- Jeep Compass insurance averages $2,594 per year or around $216 per month, depending on the trim level.

- The Jeep Compass is one of the more expensive small SUVs to insure, costing $388 more per year on average as compared to other small SUVs

- The cheapest Jeep Compass insurance is on the Sport trim level, costing around $2,430 per year. The most expensive trim is the Red at $2,680 per year.

How much does Jeep Compass insurance cost?

Jeep Compass car insurance rates average $2,594 annually for full coverage. Monthly insurance cost for a Jeep Compass averages $216 and ranges from $203 to $223, depending on the trim level.

With the average small SUV costing $2,206 a year to insure, the Jeep Compass may cost around $388 or more every 12 months when compared to similar models. Insurance rates can vary based on the trim level of the vehicle you’re insuring, and we will address this later in the article when we compare rates for each Compass trim level.

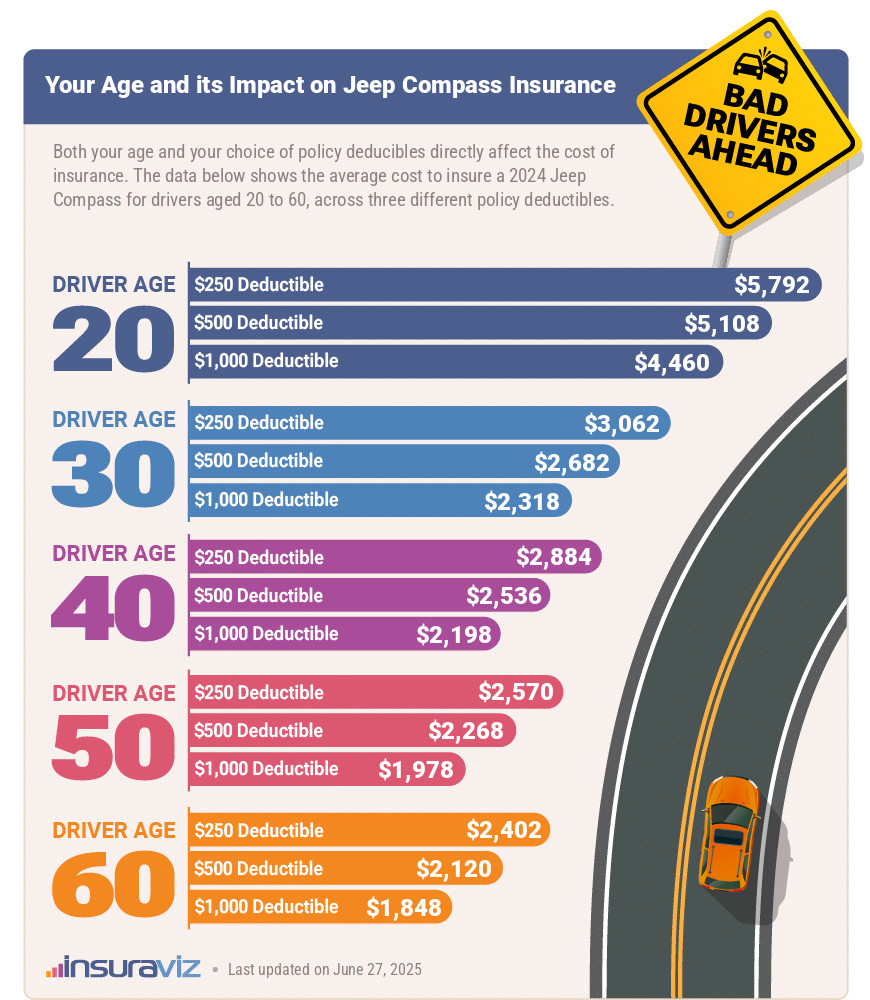

The graphic below details how average Jeep Compass car insurance rates vary with changes in driver age and a range of policy deductibles. Insurance cost varies from the cheapest rate of $1,892 per year for a driver age 60 with a $1,000 policy deductible to the highest policy cost of $5,934 annually for a 20-year-old driver with a $250 policy deductible.

Average rates are determined for the 2024 model year and our overall average rate is based on a 40-year-old driver with $500 physical damage deductibles.

Jeep Compass vs. the competition

When compared to the best-selling models in the small SUV category, insurance for a Jeep Compass costs $382 more per year than the Toyota RAV4, $548 more than the Honda CR-V, $384 more than the Chevrolet Equinox, and $440 more than the Nissan Rogue.

The Jeep Compass ranks 45th out of 47 total vehicles in the compact SUV and crossover category. The Compass costs an estimated $2,594 per year to insure for full coverage, while the segment median average cost is $2,206 annually, a difference of $388 per year.

When compared to all vehicles for the 2024 model year (not just the small SUV segment), average Jeep Compass insurance costs 13.1% more than the national average car insurance rate of $2,276 per year.

