- Chevrolet Equinox car insurance costs an average of $2,210 per year, or $184 per month, for the 2024 model.

- Equinox insurance cost ranges from $2,066 to $2,390 annually for the average driver, depending on trim level.

- In a comparison of large insurance companies, GEICO and Progressive had the cheapest average Equinox insurance rates at $1,788 and $1,821 per year, respectively.

- If you’re a good driver, you could save as much as $309 per year by earning policy discounts.

How much does Chevy Equinox insurance cost?

Chevrolet Equinox car insurance costs an average of $2,210 per year for full coverage, which is about $184 each month. The Equinox ranks 24th out of 47 vehicles in the 2024 compact SUV segment for insurance affordability.

Depending on the trim level being insured, the average monthly car insurance cost for a Chevrolet Equinox ranges from $172 per month on the Equinox LS model to $199 per month on the EV 3RS model.

For individual policy coverages, collision coverage costs an average of $884 a year, comprehensive (or other-than-collision) coverage costs approximately $582, and the remaining liability and medical coverage combined costs around $744.

The table below shows how each of these coverages compares to the average cost for all 2024 model-year vehicles.

| Policy Coverage | 2024 Chevrolet Equinox | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $582 | $656 | -12% |

| Collision | $884 | $1,216 | -31.6% |

| Liability | $522 | $492 | 5.9% |

| Med/PIP Other | $222 | $208 | 6.5% |

| Total Policy Cost | $2,210 | $2,572 | -15.1% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Chevrolet Equinox. Updated October 24, 2025

Based on the table results, physical damage coverage, which includes comprehensive and collision insurance, for a 2024 Equinox is quite a bit cheaper than the average 2024 model year vehicle.

Liability and medical expense coverage is slightly higher, however, but overall the cost to insure an Equinox is quite good in comparison at 15.1% less per year.

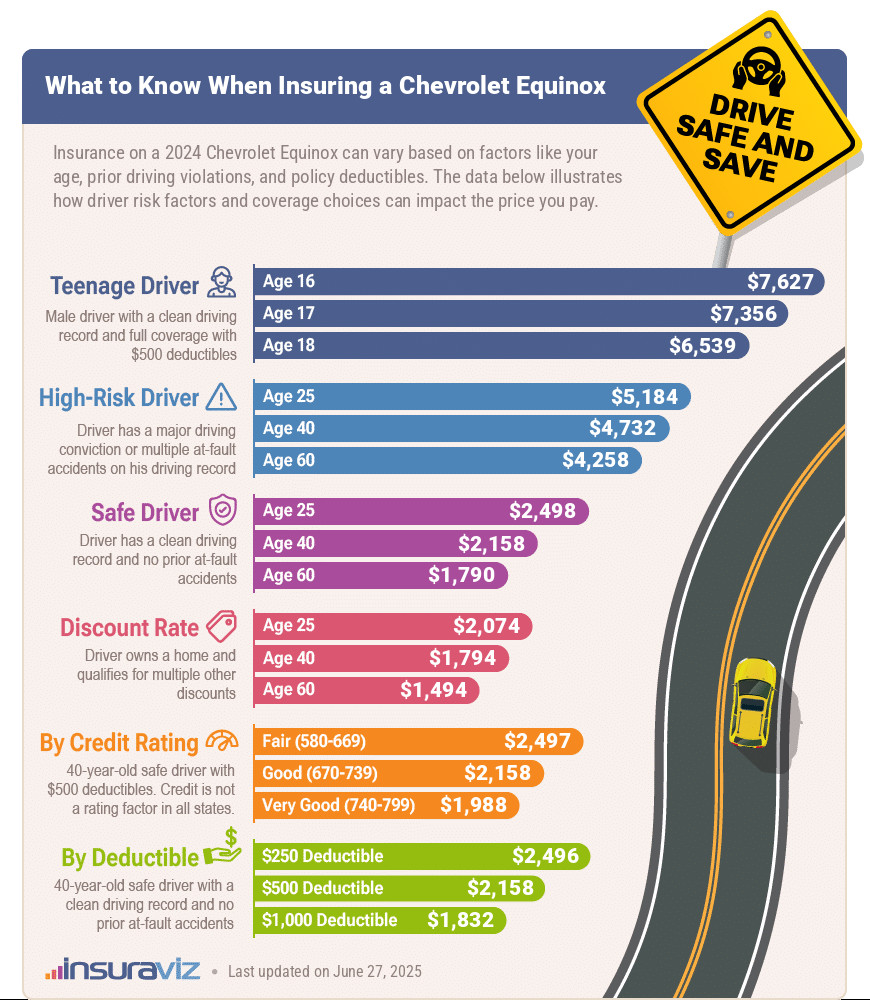

The following infographic displays average car insurance rates for a 2024 Equinox with a range of different policy situations. Different driver ages, driving records, and policy deductible amounts can make a big difference in how much Equinox insurance costs.

