of the rated driver is the one factor that has the largest impact on the price you pay for car insurance. The list below illustrates this by breaking out average car insurance rates in Roanoke for drivers from 16 to 60.

Average car insurance rates in Roanoke for drivers age 16 to 60

- 16 year old – $4,273 per year or $356 per month

- 17 year old – $4,140 per year or $345 per month

- 18 year old – $3,708 per year or $309 per month

- 19 year old – $3,377 per year or $281 per month

- 20 year old – $2,412 per year or $201 per month

- 30 year old – $1,280 per year or $107 per month

- 40 year old – $1,196 per year or $100 per month

- 50 year old – $1,062 per year or $89 per month

- 60 year old – $996 per year or $83 per month

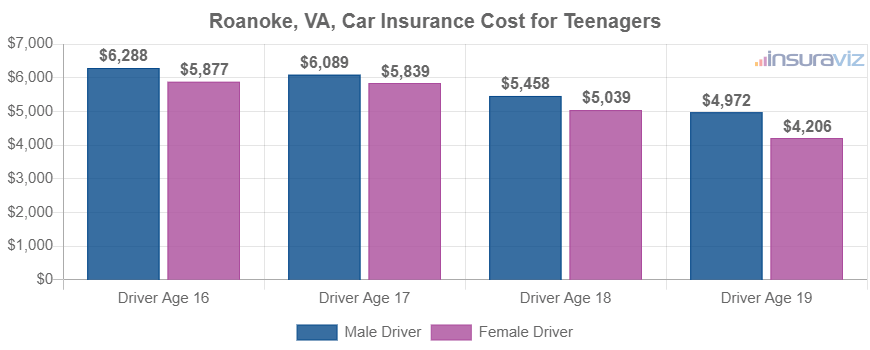

The previous rates shown for teen drivers assumed the gender of the driver was male. The next chart goes into more detail for teenage car insurance rates and illustrates average car insurance rates for teen drivers by gender. Females are generally cheaper to insure, especially up to age 20.

Auto insurance for a female 16-year-old driver in Roanoke costs an average of $281 less per year than male drivers, while at age 19, the cost is still $520 less per year.

Roanoke’s favorite vehicles and the cost to insure them

The previous auto insurance rates in this article take all 2024 models and come up with an average cost, which is handy when making overall comparisons such as the difference in average car insurance cost for two different locations in Virginia.

But for more useful car insurance cost comparisons, we will get better data if we compare rates for the specific model of vehicle being insured. Let’s look at just a few of the more popular vehicles to see how auto insurance rates stack up in Roanoke.

This next chart details the cost of auto insurance in Roanoke for a small sample of popular cars, pickups, and SUVs.

Let’s take a quick look at the main concepts that we have covered in the data above.

- Average car insurance cost per month ranges from $83 to $356 – That’s the average auto insurance price range for drivers from age 16 to 60 in Roanoke.

- Low deductible auto insurance costs more – A 50-year-old driver pays an average of $498 more per year for a policy with $250 deductibles compared to $1,000 deductibles.

- Teenage female drivers have cheaper rates than teenage males – Teen females (age 16 to 19) pay $520 to $281 less annually than males of the same age.

- Roanoke car insurance prices are cheaper than the Virginia state average – $1,196 (Roanoke average) compared to $1,322 (Virginia average)

- Insuring a teenager is expensive in Roanoke – Cost ranges from $2,857 to $4,273 per year for insurance on a teen driver in Roanoke, Virginia.

In Roanoke, which vehicles are cheapest to insure?

The models with the cheapest average car insurance rates in Roanoke tend to be crossovers and compact SUVs like the Kia Soul, Subaru Crosstrek, and Buick Envision.

Average insurance prices for cars and SUVs in the top 10 cost $982 or less per year for a policy with full coverage.

Examples of other vehicles that rank in the top 20 in the cost comparison table are the Nissan Murano, Buick Encore, Chevrolet Colorado, and Buick Envista. Average insurance cost is slightly higher for those models than the cheapest crossover SUVs that rank near the top, but they still have an average cost of $1,028 or less per year in Roanoke.

The table below details the vehicles with the cheapest overall insurance rates in Roanoke, ordered starting with the cheapest.

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Roanoke, VA Zip Codes. Updated February 23, 2024

Additional vehicles that made the top 50 above include the Nissan Leaf, the Subaru Ascent, the Ford Escape, the Mazda MX-30, and the Ford Explorer. Auto insurance rates for those models cost between $1,028 and $1,118 per year in Roanoke, VA.

To put the rates of the cheapest vehicles in perspective, a few examples of more expensive insurance rates include the Tesla Model 3 at $1,408 per year, the Toyota Tundra at an average of $1,426, and the BMW X3 at an average of $1,414.

For extremely high auto insurance rates in Roanoke, vehicles like the Porsche 911, BMW M8, and Audi RS 6 have rates that frequently cost two to three times those of the cheapest cars and SUVs.

This next article section showcases the average cost of auto insurance in Roanoke for each different automotive segment. These rates should provide a good idea of the automotive segments that have the overall best average car insurance rates.

Roanoke car insurance rates by automotive segment

When comparing new or used vehicles, it’s important to have a basic understanding of which categories of vehicles are more affordable to insure.

For instance, maybe you’re wondering if midsize SUVs are more affordable to insure than full-size SUVs or which size of luxury car has cheaper insurance.

The next chart displays average auto insurance rates in Roanoke for different vehicle segments. As a general rule, compact SUVs, midsize trucks, and minivans tend to have the most affordable average rates, while exotic performance cars have the highest average insurance cost.

From an accuracy standpoint, it’s fine to use segment averages as a good starting point, as it’s best to use model-level data to find the models in each segment that have the best insurance rates.

For example, in the large truck segment, insurance rates range from the Nissan Titan costing $1,122 per year for full coverage insurance up to the Toyota Tundra costing $1,426 per year, a difference of $304 just within that segment. As another example, in the large luxury car segment, the average cost of insurance can range from the Audi A5 costing $1,420 per year to the Mercedes-Benz Maybach S680 costing $2,510 per year, a difference of $1,090 just within that segment.