- Average car insurance cost in Weirton is $2,288 per year, or approximately $191 per month.

- Monthly car insurance rates for a few popular models in Weirton include the Nissan Rogue at $171, Hyundai Elantra at $207, and Nissan Altima at $207.

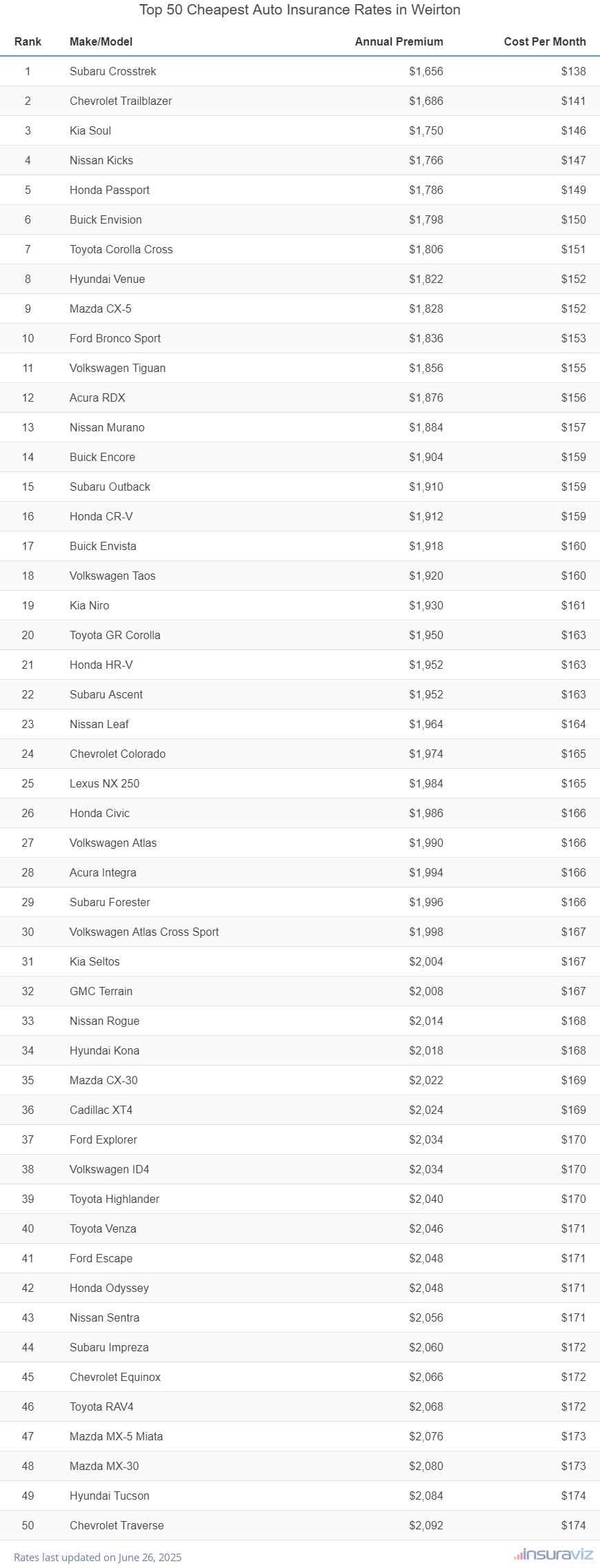

- Vehicles like the Kia Soul, Buick Envision, and Toyota Corolla Cross are our top picks for having the cheapest auto insurance in Weirton.

Average cost of car insurance in Weirton, WV

Weirton car insurance costs an average of $2,288 per year, which is 0.5% more than the U.S. average rate of $2,276. The average monthly cost of car insurance in Weirton is $191 for a policy with full coverage.

The average price for car insurance in West Virginia is $2,328 per year, so drivers in Weirton pay an average of $40 less per year than the overall West Virginia rate. When prices are compared to other larger cities in West Virginia, the average cost of car insurance in Weirton is around $68 per year cheaper than in Parkersburg, $20 per year cheaper than in Morgantown, and $82 per year cheaper than in Charleston.