The key takeaway from this image is the fact that younger drivers and high-risk drivers will have much higher car insurance rates than older and safer drivers.

Also, buying a policy with low deductibles costs much more than a policy with high deductibles, which is a difference of $680 for a 40-year-old driver.

The cheapest rate shown in the chart is the discount rate, which simply means an average driver who qualifies for policy discounts like being a good driver, being claim-free, and having multiple cars on the same policy. The more discounts you can earn, the cheaper the insurance rate on your Equinox.

Some additional insights concerning Equinox insurance costs include:

- Safe drivers have cheaper Equinox insurance. Too many at-fault accidents can raise rates, potentially up to $3,088 per year for a 20-year-old driver and even as much as $534 per year for a 60-year-old driver.

- Get cheaper rates by researching discounts. Discounts may be available if the policyholders are senior citizens, are military or federal employees, belong to certain professional organizations, are away-from-home students, are good students, or other discounts which could save the average driver as much as $372 per year.

- Raise your credit for better rates. Having an excellent credit rating above 800 could save around $347 per year over a lower credit score of 670-739. Conversely, a not-so-perfect credit rating could cost up to $402 more per year.

- The cost to insure teen drivers is expensive. Average rates for full coverage Equinox car insurance costs $7,815 per year for a 16-year-old driver, $7,540 per year for a 17-year-old driver, and $6,702 per year for an 18-year-old driver.

- Driving violations increase insurance rates. To get the cheapest rates, it just makes good sense to be a safe driver. As a matter of fact, just one or two minor moving violations can increase insurance costs by up to $580 per year. Being convicted of a serious infraction such as reckless driving could raise rates by an additional $2,016 or more.

- As you get older, car insurance rates go down. The difference in insurance rates for an Equinox between a 60-year-old driver ($1,836 per year) and a 20-year-old driver ($4,390 per year) is $2,554, or a difference of 82%.

- Prepare for sticker shock for high-risk insurance. For a 30-year-old driver, having a tendency to get into accidents or receive driving citations increases the cost by $2,680 or more per year.

The Chevy Equinox was originally a midsize SUV, but with the third-generation model in 2018, GM reduced it to a compact model and sales soared to over 300,000 units.

What is the cheapest Chevy Equinox to insure?

The cheapest model of Chevy Equinox to insure is the base LS model at $2,066 per year, or about $172 per month. Other trims like the LS and LT 2WD models cost a little more than the L version but are still quite affordable.

The most expensive EV 3RS trim level costs an extra $324 per year over the lowest cost LS model. In most instances, as the cost of the vehicle increases with multiple add-on feature packages, the cost of insurance always seems to increase as well.

The next table shows average yearly and 6-month Chevrolet Equinox car insurance rates, including a monthly budget amount, for each 2024 model year trim level.

| 2024 Chevrolet Equinox Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LS | $2,066 | $172 |

| LS AWD | $2,112 | $176 |

| EV 1LT | $2,126 | $177 |

| LT | $2,146 | $179 |

| RS | $2,180 | $182 |

| LT AWD | $2,186 | $182 |

| Premier | $2,202 | $184 |

| RS AWD | $2,216 | $185 |

| Premier AWD | $2,234 | $186 |

| EV 2LT | $2,250 | $188 |

| EV 3LT | $2,298 | $192 |

| EV 2RS | $2,324 | $194 |

| EV 3RS | $2,390 | $199 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

As you should be able to tell by the table above, as the MSRP of an Equinox increases with higher-end trim levels and options, the cost of car insurance also increases.

Vehicles that cost more also have higher “actual cash value” or ACV, which simply means that if the vehicle is totaled in an accident or other event (fire, hail, flood, etc.), your car insurance company will have to pay more to replace it. And more money out of the car insurance company’s pocket means more money out of your pocket in the form of more expensive car insurance rates.

How do Equinox insurance rates compare to other SUVs?

The Chevy Equinox ranks 24th out of 47 total comparison vehicles in the 2024 compact SUV segment. The Equinox costs an average of $2,210 per year to insure for full coverage, while the segment median rate is $2,206 per year.

When compared to other small SUVs, Equinox insurance costs $2 less per year than the Toyota RAV4, is $164 more than the Honda CR-V, costs $56 more than the Nissan Rogue, and is $22 more than the Ford Escape.

