- Mazda CX-5 insurance costs $1,956 per year ($163 per month) on average for a full coverage policy for a 2024 model.

- The Mazda CX-5 is one of the cheaper small SUVs to insure for the 2024 model year, costing $250 less per year on average as compared to other small SUVs

- The cheapest CX-5 to insure is the 2.5 S Select trim level at an estimated $1,834 per year. The most expensive is the 2.5 Turbo Signature at $2,068 annually.

How much does Mazda CX-5 car insurance cost?

Average monthly car insurance cost on a 2024 Mazda CX-5 ranges from $153 to $172, with the 2.5 S Select being cheapest and the 2.5 Turbo Signature costing the most to insure.

Compared to other small SUVs, average Mazda CX-5 insurance costs 12% less than the segment average and 15.1% less than the all-vehicle national average rate of $2,276.

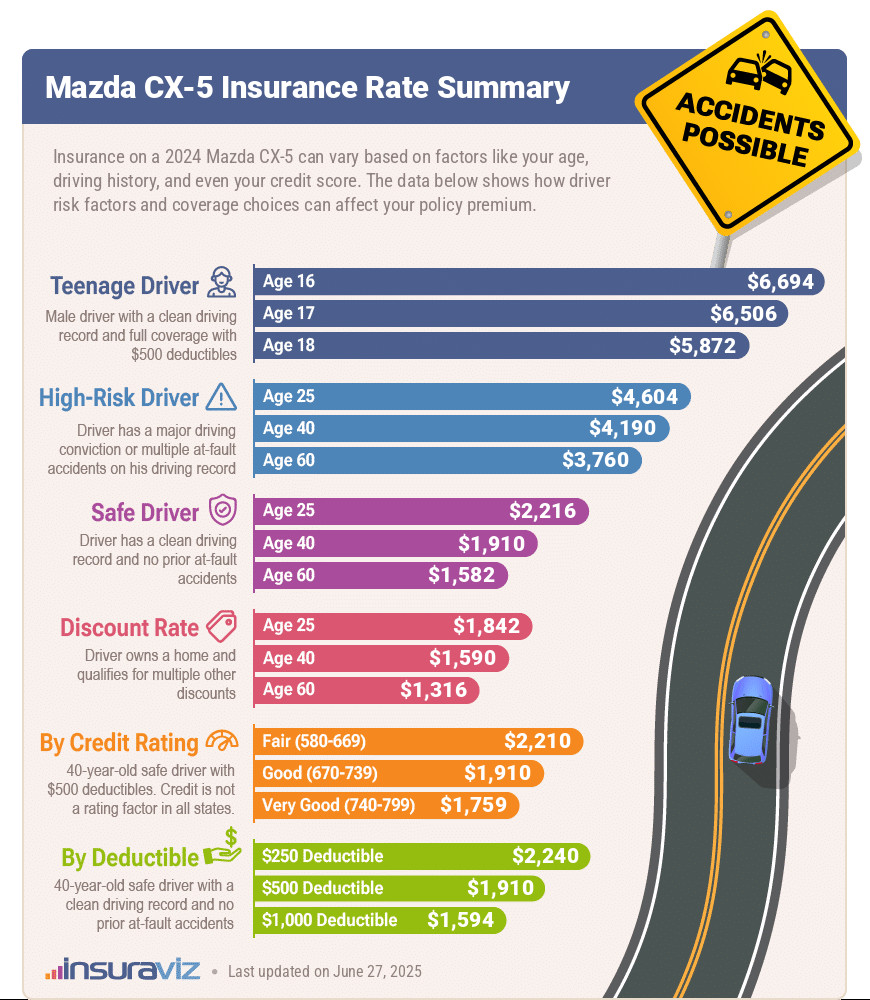

The following infographic displays average 2024 Mazda CX-5 insurance cost using a range of driver ages, deductible levels, and risk profiles.

The rates in this graphic have a fairly wide range, from $1,352 for a 60-year-old driver who qualifies for a discount rate, up to $4,716 for a 25-year-old driver with high-risk insurance or even $6,861 per year for a 16-year-old driver.