The chart below shows how average car insurance rates for a 2024 Compass compare to the other nine vehicles in the top 10 list. We also included a more comprehensive table after the chart displaying average insurance cost for the entire 47 vehicle small SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$822 |

| 2 | Chevrolet Trailblazer | $1,804 | -$790 |

| 3 | Kia Soul | $1,872 | -$722 |

| 4 | Nissan Kicks | $1,888 | -$706 |

| 5 | Buick Envision | $1,922 | -$672 |

| 6 | Toyota Corolla Cross | $1,932 | -$662 |

| 7 | Hyundai Venue | $1,950 | -$644 |

| 8 | Mazda CX-5 | $1,956 | -$638 |

| 9 | Ford Bronco Sport | $1,966 | -$628 |

| 10 | Volkswagen Tiguan | $1,984 | -$610 |

| 11 | Buick Encore | $2,038 | -$556 |

| 12 | Honda CR-V | $2,046 | -$548 |

| 13 | Volkswagen Taos | $2,056 | -$538 |

| 14 | Kia Niro | $2,066 | -$528 |

| 15 | Honda HR-V | $2,088 | -$506 |

| 16 | Subaru Forester | $2,134 | -$460 |

| 17 | Kia Seltos | $2,144 | -$450 |

| 18 | GMC Terrain | $2,148 | -$446 |

| 19 | Nissan Rogue | $2,154 | -$440 |

| 20 | Hyundai Kona | $2,158 | -$436 |

| 21 | Mazda CX-30 | $2,164 | -$430 |

| 22 | Volkswagen ID4 | $2,176 | -$418 |

| 23 | Ford Escape | $2,188 | -$406 |

| 24 | Chevrolet Equinox | $2,210 | -$384 |

| 25 | Toyota RAV4 | $2,212 | -$382 |

| 26 | Mazda MX-30 | $2,226 | -$368 |

| 27 | Hyundai Tucson | $2,232 | -$362 |

| 28 | Chevrolet Trax | $2,264 | -$330 |

| 29 | Mini Cooper Clubman | $2,274 | -$320 |

| 30 | Mini Cooper | $2,278 | -$316 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | -$292 |

| 32 | Jeep Renegade | $2,308 | -$286 |

| 33 | Mitsubishi Outlander | $2,336 | -$258 |

| 34 | Kia Sportage | $2,350 | -$244 |

| 35 | Hyundai Ioniq 5 | $2,358 | -$236 |

| 36 | Fiat 500X | $2,368 | -$226 |

| 37 | Mini Cooper Countryman | $2,374 | -$220 |

| 38 | Subaru Solterra | $2,376 | -$218 |

| 39 | Mazda CX-50 | $2,380 | -$214 |

| 40 | Nissan Ariya | $2,386 | -$208 |

| 41 | Toyota bz4X | $2,390 | -$204 |

| 42 | Mitsubishi Mirage | $2,398 | -$196 |

| 43 | Kia EV6 | $2,474 | -$120 |

| 44 | Dodge Hornet | $2,554 | -$40 |

| 45 | Jeep Compass | $2,594 | -- |

| 46 | Hyundai Nexo | $2,648 | $54 |

| 47 | Ford Mustang Mach-E | $2,806 | $212 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Another useful comparison is to consider the average purchase price for each model and see which compact SUVs are closest in price to the Jeep Compass and how insurance rates compare.

For the 2024 Compass, sticker price averages $35,327, ranging from the cheapest Sport model at $28,400 to the most expensive Red costing $39,515.

The compact SUVs most similar in price to the Compass are the Hyundai Tucson, Toyota RAV4, Ford Escape, and Mazda MX-30.

Here’s how those models compare to a 2024 Compass both by sticker price and average insurance rates.

- Compared to the Hyundai Tucson – The 2024 Jeep Compass has an average MSRP that is $74 cheaper than the Hyundai Tucson ($35,327 versus $35,401). The cost to insure a Jeep Compass compared to the Hyundai Tucson is $362 more annually on average.

- Compared to the Toyota RAV4 – New off the lot, the MSRP for the 2024 Toyota RAV4 averages $126 more than the MSRP for the Jeep Compass ($35,453 compared to $35,327). Full-coverage insurance on the Toyota RAV4 costs an average of $382 less every 12 months than the Jeep Compass.

- Compared to the Ford Escape – The average MSRP for a 2024 Jeep Compass is $169 cheaper than the Ford Escape, at $35,327 compared to $35,496. Insurance on the Ford Escape costs an average of $406 less per year than the Jeep Compass.

- Compared to the Mazda MX-30 – The average MSRP for a 2024 Jeep Compass is $352 more expensive than the Mazda MX-30, at $35,327 compared to $34,975. Buying car insurance for the Mazda MX-30 costs an average of $368 less per year than the Jeep Compass.