The chart below shows how well average Chevrolet Equinox insurance rates compare to other popular compact SUVs. The average insurance rate for the Equinox is shown in orange, while the average rate for the entire small SUV segment is shown in dark blue.

In addition, a table is included after the chart that ranks insurance rates for the entire 2024 small SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$438 |

| 2 | Chevrolet Trailblazer | $1,804 | -$406 |

| 3 | Kia Soul | $1,872 | -$338 |

| 4 | Nissan Kicks | $1,888 | -$322 |

| 5 | Buick Envision | $1,922 | -$288 |

| 6 | Toyota Corolla Cross | $1,932 | -$278 |

| 7 | Hyundai Venue | $1,950 | -$260 |

| 8 | Mazda CX-5 | $1,956 | -$254 |

| 9 | Ford Bronco Sport | $1,966 | -$244 |

| 10 | Volkswagen Tiguan | $1,984 | -$226 |

| 11 | Buick Encore | $2,038 | -$172 |

| 12 | Honda CR-V | $2,046 | -$164 |

| 13 | Volkswagen Taos | $2,056 | -$154 |

| 14 | Kia Niro | $2,066 | -$144 |

| 15 | Honda HR-V | $2,088 | -$122 |

| 16 | Subaru Forester | $2,134 | -$76 |

| 17 | Kia Seltos | $2,144 | -$66 |

| 18 | GMC Terrain | $2,148 | -$62 |

| 19 | Nissan Rogue | $2,154 | -$56 |

| 20 | Hyundai Kona | $2,158 | -$52 |

| 21 | Mazda CX-30 | $2,164 | -$46 |

| 22 | Volkswagen ID4 | $2,176 | -$34 |

| 23 | Ford Escape | $2,188 | -$22 |

| 2024 Small SUV Average | $2,206 | -$4 | |

| 24 | Chevrolet Equinox | $2,210 | -- |

| 25 | Toyota RAV4 | $2,212 | $2 |

| 26 | Mazda MX-30 | $2,226 | $16 |

| 27 | Hyundai Tucson | $2,232 | $22 |

| 28 | Chevrolet Trax | $2,264 | $54 |

| 29 | Mini Cooper Clubman | $2,274 | $64 |

| 30 | Mini Cooper | $2,278 | $68 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $92 |

| 32 | Jeep Renegade | $2,308 | $98 |

| 33 | Mitsubishi Outlander | $2,336 | $126 |

| 34 | Kia Sportage | $2,350 | $140 |

| 35 | Hyundai Ioniq 5 | $2,358 | $148 |

| 36 | Fiat 500X | $2,368 | $158 |

| 37 | Mini Cooper Countryman | $2,374 | $164 |

| 38 | Subaru Solterra | $2,376 | $166 |

| 39 | Mazda CX-50 | $2,380 | $170 |

| 40 | Nissan Ariya | $2,386 | $176 |

| 41 | Toyota bz4X | $2,390 | $180 |

| 42 | Mitsubishi Mirage | $2,398 | $188 |

| 43 | Kia EV6 | $2,474 | $264 |

| 44 | Dodge Hornet | $2,554 | $344 |

| 45 | Jeep Compass | $2,594 | $384 |

| 46 | Hyundai Nexo | $2,648 | $438 |

| 47 | Ford Mustang Mach-E | $2,806 | $596 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

Another useful way to evaluate rates is to discover how the cost of insurance for a Chevrolet Equinox compares to similarly priced models. With an average MSRP of $34,096, the cost to buy a new 2024 Chevrolet Equinox ranges from $27,995 to $45,000, depending on the trim level.

The vehicles in the compact SUV segment most similar in price to the Equinox are the Nissan Rogue, Honda CR-V, Volkswagen Tiguan, and Ford Bronco Sport.

Here’s how they compare to a 2024 Equinox for price and the cost to insure. Additional car insurance comparisons for the Equinox and other vehicles can be found on our cost comparisons page.

- Chevrolet Equinox vs. Nissan Rogue – The average MSRP for a 2024 Chevrolet Equinox is $129 cheaper than the Nissan Rogue, at $34,096 compared to $34,225. Insuring the Nissan Rogue costs an average of $56 less than the Chevrolet Equinox.

- Chevrolet Equinox vs. Honda CR-V – The 2024 Chevrolet Equinox has an average MSRP that is $142 more expensive than the Honda CR-V ($34,096 versus $33,954). Anticipate paying around $164 less per year for insurance on the Honda CR-V compared to an Equinox.