In reality, liability-only insurance on a Mazda CX-5 could cost well under $300 a year in cheaper parts of the country, while a 16-year-old male driver with a few citations and accidents could have to pay $14,391 a year in some locations for a full coverage policy.

$1,352 to $14,391 is a massive difference in cost to insure the same vehicle. We only make this comparison to show that the rate you pay can be extremely different based on factors like your age, location, and driving record.

Up to this point, we’ve used the 2024 model year CX-5 as our rated vehicle. But the actual model year of your vehicle also impacts insurance cost.

The table below details average car insurance rates for the 2013 through 2024 model years for five different driver age categories.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Mazda CX-5 | $3,916 | $1,956 | $1,622 |

| 2023 Mazda CX-5 | $3,644 | $1,840 | $1,516 |

| 2022 Mazda CX-5 | $3,302 | $1,668 | $1,378 |

| 2021 Mazda CX-5 | $3,504 | $1,752 | $1,454 |

| 2020 Mazda CX-5 | $3,398 | $1,700 | $1,412 |

| 2019 Mazda CX-5 | $3,606 | $1,782 | $1,486 |

| 2018 Mazda CX-5 | $3,320 | $1,644 | $1,374 |

| 2017 Mazda CX-5 | $3,178 | $1,576 | $1,320 |

| 2016 Mazda CX-5 | $2,978 | $1,468 | $1,230 |

| 2015 Mazda CX-5 | $2,534 | $1,264 | $1,058 |

| 2014 Mazda CX-5 | $2,948 | $1,452 | $1,222 |

| 2013 Mazda CX-5 | $2,622 | $1,304 | $1,096 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mazda CX-5 trim levels for each model year. Updated October 24, 2025

Mazda CX-5 insurance cost vs. the competition

The Mazda CX-5 ranks eighth out of 47 comparison vehicles in the small SUV class for the 2024 model year. The CX-5 costs an average of $1,956 per year for insurance and the class average rate is $2,206 per year, a difference of $250 less per year.

When compared directly to the top-selling other small SUVs, car insurance for a Mazda CX-5 costs $256 less per year than the cost of Toyota RAV4 insurance, $90 less than Honda CR-V insurance, $254 less than Chevy Equinox insurance, and $198 less than Nissan Rogue insurance rates.

The table below shows how average car insurance rates for a CX-5 compare to the entire U.S. compact SUV segment. Vehicles are ranked by average annual car insurance cost, and the difference calculation indicates how much cheaper or more expensive each model is than the Mazda CX-5.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$184 |

| 2 | Chevrolet Trailblazer | $1,804 | -$152 |

| 3 | Kia Soul | $1,872 | -$84 |

| 4 | Nissan Kicks | $1,888 | -$68 |

| 5 | Buick Envision | $1,922 | -$34 |

| 6 | Toyota Corolla Cross | $1,932 | -$24 |

| 7 | Hyundai Venue | $1,950 | -$6 |

| 8 | Mazda CX-5 | $1,956 | -- |

| 9 | Ford Bronco Sport | $1,966 | $10 |

| 10 | Volkswagen Tiguan | $1,984 | $28 |

| 11 | Buick Encore | $2,038 | $82 |

| 12 | Honda CR-V | $2,046 | $90 |

| 13 | Volkswagen Taos | $2,056 | $100 |

| 14 | Kia Niro | $2,066 | $110 |

| 15 | Honda HR-V | $2,088 | $132 |

| 16 | Subaru Forester | $2,134 | $178 |

| 17 | Kia Seltos | $2,144 | $188 |

| 18 | GMC Terrain | $2,148 | $192 |

| 19 | Nissan Rogue | $2,154 | $198 |

| 20 | Hyundai Kona | $2,158 | $202 |

| 21 | Mazda CX-30 | $2,164 | $208 |

| 22 | Volkswagen ID4 | $2,176 | $220 |

| 23 | Ford Escape | $2,188 | $232 |

| 24 | Chevrolet Equinox | $2,210 | $254 |

| 25 | Toyota RAV4 | $2,212 | $256 |

| 26 | Mazda MX-30 | $2,226 | $270 |

| 27 | Hyundai Tucson | $2,232 | $276 |

| 28 | Chevrolet Trax | $2,264 | $308 |

| 29 | Mini Cooper Clubman | $2,274 | $318 |

| 30 | Mini Cooper | $2,278 | $322 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $346 |