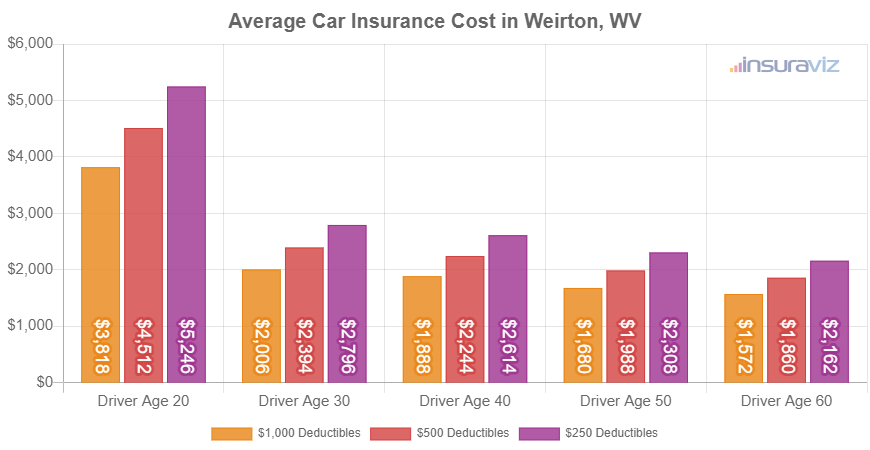

The next chart shows average auto insurance cost in Weirton broken out not only by the age of the driver, but also by three different physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury brand cars and SUVs.

Average rates in the previous chart range from $1,606 per year for a 60-year-old driver with $1,000 deductibles for comprehensive and collision coverage to $5,350 per year for a 20-year-old driver with $250 deductibles. The average rate we use for comparing different vehicles or locations is a 40-year-old driver with $500 deductibles, which has an average cost of $2,288 per year in Weirton.

As a monthly expense, car insurance cost in Weirton ranges from $134 to $446 for the same driver risk profiles shown in the prior chart.

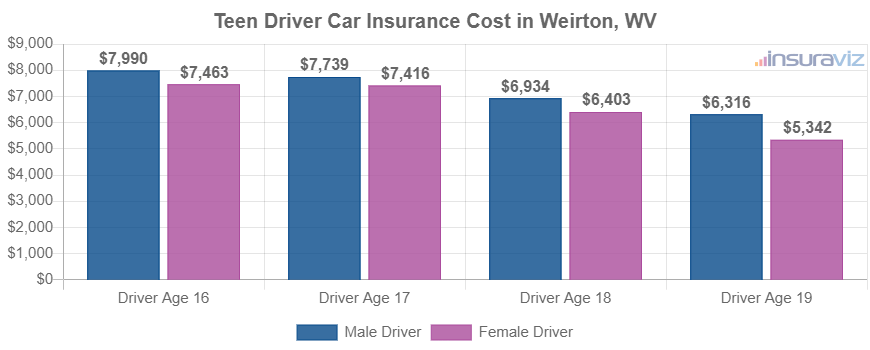

The chart above starts with a 20-year-old driver, but the next chart details car insurance rates for teen drivers in Weirton. Rates are separated for male and female drivers age 16 to 19.

Car insurance for a 16-year-old female driver in Weirton costs an average of $533 less per year than the cost for a male driver, while at age 19, the cost difference is less but males still pay an average of $995 more per year.

Car insurance for popular cars, trucks, and SUVs

The previously referenced car insurance rates are averaged for all 2024 vehicle models, which is helpful when making generalized comparisons such as the average cost difference between multiple locations.

Average auto insurance rates are awesome for answering questions like “is Weirton car insurance cheaper than Wheeling?” or “is West Virginia car insurance cheaper than New York?”.

For more complete auto insurance comparisons, however, we should instead look at the specific make and model of vehicle being insured. Every car, truck, SUV and minivan has a different profile for determining auto insurance prices and this data allows us to perform cost comparisons.

The following list shows both annual and monthly car insurance rates for some of the more popular vehicles cruising around Weirton.

Average annual and monthly car insurance cost for popular models in Weirton

- Nissan Rogue – $2,201 per year or $183 per month

- Hyundai Elantra – $2,663 per year or $222 per month

- Nissan Altima – $2,659 per year or $222 per month

- Toyota Tacoma – $2,480 per year or $207 per month

- Jeep Grand Cherokee – $2,458 per year or $205 per month

- Subaru Outback – $2,093 per year or $174 per month

- Toyota Camry – $2,641 per year or $220 per month

- Honda Accord – $2,370 per year or $198 per month

- Honda Civic – $2,172 per year or $181 per month

- Tesla Model 3 – $2,884 per year or $240 per month

Vehicles that are popular in Weirton tend to be compact and midsize cars like the Volkswagen Jetta, Toyota Corolla, and Kia K5 and small or midsize SUVs like the Honda CR-V and Toyota Highlander.

Some additional popular models in Weirton from different automotive segments include luxury cars like the Acura ILX, Tesla Model S, and BMW 530i, luxury SUVs like the BMW X5, Infiniti QX60, and Lexus RX 350, and pickup trucks like the Ram 1500, Toyota Tacoma, and Ford F-150.

Which vehicles are cheapest to insure?