Which Jeep Compass has the cheapest insurance?

With Jeep Compass insurance cost ranging from $2,430 to $2,680 per year for the average driver, the most budget-friendly model to insure is the Sport. The second cheapest trim level to insure is the Latitude at $2,562 per year.

Anticipate paying at least $203 per month for full coverage Compass insurance, but this amount varies considerably based on your location, age, and driving record, so keep this in mind.

Also, older models may not justify full coverage insurance, so expect much lower cost if you’re only insuring your Compass with liability insurance. Later in the article, we break down average rates when insuring the 2007 to 2012 models with only liability coverage.

The most expensive trim level to insure is the Red at $2,680, which is $240 more than the cheapest Sport model. The rate table below displays the average annual and 6-month car insurance costs, in addition to the average monthly payment, for each Jeep Compass model and trim level.

| 2024 Jeep Compass Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport | $2,430 | $203 |

| Latitude | $2,562 | $214 |

| Altitude | $2,584 | $215 |

| Latitude Lux | $2,596 | $216 |

| Limited | $2,620 | $218 |

| Trailhawk | $2,622 | $219 |

| High Altitude | $2,670 | $223 |

| Red | $2,680 | $223 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Jeep Compass full coverage insurance rates

The following table shows average full coverage insurance rates for a Jeep Compass for the 2013 to 2024 model years. Data includes average rates for drivers age 20 to 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Jeep Compass | $5,234 | $2,594 | $2,170 |

| 2023 Jeep Compass | $4,388 | $2,182 | $1,822 |

| 2022 Jeep Compass | $4,272 | $2,118 | $1,772 |

| 2021 Jeep Compass | $3,676 | $1,822 | $1,522 |

| 2020 Jeep Compass | $3,624 | $1,798 | $1,502 |

| 2019 Jeep Compass | $3,094 | $1,542 | $1,290 |

| 2018 Jeep Compass | $2,932 | $1,462 | $1,226 |

| 2017 Jeep Compass | $3,062 | $1,528 | $1,282 |

| 2016 Jeep Compass | $2,834 | $1,418 | $1,192 |

| 2015 Jeep Compass | $2,774 | $1,386 | $1,168 |

| 2014 Jeep Compass | $2,970 | $1,480 | $1,250 |

| 2013 Jeep Compass | $2,546 | $1,278 | $1,080 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Jeep Compass trim levels for each model year. Updated October 24, 2025

Jeep Compass liability insurance rates

For older Compass models, it doesn’t always make smart financial sense to buy full coverage insurance. The table below details the cost difference between full coverage and liability-only insurance for the 2007 to 2012 Compass model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Jeep Compass | $1,228 | $670 |

| 2011 Jeep Compass | $1,188 | $664 |

| 2010 Jeep Compass | $1,142 | $658 |

| 2009 Jeep Compass | $1,098 | $652 |

| 2008 Jeep Compass | $1,062 | $646 |

| 2007 Jeep Compass | $1,048 | $640 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Liability insurance prices vary considerably depending on the state you live in, so it’s always a good idea to get some quotes to see how rates stack up. Each state has a minimum liability amount that is required, but that minimum is often inadequate in the case of more serious claims and accidents.

Additional rates and information

Other scenarios that affect the cost of insurance are listed below along with a few ways to reduce your monthly insurance bill.

- Get cheaper rates because of your choice of occupation. Many auto insurance companies offer discounts for working in professions like emergency medical technicians, the military, police officers and law enforcement, high school and elementary teachers, college professors, and others. If you can earn this discount, you may save between $78 and $233 on your annual insurance bill.

- Compass car insurance rates for teenagers are high. Average rates for full coverage Compass insurance costs $9,567 per year for a 16-year-old driver, $9,168 per year for a 17-year-old driver, and $8,025 per year for an 18-year-old driver.

- Increasing deductibles makes car insurance cheaper. Increasing your policy deductibles from $500 to $1,000 could save around $342 per year for a 40-year-old driver and $666 per year for a 20-year-old driver.

- Decreasing deductibles will cost more. Lowering your policy deductibles from $500 to $250 could cost an additional $358 per year for a 40-year-old driver and $700 per year for a 20-year-old driver.

- A clean driving record saves money. To earn the cheapest Jeep Compass insurance rates, it pays to be an excellent driver. In fact, just one or two minor infractions on your motor vehicle report could result in raising Compass insurance cost by at least $706 per year. Major convictions like DWI and leaving the scene of an accident could raise rates by an additional $2,446 or more.

- Expect to pay a lot for high-risk insurance. For a 50-year-old driver, the need to buy a high-risk policy can increase the cost by $3,120 or more per year.