- Chevrolet Equinox vs. Volkswagen Tiguan – The sticker price on the Volkswagen Tiguan averages $230 more than the Chevrolet Equinox ($34,326 compared to $34,096). The average insurance cost for a 2024 Chevrolet Equinox compared to the Volkswagen Tiguan is $226 more each year.

- Chevrolet Equinox vs. Ford Bronco Sport – The 2024 Chevrolet Equinox has an average MSRP that is $497 cheaper than the Ford Bronco Sport ($34,096 versus $34,593). Insurance on a Chevrolet Equinox costs an average of $244 more annually than the Ford Bronco Sport.

Insurance cost on new versus used models

Insuring a 2013 Equinox could save $730 each year over the cost of insuring a new 2024 model. A 2018 model would save around $618 each year for the average driver. Younger drivers would see even a larger cost difference on used models.

The following table shows average car insurance rates for a Chevy Equinox for various driver age groups for the 2013 to 2024 model years.

Rates range from $1,192 for a 60-year-old driver rated on a 2014 Chevy Equinox to the most expensive rate of $4,390 for a 20-year-old driver rated on a 2024 Equinox.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chevrolet Equinox | $4,390 | $2,210 | $1,836 |

| 2023 Chevrolet Equinox | $4,170 | $2,096 | $1,742 |

| 2022 Chevrolet Equinox | $4,086 | $2,046 | $1,704 |

| 2021 Chevrolet Equinox | $3,656 | $1,838 | $1,530 |

| 2020 Chevrolet Equinox | $3,552 | $1,784 | $1,486 |

| 2019 Chevrolet Equinox | $3,418 | $1,720 | $1,434 |

| 2018 Chevrolet Equinox | $3,154 | $1,592 | $1,330 |

| 2017 Chevrolet Equinox | $3,012 | $1,522 | $1,276 |

| 2016 Chevrolet Equinox | $3,008 | $1,514 | $1,266 |

| 2015 Chevrolet Equinox | $2,870 | $1,444 | $1,210 |

| 2014 Chevrolet Equinox | $2,834 | $1,424 | $1,192 |

| 2013 Chevrolet Equinox | $2,968 | $1,480 | $1,240 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Equinox trim levels for each model year. Updated October 24, 2025

After the vehicle depreciates considerably, it will probably be a good idea to drop coverage for physical damage from the insurance policy. As a vehicle ages, the added cost of comprehensive and collision coverage surpasses the benefit of having it.

Deleting physical damage coverage on an older Chevrolet Equinox may save you $804 a year, depending on the coverage deductibles and the age of the driver rated on the vehicle.

What is the best insurance for a Chevy Equinox?

We compared rates for large U.S. auto insurance companies and found that GEICO had the best average insurance rates for a 2024 Chevrolet Equinox at $1,788 per year. Progressive was the second cheapest company, with an average rate of $1,821.

The cheapest price may not be your top priority when shopping for the best insurance for a Chevrolet Equinox, however. Every company differs slightly in how they settle claims, whether or not they have a local office in your area, and how easily you can manage your policy and make payments.

The best insurance is often a balance between price, service, and convenience, so before signing on the dotted line for a new policy, make sure the company you choose meets the concerns that you feel are the most important.

We recommend comparing rates between at least five different car insurance companies in order to find the best rates. Include several large companies (GEICO, Progressive, etc.) but also include smaller insurance companies as well.

How to get discount Chevy Equinox insurance

Everyone wants cheaper car insurance, and one of the best (and easiest) ways to save money on insurance is to qualify for policy discounts.

If you’re a safe driver, have a clean driving record, have been continuously insured for several years, and are claim-free, you should be able to qualify for some pretty decent discounts.

Additional discounts can be earned if you own your home, if you bundle your auto and home insurance with the same company, and if you have multiple vehicles on the same car insurance policy.

We put together a list of the top ten best discounts offered by larger insurance companies, and also calculated the average savings each discount could earn you when insuring a 2024 Chevy Equinox.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $309 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $243 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $206 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $175 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $166 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $155 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $139 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $133 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $128 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $115 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

This is by no means a comprehensive list of every discount offered by these companies. Rather, it just shows some of the larger discounts that can help you save the most money if you qualify for them.

There are lots of smaller discounts as well, and every company offers slightly different discount types and amounts.

If you are currently insured, it could pay dividends to check with your current company just to make sure you’re not missing any discounts you’re entitled to.

Some discounts may require verification in order to qualify (like proof of good grades for a student driver or certification from a driver training course), but the savings definitely make it worth the effort.

During his career as an independent insurance agent,

During his career as an independent insurance agent,