When all vehicles are compared, the models with the cheapest car insurance rates in Weirton, WV, tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Kia Soul, and Toyota Corolla Cross.

Average car insurance prices for the models ranking in the top 10 cost $2,007 or less per year ($167 per month) for a full-coverage insurance policy.

Some other vehicles that have affordable insurance rates in the cost comparison table below are the Buick Encore, Toyota GR Corolla, Ford Bronco Sport, and Kia Niro. The average rates are a little bit more for those models than the small SUVs and crossovers that rank near the top, but they still have an average insurance cost of $2,134 or less per year ($178 per month) in Weirton.

The following table details the 50 cars, trucks, and SUVs with the cheapest insurance rates in Weirton, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,692 | $141 |

| 2 | Chevrolet Trailblazer | $1,720 | $143 |

| 3 | Kia Soul | $1,786 | $149 |

| 4 | Nissan Kicks | $1,800 | $150 |

| 5 | Honda Passport | $1,822 | $152 |

| 6 | Buick Envision | $1,834 | $153 |

| 7 | Toyota Corolla Cross | $1,842 | $154 |

| 8 | Hyundai Venue | $1,856 | $155 |

| 9 | Mazda CX-5 | $1,868 | $156 |

| 10 | Ford Bronco Sport | $1,872 | $156 |

| 11 | Volkswagen Tiguan | $1,894 | $158 |

| 12 | Acura RDX | $1,914 | $160 |

| 13 | Nissan Murano | $1,920 | $160 |

| 14 | Buick Encore | $1,942 | $162 |

| 15 | Honda CR-V | $1,948 | $162 |

| 16 | Subaru Outback | $1,950 | $163 |

| 17 | Buick Envista | $1,956 | $163 |

| 18 | Volkswagen Taos | $1,960 | $163 |

| 19 | Kia Niro | $1,968 | $164 |

| 20 | Toyota GR Corolla | $1,988 | $166 |

| 21 | Subaru Ascent | $1,990 | $166 |

| 22 | Honda HR-V | $1,992 | $166 |

| 23 | Nissan Leaf | $2,004 | $167 |

| 24 | Chevrolet Colorado | $2,016 | $168 |

| 25 | Honda Civic | $2,024 | $169 |

| 26 | Lexus NX 250 | $2,026 | $169 |

| 27 | Volkswagen Atlas | $2,030 | $169 |

| 28 | Acura Integra | $2,032 | $169 |

| 29 | Subaru Forester | $2,036 | $170 |

| 30 | Volkswagen Atlas Cross Sport | $2,040 | $170 |

| 31 | Kia Seltos | $2,044 | $170 |

| 32 | GMC Terrain | $2,046 | $171 |

| 33 | Nissan Rogue | $2,054 | $171 |

| 34 | Hyundai Kona | $2,058 | $172 |

| 35 | Mazda CX-30 | $2,062 | $172 |

| 36 | Cadillac XT4 | $2,064 | $172 |

| 37 | Ford Explorer | $2,074 | $173 |

| 38 | Volkswagen ID4 | $2,074 | $173 |

| 39 | Toyota Highlander | $2,080 | $173 |

| 40 | Ford Escape | $2,086 | $174 |

| 41 | Toyota Venza | $2,088 | $174 |

| 42 | Honda Odyssey | $2,090 | $174 |

| 43 | Nissan Sentra | $2,094 | $175 |

| 44 | Subaru Impreza | $2,102 | $175 |

| 45 | Chevrolet Equinox | $2,106 | $176 |

| 46 | Toyota RAV4 | $2,110 | $176 |

| 47 | Mazda MX-5 Miata | $2,116 | $176 |

| 48 | Hyundai Tucson | $2,124 | $177 |

| 49 | Mazda MX-30 | $2,124 | $177 |

| 50 | Chevrolet Traverse | $2,136 | $178 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Weirton, WV Zip Codes. Updated October 24, 2025

Some other popular models that made the top 50 table above include the Cadillac XT4, Toyota Venza, Toyota Highlander, and Toyota RAV4. Rates for those vehicles fall between $1,988 and $2,140 per year in Weirton.

As a comparison to gauge how inexpensive the top models are, a few examples that have more expensive auto insurance include the Jeep Wagoneer costing an average of $237 per month, the Subaru BRZ that averages $228, and the Mercedes-Benz S560 which averages $335.

With average rates in West Virginia being below the U.S. average, and rates in Weirton averaging even less than the West Virginia average, drivers should have a pretty easy time finding affordable car insurance.

There are a lot of factors that go into the price of car insurance, but if you are a safe driver, have decent credit, and have a good claims history, you should be paying some of the lower rates in the country.