| 32 | Jeep Renegade | $2,308 | $352 |

| 33 | Mitsubishi Outlander | $2,336 | $380 |

| 34 | Kia Sportage | $2,350 | $394 |

| 35 | Hyundai Ioniq 5 | $2,358 | $402 |

| 36 | Fiat 500X | $2,368 | $412 |

| 37 | Mini Cooper Countryman | $2,374 | $418 |

| 38 | Subaru Solterra | $2,376 | $420 |

| 39 | Mazda CX-50 | $2,380 | $424 |

| 40 | Nissan Ariya | $2,386 | $430 |

| 41 | Toyota bz4X | $2,390 | $434 |

| 42 | Mitsubishi Mirage | $2,398 | $442 |

| 43 | Kia EV6 | $2,474 | $518 |

| 44 | Dodge Hornet | $2,554 | $598 |

| 45 | Jeep Compass | $2,594 | $638 |

| 46 | Hyundai Nexo | $2,648 | $692 |

| 47 | Ford Mustang Mach-E | $2,806 | $850 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Which CX-5 has the cheapest insurance?

The cheapest model of Mazda CX-5 to insure is the 2.5 S Select at $1,834 per year, or about $153 per month. The second cheapest model is the 2.5 S Preferred at $1,868 per year, and the third cheapest trim to insure is the CX-5 2.5 S Carbon Edition at $1,902 per year.

The most expensive models of Mazda CX-5 to insure are the 2.5 Turbo Signature at $2,068 and the 2.5 Turbo Premium at $2,022 per year. Those trim levels will cost an extra $234 and $188 per year, respectively, over the lowest cost 2.5 S Select model.

The table below shows average car insurance cost for various policy lengths for the 2024 Mazda CX-5.

| 2024 Mazda CX-5 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 2.5 S Select | $1,834 | $153 |

| 2.5 S Preferred | $1,868 | $156 |

| 2.5 S Carbon Edition | $1,902 | $159 |

| 2.5 S Premium | $1,946 | $162 |

| 2.5 S Premium Plus | $2,002 | $167 |

| 2.5 Carbon Turbo | $2,010 | $168 |

| 2.5 Turbo Premium | $2,022 | $169 |

| 2.5 Turbo Signature | $2,068 | $172 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Final thoughts on Mazda CX-5 insurance rates

Some additional thoughts on rates, policy discounts, and possible savings tips are below.

- Raising deductibles makes insurance more affordable. Boosting your deductibles from $500 to $1,000 could save around $324 per year for a 40-year-old driver and $632 per year for a 20-year-old driver.

- Low deductibles make Mazda CX-5 car insurance more expensive. Lowering deductibles from $500 to $250 could cost an additional $338 per year for a 40-year-old driver and $668 per year for a 20-year-old driver.

- Clean up your credit for better rates. Having a high credit rating of over 800 could save as much as $307 per year over a good rating of 670-739. Conversely, a below-average credit score could cost around $356 more per year. Not all states allow credit information to be used when determining insurance rates, so that discount may not be available where you live.

- Gender and age affect the rate you pay. For a 2024 Mazda CX-5, a 20-year-old man will have an average rate of $3,916 per year, while a 20-year-old female driver will pay $2,806, a difference of $1,110 per year in favor of the women by a long shot. But by age 50, male rates are $1,730 and female driver rates are $1,690, a difference of only $40.

- Don’t be a negligent driver. Having multiple accidents could cost you more, possibly by an additional $2,756 per year for a 20-year-old driver and even as much as $564 per year for a 50-year-old driver.

- Your choice of occupation could save you a few bucks. The vast majority of auto insurance companies offer policy discounts for being employed in professions like scientists, firefighters, police officers and law enforcement, accountants, farmers, and other occupations. Working in a qualifying occupation may save between $59 and $233 on your annual auto insurance bill, depending on the age of the rated driver.

- Policy discounts save money. Discounts may be available if the policyholders are accident-free, sign their policy early, insure their home and car with the same company, take a defensive driving course, or many other policy discounts which could save the average driver as much as $328 per year on the cost of insuring a Mazda CX-5.